On-chain information reveals the crypto trade Binance has simply obtained Bitcoin inflows of 130k BTC, an indication which may be bearish for the value of the crypto.

Binance’s Bitcoin Alternate Reserve Has Sharply Spiked Up Over Previous Day

As identified by an analyst in a CryptoQuant post, Binance has obtained an enormous Bitcoin deposit right this moment.

The related indicator right here is the “trade reserve,” which tells us the full quantity of BTC presently sitting within the wallets of a centralized trade.

When the worth of this metric goes down, it means traders are withdrawing their cash from the trade proper now. Such a pattern, when sustained, might be bullish for the crypto’s value because it is likely to be an indication of accumulation.

However, rises within the indicator recommend holders are transferring their BTC to the trade’s wallets presently. As traders might be depositing for promoting functions, this sort of pattern could be bearish for the coin’s worth.

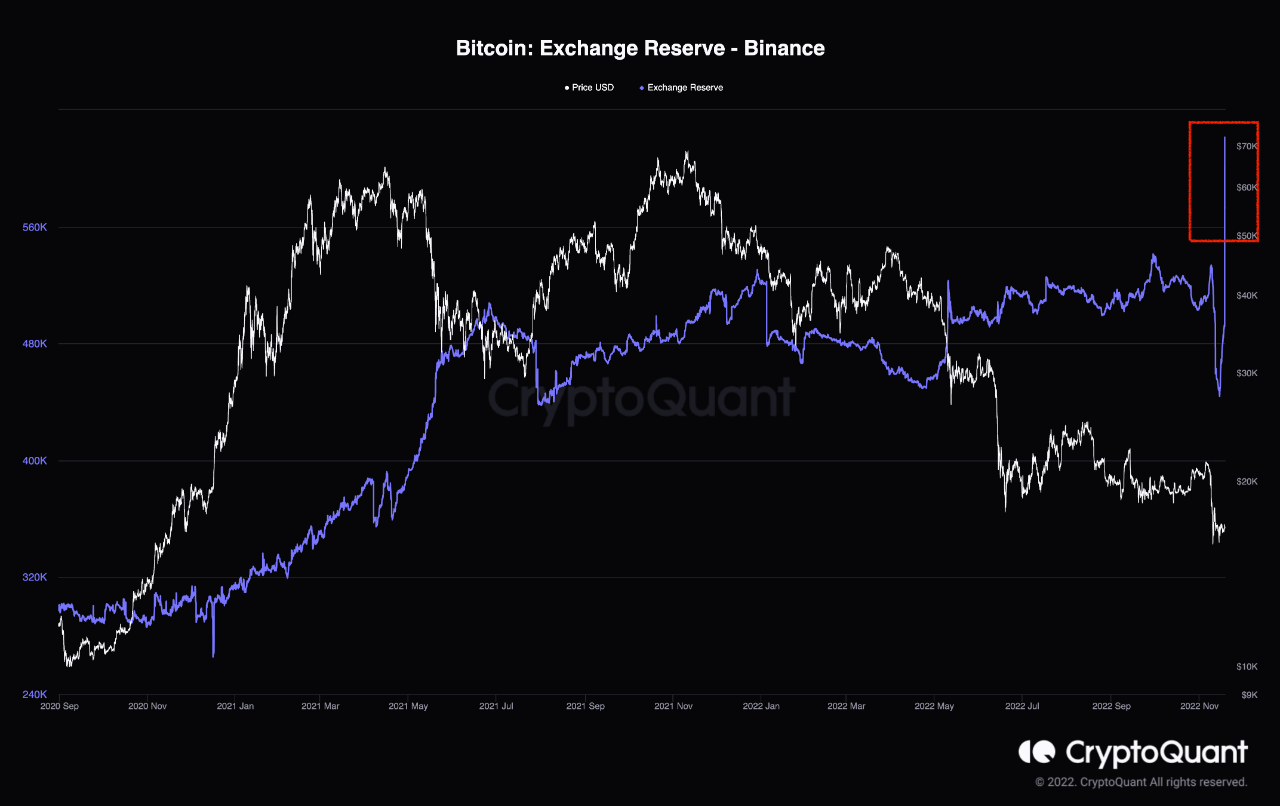

Now, here’s a chart that reveals the pattern within the Bitcoin trade reserve of the crypto trade Binance over the previous few years:

The worth of the metric appears to have all of the sudden jumped up in latest days | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin trade reserve for Binance sharply fell off earlier within the month.

These outflows occurred because the crypto trade FTX went stomach up, reigniting worry amongst traders round central custody, and inflicting them to hurry to withdraw their cash from such platforms.

In the previous few days, nonetheless, Binance’s BTC reserve has as soon as once more began to pattern up, implying that whales is likely to be making strikes to dump.

And right this moment, the indicator has very quickly elevated to a brand new excessive, as traders have made an enormous deposit of 130k BTC to the trade.

In the mean time, it’s unclear whether or not that is an natural improve in Binance’s Bitcoin reserve, or if it’s due to the trade making some inside pockets shuffles which were mistakenly picked up as recent deposits by CryptoQuant’s metric.

Nonetheless, if it’s certainly a real spike, then the end result from this might be bearish for the value of BTC.

BTC Worth

On the time of writing, Bitcoin’s value floats round $16.7k, down 3% within the final week. Over the previous month, the crypto has misplaced 14% in worth.

The under chart reveals the pattern within the value of the coin over the past 5 days.

Seems to be like BTC has continued to carry nonetheless in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Jonathan Borba on Unsplash.com, charts from TradingView.com, CryptoQuant.com