Bitcoin NUPL knowledge means that the crypto’s cycles are getting much less sharper with time as revenue tops and loss bottoms aren’t following a horizontal line.

Bitcoin NUPL Didn’t Exceed The 0.75 “Greed” Mark Throughout This Cycle

As defined by an analyst in a CryptoQuant post, the BTC revenue and loss cycles shouldn’t be handled with horizontal strains.

The “Web Unrealized Revenue and Loss” (or the NUPL briefly) is an indicator that tells us whether or not the market as a complete is holding a web revenue or a web loss proper now.

The metric’s worth is calculated by taking the distinction between the market cap and the realized cap, and dividing it by the market cap.

NUPL = (Market Cap – Realized Cap) ÷ Market Cap

When the worth of this indicator is larger than zero, it means the common investor is presently holding some income.

However, unfavourable NUPL values indicate the general market is holding a web quantity of unrealized loss in the meanwhile.

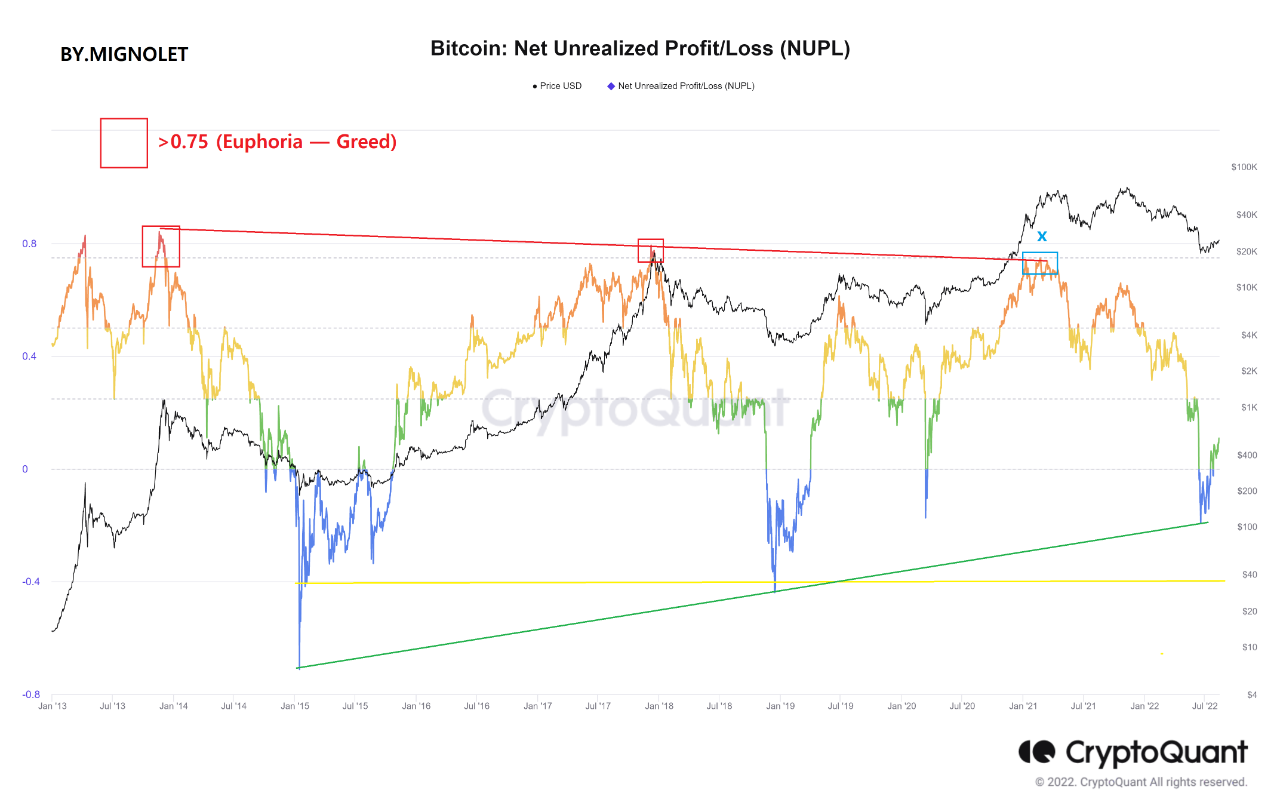

Now, here’s a chart that exhibits the pattern within the Bitcoin NUPL over the course of the historical past of the crypto:

Seems to be like the worth of the metric has surged up and turned optimistic once more lately | Supply: CryptoQuant

As you may see within the above graph, the quant has marked the related zones of pattern for the Bitcoin NUPL indicator.

Up to now, many merchants used to imagine that cycle tops kind at any time when the metric’s worth surges above 0.75, getting into into the “greed” zone.

Equally, bottoms have been thought to happen when the indicator went under the -0.4 mark, reaching into the “concern” area.

Nonetheless, the analyst from the submit argues that horizontal strains like these shouldn’t be used to mark these cycle tops and bottoms.

Through the earlier two cycles, the highest that got here after was decrease than the one earlier than. Within the present cycle, the metric by no means crossed into the greed zone and topped out simply across the 0.75 degree. This might imply that tops are getting decrease and decrease with every cycle.

Equally, the final two bottoms additionally had descending loss quantities. Only a whereas in the past, the NUPL’s worth sharply dropped off into unfavourable and subsequently rebounded again up into optimistic values after forming a possible backside. Nonetheless, this low was removed from the traditional 0.4 mark.

If this low was actually the underside for this cycle, then it could add additional credence to the concept revenue and loss fluctuations available in the market are getting much less drastic with time.

BTC Worth

On the time of writing, Bitcoin’s value floats round $24.4k, up 5% up to now week.

The worth of the crypto appears to have been shifting sideways lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com