Key Takeaways

- Orion Cash is a collection of cross-chain DeFi merchandise offering seamless stablecoin saving, lending, and spending.

- It leverages Anchor Protocol on Terra to offer a excessive steady yield throughout a number of stablecoins and blockchains.

- The ORION token unlocks governance for the protocol and establishes a income share mechanism for Orion Cash’s customers.

Share this text

Orion Cash is aiming to develop into a cross-chain stablecoin financial institution primarily based on an revolutionary suite of DeFi merchandise offering seamless and frictionless entry to stablecoin saving, lending, and spending. Its flagship product is Orion Saver, which permits customers to entry Anchor’s enticing and steady yield on stablecoin deposits throughout a number of blockchains.

Orion Cash Defined

Orion Cash is a collection of cross-chain DeFi merchandise offering customers with seamless entry to a number of the highest yield charges on stablecoin deposits in the marketplace.

With the intention to perceive how Orion works, we have to look into Anchor Protocol on Terra. Anchor is a decentralized cash market and financial savings protocol providing a hard and fast 20% yield on UST deposits. It generates a excessive steady yield on UST deposits by lending out deposits to debtors who’ve secured collateral in yield-bearing belongings.

These belongings, which Anchor calls “liquid-staked belongings” or “bonded belongings” (bAssets), signify native staked tokens of Proof-of-Stake-based chains. For instance, as a substitute of requiring collateral in Ethereum, Anchor asks debtors to safe collateral in staked Ethereum on Lido (bEth), which presently yields round 5% APR.

Anchor successfully reallocates the on-chain yield earned from the borrower’s overcollateralized bAssets to depositors. The minimal collateral ratio is ready to 2:1, so a consumer borrowing $1,000 in UST would want to safe $2,000 collateral in bEth or bLuna, which might generate $100 or 10% yield for the lender from a 5% APR. The remaining 10% is roofed by the curiosity debtors pay on the loans. The speed the debtors pay fluctuates relying on market situations.

Anchor’s course of for providing a steady 20% rate of interest is easy. When it earns greater than 20% or the true yield is greater than the Anchor charge, the protocol allocates the surplus yield in a UST denominated “yield reserve,” whereas when the true yield is decrease than the Anchor charge, the protocol attracts down from the reserve to make up for the yield shortfall.

Nevertheless, Anchor’s enticing and low unstable lending yields are unique to UST depositors on the Terra community, which is the place Orion comes into play. Orion leverages Anchor to deliver the identical excessive stablecoin yield to Ethereum, Polygon, and Binance Good Chain, amongst others, and to depositors of various stablecoins, together with DAI, USDT, USDC, FRAX, and BUSD. Explaining why the venture selected to construct Orion, co-founder Vol Pigrukh says that it needed to assist a wider consumer base leverage Anchor. “We needed to democratize the protocol and convey it to all huge chains and supply entry to Anchor’s excessive steady rate of interest to any stablecoin holders on their native blockchains,” he explains.

With Orion, customers don’t must bridge their stablecoins to Terra. As an alternative, they’ll deposit to Orion Saver from Ethereum or one other supported chain to start out incomes a hard and fast yield on their stablecoins.

Vol and Kos Chernysh are the co-founders of Orion. They beforehand based the eCommerce analytics startup Profitero earlier than promoting the corporate in April 2020. The pair enrolled in Terra’s first hackathon with three former Profitero workers and developed Orion’s first minimal viable product after two days of coding. They received first place.

Orion Saver Beneath the Hood

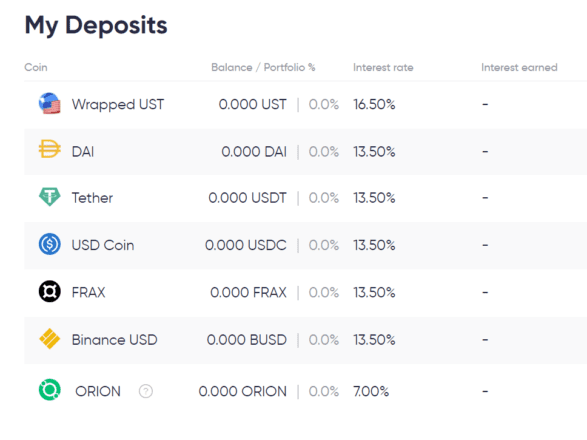

Orion’s present rates of interest on stablecoin deposits are decrease than the 20% goal. For instance, Orion is paying 16.5% APY on UST, and 13.5% on different supported stablecoins. It is because Orion Saver is presently in beta, and the staff is experimenting with totally different charges to check how the system performs. Pigrukh explains:

“When a consumer deposits USDT, we swap this USDT into wrapped UST, bridge it to Terra protocol, and deposit into Anchor for the Anchor charge. This course of contains bridge charges, swap charges, and so forth, which the protocol is overlaying. So we wish to make sure that the system works successfully with out getting an excessive amount of into the adverse margin on the revenues earlier than we deliver the charges greater.”

Orion’s final objective is to deliver the rates of interest throughout all stablecoins as much as the Anchor charge of 20%. In truth, the staff says that Orion plans to stage and lift the charges throughout each supported stablecoin to fifteen% by the top of the month.

Within the background, Orion makes use of EthAnchor—a set of good contracts developed by Orion in collaboration with Anchor—to deposit Ethereum-based stablecoins into Anchor on Terra. The method of bridging stablecoins to Terra and depositing them in Anchor includes a number of good contract interactions. With the inner stablecoin swimming pools, customers solely must pay for one good contract transaction, so they’re much less uncovered to Ethereum’s excessive gasoline charges.

Governance and Tokenomics

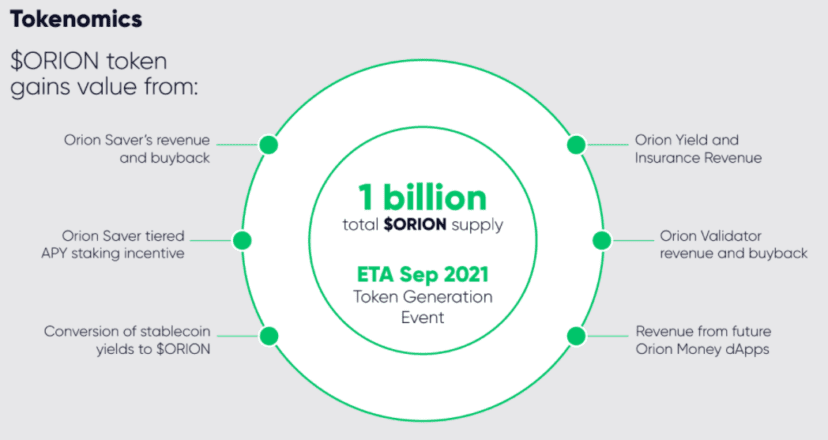

Orion Cash is presently within the means of launching its native token, ORION, by way of an preliminary decentralized providing (IDO) on Polkastarter and DaoMaker, with over 100,000 customers on the waitlist. The ORION token can be minted on Ethereum, and a portion of the availability can be bridged to Terra, Polygon, Binance Good Chain, and different networks as required to allow the protocol to perform extra effectively throughout a number of ecosystems.

The objective of the ORION token is to unlock governance for the protocol and set up a income share mechanism for Orion Cash’s customers. Discussing the worth proposition of the ORION token, Pigrukh says:

“There are two huge causes to carry and stake ORION tokens. The primary is to spice up the yields on stablecoin deposits, which can depend upon the variety of tokens staked, and the second is to get a proportion of the protocol’s income share by way of staking. We wish to develop numerous income streams that can all converge on the ORION token as the worth seize mechanism for the protocol.”

Orion plans to leverage quite a lot of income streams and dedicate them in the direction of staking rewards. For instance, Orion presently operates the most important Proof-of-Stake validator on the Terra community and plans to allocate 100% of the validator’s income in the direction of the Orion “staking fund” to be distributed to ORION stakers as soon as the token is dwell. Moreover, Orion Cash will siphon the income from future Orion Cash merchandise in the direction of the staking fund, which brings us to our subsequent level.

Orion Cash’s Future Product Providing

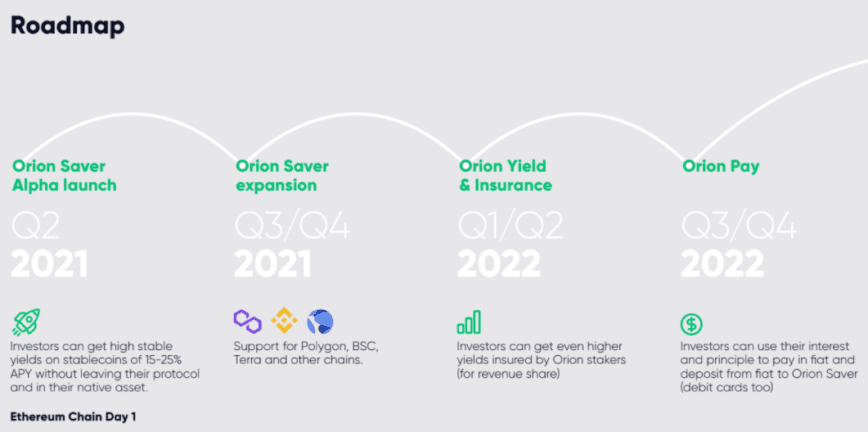

In addition to the Orion Saver product, which is already dwell on Ethereum, the Orion staff additionally plans on launching a number of different merchandise, together with Orion Yield and Insurance coverage, Orion Pay, tokenized derivatives, self-paying and no-liquidation loans, and protocol-specific optimizers.

First on the roadmap is the Yield and Insurance coverage product, which can provide present high-yield financial savings to customers and use the liquidity to spend money on diversified methods. Explaining the product, Pigrukh says:

“The Orion Yield and Insurance coverage product will come from the collaboration with different cash markets on Terra comparable to Mars Protocol. It should present assured greater financial savings charges to Orion Saver depositors by implementing asset-neutral investing methods through Mars Protocol with greater however variable yield of say 30%. Then we’ll work with stakers to underwrite the insurance coverage for the curiosity to make it steady in change for the income share.”

For Orion Pay, the staff is planning to develop fiat on-off ramps, crypto-to-fiat direct funds, and launch a crypto debit card to permit customers to pay for “real-world” items with high-yield-earning stablecoins. Orion Pay is due in Q2 or Q3 of subsequent 12 months, whereas no launch dates have been set for the remaining merchandise.

Competitors and Doable Dangers

In terms of competitors, Orion sees itself in a category of its personal. For now, the staff says it isn’t involved about different initiatives providing comparable merchandise. The venture’s development philosophy is to extend the dimensions of the crypto financial savings market slightly than preventing to seize a bigger share of the present one. Commenting on the venture’s plans to draw new customers, Pigrukh says:

“Orion Cash brings a greater and far greater stage worth proposition than any financial savings product in the marketplace. We’re already experiencing some movement of customers from centralized lending protocols like Celsius, Nexo, and BlockFi, and in addition from decentralized ones like Aave and Compound. As soon as the Orion Pay product comes out, we wish to actually go mass market and convey new customers into crypto.”

Orion additionally says it’s thought-about the potential dangers. The staff has addressed the everyday good contract safety issues related to DeFi protocols by hiring three respected safety companies to conduct audits. Nevertheless, safe good contracts wouldn’t defend the ecosystem from regulatory assaults. Orion makes use of stablecoins, which have just lately develop into a degree of focus for regulators within the U.S. and all over the world. In July, the Treasury Secretary Janet Yellen urged regulators to “act shortly” to cope with stablecoins. Earlier this month, Treasury officers expressed issues concerning the fast development of pegged belongings and their potential to trigger monetary instability. Nonetheless, Pigrukh says that the staff is “not apprehensive” concerning the heightened consideration from regulators. He provides:

“We’re monitoring the [regulatory] developments very carefully. I do assume that UST has an enormous benefit by being a decentralized and algorithmic stablecoin. As for Orion Cash, we’re planning to implement a DAO to be able to actually decentralize. That is the one solution to function in crypto, and I believe the elevated scrutiny from regulators will solely make crypto extra decentralized, which might be a superb factor.”

In conclusion, Orion Cash is an bold venture developed by an skilled staff with a confirmed product-market match. The staff’s largest challenges are constructing the on-chain infrastructure required to deliver Anchor’s yield charges throughout as many blockchains and stablecoins as attainable, in addition to the on and off-ramp infrastructure to assist usher in mass crypto adoption.