Lower than 24 hours after Ethereum (ETH) accomplished its transition to proof-of-stake, the crypto neighborhood is enmeshed in arguments about whether or not the asset can now be thought-about a safety or not.

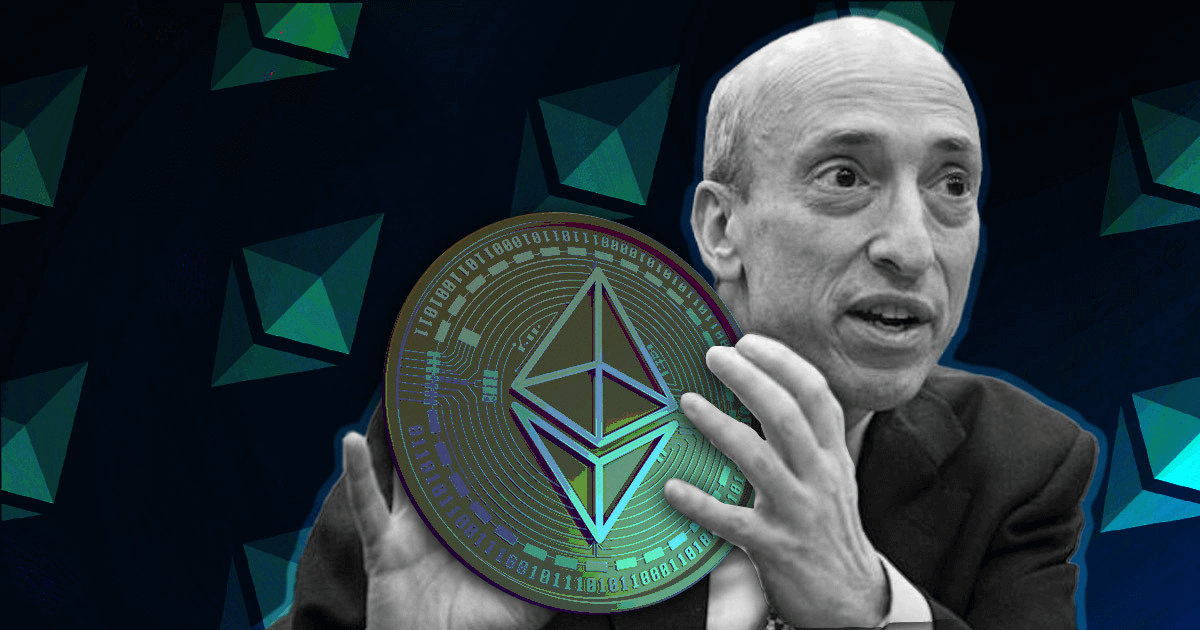

SEC chairman assertion

The Wall Road Journal reported that US Securities and Change Fee (SEC) chairman Gary Gensler mentioned cryptocurrencies that permit staking may qualify as securities below the Howey take a look at.

Gensler made this assertion after a congressional listening to the place he reiterated his perception that almost all crypto belongings are securities. He mentioned:

“From the coin’s perspective…that’s one other indicia that below the Howey take a look at, the investing public is anticipating earnings based mostly on the efforts of others.”

Gensler continued that intermediaries like crypto exchanges providing staking providers supply providers just like lending even when there are modifications within the labeling.

Gensler didn’t specify a crypto asset.

Neighborhood debates if Ethereum is safety

Some throughout the crypto neighborhood argued that Gensler’s assertion meant that Ethereum may now be categorised as a safety.

With Ethereum’s migration to PoS, the asset joins a number of different sensible contract-enabled blockchains that use staking mechanisms to safe their community.

SEC chair says system utilized by Ethereum following software program replace may set off securities legal guidelines. Actually revealed on day 1 of the fork/merge. I’ve been saying this for over 6 years that POW to POS transitions can draw regulatory consideration.https://t.co/3N7v5bcgBo

— Gabor Gurbacs (@gaborgurbacs) September 15, 2022

A technique advisor at VanECK, Gabor Gurbacs, wrote that Ethereum’s migration from PoW to PoS “can draw regulatory consideration.” Gurbacs mentioned:

“To be clear, I’m not saying that ETH is essentially a safety due to its proof mannequin, however regulators do speak about staking within the context of dividends which if one characteristic of what securities legal guidelines name a “frequent enterprise”. There are different components within the Howey take a look at too.”

Adam Cochran argued that the fee’s chairman assertion is a “baseless FUD from entities that don’t perceive the tech, or gloss over authorized parts.”

With Gensler’s feedback in the present day, the query of “Is staking Ether a safety?” has risen once more.

I feel it is baseless FUD from entities that do not perceive the tech, or gloss over authorized parts.

I wrote a rebuttal citing instances on this again in July: https://t.co/rc3ieWOzSz

— Adam Cochran (adamscochran.eth) (@adamscochran) September 15, 2022

Crypto advocacy group Coin Middle in a Sept. 15 weblog publish, argued that Ethereum’s transition to PoS mustn’t have an effect on its classification.

The non-profit mentioned the technological variations between PoW and PoS don’t name for various remedies, saying “the financial realities of validating a sequence by means of mining and validating a sequence by means of staking are related.”

In the meantime, Bitcoin (BTC) maximalists, together with Michael Saylor, solely tweeted the Wall Road Journal report. Saylor had beforehand declared ETH safety.

An funding Supervisor Timothy Peterson said;

“(An) average individual most likely doesn’t perceive why, however Ethereum is now an unregistered safety.”