Sub-saharan Africa recorded $100.6 billion price of crypto transactions on-chain between July 2021 and June 2022, in accordance with a Chainalysis report.

Whereas it represented a development of 16% year-over-year, it accounted for under 2% of worldwide crypto transactions — the bottom on the planet.

Nonetheless, the newest Chainalysis report signifies that the area has a number of the most well-developed crypto markets, with:

“Deep penetration and integration of cryptocurrency into on a regular basis monetary exercise.”

Chief in small retail crypto transactions

In Sub-saharan Africa, retail crypto transfers account for 95% of all crypto-related transactions within the area, in accordance with the report.

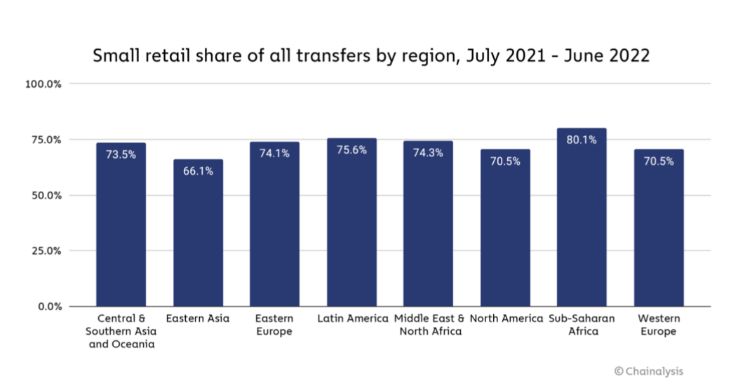

Small retail transfers of lower than $1,000 made up for 80% of crypto transactions between July 2021 and June 2022, greater than every other area on the planet. Comparatively, the share of small retail crypto transfers in North America stood at 70.5% throughout the identical interval.

Nigerian blockchain consultancy and product studio Convexity founder Adedeji Owonibi advised Chainalysis that Sub-saharan Africa doesn’t have institutional crypto traders. As an alternative, the area’s crypto market is pushed by retail utilization, the place every day merchants attempt to earn a dwelling amid excessive unemployment charges. He added:

“It [crypto] is a solution to feed their household and clear up their every day monetary wants.”

Due to this fact, the adoption of cryptocurrencies is being pushed by necessity in Sub-saharan Africa. That is why the variety of small retail transactions within the area grew when the bear market began in Might 2022, in accordance with Chainalysis information.

The report additional said that the fluctuating worth of fiat currencies of some international locations within the area — equivalent to Kenya and Nigeria — present additional incentive to commerce cryptocurrencies, particularly stablecoins. Many traders within the area have turned to stablecoins to keep up their financial savings amid the volatility of native currencies.

Peer-to-peer buying and selling is the important thing

In keeping with the Chainalysis report, P2P exchanges account for six% of all crypto transactions within the area.

Anti-crypto rules, like Nigeria banning banks from interacting with crypto companies in 2021, have prompted increasingly more folks to show to P2P trades.

Moreover, P2P buying and selling is just not solely restricted to P2P exchanges within the area like Paxful, whose prospects grew 55% year-over-year in Nigeria.

In keeping with the report, crypto merchants within the area additionally perform personal trades through teams on social media platforms like WhatsApp and Telegram.

Crypto for remittances and worldwide enterprise funds

The Sub-saharan area has 1000’s of cost programs with no interoperability or communication with one another.

Sending a cost to a rustic within the area could be extraordinarily costly in comparison with crypto.

Companies within the area with worldwide suppliers additionally use crypto to make funds.