Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- Can World Cup excessive spur Chiliz on in the direction of new heights?

- Stiff resistance ranges are forward for CHZ, however a bullish Bitcoin may help Chiliz break above these

The launch of Scoville Testnet Section 4 has been introduced by Chiliz. This got here across the time when the token broke above its native resistance degree at $0.19. With Bitcoin additionally having a decrease timeframe bullish bias, it appears like CHZ can register extra positive factors.

Right here’s AMBCrypto’s Worth Prediction for Chiliz [CHZ] in 2022-23

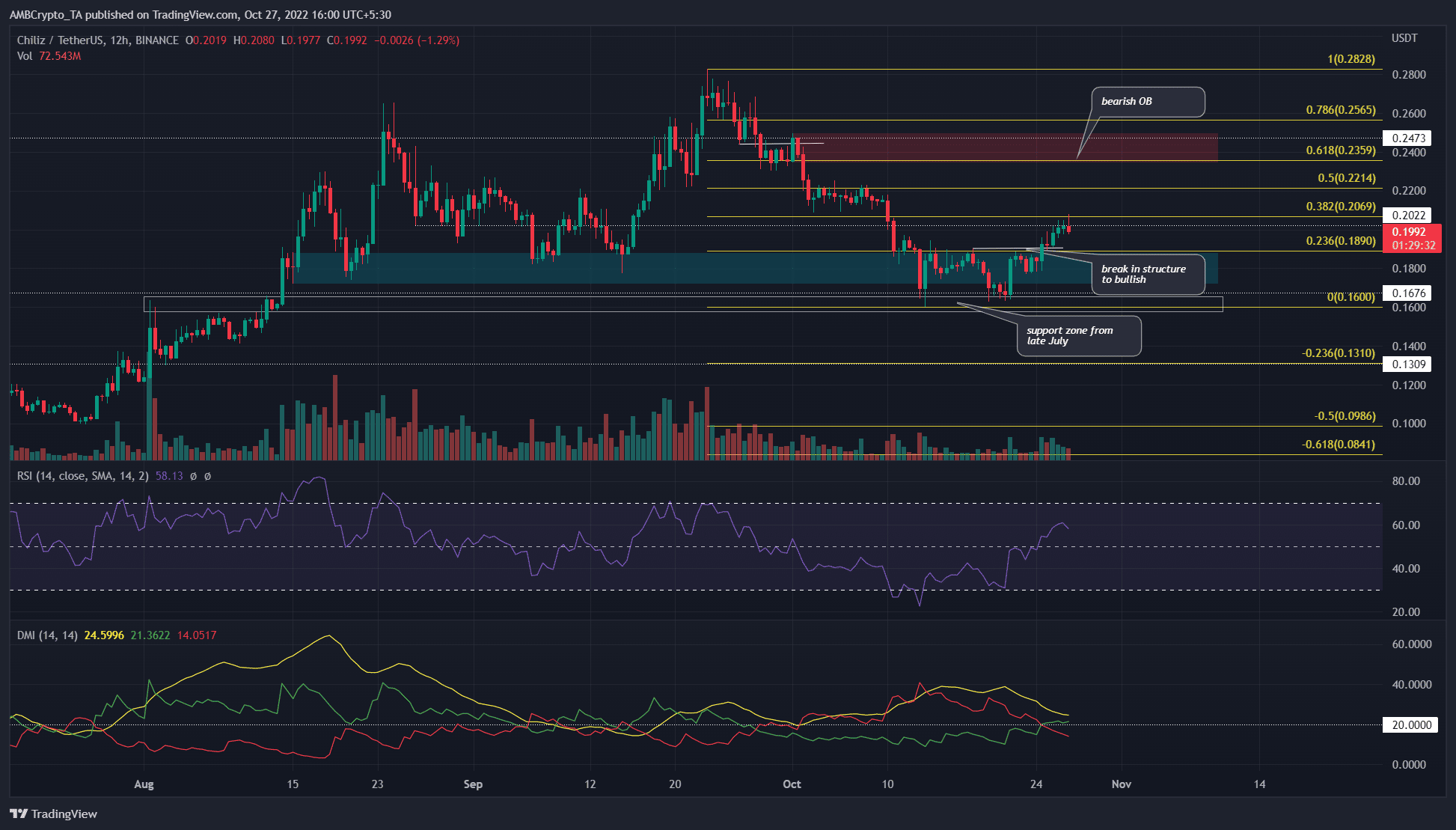

Over the previous week, CHZ noticed a break in market construction to the bullish aspect. Nonetheless, at press time, it confronted important resistance close to the $0.2-mark.

Demand was current at $0.16 and CHZ was fast to rally

Supply: CHZ/USDT on TradingView

In cyan, a bullish order block from mid-September was highlighted. In current weeks, the value threatened to interrupt underneath this zone. Nonetheless, there appeared to be prepared patrons on the $0.16-mark. The bounce from that degree noticed the RSI slowly pull itself again above the impartial 50-line. This confirmed bullish momentum in current days.

The bullish momentum was additionally mirrored in CHZ’s break of market construction from bearish to bullish, highlighted on the chart. The DMI additionally denoted a powerful upward development in progress as each the ADX (yellow) and the +DI (inexperienced) have been above the 20-mark.

One concern for the bulls is the marginally diminished buying and selling quantity over the previous couple of days when the transfer upward occurred. Is that this an indication that patrons have already run out of steam?

Merchants won’t need to purchase CHZ, on the time of writing, because it didn’t supply a superb risk-to-reward shopping for or promoting alternative. Sellers can look to brief the asset with a cease loss above the $0.21-mark. On its means down earlier this month, CHZ didn’t check the liquidity across the $0.21-area. Therefore, a revisit to this zone may face rejection and a retest of $0.207 can supply a shopping for alternative focusing on $0.22 and $0.24.

However, the bulls will start to lose conviction if the value dips again beneath the $0.19-level the place it posted its most up-to-date larger low.

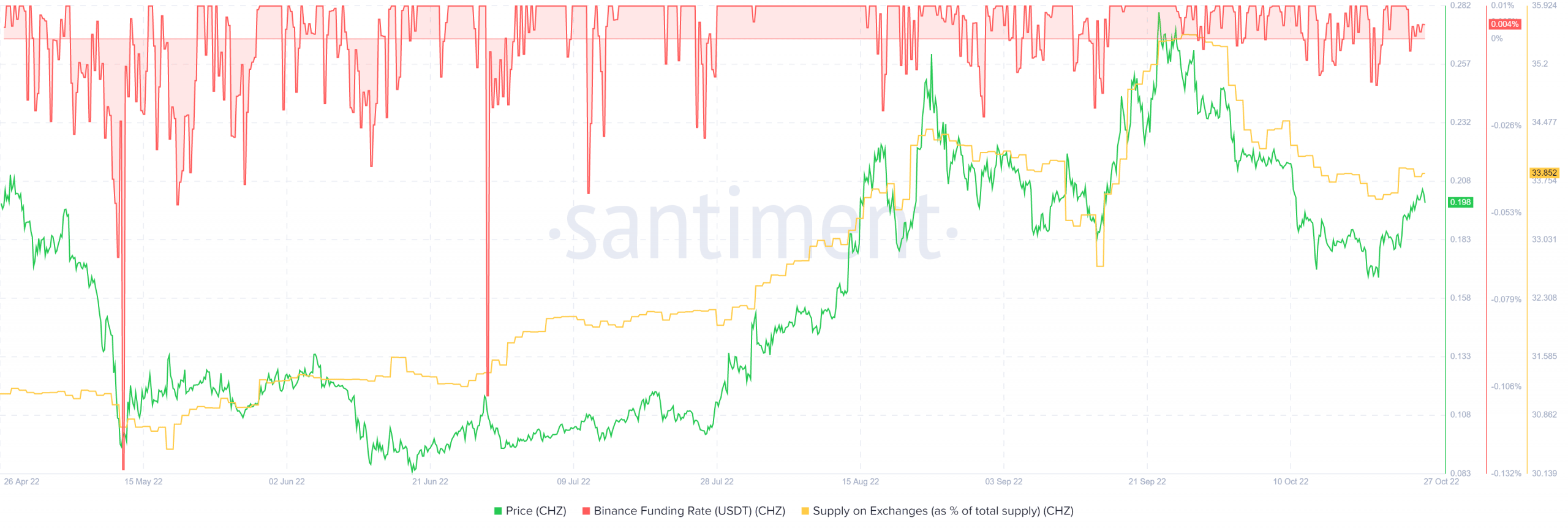

The funding fee is optimistic as speculators stay bullish on Chiliz

Its optimistic funding fee indicated that lengthy positions paid funding periodically to brief place holders. It implied that almost all of the market has been bullishly positioned. Mixed with the bullish construction shift, speculator confidence is comprehensible. The Provide on Exchanges, however, has undergone a big drop.

It shaped a peak round late September with practically 35% of the provision on identified change wallets. This was adopted by a sell-off and a drop to $0.16 on the value charts.

![Chiliz [CHZ]: A change in market structure, cautiously bullish traders, and…](https://ambcrypto.com/wp-content/uploads/2022/10/PP-3-CHZ-cover-1000x600.jpg)