Because it reclaimed its psychological $20,000 worth mark a couple of days in the past, Bitcoin’s [BTC] worth went forward to the touch highs that have been final touched a number of weeks in the past. In response to knowledge from Santiment, the main coin traded for as excessive as $20,770 throughout buying and selling periods on 26 October.

Nevertheless, as the remainder of the cryptocurrency retraced within the final 24 hours, BTC’s worth proceeded to shed a few of its good points. As of this writing, the king coin exchanged fingers at $20,291.61, a 2.3% drop from the $20,770 worth excessive, knowledge from CoinMarketCap revealed.

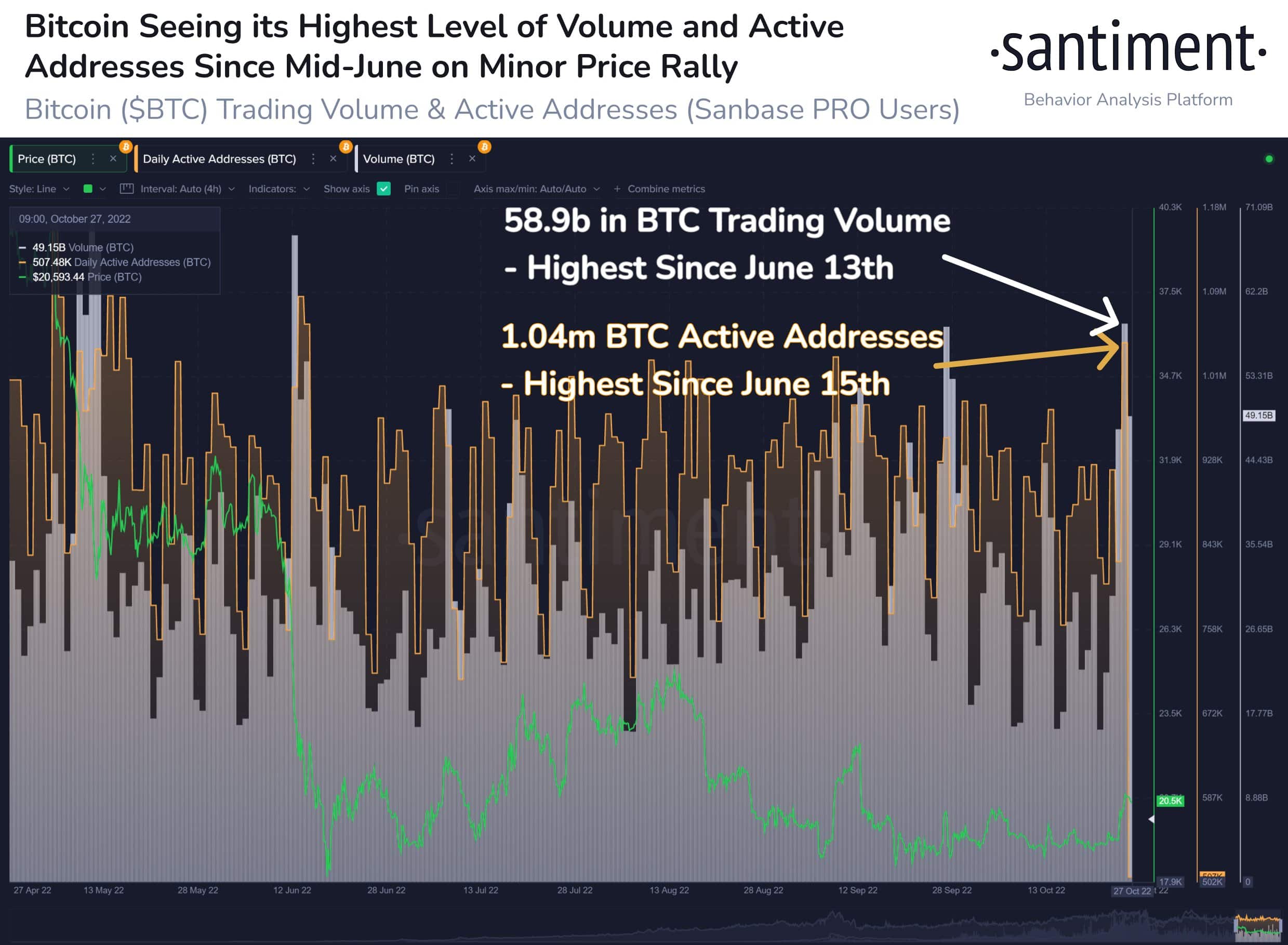

Regardless of the value decline previously 24 hours, BTC’s buying and selling quantity and each day energetic handle exercise each clinched 4-month highs on 27 October.

As per Santiment, throughout the intraday buying and selling session on 27 October, BTC’s buying and selling quantity went as excessive as $58.9 billion, its highest buying and selling quantity since 13 June. On the time of writing, this was $48.86 billion, having dropped by 17% previously 24 hours.

As well as, the rely of each day energetic addresses on the BTC community additionally touched a excessive of 1.04 million addresses throughout the intraday buying and selling session on 27 October.

The final time BTC’s handle exercise was this excessive was on 15 June. As of this writing, this was pegged at 131,000, knowledge from Santiment confirmed.

Supply: Santiment

On the chain, here’s what we all know

In response to CryptoQuant analyst Nino, the rally in BTC’s worth has led its short-term holders to log good points. Whereas assessing the king coin’s Brief Time period Output Revenue Ratio (STH SOPR), Nino discovered that this cohort of traders had “been shopping for on the lows since late Could.” The STH SOPR over one indicated that they now bought at a revenue.

Different on-chain indicators displaying indicators of a bullish market are BTC Trade Reserves, its Web Unrealized Revenue and Loss (NUPL), and its Market-Worth-to-Realized-Worth (MVRV) ratio, as discovered by one other CryptoQuant analyst Onchain Edge.

In response to Onchain Edge, “BTC alternate reserves have decreased over the previous few days resulting in decrease promoting strain.”

As for its NUPL, this was nonetheless beneath zero, which confirmed that the market continues to be in an accumulation part. Onchain Edge, nonetheless, opined that the place of BTC’s NUPL is “not as nice as when the NUPL was at -0.18, which was very near the 2020 backside.”

Supply: CryptoQuant

Lastly, BTC’s MVRV was lower than one, which in keeping with Onchain Edge, it was a “Robust shopping for” space.

Supply: CryptoQuant