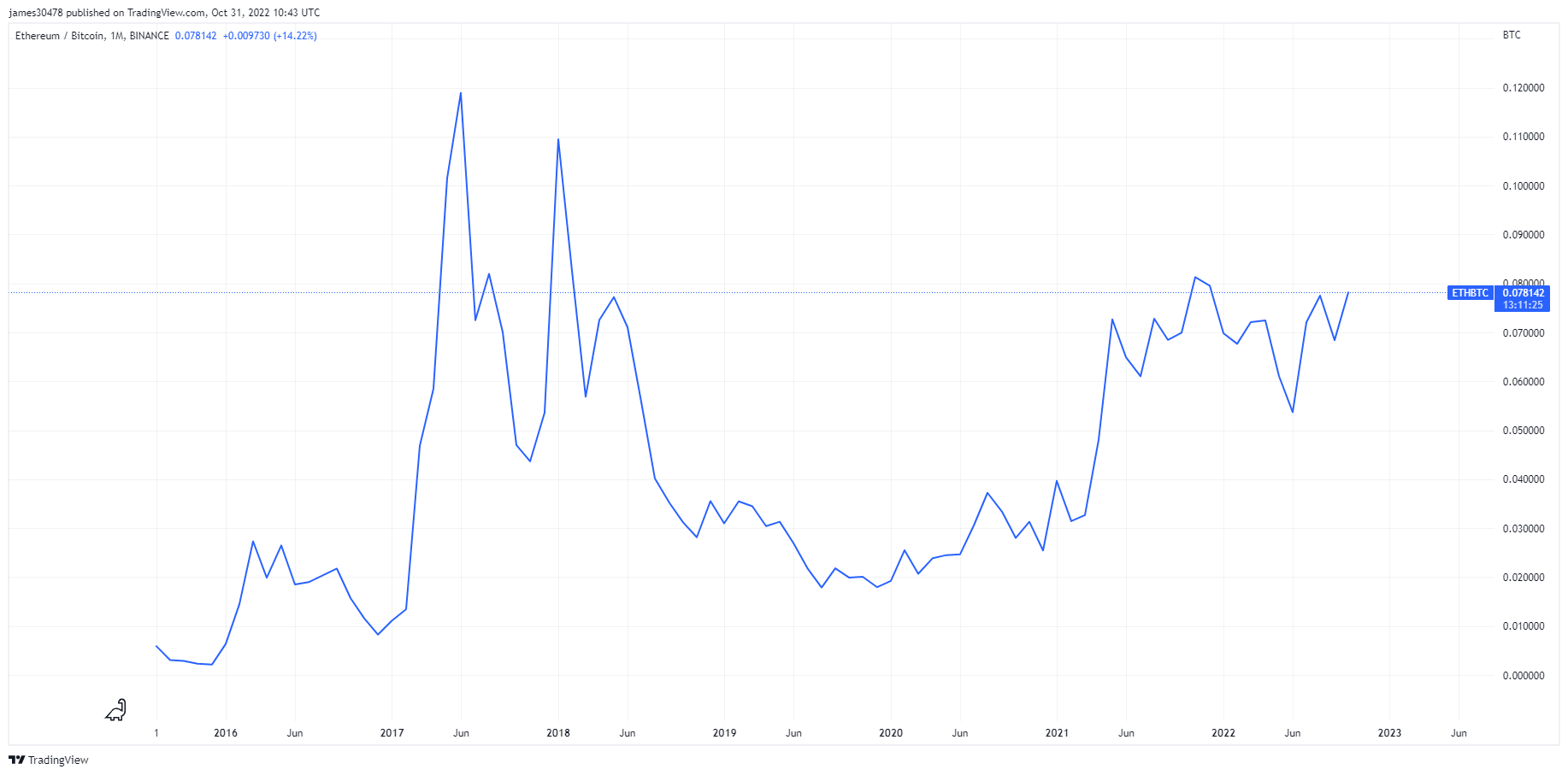

The 2022 excessive for Ethereum denominated in Bitcoin was 0.084BTC simply earlier than The Merge, and a current rally has traders contemplating if Ethereum might regain its pre-merge excessive.

Ethereum made robust positive aspects in opposition to Bitcoin forward of The Merge on Sept. 15. Nevertheless, the second-largest cryptocurrency by market cap failed to succeed in the all-time excessive set again in 2017.

Ethereum reached 0.12BTC round June 2017 and 0.1BTC in 2018. Since then, Ethereum has struggled to remain above the important thing resistance of 0.075BTC, in accordance with CryptoSlate’s evaluation of Glassnode knowledge.

Ethereum dropped as little as 0.018BTC in the course of the bear market of 2019. But, this cycle Ethereum has carried out much better, retesting the 0.075BTC resistance in November 2021 and once more following The Merge in September.

Following a retracement at first of October, Ethereum is as soon as once more gaining tempo on Bitcoin — at the moment sitting across the 0.075BTC mark.

There are a number of attainable catalysts for Ethereum’s resurgence in opposition to Bitcoin. Whereas there was restricted innovation within the core know-how behind Bitcoin, Ethereum has seen a serious overhaul of its community.

Ethereum skilled its first deflationary month following The Merge as provide declined for the primary time in its historical past. At its present trajectory, the overall provide of Ethereum will lower by 0.07% over the following one year. A discount in complete provide is commonly seen as a bullish indicator of future worth motion.

A number of elements might alter Ethereum’s projected provide development, akin to the quantity of ETH locked into staking and the quantity of ETH burned from community transactions. Information associated to the availability and burn of Ethereum could be discovered on ultrasound.money.

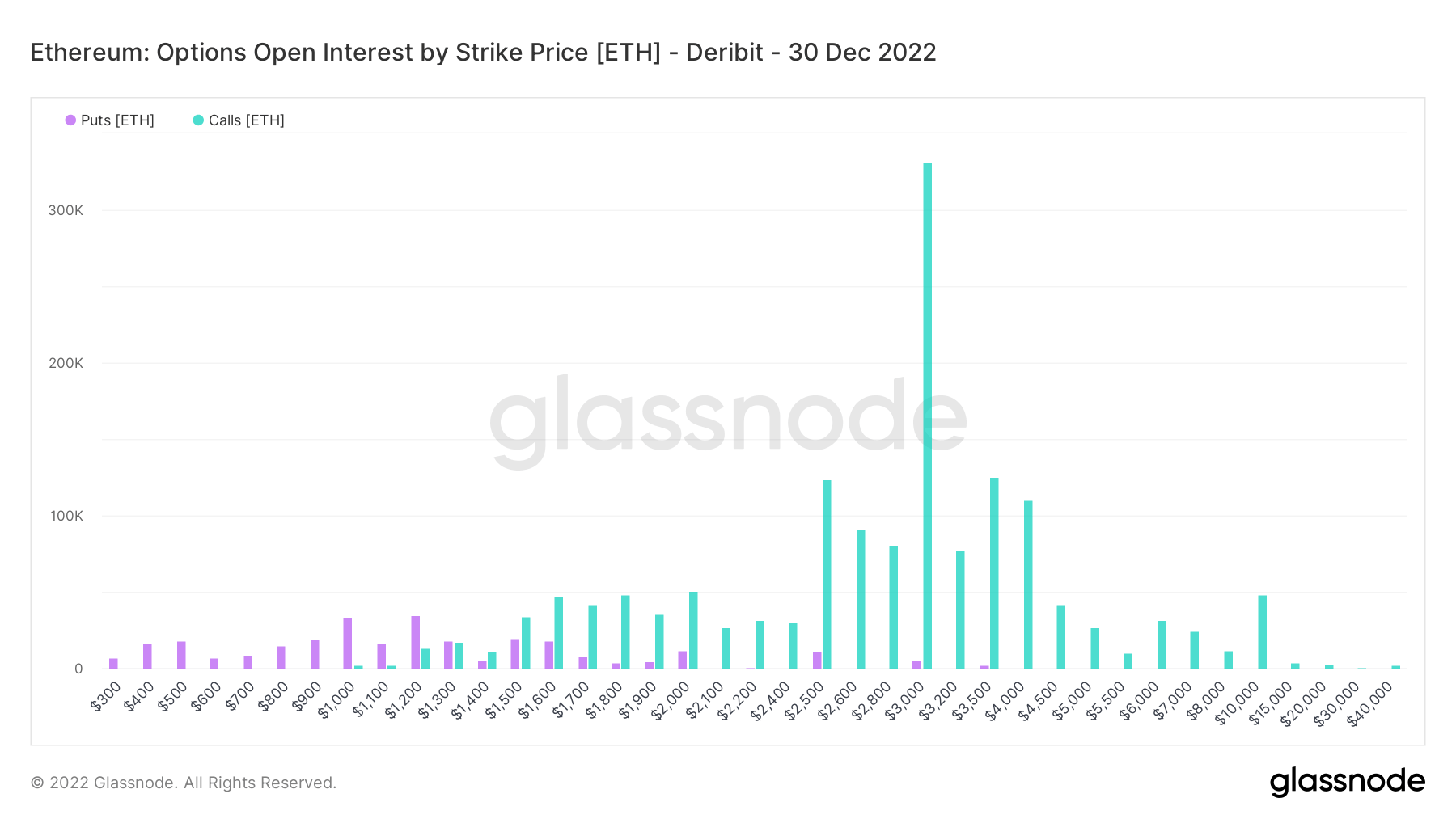

Additional bullish outlook for Ethereum in the course of the fourth quarter is additional supported by reviewing choices open curiosity. There may be an amazing variety of requires $3,000 on derivatives trade Deribit expiring on Dec, 30.