Bitcoin mining continues to indicate indicators of volatility. With growing prices to mine and unpredictable revenues, will the curiosity in mining proceed to develop or will miners transfer on to greener proof-of-work pastures?

Right here’s AMBCrypto’s Worth Prediction for Bitcoin [BTC] for 2022-2023

One of many causes behind the rising FUD amongst Bitcoin miners is the fluctuation in income being generated by miners. Actually, the identical has been persistently unstable over the previous few months.

Parallely, Bitcoin’s hashrate has additionally continued to hike, with the identical appreciating by 10% over the past 30 days, in accordance with Messari.

A variety of uncertainty across the income being generated, coupled with a rising hashtrate, might improve promoting stress on miners.

Supply: Glassnode

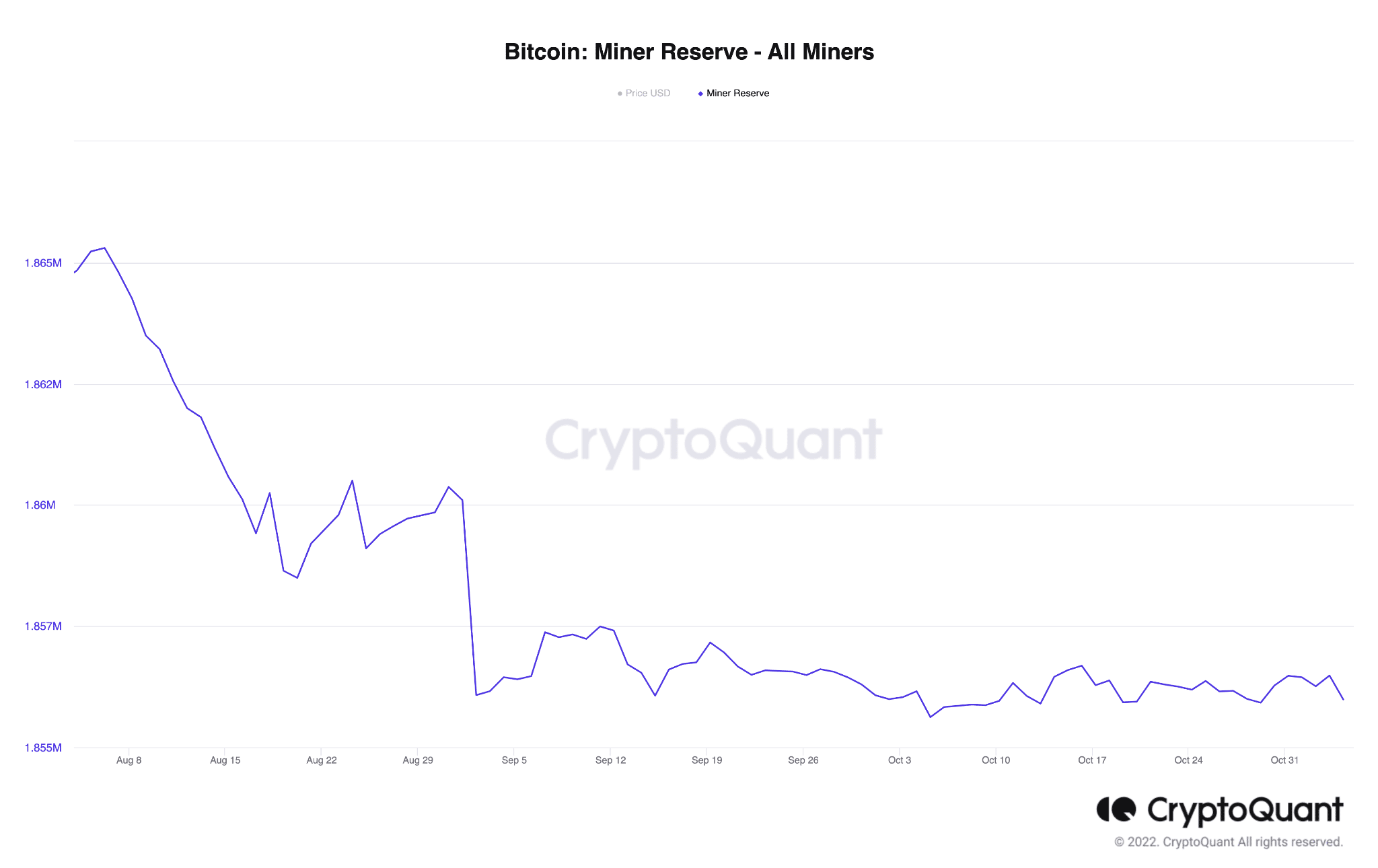

One other indicator of rising promoting stress could be the decline in miners’ reserves. As could be seen from chart, Miners’ Reserves for Bitcoin have declined considerably over the past 3 months. This metric highlights the reserves that Bitcoin miners haven’t but offered. When miners begin promoting, it might result in value drop.

Nevertheless, regardless of the decline in income being generated and excessive promote stress, the miner inflows for Bitcoin miners remained steady and didn’t witness a number of fluctuations, in accordance with CryptoQuant. It is a signal that the variety of cash that had been obtained as a reward for mining remained the identical, regardless of volatility in different areas.

Supply: CryptoQuant

Concern, uncertainty and clout

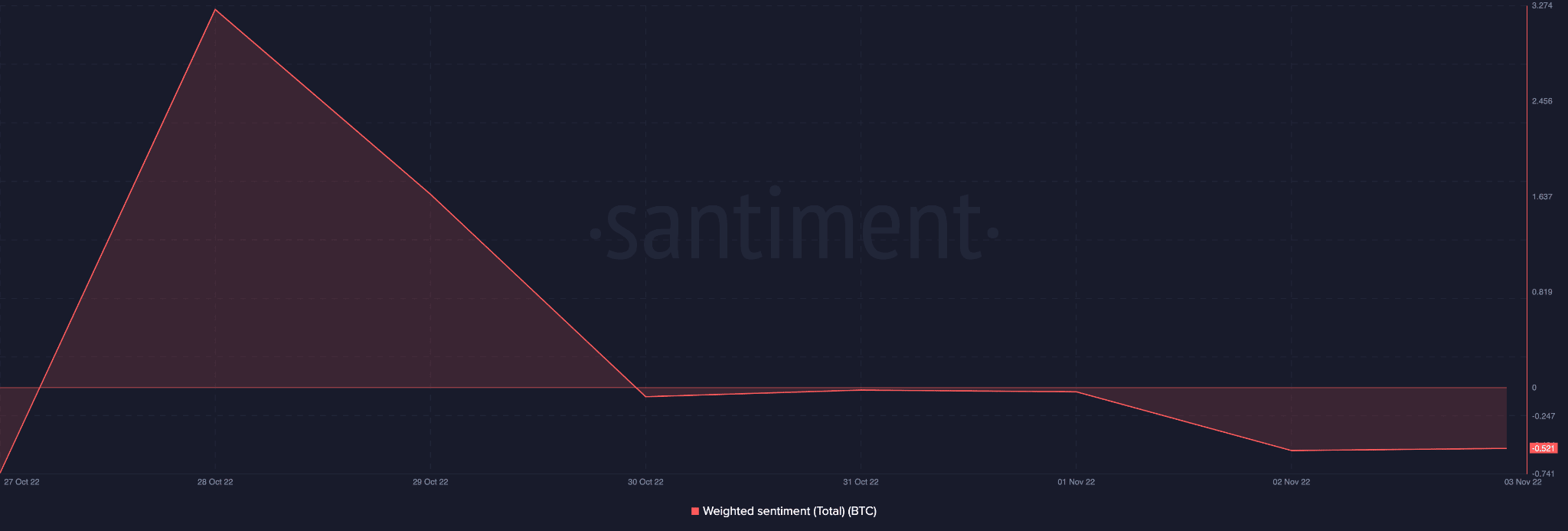

The FUD surrounding mining might have led to the decline in weighted sentiment for Bitcoin. As is obvious from the chart connected herein, over the previous week, the weighted sentiment went south for $BTC.

A decline in weighted sentiment implies that the crypto-community had extra damaging than constructive issues to say about Bitcoin, on the time of writing. Bitcoin was additionally noticed to be loosing its footing on the social entrance.

In line with LunarCrush, a social media analytics corporations, over the past 3 months, Bitcoin’s social mentions and engagements have fallen. Actually, the variety of social mentions for Bitcoin depreciated by 19% and the variety of engagements fell by 29% over the past 90 days.

Supply: Santiment

And but, regardless of rising damaging sentiment and declining variety of engagements, the variety of new addresses on Bitcoin’s community have continued to develop.

In line with Glassnode, the quantity of latest addresses on Bitcoin hit a 10-month excessive and 17 thousand new addresses had been registered. This inflow of latest addresses may very well be a constructive for $BTC’s costs.

The way forward for Bitcoin’s value and the destiny of its miners will proceed to be interlinked. It stays to be seen whether or not miners are keen to climate this bearish storm or are they quickly going to leap ship.