Bitcoin bulls managed to retain their dominance over the cryptocurrency for the final two weeks. This was a wholesome aid for BTC traders hoping for extra upside. Nevertheless, investor considerations had been beginning to resume particularly now that the cryptocurrency may very well be seen approaching its short-term higher vary.

Right here’s AMBCrypto’s worth prediction for Bitcoin [BTC] for 2022-2023

In keeping with a current Glassnode commentary, the quantity of Bitcoin provide in loss just lately dropped to a brand new four-week low. This recommended that a number of accumulation passed off in October, and this sturdy demand contributed to the current rally. Might this be an indication that traders can anticipate current lows to mark the assist vary for the remainder of 2022?

📉 #Bitcoin $BTC Provide in Loss (7d MA) simply reached a 1-month low of seven,656,969.279 BTC

Earlier 1-month low of seven,657,118.480 BTC was noticed on 01 November 2022

View metric:https://t.co/xF3a2VMQxm pic.twitter.com/UsQNBpqrfW

— glassnode alerts (@glassnodealerts) November 6, 2022

The current upside meant that traders that purchased close to the decrease vary already managed to earn important income. In different phrases, there may very well be ample exit liquidity particularly if one other wave of bearish promote strain would happen place.

Bitcoin bears are regaining momentum

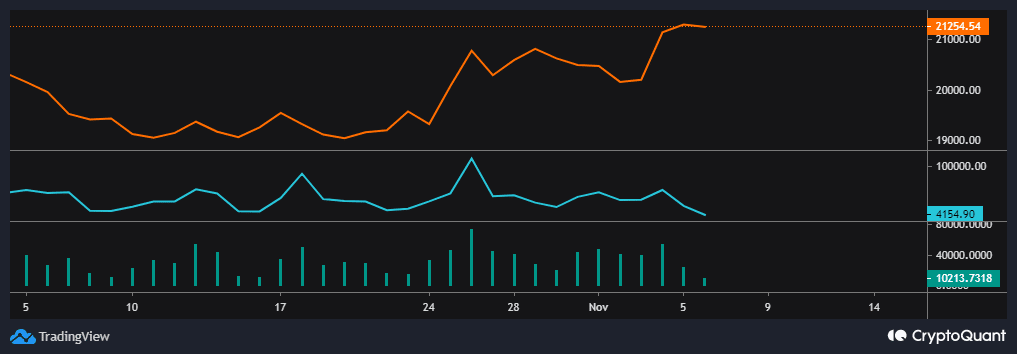

A take a look at Bitcoin’s alternate flows revealed an fascinating commentary which may decide its trajectory this week. BTC alternate inflows noticed a major upside within the final three to 4 days. In the meantime, alternate outflows dropped considerably throughout the identical interval.

Supply: CryptoQuant

The upper BTC alternate inflows indicated that promote strain was mounting. Decrease alternate outflows will be thought-about as an indication that demand is tanking. It is also an indication that Bitcoin may expertise some draw back this week.

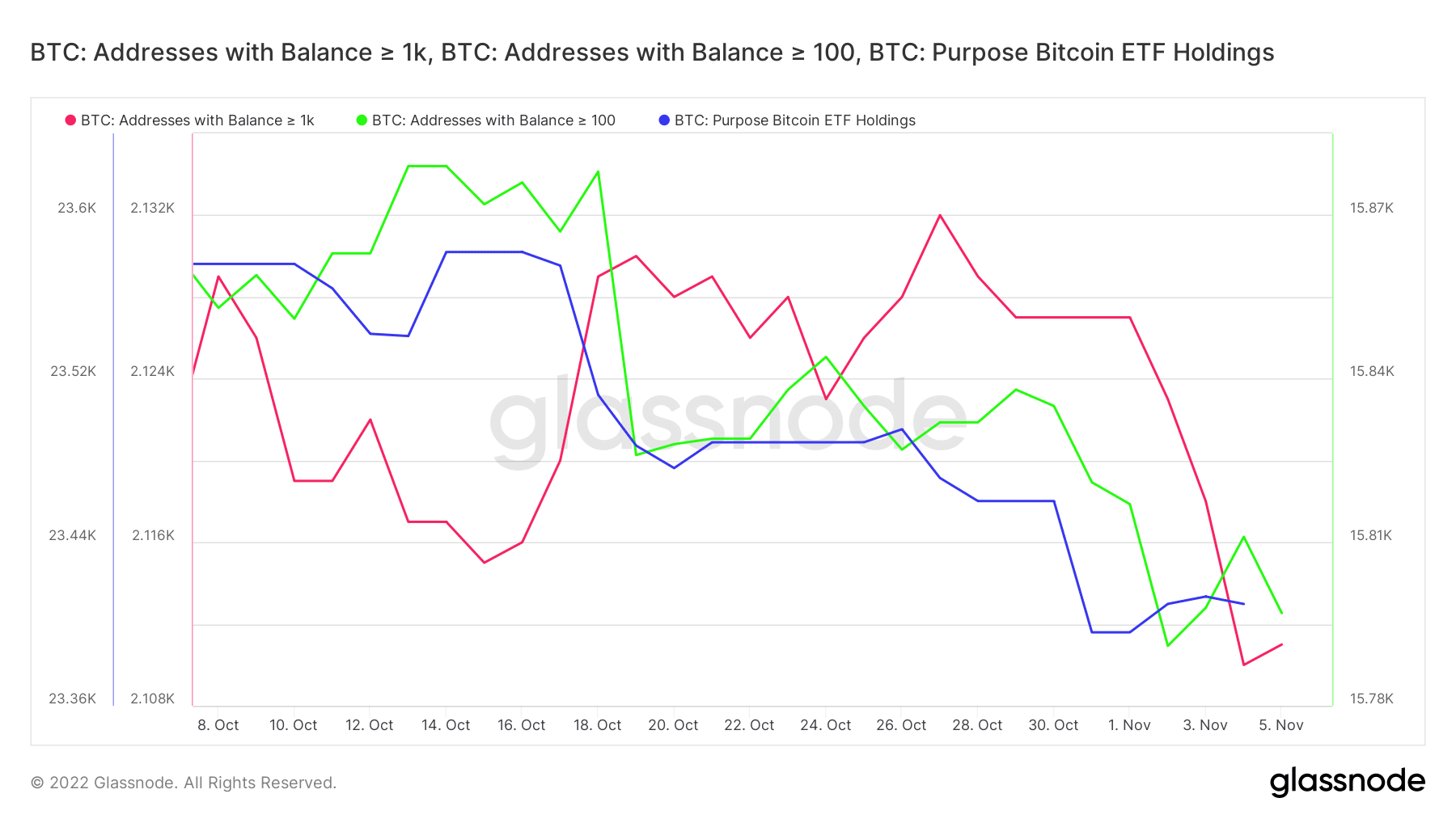

So far as Bitcoin demand was involved, we noticed a rise within the Function Bitcoin ETF holding at first of the month. Addresses holding between 100 and 1,000 cash additionally registered a large improve up till 4 November. Nevertheless, the identical demonstrated some outflows within the final two days.

Supply: Glassnode

Addresses holding greater than 1,000 BTC cash have been promoting for the reason that begin of October. Nevertheless, a rise in deal with balances inside this class was noticed within the final two days. This will have facilitated the uptick throughout the identical two-day interval.

The above-mentioned observations underscore the blended opinions available in the market since some whales had been shopping for and others had been promoting. Thus, making it troublesome to find out BTC’s subsequent transfer. Nevertheless, its worth motion may present a good answer.

Shifting on to higher prospects

Bitcoin has been shifting inside an ascending worth channel for the final two weeks. Its newest worth motion additionally retested its present two-week resistance vary. This resistance coupled with noticed improve in alternate inflows and drop in alternate outflows could point out incoming promote strain.

Supply: TradingView

Moreover, BTC noticed the next relative energy within the final two days. However, the Relative Power Index (RSI) nonetheless has some room to spare earlier than Bitcoin may very well be thought-about overbought.

Whereas there may be nonetheless room for some upside, the current observations counsel in any other case. The noticed improve in alternate inflows counsel that BTC may expertise a return of promote strain.