It’s now greater than a decade since Litecoin (LTC) was based and it has come a good distance since then. The community’s newest replace reveals the extent of Litecoin’s achievements whereas underscoring the wholesome development it has achieved thus far.

Right here’s AMBCrypto’s worth prediction for Litecoin (LTC)

Litecoin is celebrating its 11th 12 months of existence and it has additionally revealed that it managed to safe over 133 million transactions. The replace additionally famous that the community managed to realize that milestone with none downtime.

As of immediately, the Litecoin Community has processed properly over 33,000,000 transactions in 2022.

11 years of steady immutable, uncensorable, flawless uptime and an exquisite finish to the 12 months!#Litecoin ⚡ pic.twitter.com/aQ1LTdtT6M

— Litecoin Basis ⚡️ (@LTCFoundation) November 8, 2022

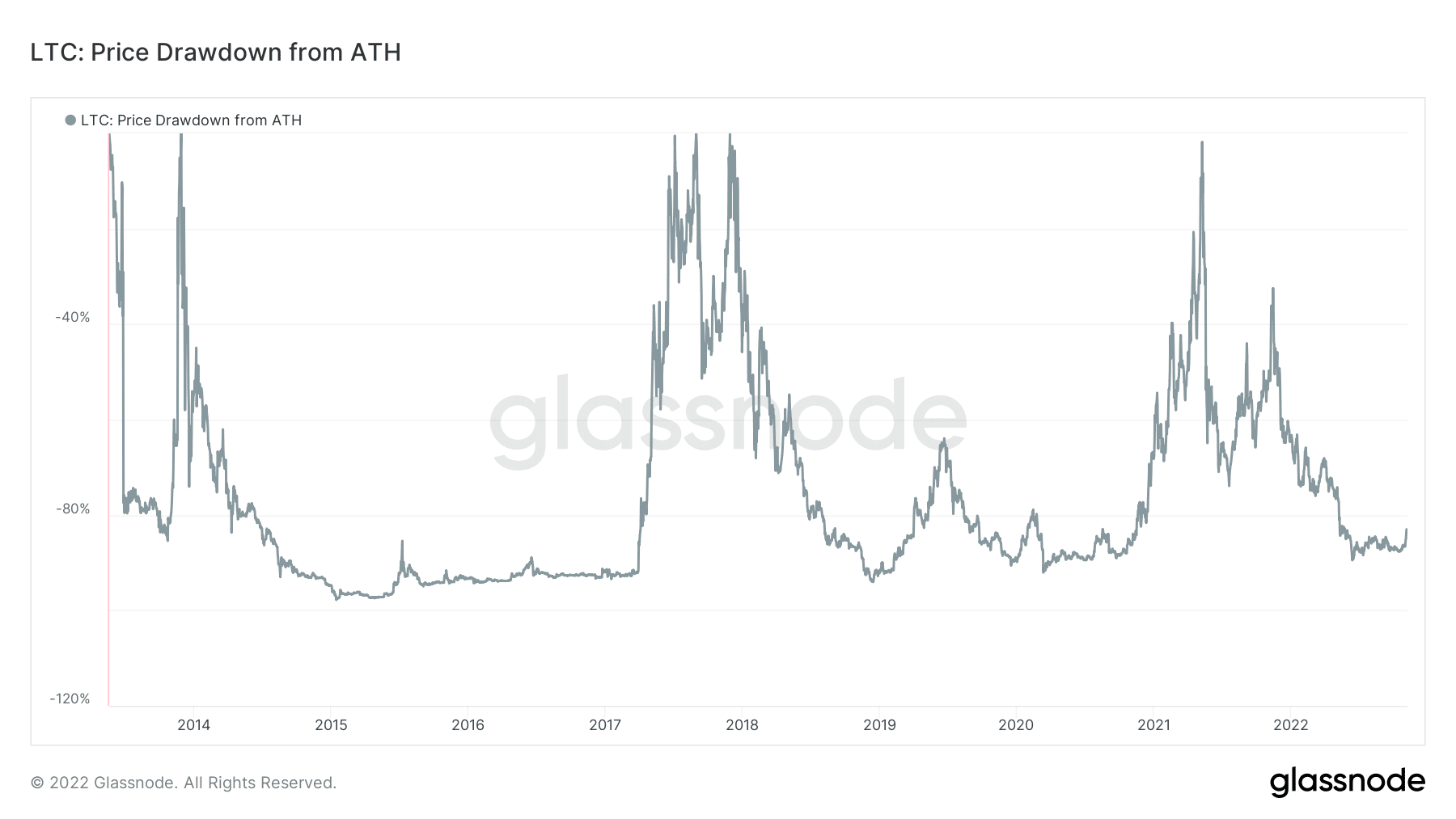

The milestone is a testomony to the Litecoin community’s effectivity and well being. Nonetheless, this has not stopped LTC from experiencing market headwinds. The cryptocurrency is at present at an 83% drawdown from its historic excessive.

Supply: Glassnode

The 2022 bear market will not be the primary time that LTC has been closely drawn down. The primary was between 2014 and 2015 whereas the second main drawdown occurred between 2018 and 2019. So far as LTC’s newest worth motion is worried, it managed to drag off a 50% upside from its October lows, in an try to exit the decrease vary.

LTC’s newest upside was capped at $73.36 after hovering into overbought territory on Monday (7 November). The return of promote stress particularly within the final two days triggered a retracement to its $64.76 press time stage.

Supply: TradingView

Actually, LTC has notably demonstrated some shopping for stress within the final 24 hours regardless of the pullback. This is perhaps an indication that the current replace has influenced buyers’ sentiment, doubtlessly cushioning Litecoin from extra promote stress. However is it sufficient to assist a restoration again above $70?

The place is Litecoin headed subsequent?

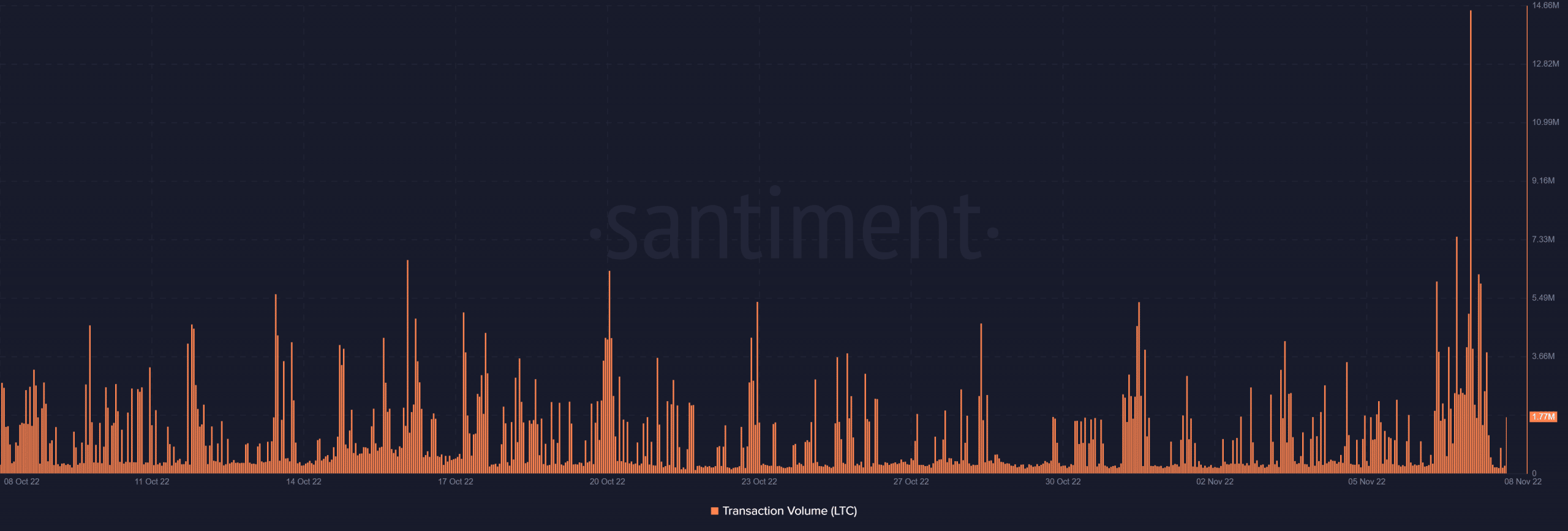

Litecoin maintained its transaction quantity for the final 4 weeks close to the 5 million vary. Nonetheless, we noticed a sudden spike in transaction quantity this week, with the transaction quantity hovering as excessive as 14.51 million LTC within the final 24 hours.

Supply: Santiment

This surge in transaction quantity is probably going a mirrored image of the surge in promote stress. A have a look at Litecoin’s circulation metric reveals the same final result.

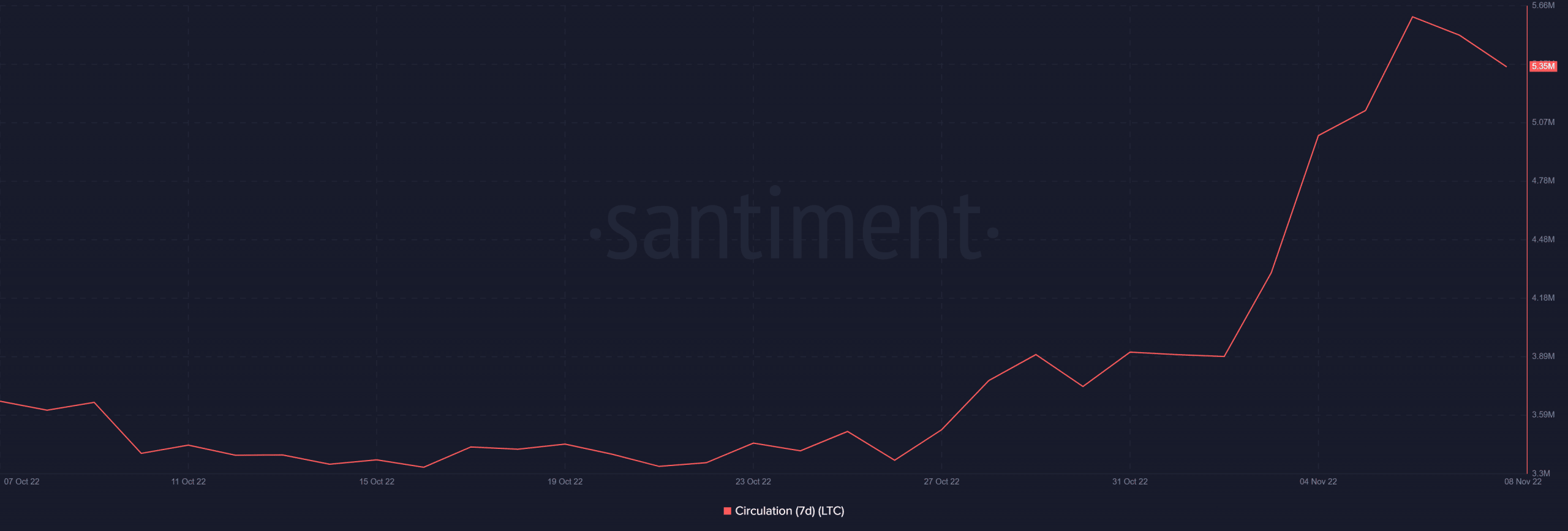

We noticed a surge within the circulation metric within the final seven days, leading to a brand new weekly excessive. Nonetheless, the identical metric indicated a pivot since Sunday (6 November).

Supply: Santiment

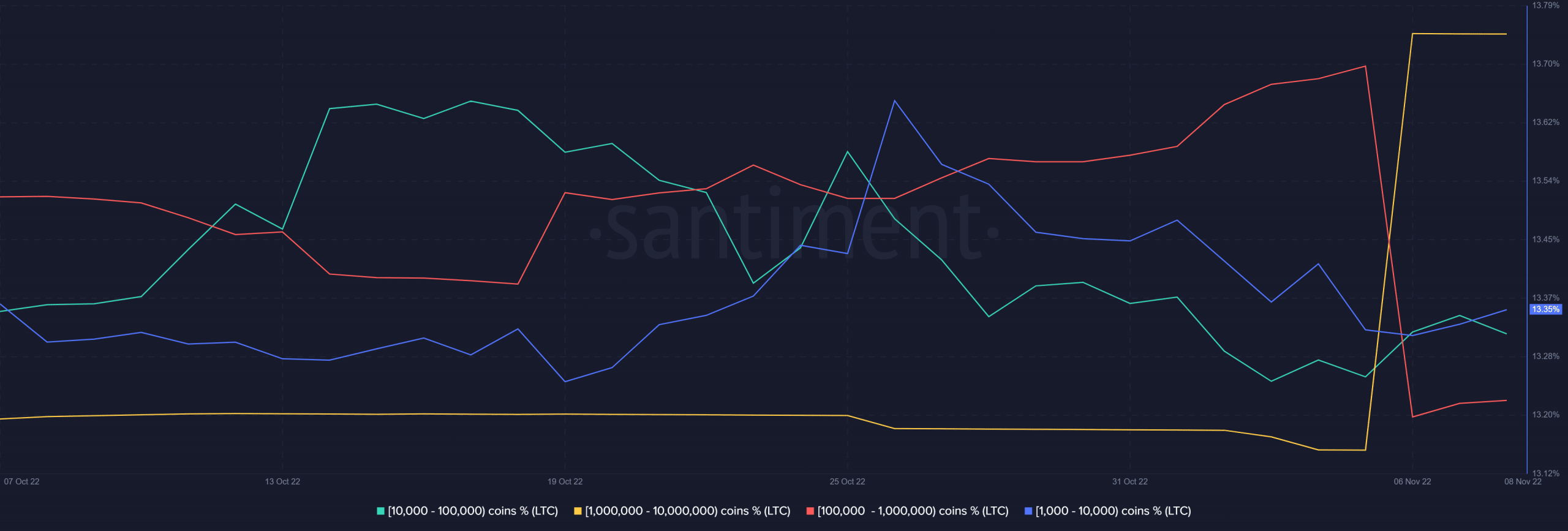

Litecoin’s provide distribution supplies a greater view of what the highest addresses or whales have been doing. LTC’s largest addresses holding over a million cash registered a large enhance of their balances on 5 November. Nonetheless, this incoming purchase stress tapered out the following day (Sunday).

Supply: Santiment

Addresses holding between 1,000 and 100,000 additionally elevated their balances on the similar time. In the meantime, addresses holding between 100,000 and a million LTC had been taking earnings.

A lot of the high whale classes have leveled out, which means they don’t seem to be promoting or shopping for. This may end in a restricted draw back for Litecoin. However, the market stays extremely unpredictable, which implies there may be nonetheless extra room for draw back.