- Following the market downturn on 8 November, Chiliz [CHZ] broke out of a rising wedge to undergo a 17% worth decline within the final 24 hours

- Shopping for stress declined considerably on a day by day chart as sellers managed the market

- Most CHZ holders incurred losses on their investments previously 24 hours

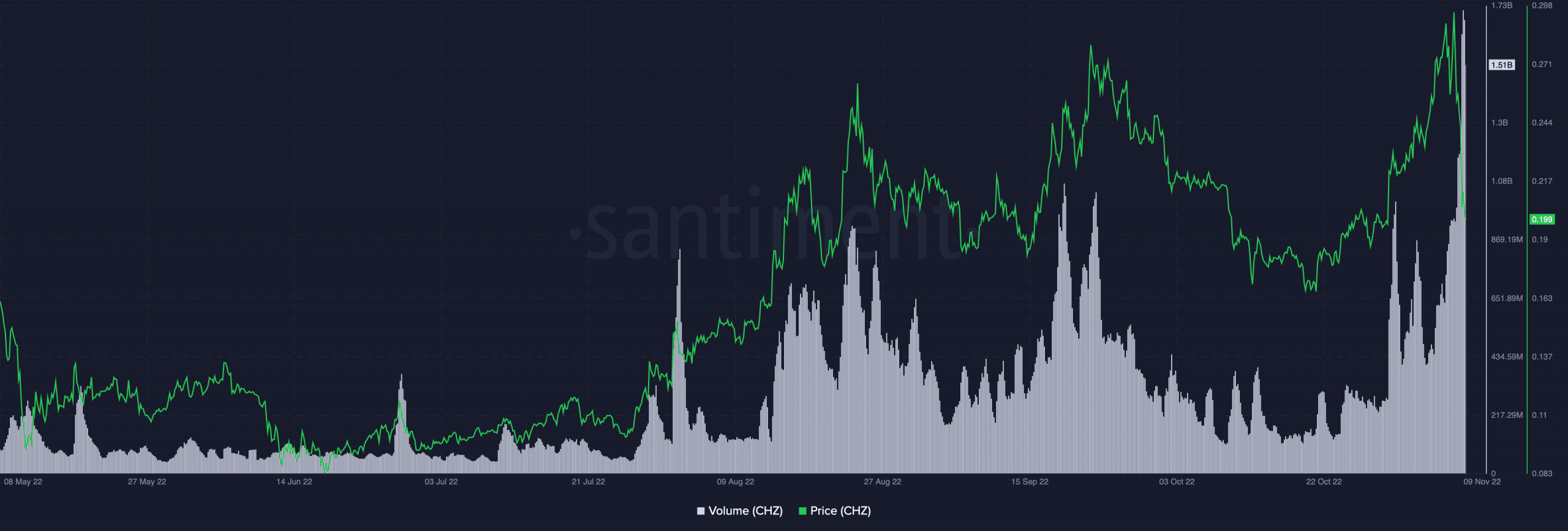

On the time of writing, $1.52 billion value of Chiliz [CHZ] was traded within the final 24 hours. Moreover, information from Santiment revealed that the #36 ranked cryptocurrency by market capitalization clinched a six-month excessive in its day by day buying and selling quantity.

Supply: Santiment

_____________________________________________________________________________________

Learn Chiliz [CHZ] Value Prediction 2023-2024

_____________________________________________________________________________________

With the market stricken by a downturn as a result of liquidity points at main cryptocurrency alternate FTX, the hike in buying and selling quantity wasn’t mirrored within the token’s worth. CHZ traded at $0.1996, with a 17% decline in worth within the final 24 hours. In keeping with information from CoinMarketCap, buying and selling quantity rallied by 54% throughout the similar interval.

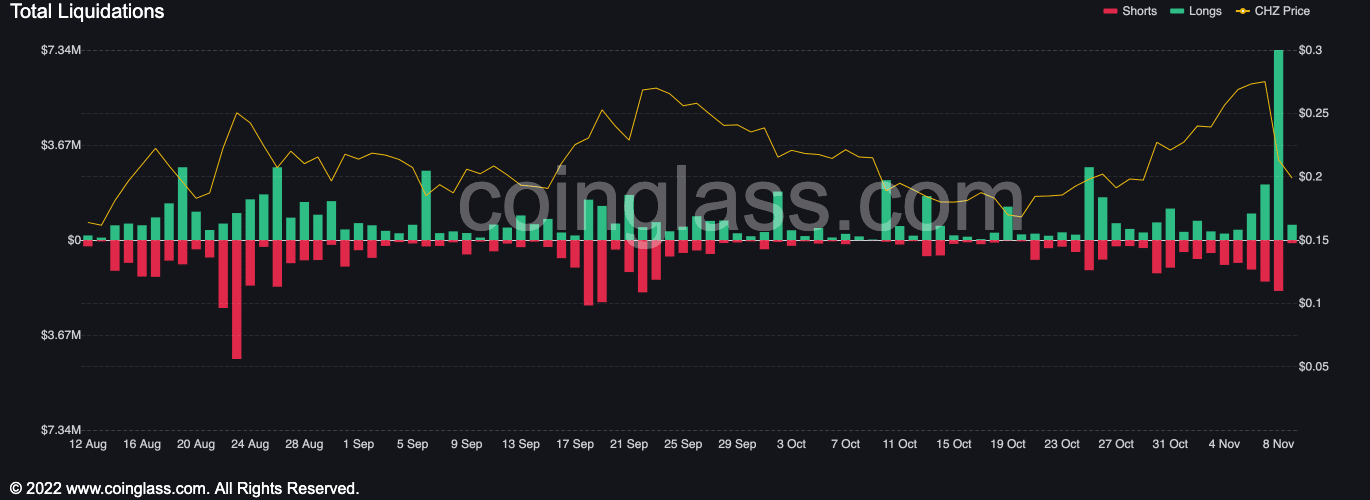

The alternative actions of CHZ’s worth and buying and selling quantity created a divergence that prompt patrons’ exhaustion within the present market. With important liquidation within the final 24 hours, information from Coinglass revealed that 327,611 merchants had been liquidated, and $717.21 million was faraway from the market.

Inside that interval, CHZ’s liquidation totaled $6.78 million.

Supply: Coinglass

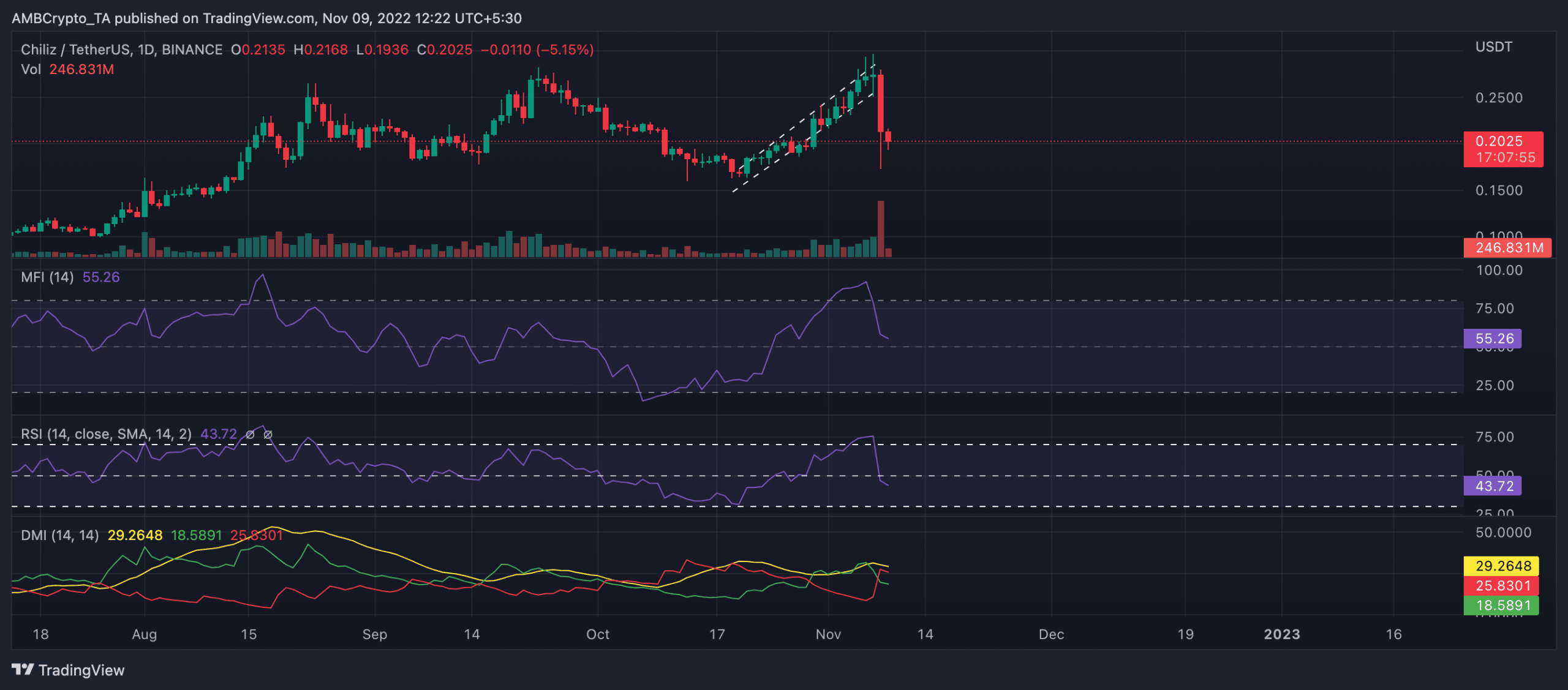

CHZ on a day by day chart

With much less patrons’ conviction to build up, sellers managed CHZ on a day by day chart. The information of Binance’s proposed acquisition of competitors FTX brought about CHZ to interrupt out of a rising wedge it had shaped since 21 October. Between 21 October and eight November, CHZ’s worth rallied by over 55%.

Nonetheless, as the final market plummeted throughout the intraday buying and selling session on 8 November, CHZ instantly broke out of its 18-day-long rising wedge to submit a protracted crimson candle.

The sharp fall in CHZ’s worth additionally brought about key indicator Relative Power Index (RSI), to fall beneath its 50-neutral spot. At press time, the RSI was pegged at 43.72 in a downtrend. Additionally in a downtrend was the alt’s Cash Circulate Index (MFI) because it inched nearer to the 50-neutral area at 55.26.

The place of the asset’s Directional Motion Index (DMI) additional prompt that sellers had pushed patrons out of the market at press time. The sellers’ power (crimson) at 25.83 was above the patrons’ (inexperienced) at 18.58.

As well as, the Common Directional Index (ADX) confirmed that the sellers’ power was one which patrons may discover unattainable to revoke within the brief time period.

Supply: TradingView

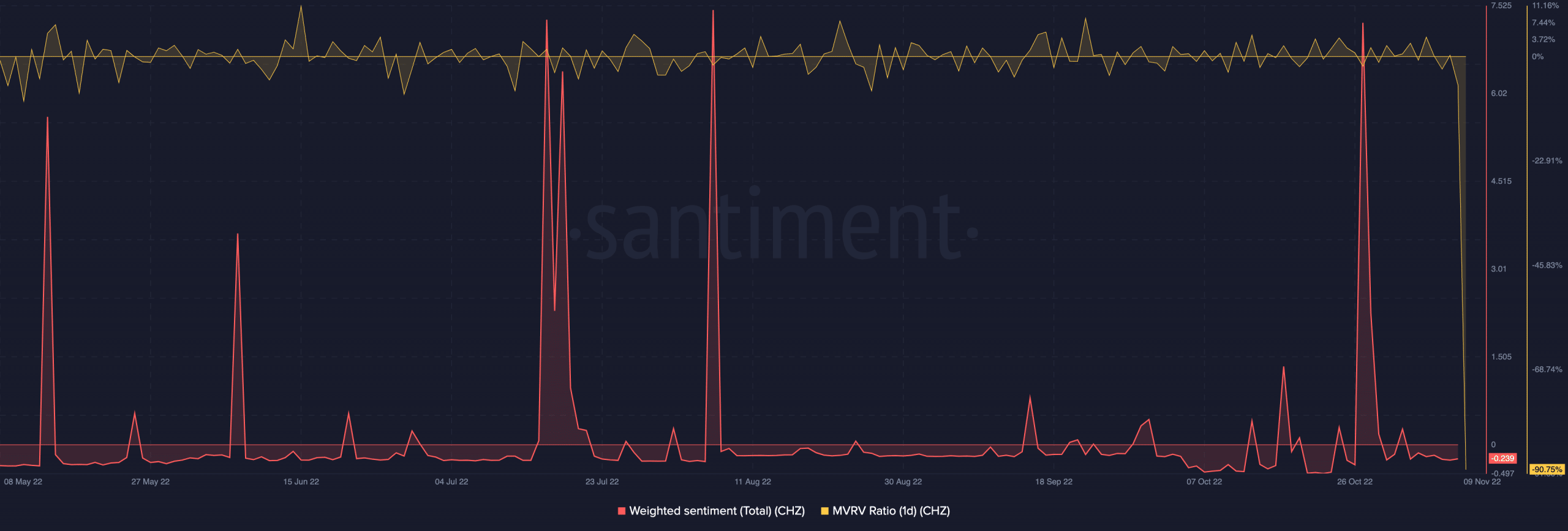

Regardless of the worth rally within the final week, adverse sentiment trailed CHZ for the reason that finish of October, information from Santiment confirmed. Additionally, the sharp fall in CHZ’s worth within the final 24 hours plunged most of its holders into losses because the Market Worth to Realized Worth (MVRV) ratio on a one-day transferring common was -90.75% on the time of writing.

Supply: Santiment