Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation.

- MANA threatens to crash additional after dropping about 80% of its worth during the last yr

- Its optimistic correlation with BTC nudges traders to comply with the king coin’s worth

At press time, MANA was buying and selling at $0.5279. It dropped by 80% in a yr after a one-year resistance trendline blocked all makes an attempt at worth restoration.

An especially weak breakout from the trendline in August put MANA in a variety of $0.6184-1.0692. Buyers can goal the lows and highs if the worth continues to pattern sideways on this vary.

Nonetheless, an additional transfer under the buying and selling vary ought to accompany a cease loss set at this Fib degree.

Can this vary maintain MANA worth motion any longer?

Supply: MANA/USDT, TradingView

Two obstacles have cornered MANA over the previous yr. After an upward transfer in late 2021, a trendline resistance blocked all makes an attempt by consumers to recuperate and money in on the altcoin. Sellers had the higher hand since December 2021 earlier than exhaustion hit in Could 2022.

A remaining try by the bulls failed to supply a convincing breakout and MANA ran right into a second barrier – A variety. Restricted shopping for strain undermined the worth rally, as proven by the flattening On Steadiness Quantity (OBV).

The altcoin’s worth has stayed within the $0.6184 – $1.0692 vary over the previous 5 months.

The present vary seems to be just like the one from July to August 2021. Apparently, MANA staged a giant rally in final yr’s vary, ending with an ATH of $5.85 on 25 November. That will make the prevailing vary an area backside ready for an upside breakout.

If so, a weekly candle closing above and retesting assist at $0.6184 would verify an entry alternative for lengthy positions. The rapid goal for lengthy positions could be the vary resistance at $1.1 and the secondary goal on the Fib degree of 0.236.

Nonetheless, a weekly candle closing under $0.6184 would reinforce the bearish outlook. The Chaikin Cash Stream (CMF) was under zero and the RSI was in oversold territory, confirming that sellers have been gaining momentum.

If sellers overcome the continuing exhaustion, they’d push MANA under $0.6184 in direction of the 0-Fib degree at $0.3849. Subsequently, $0.3849 could possibly be a cease loss if the downtrend continues.

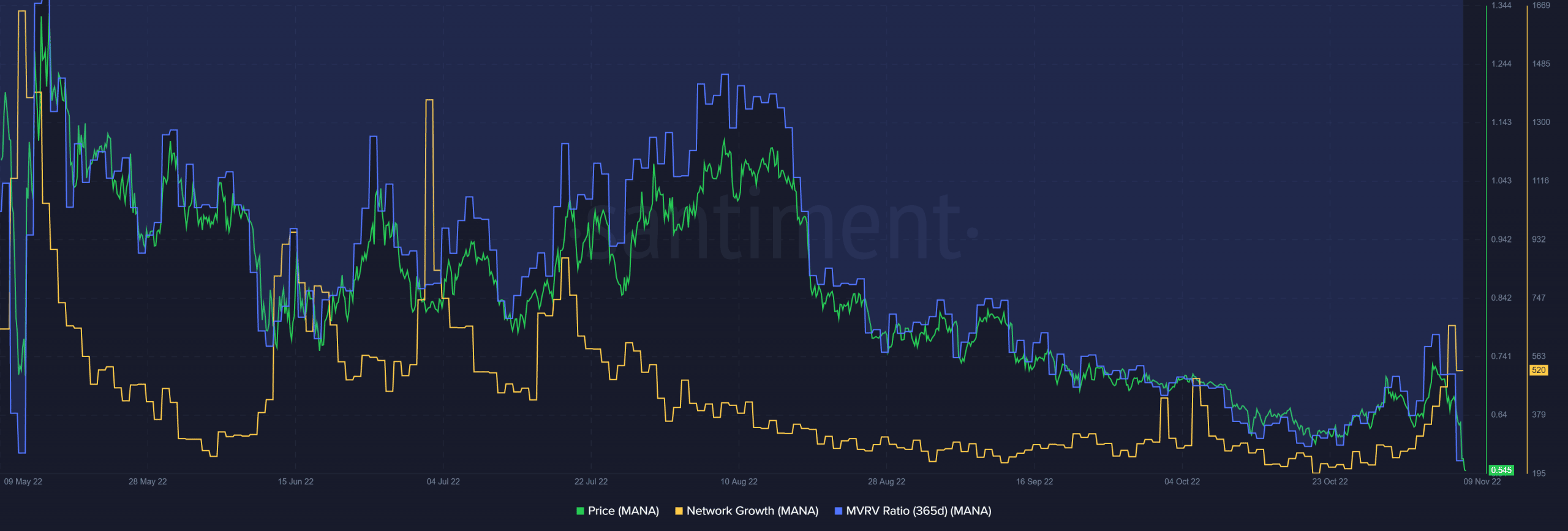

Lengthy-term MANA holders undergo losses as community development declines

Supply: Santiment

In keeping with Santiment, MANA noticed important community development in Q1 and Q2 2022. A rise in costs accompanied this community development uptick.

Nonetheless, the general community development of MANA has been declining since Could. Lengthy-term MANA holders are but to e-book earnings from their funding, as underlined by the adverse 365-day MVRV (Market Worth to Realized Worth ratio).

Buyers ought to due to this fact comply with MANA’s sentiment and the motion of BTC because it correlates positively with it.