Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation.

- Ethereum witnessed a bullish invalidation after reversing from its speedy resistance

- The altcoin registered enhancements in its funding charges during the last day

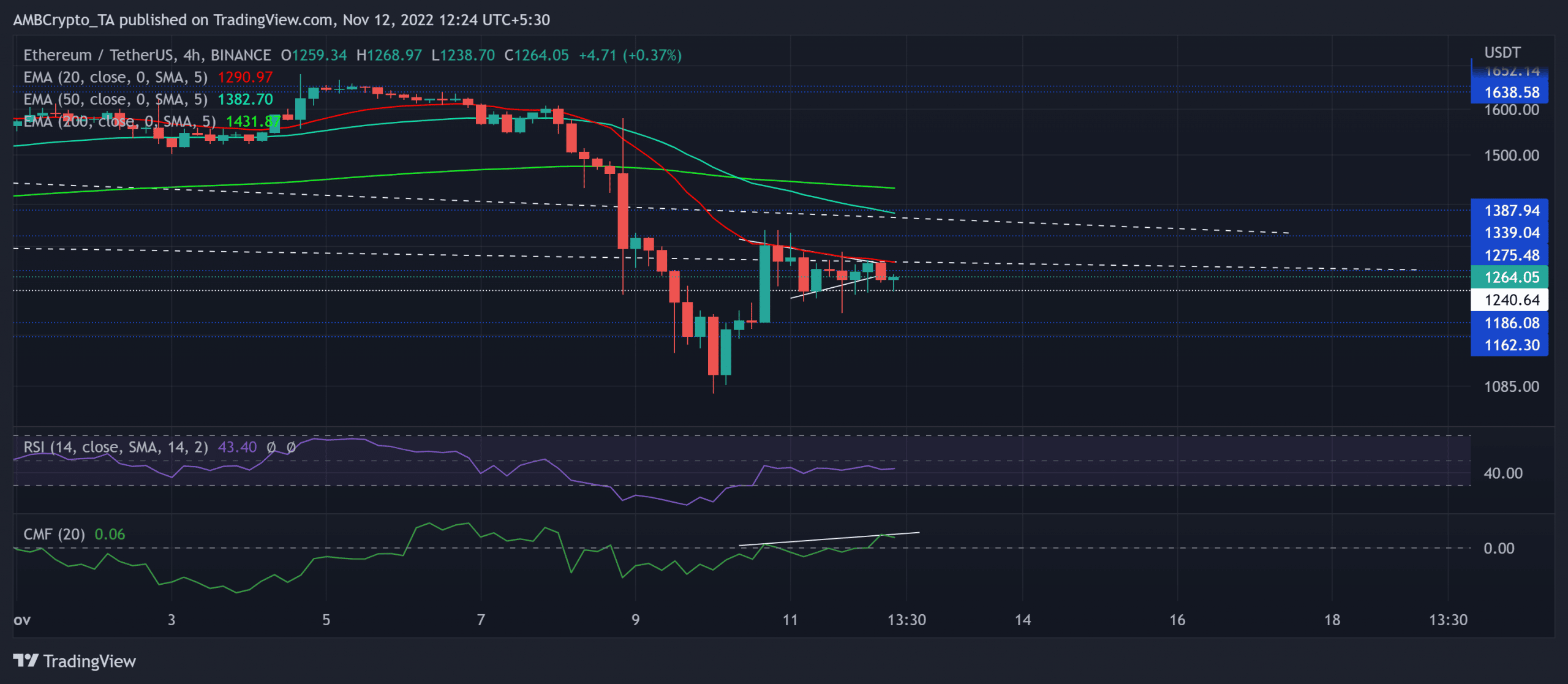

Ethereum [ETH] misplaced a 3rd of its worth in its reversal on 5 November from the $1,652 resistance. The broader market uncertainties amidst the FTX drama expedited the worry sentiment. The resultant losses pulled the king alt beneath its 20/50/200 EMA within the four-hour timeframe.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Ought to the $1,240 assist stand sturdy, it might invalidate the continued bearish inclinations out there. At press time, ETH was buying and selling at $1,264.

ETH noticed a confluence of resistances within the $1,290 area

Supply: TradingView, ETH/USDT

The latest worth actions chalked out a bullish flag-like setup after a steep uptrend within the four-hour timeframe. As a rule, this sample acts as a continuation sample.

However given the present market circumstances, the bulls didn’t breach the 20 EMA (purple) close to its speedy trendline resistance (white, dashed). Since then, patrons have been resting on the $1,240 assist over the previous day.

A possible decline beneath this assist might induce a retest of its first main assist degree within the $1,162-$1,186 vary. The patrons might then almost certainly propel for a near-term rebound.

However a direct break above the 20 EMA barrier adopted and the speedy trendline resistance might invalidate the near-term bearish inclinations. On this scenario, the potential targets would lie close to the $1,382 zone.

The Relative Power Index (RSI) depicted a slight bearish edge after struggling to sway previous the equilibrium. However, the Chaikin Cash Stream (CMF) depicted a bullish edge by sustaining its spot above the zero mark. However its latest peaks bearishly diverged with the value motion.

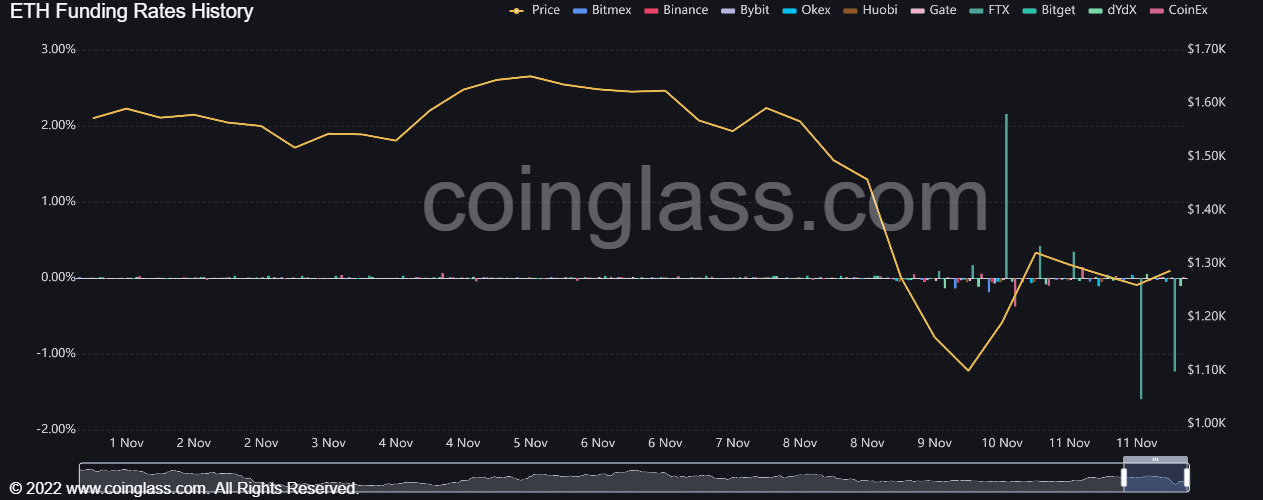

ETH’s revival plausibility

Supply: Coinglass

In keeping with information from Coinglass, ETH’s funding charges throughout half its exchanges turned damaging on 11 November. Moreover, its charge on FTX marked its file low as of 11 November. Nevertheless, because the previous day, the charges have witnessed an uptrend.

This incline depicted ease within the near-term bearish sentiment within the futures market. The patrons ought to preserve an in depth watch on these charges to gauge sensible probabilities of a comeback.

The targets would stay the identical as mentioned. Final however not least, traders/merchants should be careful for Bitcoin’s [BTC] motion. It is because ETH shared an 88% 30-day correlation with the king coin.