- As FTX US filed for chapter, Voyager introduced the re-commencement of the public sale strategy of its property

- This brought on VGX to rally astronomically previously 24 hours

Bankrupt crypto lender Voyager [VGX] introduced the reopening of the bidding course of for its property on 11 November. The announcement was made after information broke that crypto change FTX US had filed for Chapter 11 chapter safety.

Right this moment, after a aggressive public sale geared toward returning most worth to prospects, @FTX_Official US was chosen as the best and greatest bidder. Press launch linked under. Extra details about what this settlement means for purchasers to observe.https://t.co/OmOd7pvSza

— Voyager (@investvoyager) September 27, 2022

Learn Voyager [VGX] Value Prediction 2023-2024

Earlier in September, the now-failed FTX US gained the public sale for the property of the bankrupt crypto brokerage agency with a bid of round $1.4 billion.

Voyager acknowledged within the new press assertion that it had opened “discussions with various bidders.” It additional confirmed that with the Voyager Official Committee of Unsecured Collectors (UCC), it was,

“Shifting with all due care and deliberate velocity to determine an alternate plan of reorganization in line with the core goal all through this course of: maximizing the worth returned to prospects and different collectors.”

Though FTX US had gained the bid for its property in September, Voyager claimed that it didn’t switch any property to the change “in reference to the beforehand proposed transaction.” It, nonetheless, clarified that FTX US submitted the sum of $5 million as a “good religion” deposit as a part of the public sale course of, which was held in escrow.

Additionally, Voyager mentioned it had no excellent loans made out to FTX’s sister buying and selling firm, Alameda Analysis.

“Voyager efficiently recalled loans from Alameda Analysis for six,500 BTC and 50,000 ETH. Presently, Voyager has no loans excellent with any borrower,” the crypto brokerage agency claimed.

Voyager doing numbers

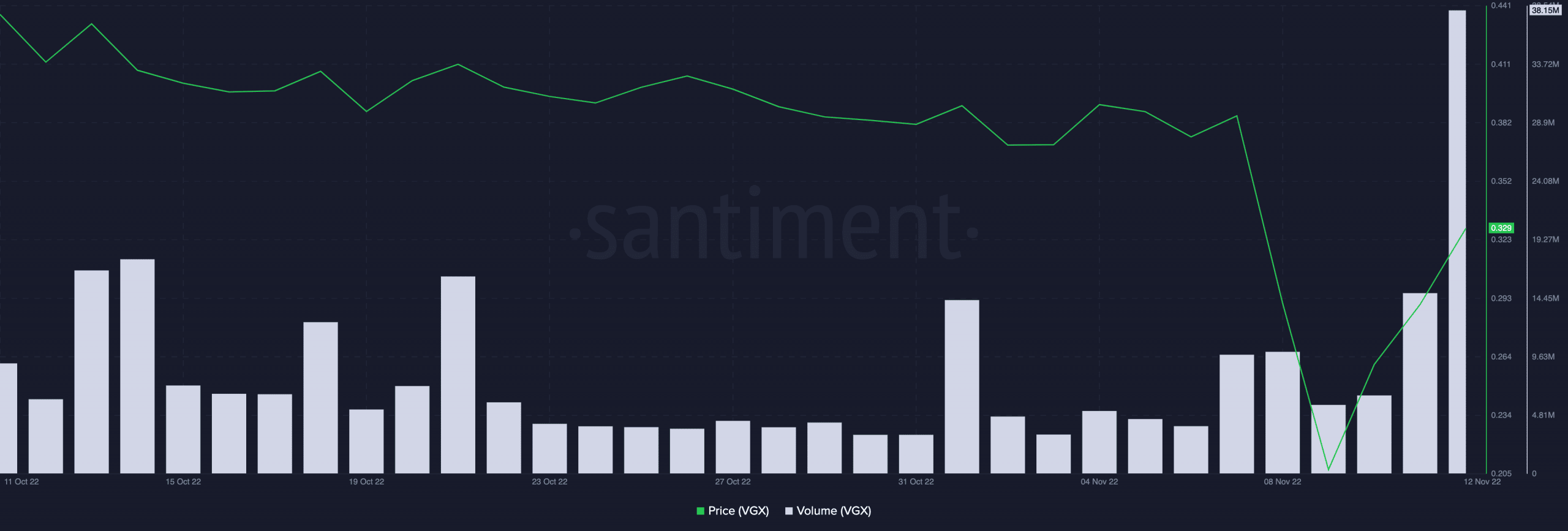

Following Voyager’s affirmation that it had reopened bidding for its asset, VGX’s worth rallied. In accordance with knowledge from CoinMarketCap, VGX exchanged fingers at $0.329, having gone up by 27% within the final 24 hours. Buying and selling quantity was additionally up by over 500% inside the similar interval.

With $38.15 million price of VGX tokens traded within the final 24 hours, the token logged its highest day by day buying and selling quantity within the final month, knowledge from Santiment revealed.

Supply: Santiment

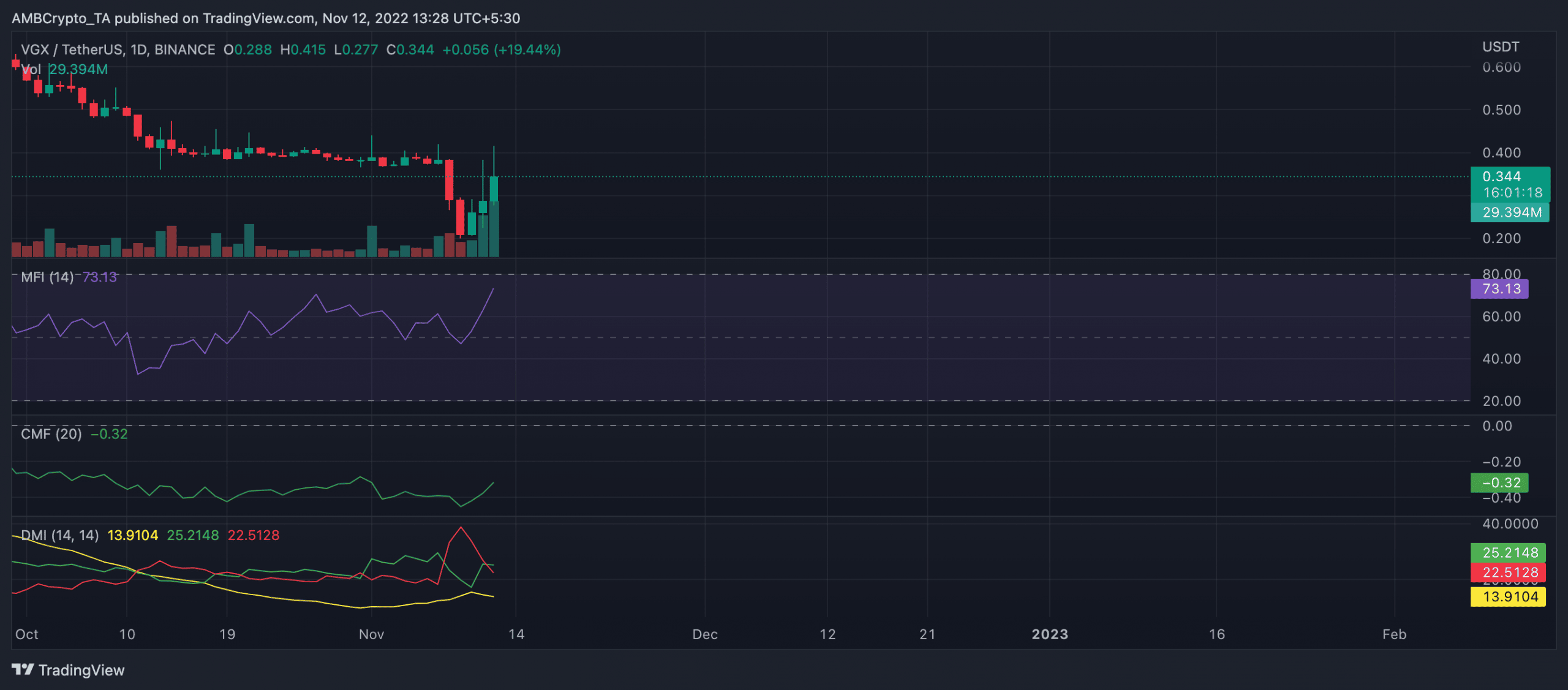

The current surge in VGX’s worth put the patrons accountable for the market on a day by day chart. The place of the asset’s Directional Motion Index (DMI) flipped within the final 24 hours to place the patrons’ power (inexperienced) at 25.21 above the vendor’s (crimson) at 22.51.

Moreover, shopping for strain continued to climb at press time. In consequence, VGX’s Cash Stream Index (MFI) was at a excessive of 73.

Supply: TradingView

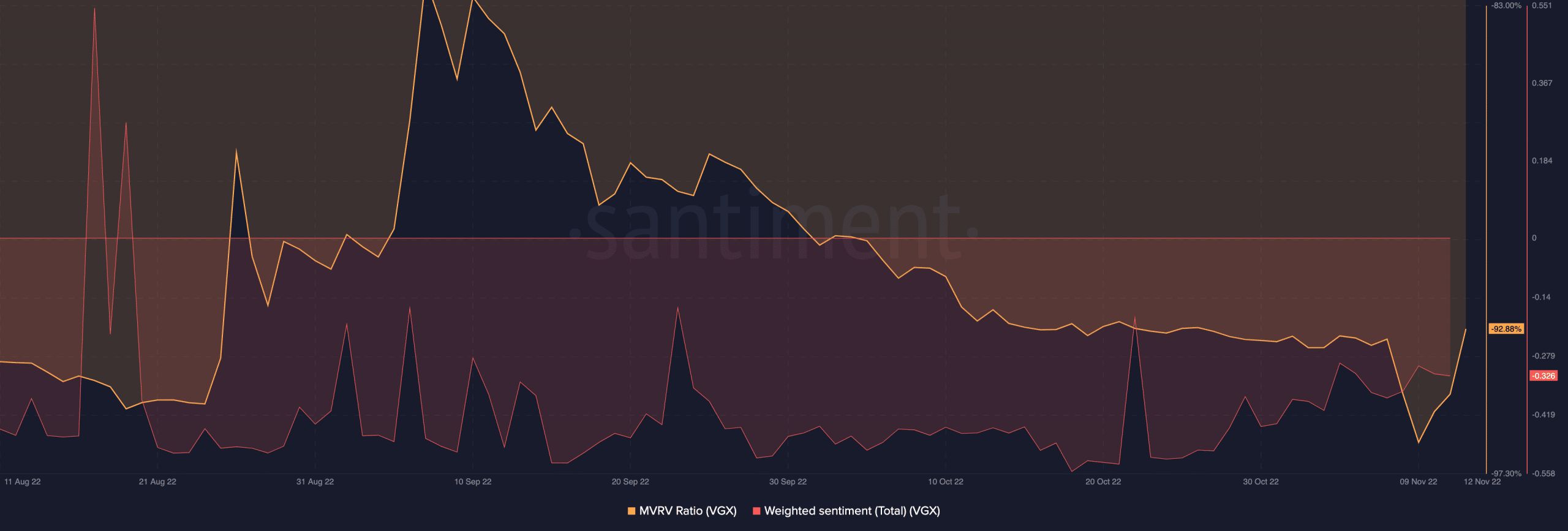

Apparently, as costs climbed within the final 24 hours, many VGX holders had been nonetheless at a loss. At press time, its Market Worth to Realized Worth (MVRV) ratio was 92.88%. Sentiment round VGX remained unfavorable at -0.326.

Supply: Santiment