Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought-about funding recommendation

- Regardless of the bounce to $0.375, the construction remained bearish

- $0.26 was the following important assist stage to be careful for

Cardano was within the grip of a hefty bearish pattern. This has been the case since August. Even earlier than the FTX fiasco, Cardano had fallen beneath a variety it had traded inside from Might to early October.

Learn Cardano’s [ADA] Value Prediction 2023-2023

Due to this fact, the renewed promoting strain didn’t mar an in any other case optimistic market however as a substitute accelerated ADA’s fall. Within the coming weeks, an additional draw back will be anticipated. The $0.37-$0.26 area was vital again in January 2021 and will show pivotal for bullish hopes as soon as once more.

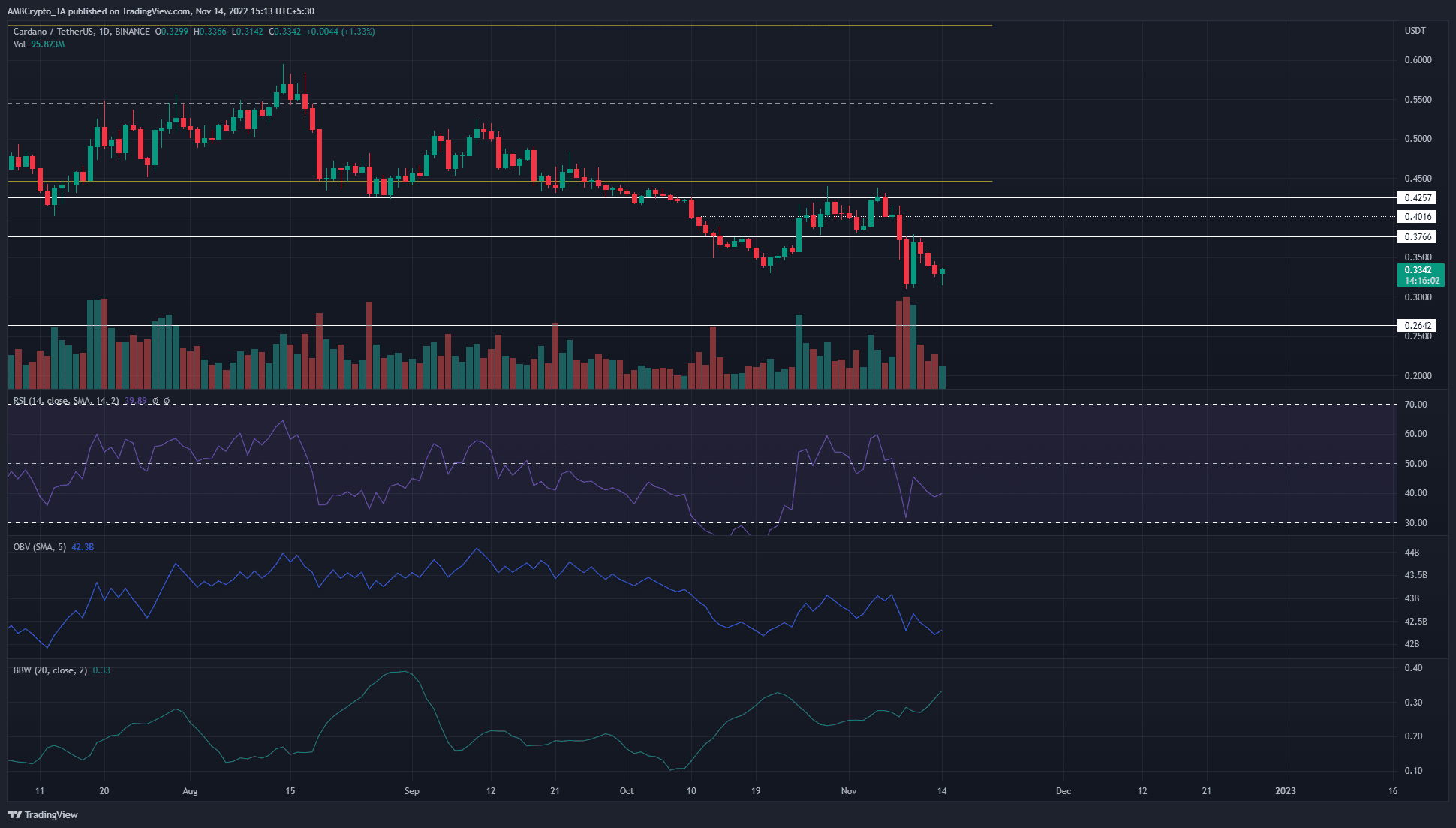

Market construction on the every day chart stays bearish, with $0.316 subsequent on bearish crosshairs

Supply: ADA/USDT on TradingView

In early November, ADA tried to remain above the $0.385 assist stage. On 5 November it tried to breach the $0.425 stage of resistance however confronted a pointy rejection. Furthermore, the value slid to publish a low of $0.31 on 9 November. In doing so, it flipped the market construction to bearish. A transfer again above $0.376 can be essential to shift the bias, though a real pattern reversal might take months to materialize.

This got here within the wake of all of the panic available in the market surrounding the FTX saga. With Bitcoin being weak on the upper timeframe charts as properly, long-term buyers in ADA may need to watch for the mud to settle.

The technical indicators didn’t present a lot hope for the bulls. The Relative Energy Index (RSI) was at 39.89, and it has been under the impartial 50 mark for a big period of time since mid-August. This confirmed {that a} downtrend on the every day charts was in progress, one thing the value motion agreed with.

The On-Stability Quantity (OBV) was again at a assist stage from October as soon as extra. It noticed a big pullback previously week, to indicate real promoting strain within the Cardano markets. In the meantime, the Bollinger bands width indicator shot upward in current weeks. This indicator highlighted the volatility behind ADA has been excessive over the previous month.

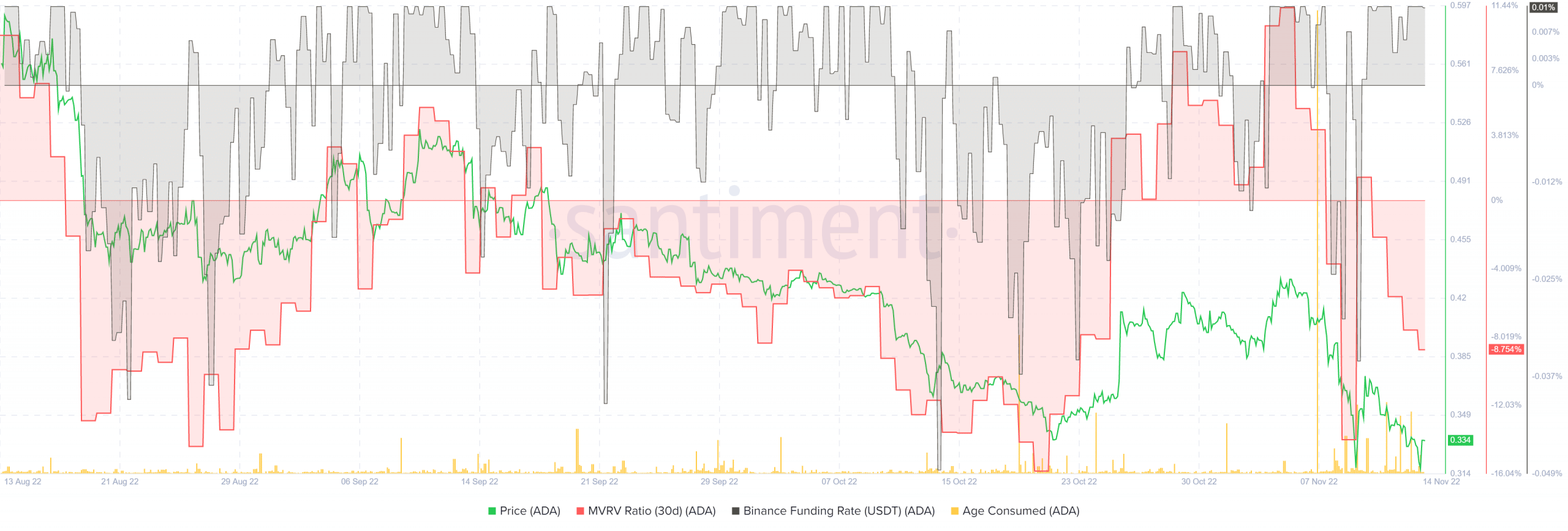

MVRV (30-day) is again within the crimson as holders go right into a loss as soon as extra

Supply: Santiment

Regardless of the losses ADA has seen over the previous week, the funding charge of the asset continued to be in optimistic territory on Binance. The Market Worth to Realized Worth (MVRV) metric slid again under the 0 mark to indicate that 30-day holders have been at a web loss. The peaks of this metric have seen promoting strain come up in current months, and will be one thing to keep watch over.

The Age Consumed metric noticed an unlimited spike on 7 November. This spike indicated that an enormous quantity of beforehand idle ADA tokens had moved between addresses. Since this was adopted by a big wave of promoting, it was doubtless that these tokens went to trade addresses to be offered.