NFT

Royal, one of many largest names within the burgeoning music NFT house, has lastly launched its long-promised market for fractionalized music royalty rights.

Began by digital musician and entrepreneur Justin “3LAU” Blau and Opendoor founder JD Ross, Royal raised $16 million in its seed funding spherical in August 2021. Final November, the Web3 music startup raised one other $55 million in funding from Andreessen Horowitz, Coinbase Ventures, and Paradigm, together with fashionable musicians like Nas and The Chainsmokers.

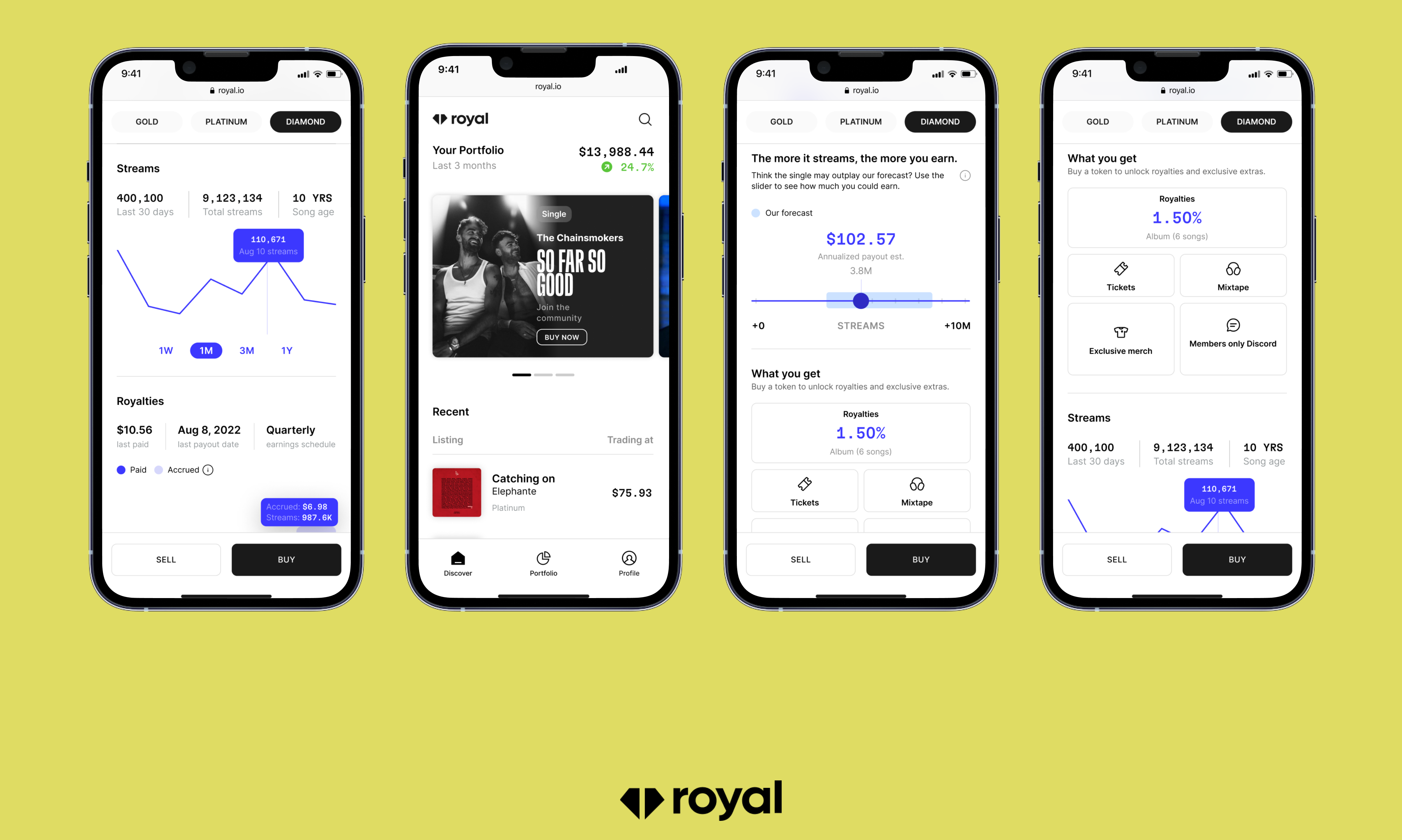

With that capital, Blau tells Decrypt that Royal has spent the previous 12 months growing its browser-based NFT market, the place customers can now uncover new artists, commerce Royal NFTs, and see detailed statistics on every asset.

Nas and The Chainsmokers Be part of $55M Increase in NFT Music Platform Royal

The Royal market pulls bid knowledge and buy historical past from high general NFT market, OpenSea, plus its dashboard aggregates streaming knowledge from Spotify, Apple Music, Amazon Prime Music, Tidal, and SoundCloud Premium.

Because it started releasing NFTs, Royal has dropped music with heavy-hitters like Diplo, Nas, The Chainsmokers, Vérité, Elephante, and 3LAU himself. As part of at the moment’s market launch, Royal is releasing a brand new drop with digital musicians Bingo Gamers and Zookëper.

Every Royal NFT gives patrons a fractionalized share of royalty funds as artists’ songs are performed on streaming companies. Earlier this month, Royal introduced that its partnered artists had paid out over $100,000 in royalties throughout greater than 9,200 NFT collectors since launch.

After at the moment’s payout, artists have shared greater than $100k in streaming royalties with collectors by way of Royal. pic.twitter.com/NRuc86iW4y

— royal (@join_royal) November 4, 2022

This milestone reveals that collector royalties, whereas at the moment modest, is usually a actual incentive for followers to purchase NFTs from their favourite musicians. The proportion varies by artist and/or music, but it surely permits followers to put money into artists whereas betting on their future success.

Whereas holders received’t make again what they paid for every Royal NFT instantly, there are potential advantages for long-term collectors relying on which artist(s) they help. Royal NFTs aren’t nearly music rights and royalties—some NFTs are eligible for bonus real-world perks, like entry to meet-and-greets or listening events.

Who’s it for?

Royal’s market launches into an NFT house that already has loads of established platforms for purchasing and promoting digital property, though many are broadly designed and never centered particularly on music. There’s additionally numerous Web3 music platforms competing for customers’ consideration, like Audius and OurSong (Blau is an advisor to Audius).

Even with so many different NFT platforms within the house, Blau mentioned that there’s a necessity for a devoted platform that may onboard new customers, as Royal isn’t concentrating on Web3 natives.

{The marketplace} additionally has new portfolio options. Picture: Royal.io

“The explanation why we constructed our personal is as a result of we felt that plenty of music followers do not know arrange a pockets,” Blau informed Decrypt. “We principally arrange a means for everyone to pay and commerce in {dollars}. So for those who’ve by no means used crypto earlier than, and also you join Royal, we generate a pockets for you. You’ll be able to deposit USDC into that pockets out of your checking account. You by no means should see Ethereum for those who do not wish to.”

Royal’s market leverages Ethereum sidechain Polygon’s community for its NFT property, however doesn’t see self-custody crypto wallets or dealing with ETH as a required a part of the Web3 expertise. Royal merely needs to leverage the idea of blockchain-verifiable possession whereas making it mainstream.

“We wanted to construct somewhat bit higher of a bridge,” Blau mentioned of Royal’s determination to deploy its personal market.

Royal’s purpose for {the marketplace} is to be extraordinarily user-friendly and preserve its crypto parts minimal. This technique could show profitable: Audius just lately hit 7.5 million customers partly as a result of, as CEO Roneil Rumburg beforehand informed Decrypt, “the common Audius consumer just isn’t even conscious the crypto is there.”

“We’re not essentially constructing it for the present customers of crypto,” Blau mentioned of Royal’s market. “We’re constructing it for all the new ones.”

Royalty debates

Royal’s music royalties for collectors aren’t fairly the identical because the idea of creator royalties within the broader world of NFTs.

Royalties have grow to be a controversial subject these days as marketplaces like OpenSea and Magic Eden debate whether or not to implement creator royalties—a payment, usually set from 5% to 10% of the sale worth, paid by secondary market sellers. Many platforms have made them non-compulsory, though OpenSea opted to maintain them following creator backlash.

“I by no means actually understood why we name them royalties within the first place,” Blau informed Decrypt. “Royalties form of indicate that one thing is consumed—that there is some type of proper that’s getting paid out on—and what we name secondary royalties are actually secondary commissions.”

Chainsmokers Share New Album Royalties With Followers by way of NFT Drop in Music Trade First

Royal’s payouts are royalties within the conventional sense of the phrase: rights homeowners obtain a share of earnings when a bit of content material is consumed. In Royal’s case, these rights homeowners are the NFT homeowners. In the remainder of the NFT world, royalties might maybe extra precisely be renamed creator charges or, as Blau urged, “secondary commissions.”

“My common opinion is the concept of secondary commissions into perpetuity has product market match, insofar as folks get actually enthusiastic about it,” he mentioned. “Its enforceability sadly requires a level of centralization.”

How UMG Is Constructing Out Its Bored Ape Metaverse Band, Kingship

A primary purpose that Blau began Royal was to disrupt the normal music business and permit musicians to earn a bigger share of the whole income pie, the place they at the moment take house roughly 12%.

“At Royal, we clearly consider that creators ought to receives a commission without end,” he defined. “We are also delicate to common payment buildings. Like, 10% each time one thing trades is simply form of irrational. However there’s some in-between that we expect is honest.”

Royal mentioned that it’s protecting its platform charges and artist charges on its market till 2023, whereas its secondary commissions payment for artists will probably be 2.5%.

The way forward for Royal

So what’s subsequent for the Royal staff? Blau informed Decrypt {that a} cell app model of {the marketplace} is within the works. “It is perhaps quickly,” he mentioned of an iOS app.

However Blau isn’t anxious about Apple’s strict NFT insurance policies or its 30% in-app buy charges for any NFTs bought. Apple’s insurance policies have divided NFT advocates. Some see these charges as incompatible with Web3 enterprise fashions, whereas others say that the mainstream viewers is important, and Web3 builders will merely must get extra artistic with how they monetize merchandise.

“We now have a direct contact with Apple that we’re working with on ensuring that we assess the right parameters for launching,” Blau mentioned. “These charges received’t get in the way in which of our imaginative and prescient.”