VGX, the native asset of bankrupt cryptocurrency lending platform Voyager Digital, noticed a big surge in buying and selling exercise over the past 24 hours.

Learn Voyager [VGX] Worth Prediction 2023-2024

The sudden rally in worth and buying and selling quantity got here after reports citing an individual acquainted with the matter revealed that Binance U.S has relaunched its bid to amass the belongings of Voyager Digital.

In an earlier bid in September, the now-collapsed cryptocurrency alternate FTX gained the public sale for the crypto-lender’s belongings. Nonetheless, following FTX’s premature demise, Voyager, on 11 November, announced the reopening of the bidding course of for its belongings.

In its announcement, Voyager confirmed that it was but to switch any belongings to FTX earlier than the latter’s collapse. It, nonetheless, talked about that FTX U.S paid a sum of $5 million as a “good religion” deposit as a part of the public sale course of. The identical is now held in escrow.

VGX emerges winner

As this information replace broke out, VGX instantly noticed a rally in its worth. In response to CoinMarketCap, the altcoin rallied by 55% over the past 24 hours. At press time, it was exchanging palms at an index worth of $0.4468.

Moreover, buying and selling quantity surged astronomically throughout the identical interval. With over $110 million value of VGX traded within the final 24 hours, the asset’s buying and selling quantity was up by virtually 2500%.

In response to Santiment, this determine represented the best each day quantity traded over the past two months.

Supply: Santiment

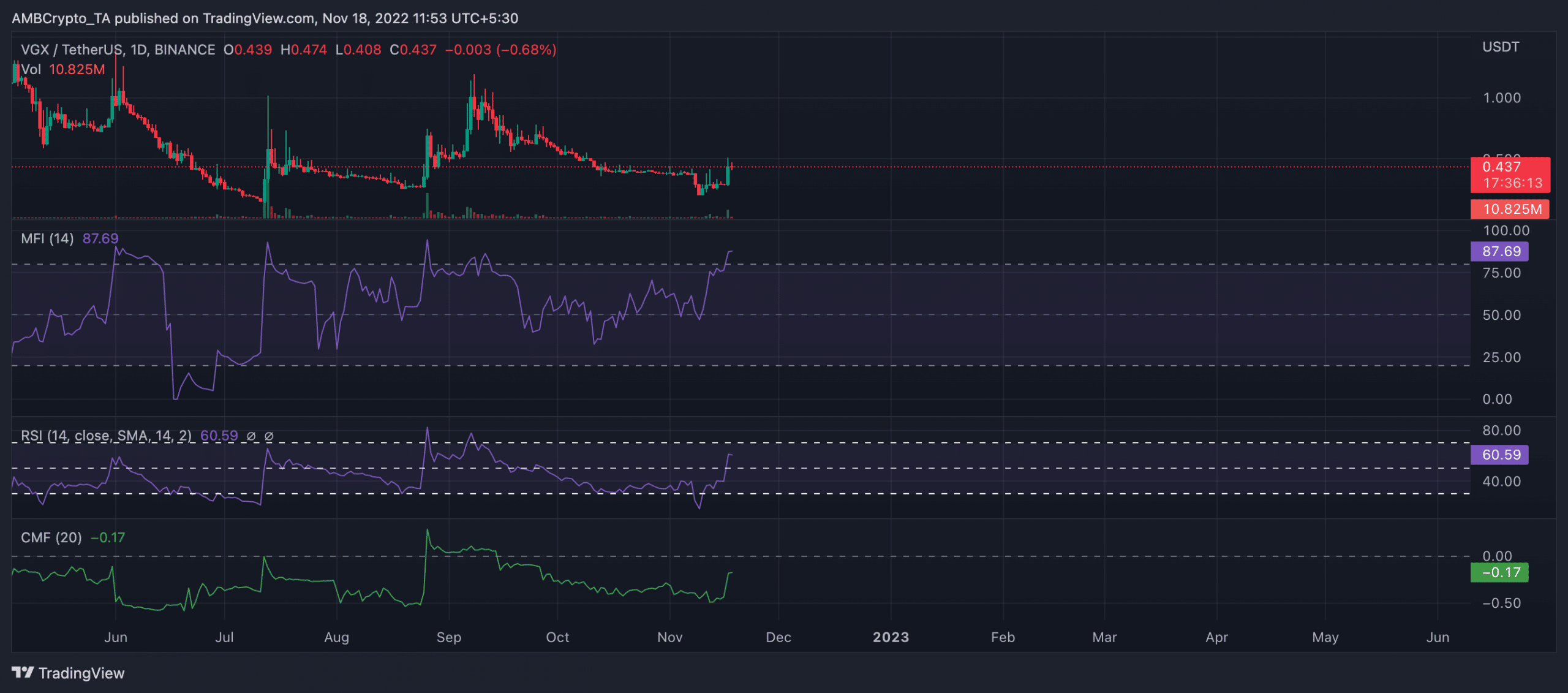

Because of Binance U.S’s rumoured bid, VGX logged important accumulation too. Piggybacking on the information, VGX’s Relative Energy Index (RSI) crossed its impartial stage to be positioned at 60.59 at press time. Additionally, on an uptrend and resting within the overbought zone, the crypto-asset’s Cash Move Index (MFI) was positioned at 87.69.

Whereas nonetheless under the middle line, the dynamic line of the Chaikin Cash Move (CMF) was pegged at -0.18. Nonetheless, noticed on an uptrend, sustained shopping for momentum can push it throughout the middle line. This might underline a level of optimistic progress in VGX’s accumulation.

Supply: TradingView

A lot ado about nothing

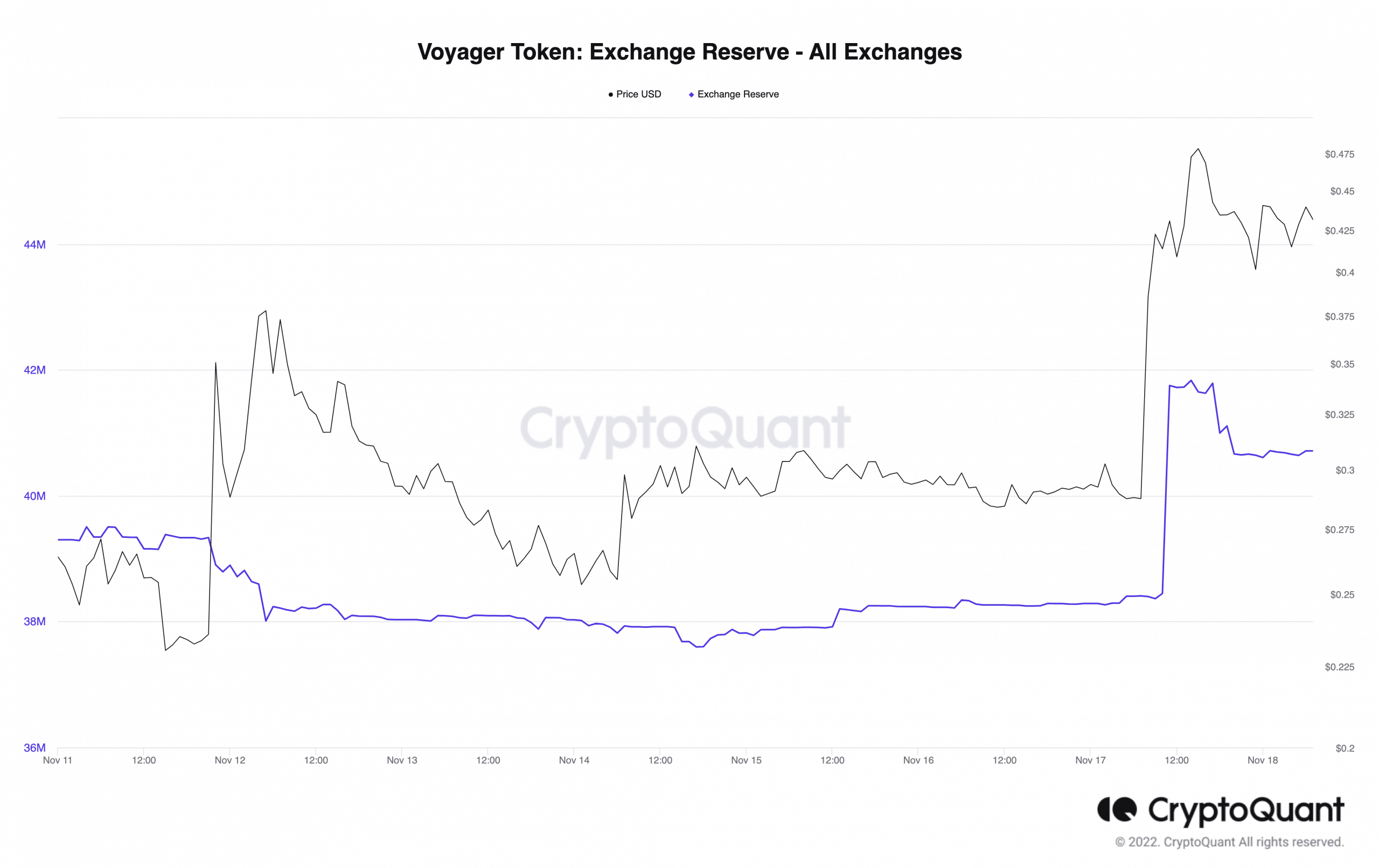

In response to CryptoQuant, as VGX’s worth rallied through the intraday buying and selling session on 17 November, traders which have lengthy held the crypto took to promoting to make a revenue.

Because of this, VGX’s alternate reserves noticed a sudden spike as its worth climbed. This was an indication that many holders tried to promote.

Supply: CryptoQuant

Nonetheless, as a result of uncertainty that has lengthy plagued Voyager Digital, most holders who offered through the newest worth rally realized losses. In reality, Santiment revealed that VGX’s MVRV ratio on a one-moving day common was -125%.

The value rally flipped traders’ sentiment from unfavourable to optimistic. Ought to the value proceed to develop, holders may see revenue so long as lengthy as macro elements stay favorable.

Supply: Santiment