- Bitcoin HODLers take away their BTC from exchanges

- Miners proceed to face strain; nevertheless, retail and whale traders begin exhibiting an curiosity in BTC

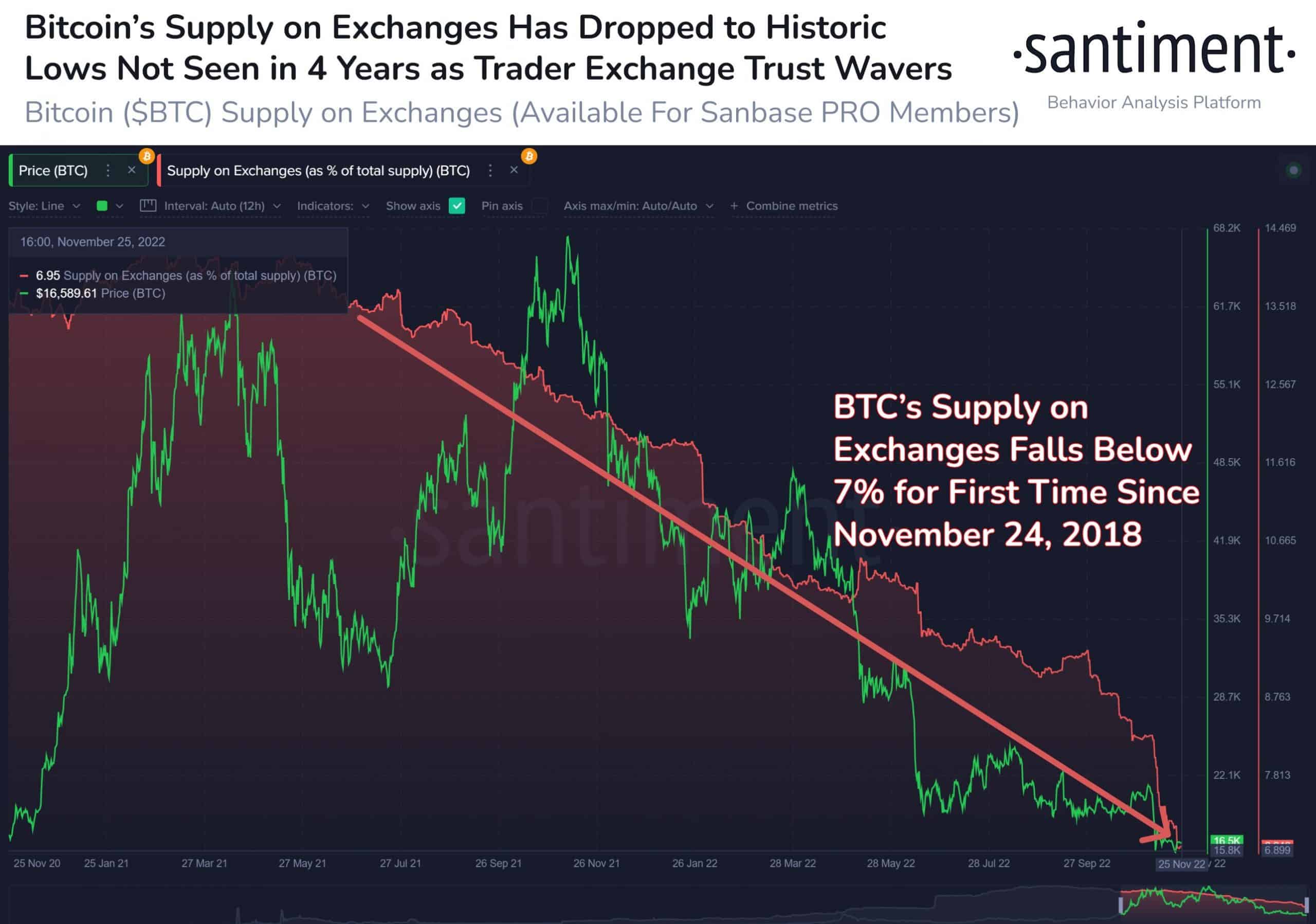

Santiment, in a brand new tweet dated 27 November, said that Bitcoin HODLers had been switching to self-custody and shifting their BTC away from exchanges. On the time of the tweet, solely 6.95% of Bitcoin was sitting on exchanges.

Learn Bitcoin’s Price Prediction 2022-2023

As is evidenced by the picture under, Bitcoin’s provide on exchanges dropped to its lowest in 4 years. Although the pattern of withdrawing BTC from exchanges began in 2020, it accelerated within the latest previous as a result of FTX fallout.

Supply: Santiment

Nonetheless, a decline in Bitcoin on trade didn’t suggest a lowering curiosity in BTC.

BTC operating on discounted costs

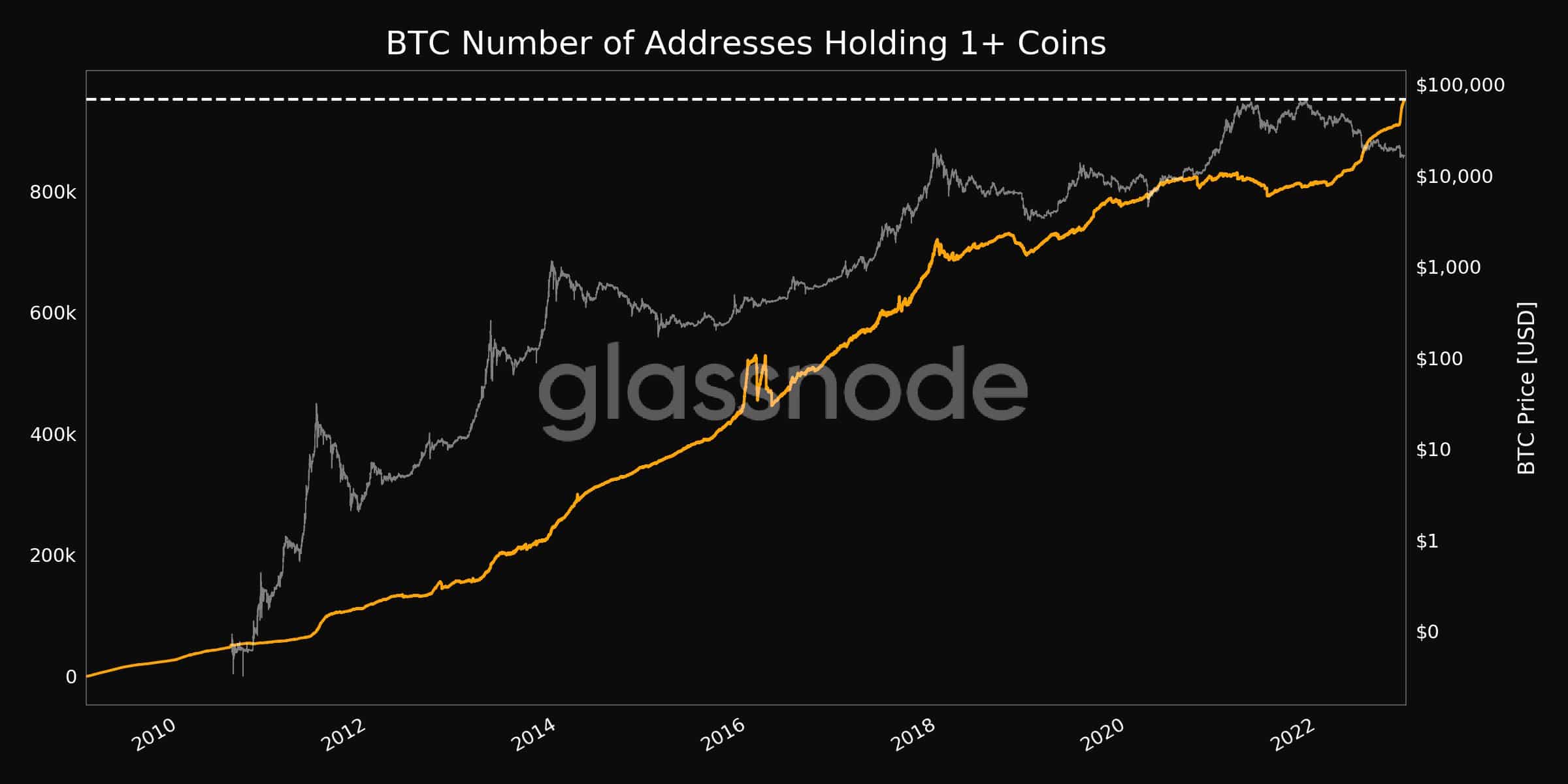

As Bitcoin’s costs fell, many traders determined to capitalize on this chance and tried to safe BTC at discounted costs. As will be seen from the picture under, the variety of addresses holding a couple of coin elevated tremendously over the previous month and reached an all-time excessive on 26 November.

Nevertheless it wasn’t simply whales and enormous addresses that had been exhibiting curiosity in BTC. Retail traders had been additionally profiting from BTC’s worth decline, in line with information provided by Glassnode. Addresses holding 0.1 Bitcoin reached an all-time excessive of 4,069,920.

Supply: Glassnode

Although traders had began exhibiting religion in Bitcoin, it nonetheless wasn’t sufficient to enhance Bitcoin miners‘ situations. The mining income generated by Bitcoin miners declined considerably over the previous couple of days.

Now, if the miner income continues to depreciate together with the value of Bitcoin, miners will likely be compelled to promote their mined BTC in order that they’ll make a revenue.

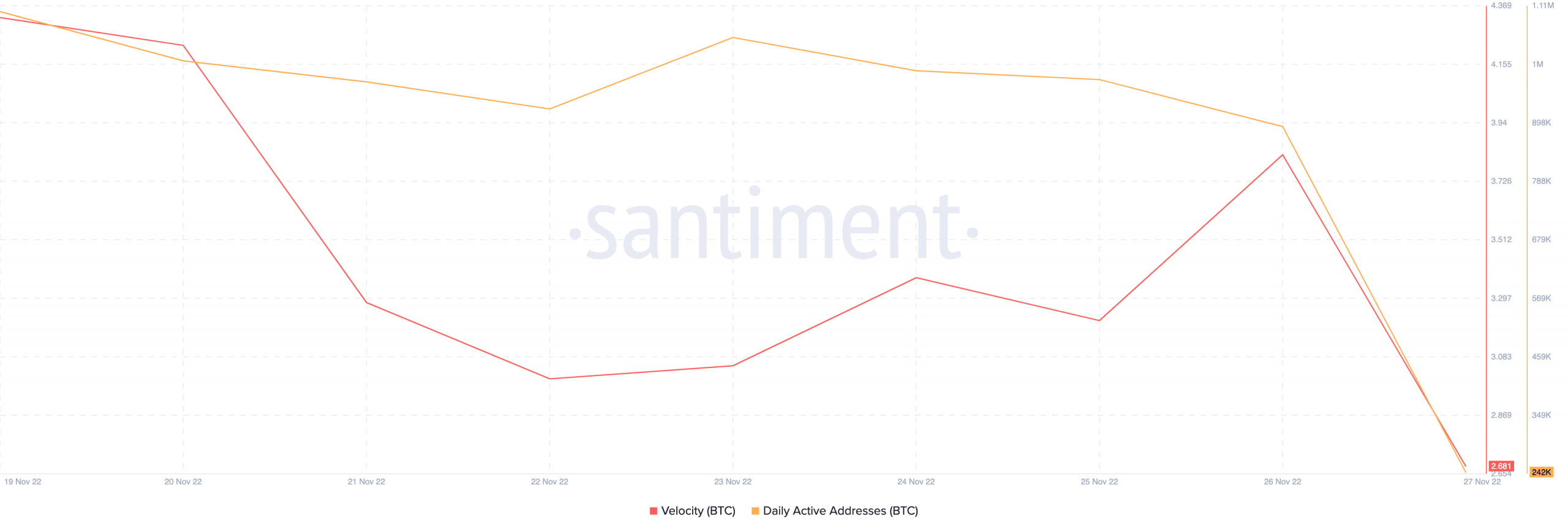

Bitcoin holders make their determination

That stated, from the chart under, it may be seen that Bitcoin’s variety of every day lively addresses had declined. Together with that, Bitcoin’s velocity depreciated considerably. Thus, indicating that the frequency with which Bitcoin was being exchanged amongst wallets had decreased.

Supply: Santiment

On the time of writing, BTC was buying and selling at $16,557.39. Its worth had decreased by 0.07% within the final 24 hours, in line with CoinMarketCap, and its quantity slumped by 4.36%.