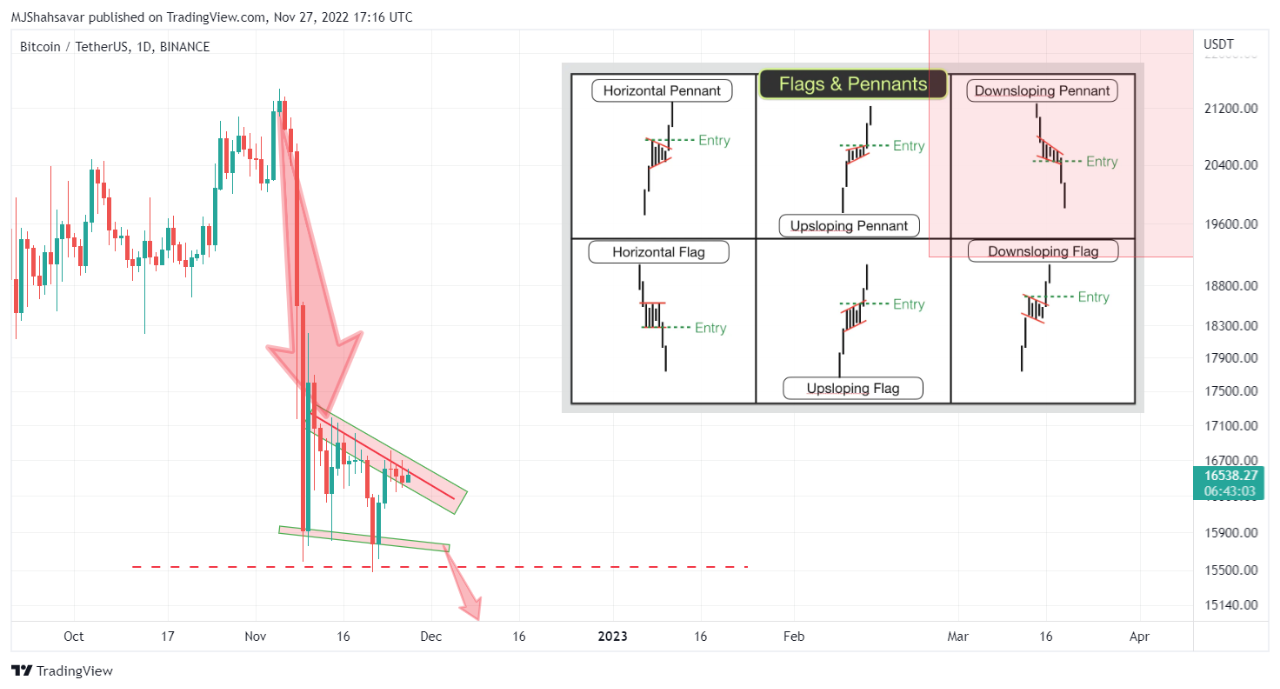

- Bitcoin is forming a bearish pennant sample

- Bitcoin’s open curiosity within the derivatives market dropped considerably final week

Bitcoin has kicked off this week with a return of promote strain after failing to keep up its upside final week. A brand new CryptoQuant evaluation means that we would see extra worth slippage this week.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Bitcoin is forming a bearish pennant sample in keeping with a CryptoQuant analyst by the pseudonym ghoddusifar. This sample is often related to a continued downtrend. In different phrases, the sample simply elevated the probability of Bitcoin extending its draw back this week.

Supply: CryptoQuant

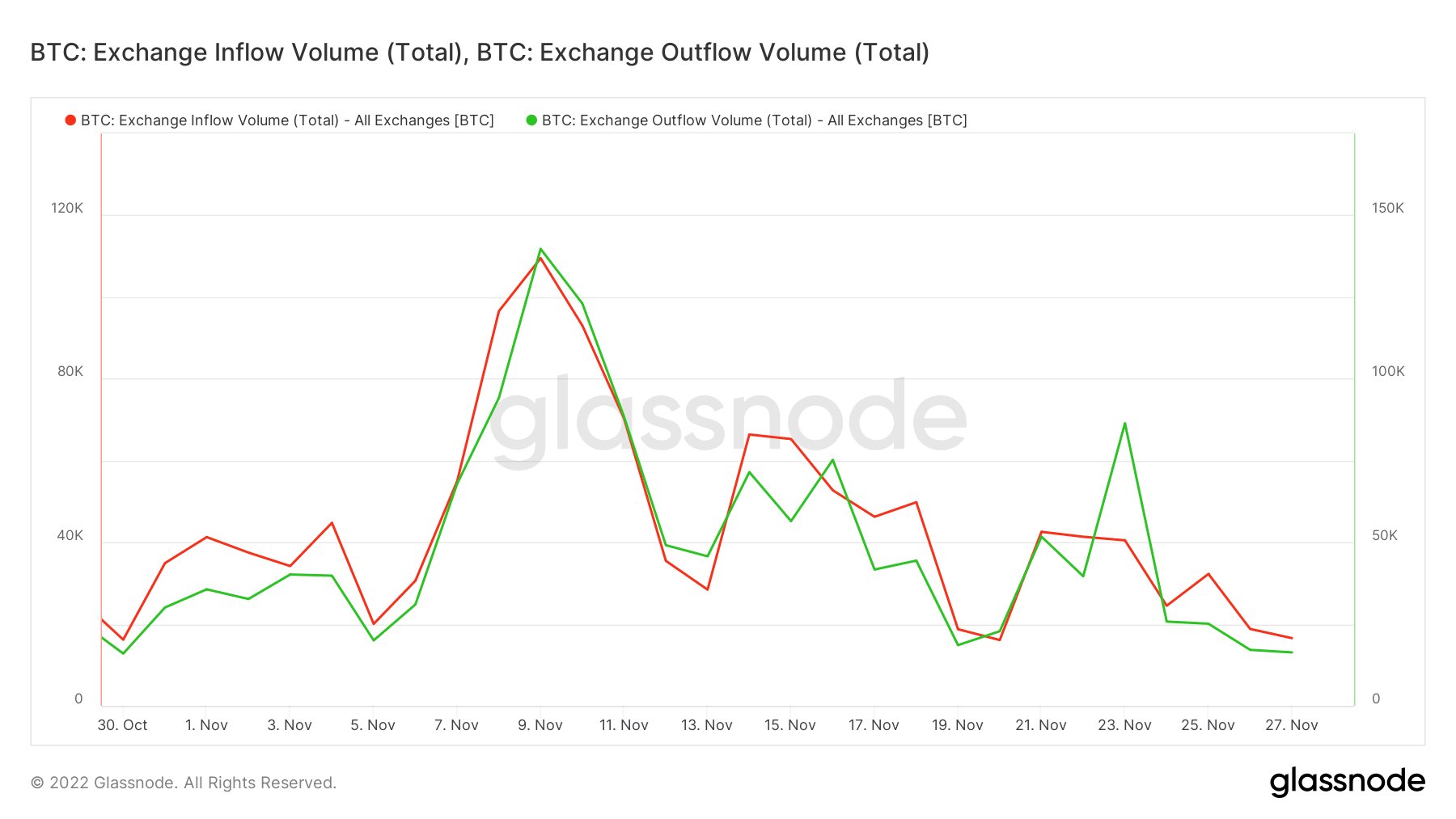

If the above commentary is true, then we must always anticipate the market to react accordingly. Properly, Bitcoin’s alternate flows align with this view. Each alternate inflows and outflows have tapered out this week, maybe a sign of decrease market confidence.

The newest alternate circulate readings from Glassnode affirm that alternate inflows barely outweighed the outflows.

Supply: Glassnode

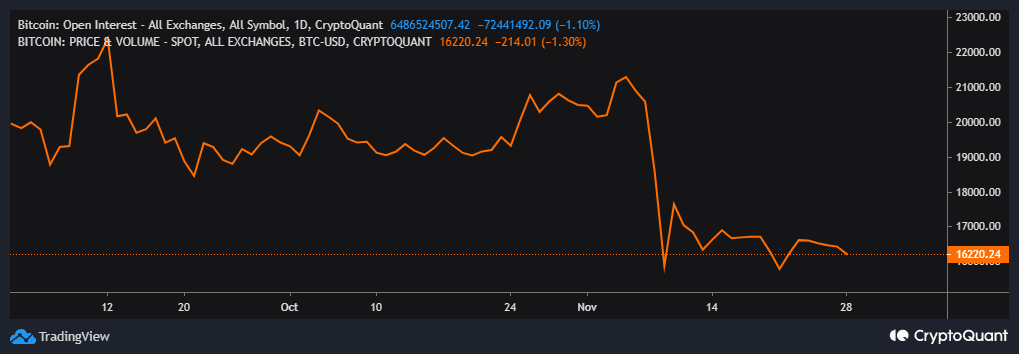

Whereas spot demand for BTC signifies decrease confidence, the derivatives market additionally highlights an identical end result. Bitcoin’s open curiosity within the derivatives market dropped considerably final week and continued to drop throughout the weekend.

Supply: CryptoQuant

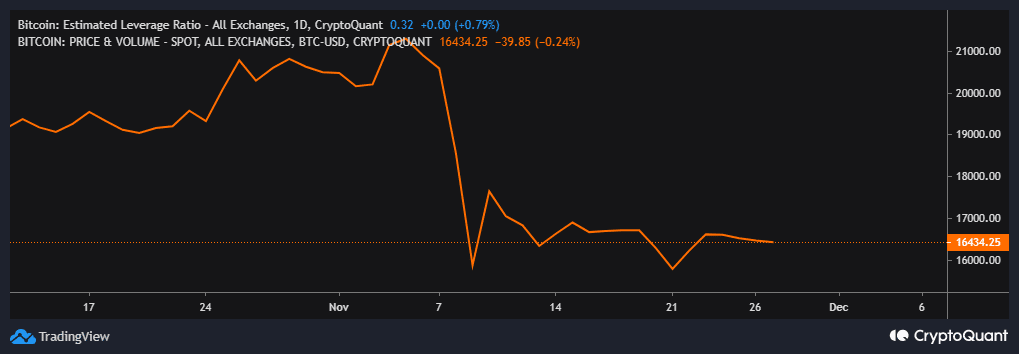

Buyers are much less prone to execute leveraged trades underneath such situations marked by uncertainty. Unsurprisingly, Bitcoin’s estimated leverage ratio dropped barely throughout the weekend, confirming that traders are much less assured concerning the short-term outlook.

Supply: CryptoQuant

What are Bitcoin whales doing?

Now that we’ve got established that there’s much less confidence available in the market, we are able to look into what whales are doing in these situations. This may increasingly assist decide the possible end result within the subsequent few days.

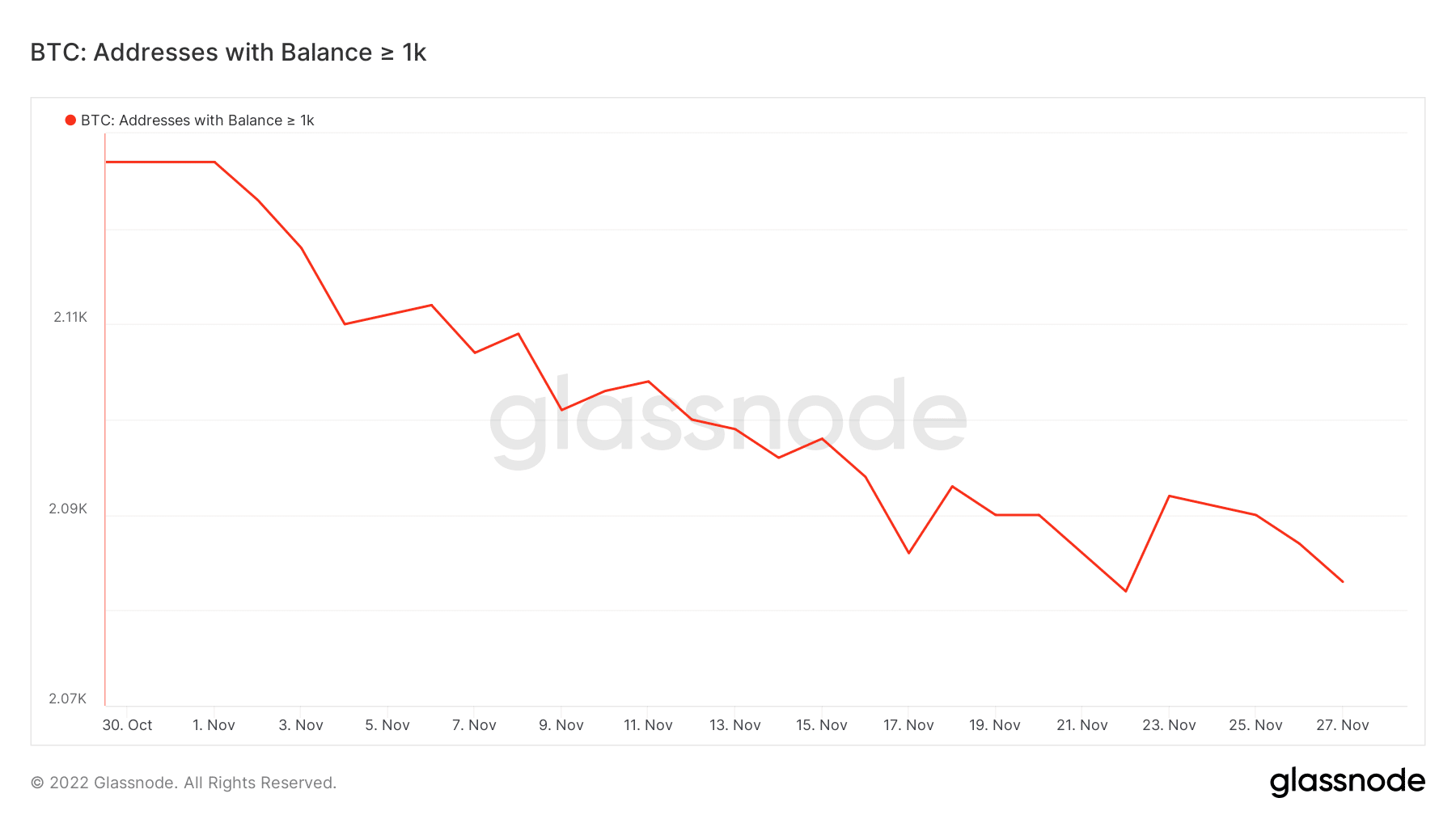

The variety of Bitcoin addresses holding over 1,000 BTC dropped considerably within the final 5 days. this explains the present promote strain, in addition to why it didn’t proceed its earlier rally try within the first half of final week.

Supply: Glassnode

If Bitcoin’s present promote strain prevails, then traders ought to anticipate one other worth drop under the $16,000 mark. Bitcoin traded at $16,219 at press time.

Supply: TradingView

The second half of final week demonstrated some sideways worth motion. It’s because there was some demand from the retail market which acted as a buffer for the incoming promote strain.

Nonetheless, the worth did slide some extra as market confidence continued to erode. Bitcoin traders needs to be looking out for extra draw back and better relative power. Such an commentary will lay the muse for a probably stronger restoration rally.

![Bitcoin’s [BTC] bearish pennant has some tips for its long-term holders](https://ambcrypto.com/wp-content/uploads/2022/11/1669639215461-639462b0-724e-4df5-9a1b-eb7747e0f599-1000x600.png)