- CryptoQuant analyst suggests a doable reversal as UTXO quantity hits sudden enhance

- Historic knowledge indicated that the reversal may take a while within the face of potential lower

Bitcoin’s [BTC] potential to keep away from important buying and selling decrease than $16,000 may need been granted a giant enhance. Certainly, there was dialogue in regards to the king coin hitting its lowest level of this cycle. Nevertheless, not many appear concrete sufficient, as there had been contradictions.

Learn Bitcoin’s [BTC] worth prediction 2023-2024

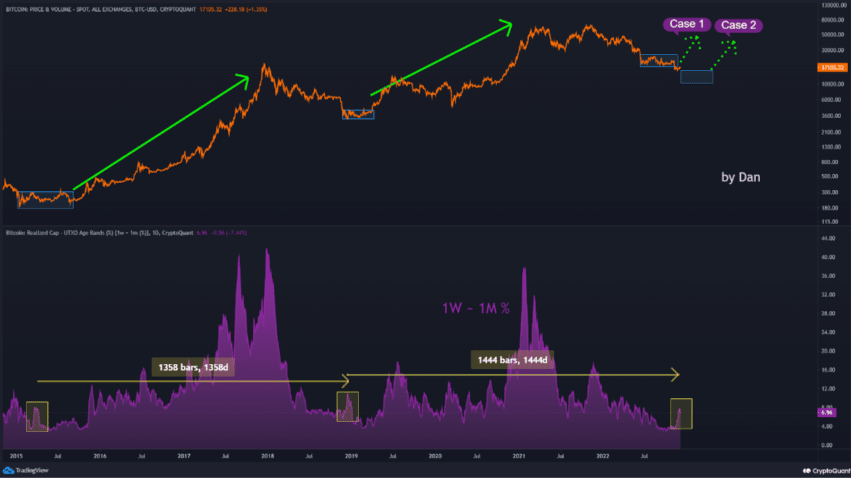

In line with CryptoQuant analyst Dan Lim, one thing that hardly ever occurs in bear markets has been triggered. Lim, additionally an lively crypto investor, identified that the one-week to one-month Unspent Transaction Output (UTXO) quantity steeply elevated for the primary time since this market situation started.

Supply: CryptoQuant

Supply: CryptoQuant

Up from right here if it was again in time

A doable clarification of this situation was that BTC had nearly bottomed out. This was as a result of an analogous scenario occurred within the cycles of 2015 and 2018. When it did, the market turned bullish as proven by the picture above.

Nevertheless, Lim famous that the reversal was not rapid, and this time, it took an extended interval of 1444 days. Therefore, there was no assurance that the intense market situation was nearly over. Lim mentioned,

“It took 1358 days in 2018, and 1444 days in 2022 to make this motion. Though bull markets weren’t began instantly, the part the place this motion got here out was the underside from a cycle perspective. Now, I’m not positive what is going to occur due to the macro points. The split-buy(accumulation) method from the long run perspective may nonetheless be the straightforward reply.”

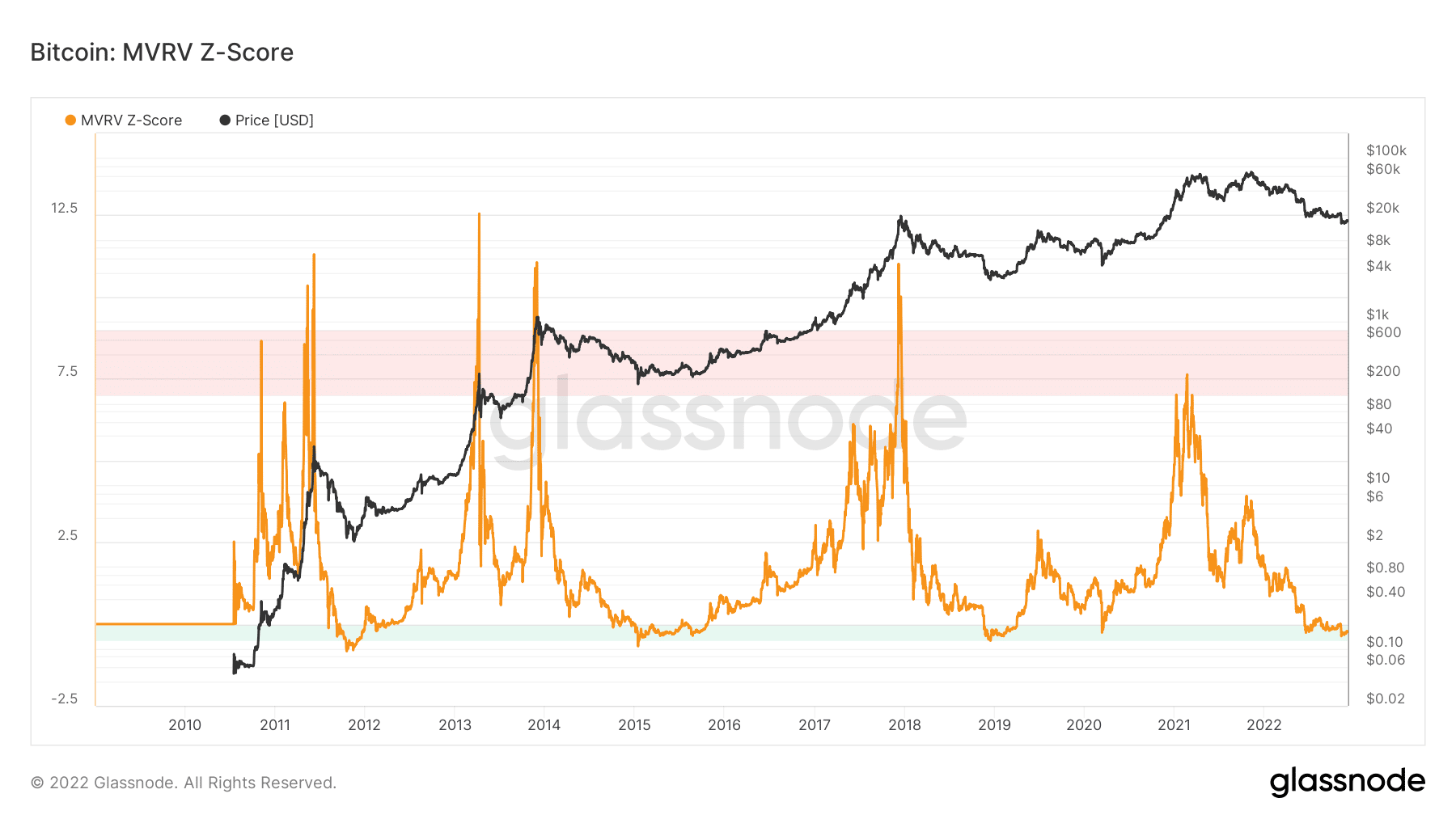

However, have been there different metrics in settlement? In line with Glassnode, the Market Worth to Realized Worth (MVRV) z-score was -0.236. Apparently, the z-score had been within the negative area since July 2022. The z-score evaluates the potential of Bitcoin to be at truthful worth or present it being oversold or overbought.

Supply: Glassnode

On the present state, the MVRV Z-score indicated that BTC had crossed beneath the truthful worth. Nevertheless, because it has been in such a state for months, there was no assure that the UTXO situation would set off its reversal.

Historical past has its half to play

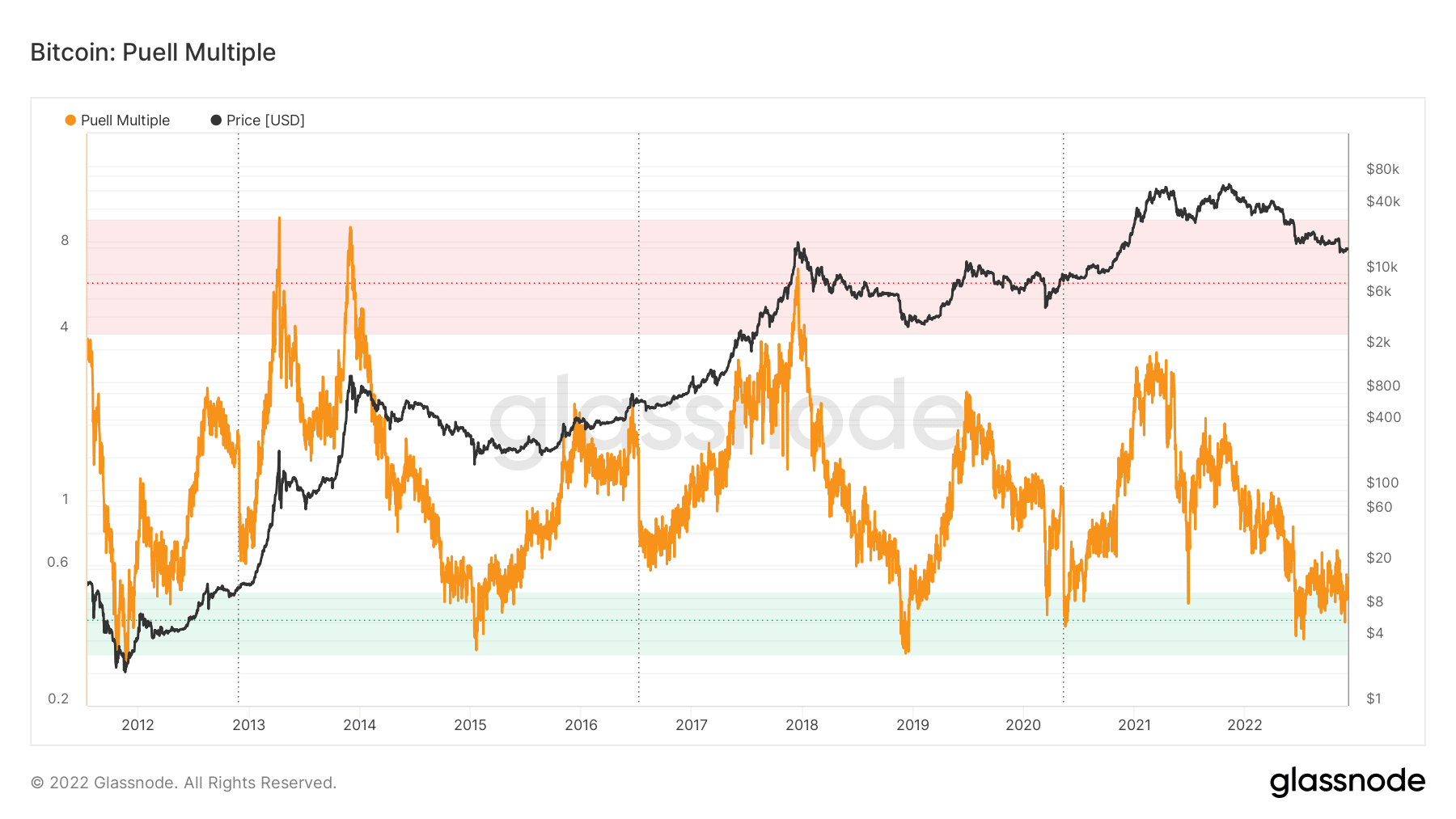

Moreover, the Bitcoin Puell Multiple was within the inexperienced zone at 0.469. For context, the Puell A number of exhibits the standing of the 365-day shifting common in every day Bitcoin issuance.

In a case, the place the worth is between 4 to eight, it signifies market peaks or a purple zone. Since, the present Puell A number of was between 0.3 to 0,5, it implied closeness to the underside. Additionally, this state may additionally point out a worth reversal.

Supply: Glasnnode

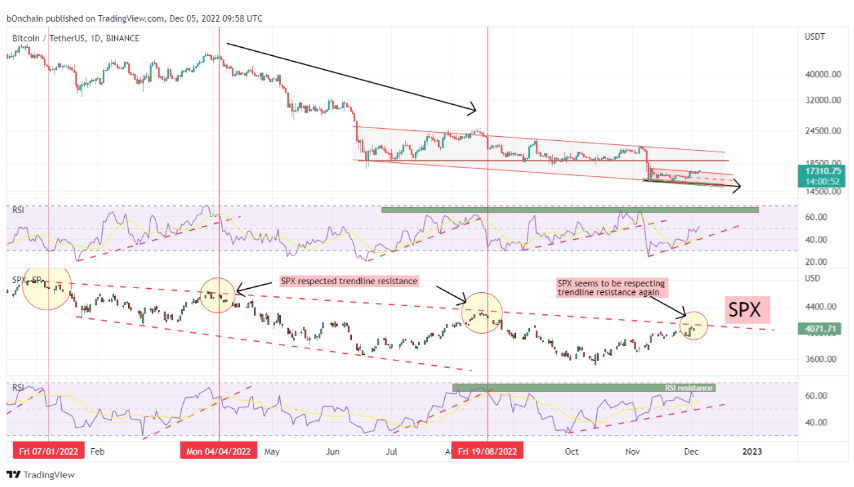

Regardless of the bullish hopes, Bitcoin’s correlation with the inventory market may hinder the reversal. As opined by one other analyst, Ghoddusifar, the latter confronted losing a trendline resistance. Within the occasion that it involves cross, BTC may fall additional.

Supply: CryptoQuant