- DOGE was in a impartial market construction however bears had slight leverage.

- It may break under $0.09508.

- A break above the present resistance at $0.10728 will invalidate this prediction.

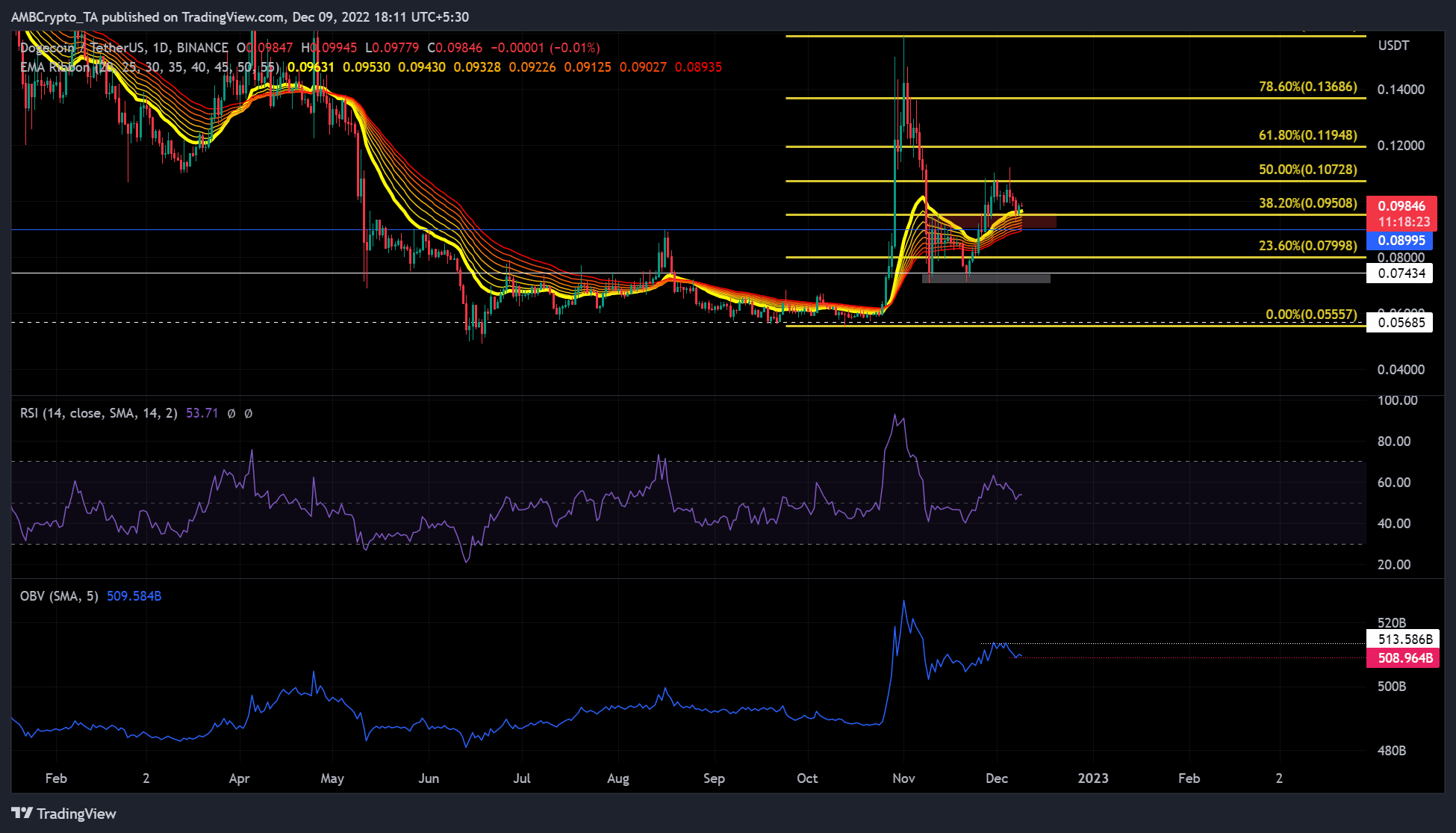

Dogecoin’s (DOGE) market construction has weakened since 1 December. At press time, the memecoin was buying and selling at $0.09846 and warming as much as retest the assist degree of $0.09508.

It’s value noting that the above assist degree was a pullback zone that might have offered the bulls with a relaxation zone for a rally. Nonetheless, DOGE’s value restoration may very well be undermined as a result of declining buying and selling volumes and weakening shopping for strain primarily based on technical indicators.

If the bears preserve momentum on the time of publication, DOGE may fall to $0.09508 or inside the 23.6% and 38.2% Fib pocket ranges. This would supply merchants with a shorting alternative.

Will DOGE maintain a value transfer above the three EMA Ribbon?

Supply: DOGE/USDT on TradingView

DOGE traded inside the $0.05685 – $0.07434 vary between mid-June and late October, with false breakouts occurring in between. Nonetheless, a convincing breakout to the upside from the vary in early November was blocked by a market droop.

DOGE established sturdy assist at 0.07434 and retested it twice for the reason that crypto market collapse. Just lately, the bulls of DOGE used the assist to begin a rally that has since allowed for a rise of over 40%, reaching a excessive of $0.11192 on 5 December.

Nonetheless, one other value decline introduced DOGE again to the present assist. Technical indicators present that DOGE may break under the assist. Specifically, the Relative Power Index (RSI) has retreated from the higher vary to a degree barely above the equilibrium level, suggesting that purchasing strain has eased.

As well as, the Exponential Shifting Common (EMA) Ribbon has acted as assist for a while. Worth motion has been approaching this band, and a break under it might formally flip the DOGE’s market construction bearish.

As well as, On Stability Quantity (OBV) has dropped from 513 billion to 508 billion, representing a drop in buying and selling quantity of about 5 billion between December 4 and seven. Due to this fact, DOGE may retest the present assist at $0.09508 and break downwards.

Thus, traders can use $0.09508, $0.08995, and $0.07998 as short-selling targets if the bears totally management the market.

An intraday shut above the 50% Fib degree ($0.10728) would disprove this prediction.

Sentiment falls as improvement exercise rise, however long-term DOGE holders noticed beneficial properties

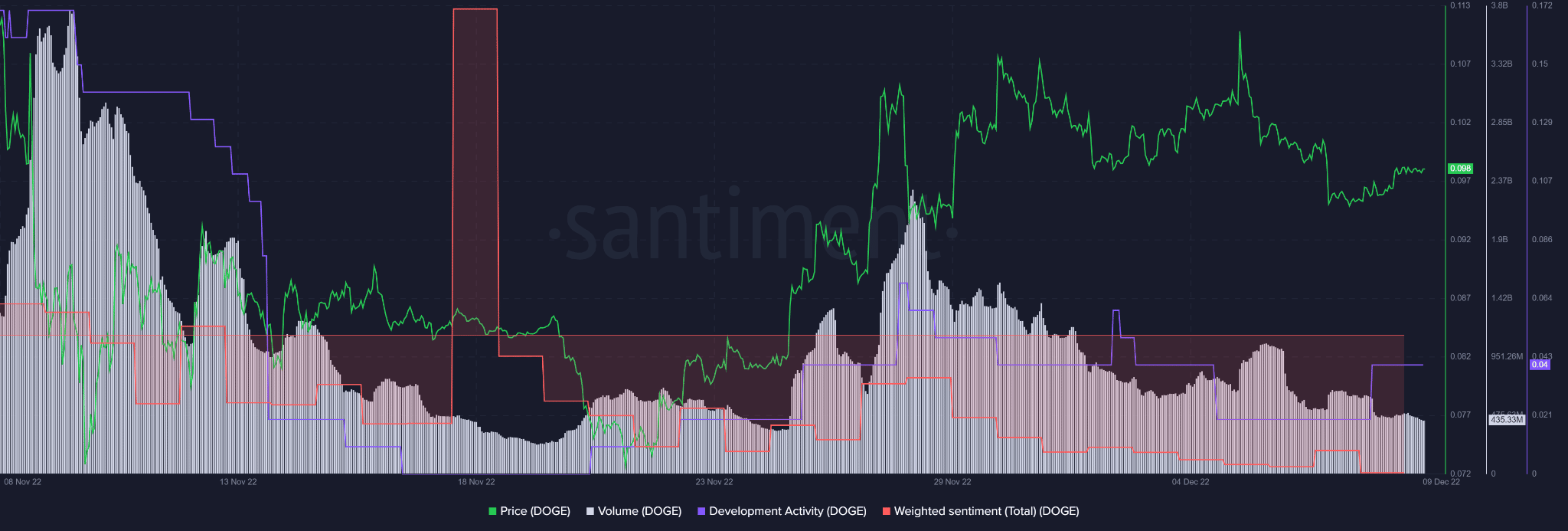

Supply: Santiment

DOGE’s weighted sentiment has continued to tread within the detrimental territory since mid-November. Nonetheless, an uptick in improvement exercise throughout this era has prevented DOGE costs from being dragged down by poor sentiment.

Apparently, the 365-day market worth to realized worth ratio (MVRV) has been in constructive territory, suggesting that long-term holders of DOGE have posted beneficial properties since 27 November.

Thus, the on-chain metrics present blended alerts that might point out a impartial market construction. It’s, subsequently, necessary to additionally take into account the efficiency of BTC and memecoin’s socials earlier than making any selections.