- XMR endured the market collapse, placing up a powerful efficiency within the final thirty days

- Merchants’ curiosity was unusually excessive with a chance of sustenance

At a time the place a bunch of crypto initiatives have been struggling for survival, Monero [XMR] appeared to have discovered stability. In accordance with CoinMarketCap, few cryptocurrencies have been capable of match XMR’s efficiency because the FTX crash pressured the complete market into disaster.

The worth monitoring platform revealed that XMR rose a powerful 16.79% throughout the 30-day window.

Learn Monero’s [XMR] Worth Prediction 2023-2024

Privateness can’t take care of the despair

Though XMR was 72.47% down from its all-time excessive, the privateness coin nonetheless exchanged hands at $148.57. As a result of stirring efficiency, one would anticipate that merchants would look in direction of XMR for fast beneficial properties. Monero has been a type of cash which principally exhibited minimal volatility. Therefore, it has been tough for merchants to look in its means.

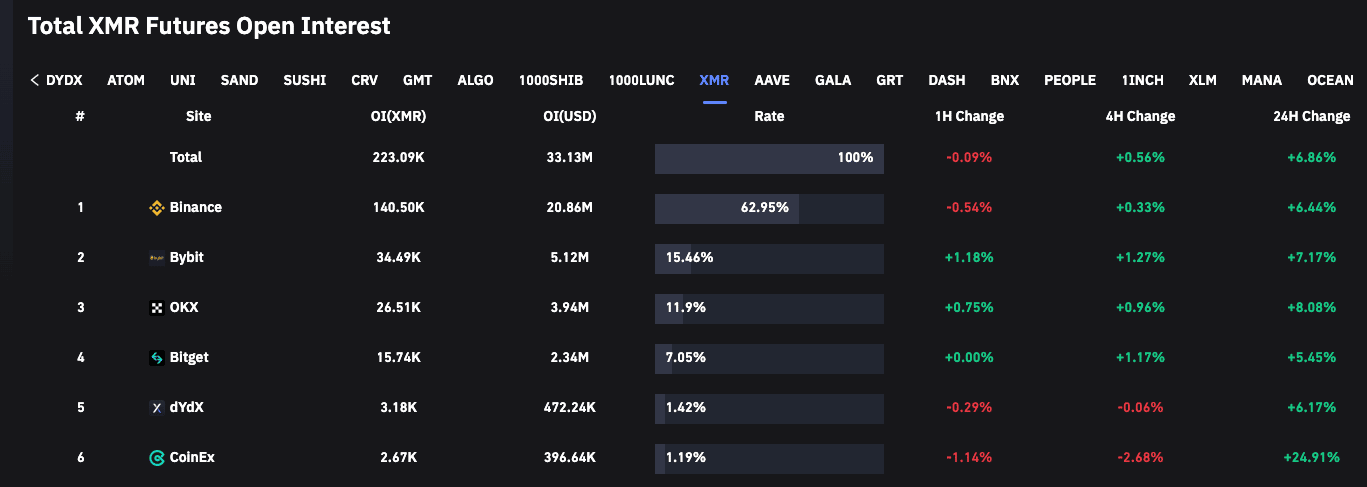

Supply: Coinglass

This information confirmed that merchants modified their minds. Additionally, because the open curiosity remained in greens, it established that XMR’s energy throughout the final month was no coincidence. Within the case the place the futures and open curiosity maintain these ranges, XMR might repeat the feat within the subsequent thirty days.

Wanting on the present XMR liquidations, shorts have been probably the most affected. Knowledge from the derivatives data portal confirmed that over $45,000 has been exterminated by merchants within the final 24 hours. Liquidations accounted for by long-positioned merchants have been nearly at zero. Surprisingly, this has occurred regardless of XMR’s minimal 1.31% enhance throughout the identical interval.

Supply: Coinglass

Nonetheless, the coin’s short-term trajectory appeared to have modified the perspective. In accordance with Coinglass, the 24-hour open interest in XMR resulted in positivity throughout the highest exchanges.

On Monero’s developments and extra

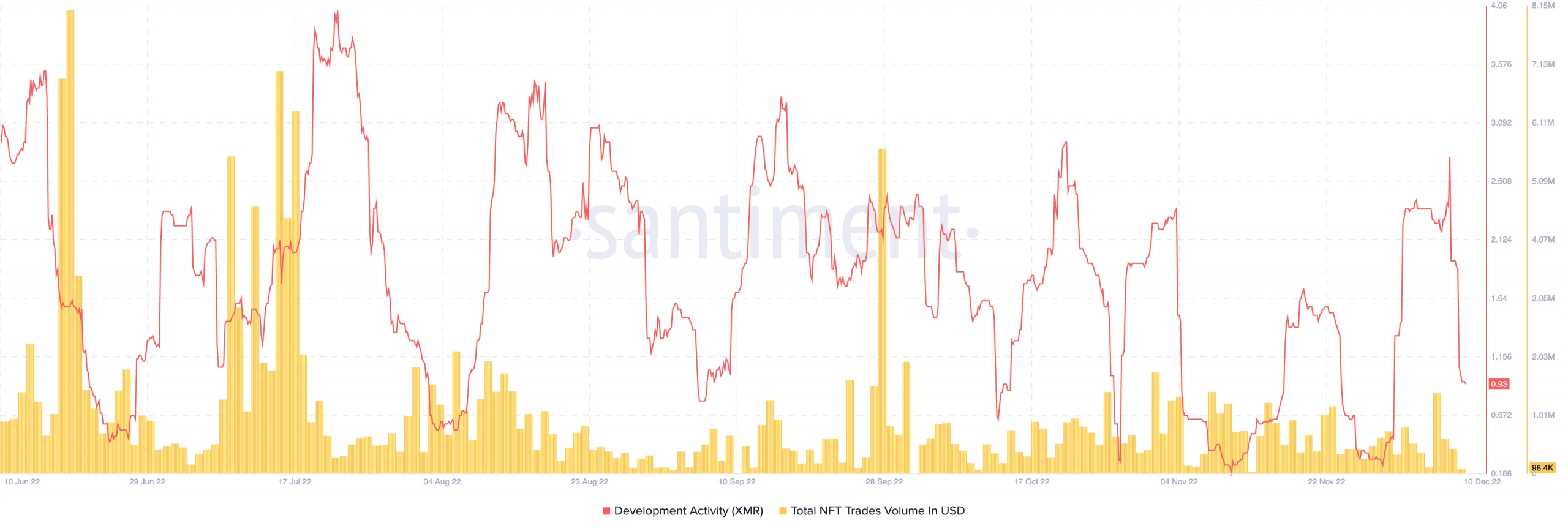

Per its on-chain situation, Monero’s growth exercise slumped considerably. In accordance with Santiment, the event exercise was 0.93.

The implication of this standing was the upgrades on the Monero chain have not been substantial. Within the final 30 days, the challenge didn’t announce any notable partnership because it requested holders to remove the tokens off exchanges on 11 November.

Supply: Santiment

Moreover the challenge’s development, involvement with its digital collectibles was not at an apex place. On the time of writing, the XMR-linked NFT quantity was 98,400. This was the bottom the quantity had hit since 12 November. This implied that curiosity in NFTs below the Monero chain was not astounding.

Owing to the knowledge above, Monero merchants may face rivalry from the on-chain situation in a bid to copy the final 30-day kind. For its whales, supply has not been so profound. Nonetheless, Santiment revealed that offer held by whales barely elevated to 41.527.

An additional enhance on this regard, coupled with merchants’ curiosity, might assist XMR preserve its stability. However, anticipating solely delight may not essentially be the best way to go, contemplating the shaky market state.

![Monero [XMR] on-chain whale supply](https://ambcrypto.com/wp-content/uploads/2022/12/Bitcoin-BTC-10.49.20-10-Dec-2022.png)

Supply: Santiment