- Addresses holding 10 – 1000 BTC soared in current months, hitting 2020 ranges for the primary time

- There are similarities within the worth degree of BTC noticed in 2020 and 2022

The variety of people who personal 10 – 1000 Bitcoin [BTC] elevated considerably in current months. BTC additionally confirmed some volatility, largely resulting from occasions surrounding the cryptocurrency trade.

Some observers declared that Bitcoin and cryptocurrencies had been ‘lifeless’ resulting from worth volatility. Judging from this metric, BTC was possible gaining extra customers.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Similarity and potential causes for the rise

Santiment reported a dramatic surge within the variety of Bitcoin addresses holding 10 – 1000 BTC as of 11 December. In keeping with the info, the addresses rose to virtually 151,000, a quantity that was final seen in 2020. The chart additionally revealed a precipitous decline following 2020’s peak.

🐳🦈 There at the moment are 151,080 addresses that maintain between 10 to 1,000 $BTC. After a large decline that started in December, 2020, these addresses have elevated considerably all through 2022 as #Bitcoin has progressively develop into extra reasonably priced. https://t.co/5rdAno5SKy pic.twitter.com/uahECloHyR

— Santiment (@santimentfeed) December 11, 2022

The similarity in BTC’s worth at every stage was an attention-grabbing commentary that is also produced from Santiment’s chart. The worth of BTC was roughly $18-19k in 2020 when the variety of addresses was roughly on the identical degree as it’s now. BTC is at the moment valued at about $17,000. Is there a motive for this corresponding development?

The similarities could possibly be defined by taking a better have a look at the chart. Essentially the most important issue can be an anticipated improve within the worth of Bitcoin. There was a lower in holdings, which occurred on the identical time that the worth of BTC elevated.

Buyers who bought at a lower cost bought their property when the worth rose. This might counsel that the present tackle improve was a precursor to an anticipated BTC bull run.

Bitcoin within the day by day timeframe

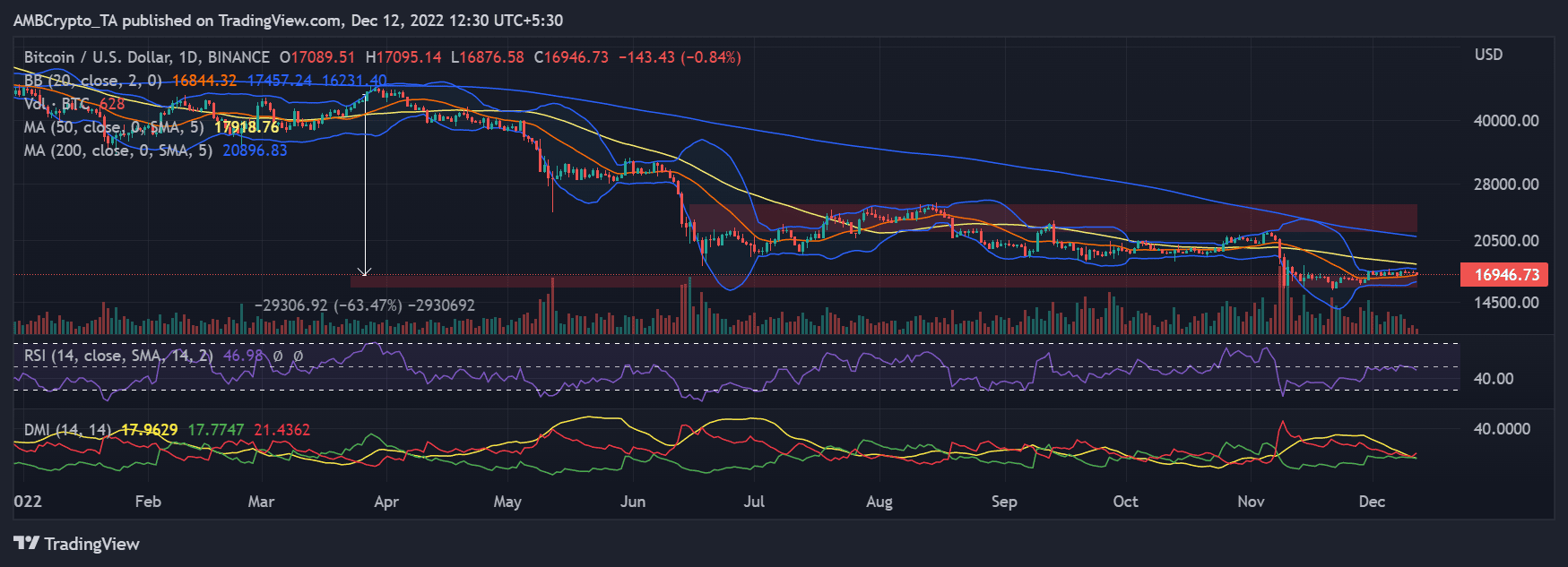

Bitcoin [BTC] was buying and selling at over $45,000 in late March and early April 2022, in response to the day by day timeframe. It was, nevertheless, buying and selling for about $16,900 on the time of writing, pointing to an apparent large decline. Plotting the worth vary revealed that the asset had declined by 60% in the time-frame.

The quick Transferring Common (yellow line) on the worth chart additionally served as resistance. With the yellow line in its present location, the preliminary noticed resistance was round $18,000. Within the long-term, nevertheless, the resistance noticed was between $21,000 and $25,000.

Whereas there have been no apparent larger highs within the present worth motion, a breach of the present resistance ranges might spark a BTC rally. As soon as the bull run begins, its worth might rise to the place it was earlier than, round $40,000, and even larger.

Supply: TradingView

Moreover, the Bollinger Bands (BB) shrank, indicating much less worth volatility for BTC. The contraction might, nevertheless, even be an indication of impending volatility.

Upcoming occasions that might impression BTC

These forthcoming occasions might have an effect on the worth of BTC because of the correlation between conventional markets and its worth motion previously. The Client Worth Index for November can be revealed on 13 December; the subsequent day, the Federal Reserve will announce its present rate of interest.

Although it’s assumed that the whole variety of addresses might change, the results of those occurrences nonetheless should be found.