- Quant whale holdings dropped from 80% beneath 72% after a collection of thrilling performances.

- Nonetheless, QNT confirmed potential to drive fulfilling costs in early 2023.

Self-acclaimed way forward for finance, Quant [QNT] has had fairly an fascinating yr because it conquered flat market circumstances. Between June and August, the QNT worth surged from $48 to $124. Just a few months later, with the crypto market in a extreme decline, QNT greater than doubled in worth, hitting $208, on 18 October.

Learn Quant’s Value Prediction 2023-24

This pattern would have been not possible with out the actions taken by addresses that held 1,000 to 1 million QNT. Based on the most recent Santiment report, the belongings held by these whales had dropped from 80% to 72%. A proof meant that these whales had most likely taken revenue whereas leaving the remainder of their holdings for the long run.

What’s in it for the QNT worth?

In additional intriguing updates, QNT had been in a position to get well from its seven-day lower. Based on CoinMarketCap, QNT was buying and selling at $120 at press time.

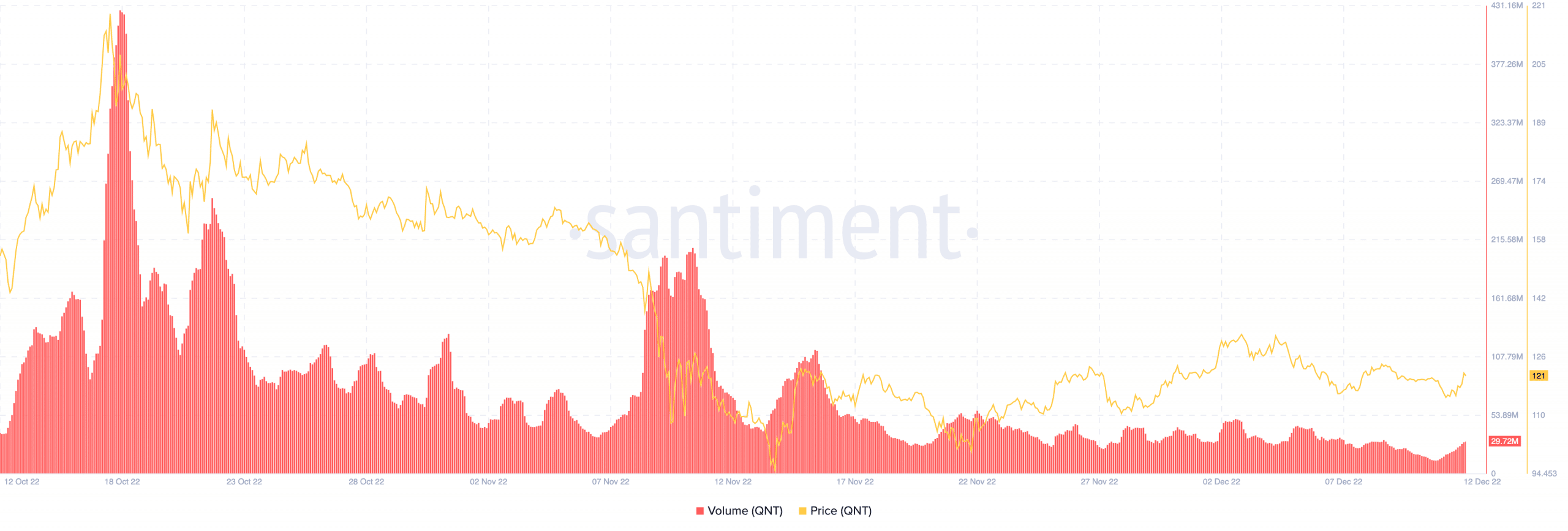

This indicated a 2.45% uptick within the final 24 hours. Furthermore, the coin’s quantity elevated by 54.59% inside the identical interval, in keeping with info from on-chain analytics supplier, Santiment.

Supply: Santiment

So, since QNT sustained a rise, wouldn’t it have the ability to proceed to climate the crypto bear market?

As QNT has not suffered losses like its counterparts, the four-hour chart confirmed that it had the potential to duplicate its June to August and September to October efficiency.

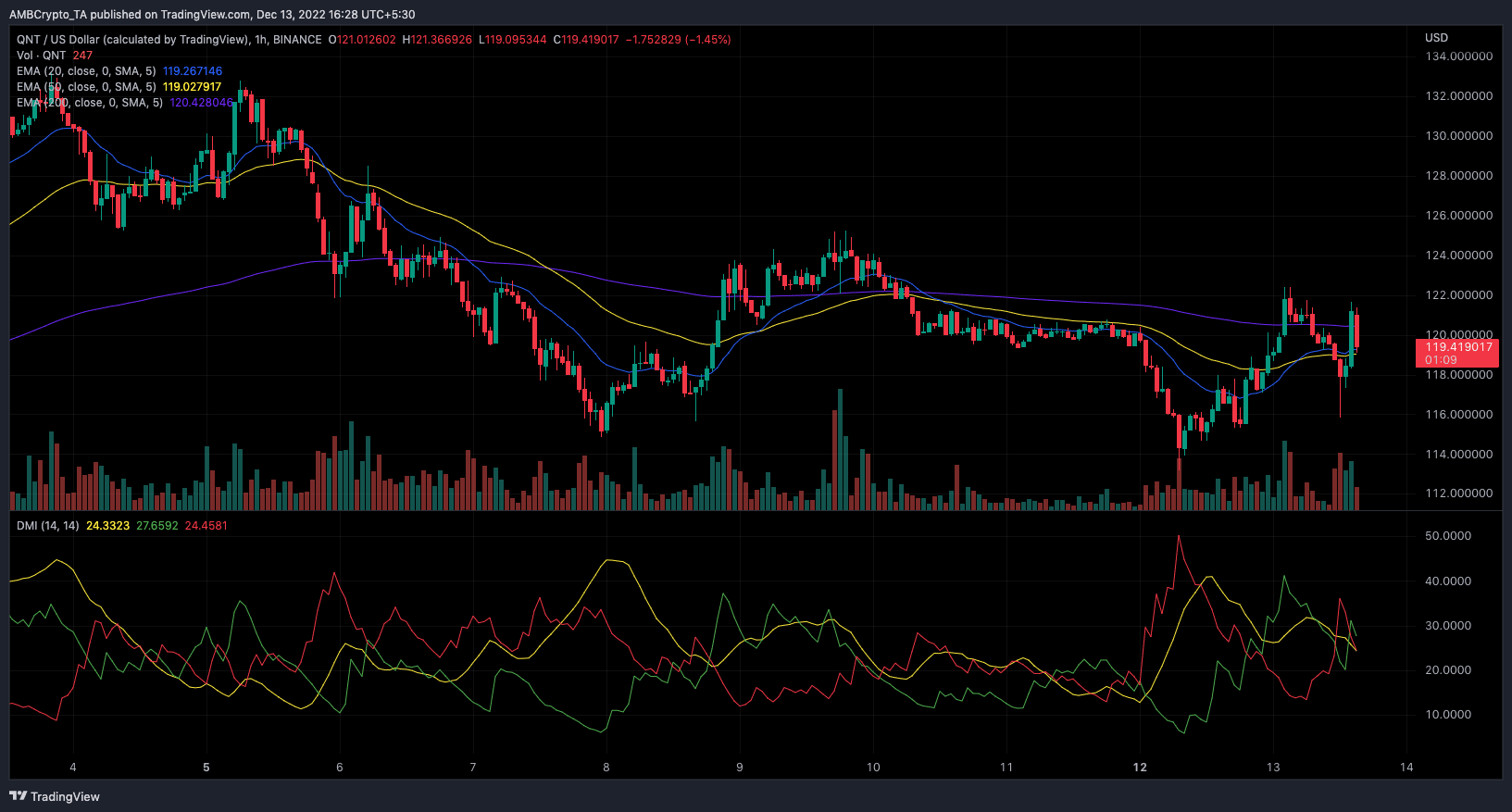

This was as a result of the Exponential Shifting Common (EMA) revealed that short-term respite was probably. On the time of writing, the QNT 50 EMA (yellow) was positioned beneath the 20 EMA (blue).

Though slight, the pattern indicated a potential bullish crossover. So, QNT had the prospect to take the efficiency to the shut of the yr.

Despite the fact that QNT was 71.47% down from its all-time excessive, the 200 EMA (purple) confirmed that the coin may take the bull motion into the primary quarter of 2023.

In opposition to the U.S Greenback, Quant’s course indicated a wrestle for a brief squeeze and shopping for energy. Nonetheless, indications from the Directional Shifting Index (DMI) exhibited uncertainty in regards to the particular course that QNT advances.

Supply: TradingView

Quant growth rule nothing

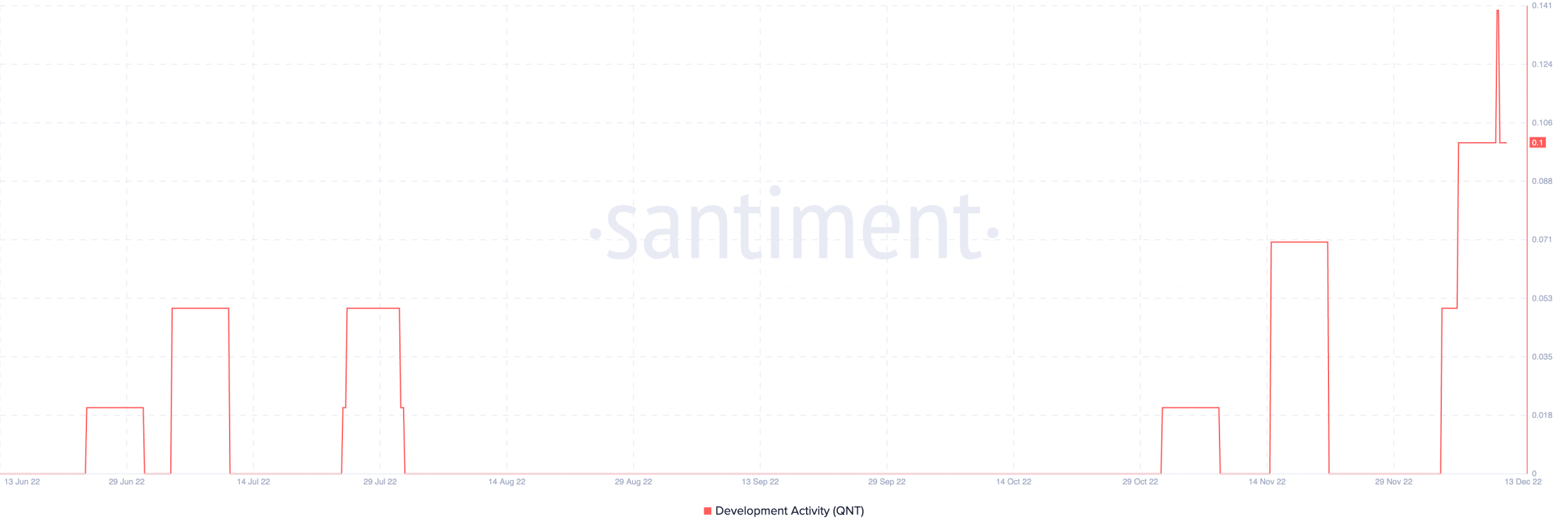

From an unimaginable rise on 12 December, Quant fell to a lull depth per its development activity. Based on Santiment, the QNT growth was 0.1.

This was in distinction with Quant’s earlier dedication to repeatedly polish its community.

Traditionally, the event exercise hardly impacted its worth. So, an upturn in developments or down would most definitely have much less impression on QNT going ahead.

Supply: Santiment

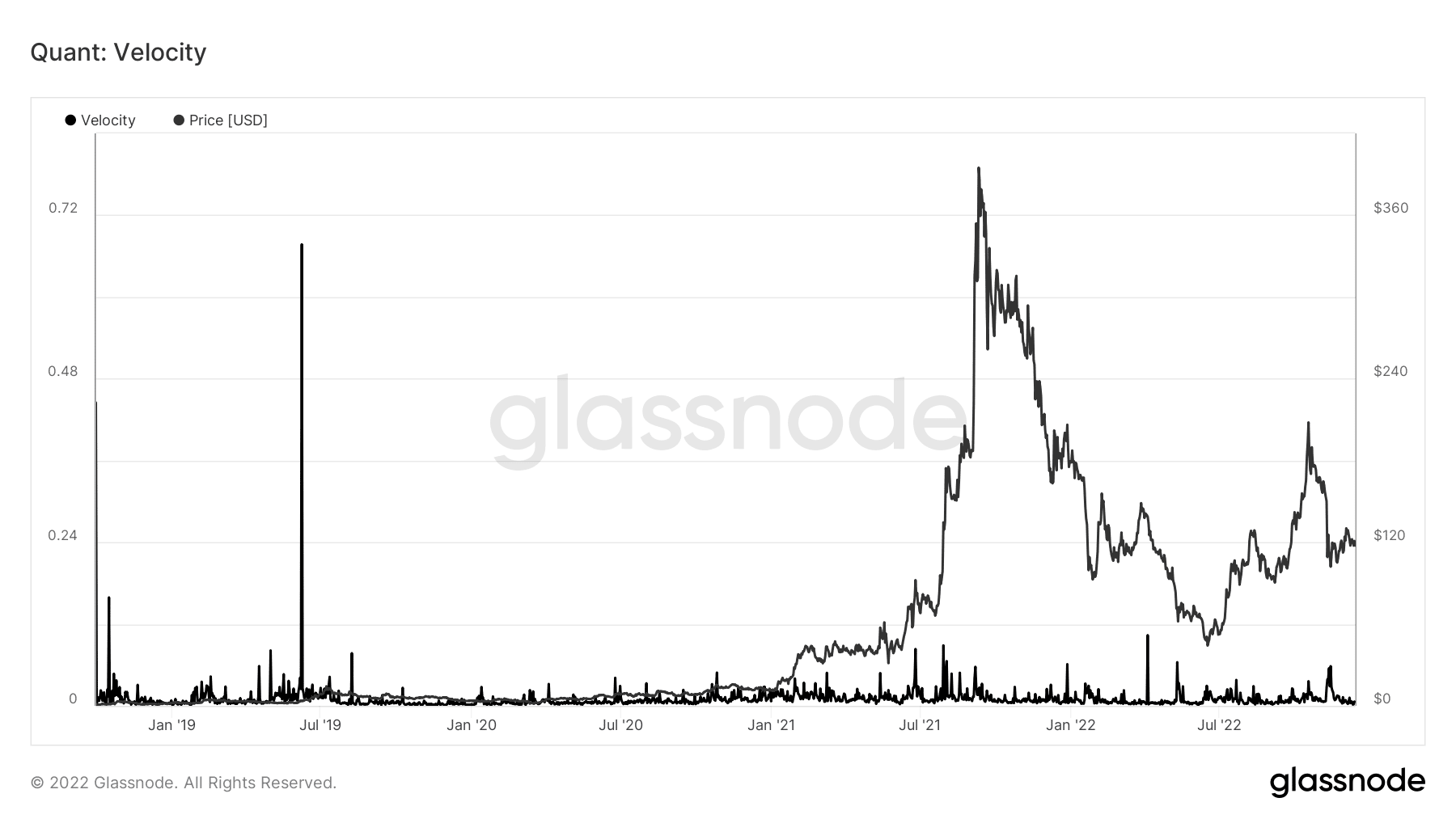

By way of velocity, Glassnode revealed that QNT models discovered it troublesome to flow into round its community. Subsequently, QNT would possibly want to enhance its on-chain transaction quantity if there was any likelihood of confirming a superb efficiency in direction of the yr and the subsequent first half.

Supply: Glassnode

![Assessing Quant’s [QNT] potential to brush aside price decline in coming year](https://ambcrypto.com/wp-content/uploads/2022/12/patrick-dozkVhDyvhQ-unsplash-1000x600.jpg)