Binance, the world’s largest crypto change by quantity, is being examined by a wave of huge outflows as merchants search to withdraw their cash.

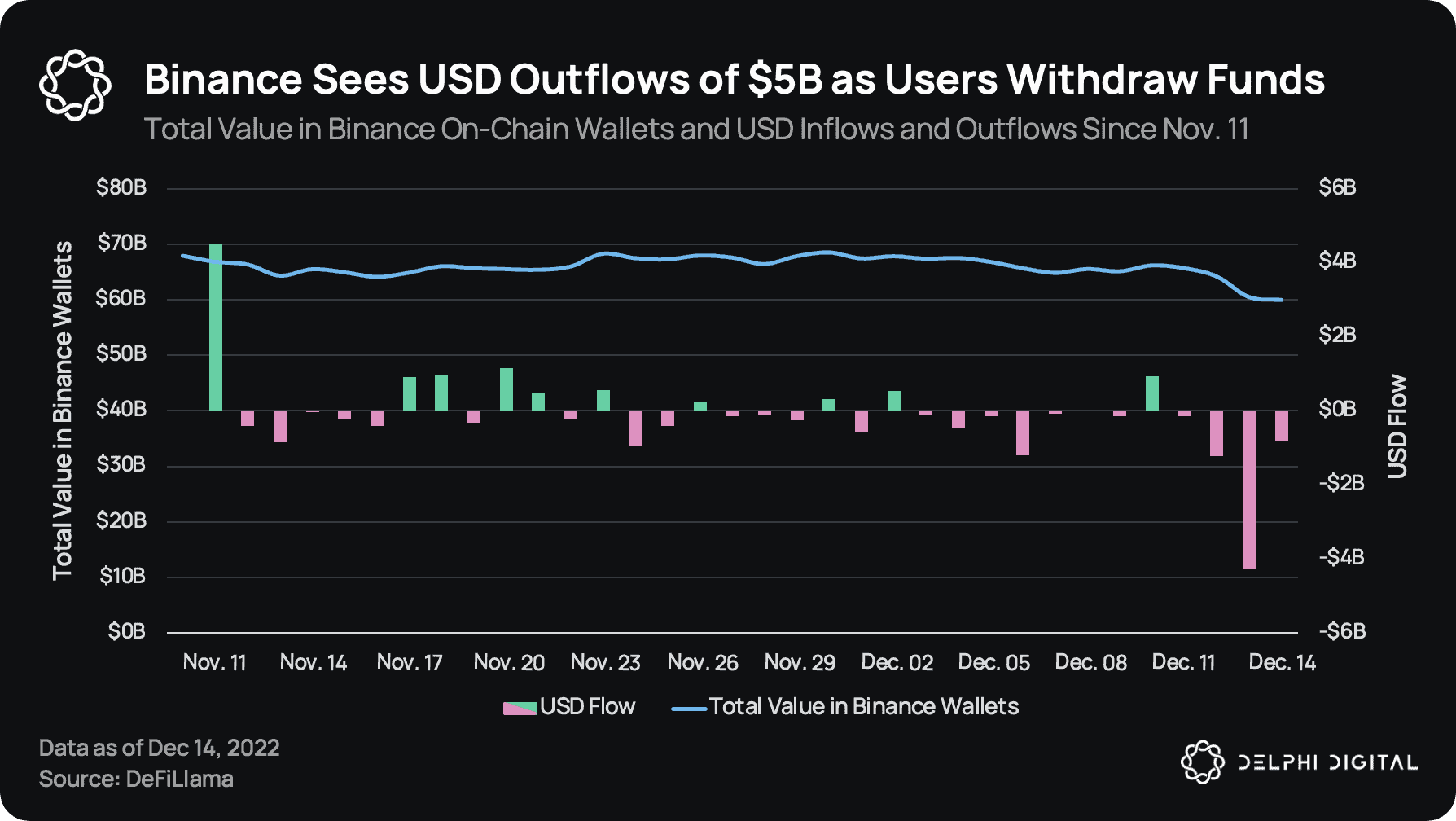

In line with crypto insights agency Delphi Digital, Binance noticed over $5 billion in web outflows on December thirteenth and 14th.

Delphi Digital says that the large withdrawal flows might stem from the collapse of FTX and the decrease ranges of belief in crypto exchanges that has adopted.

“Binance noticed greater than $5B of web outflows between December thirteenth & December 14th.

That is the most important 2-day outflow because the change began offering proof of reserves on November tenth.

As U.S. Congress holds hearings over the FTX collapse, considerations relating to Binance have been rising, resulting in a rise in withdrawals.”

Binance has provided a proof-of-reserves report displaying that each one of its prospects’ belongings are backed 1-1, and had it seemed over by international auditing agency Mazars. Nevertheless, Mazars just lately took down its audit of Binance and reportedly reduce ties with the crypto business.

The agency acknowledged,

“Mazars has paused its exercise referring to the supply of ‘Proof of Reserves Experiences’ for entities within the cryptocurrency sector attributable to considerations relating to the way in which these studies are understood by the general public.”

Binance CEO Changpeng Zhao (CZ) has maintained that each one belongings on the change are one-to-one backed.

“Folks can withdraw 100% of the belongings they’ve on Binance. We is not going to have a problem on any given day. So 100% of customers withdraw 100% of belongings, we’d be fantastic.

That is very totally different for conventional monetary folks to grasp as a result of banks run on fractional reserves, and the standard regulators, a lot of them might imagine that it’s okay for crypto companies to be operating on fractional reserves. That’s not okay. In crypto, there’s no central financial institution printing cash to bail out banks when there’s a liquidity crunch. So, crypto companies have to carry consumer belongings one-to-one and that’s what we do. It’s quite simple.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Andrea Danti/Fotomay/Natalia Siiatovskaia