Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The market construction was bearish for Shiba Inu regardless of the close to 12% pump on 18 December

- Indicators confirmed rising volatility however the development pointed downward

The night, of 19 December, New York time, noticed Bitcoin slide quickly from $16.6k to $16.2k. The next hours noticed BTC bounce again towards $16.8k. That one hour of buying and selling noticed $11.19 million value of lengthy positions liquidated, in response to Coinalyze data.

Learn Shiba Inu’s [SHIB] Worth Prediction 2023-24

Shiba Inu additionally dropped beneath a help stage however appeared to recuperate. Regardless of the bounce, the general development has lately been bearish on decrease timeframes. A transfer beneath the aforementioned help stage might set up a better timeframe downtrend as properly.

The help from early November’s crash was lastly damaged

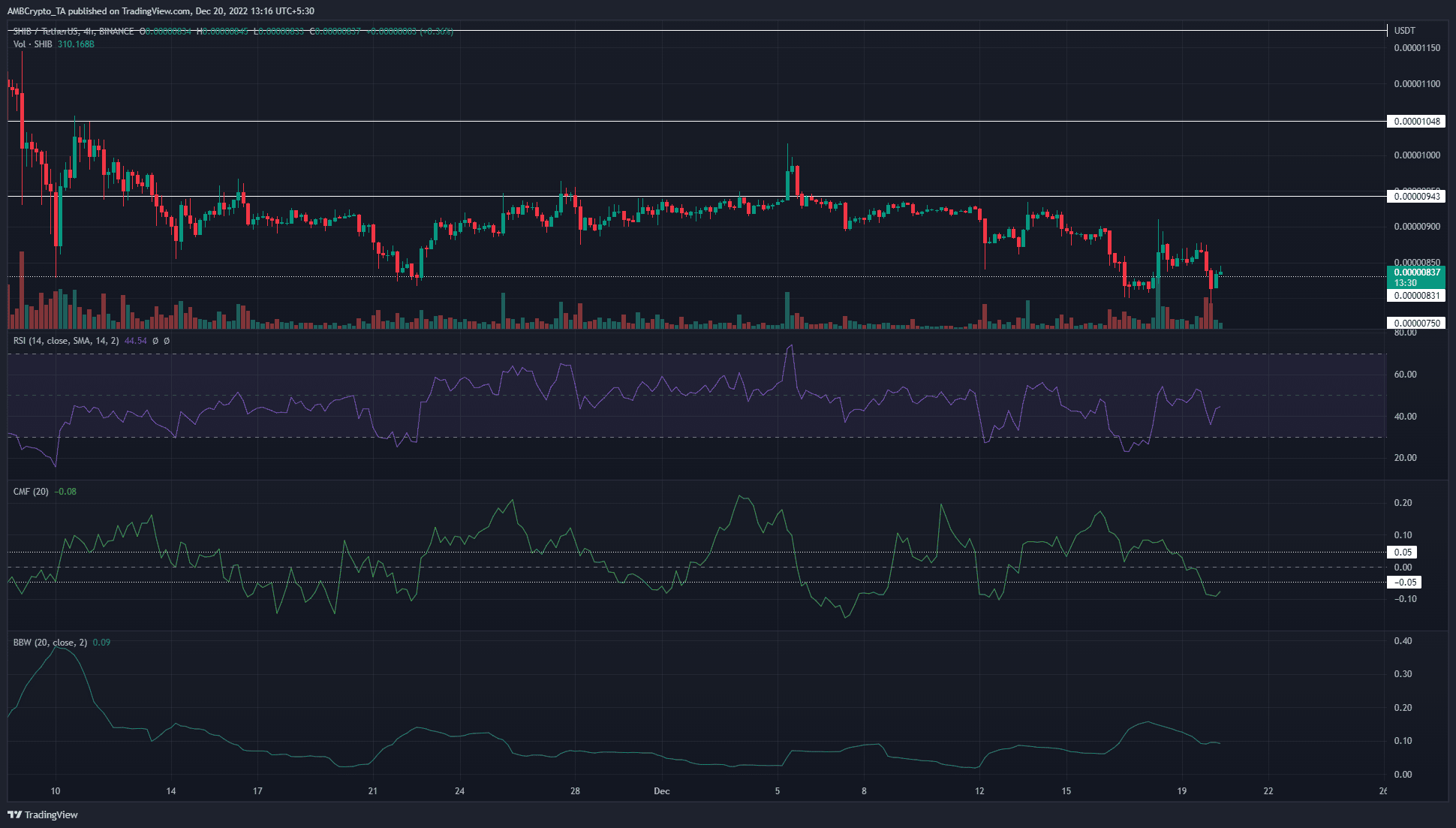

Supply: SHIB/USDT on TradingView

Since 10 November, Shiba Inu bulls have valiantly defended the $0.0000083 stage of help. This stage was breached on the day by day timeframe on 16 December. This was particularly unhealthy information as a result of it was a better timeframe, and it was already bearishly poised over the previous month.

On 5 December, SHIB tried to rally previous $0.0000094 however was unable to, and as an alternative shaped a bearish swing failure sample on the day by day chart. The transfer beneath the help stage additional strengthened the sellers’ energy.

The Relative Energy Index (RSI) has been beneath impartial 50 on the four-hour chart since 7 December, to point out a downtrend in progress. Nevertheless, the Chaikin Cash Circulate (CMF) registered intermittent durations of great capital movement into the market. In the meantime, the Bollinger Bands width indicator shaped greater lows over the previous week to focus on growing volatility.

Sellers can look out for decrease timeframe bounces to quick SHIB and would possibly discover pleasure within the elevated worth volatility.

Open Curiosity informed a narrative of fluctuating feelings available in the market however neither bulls nor bears prevailed for lengthy

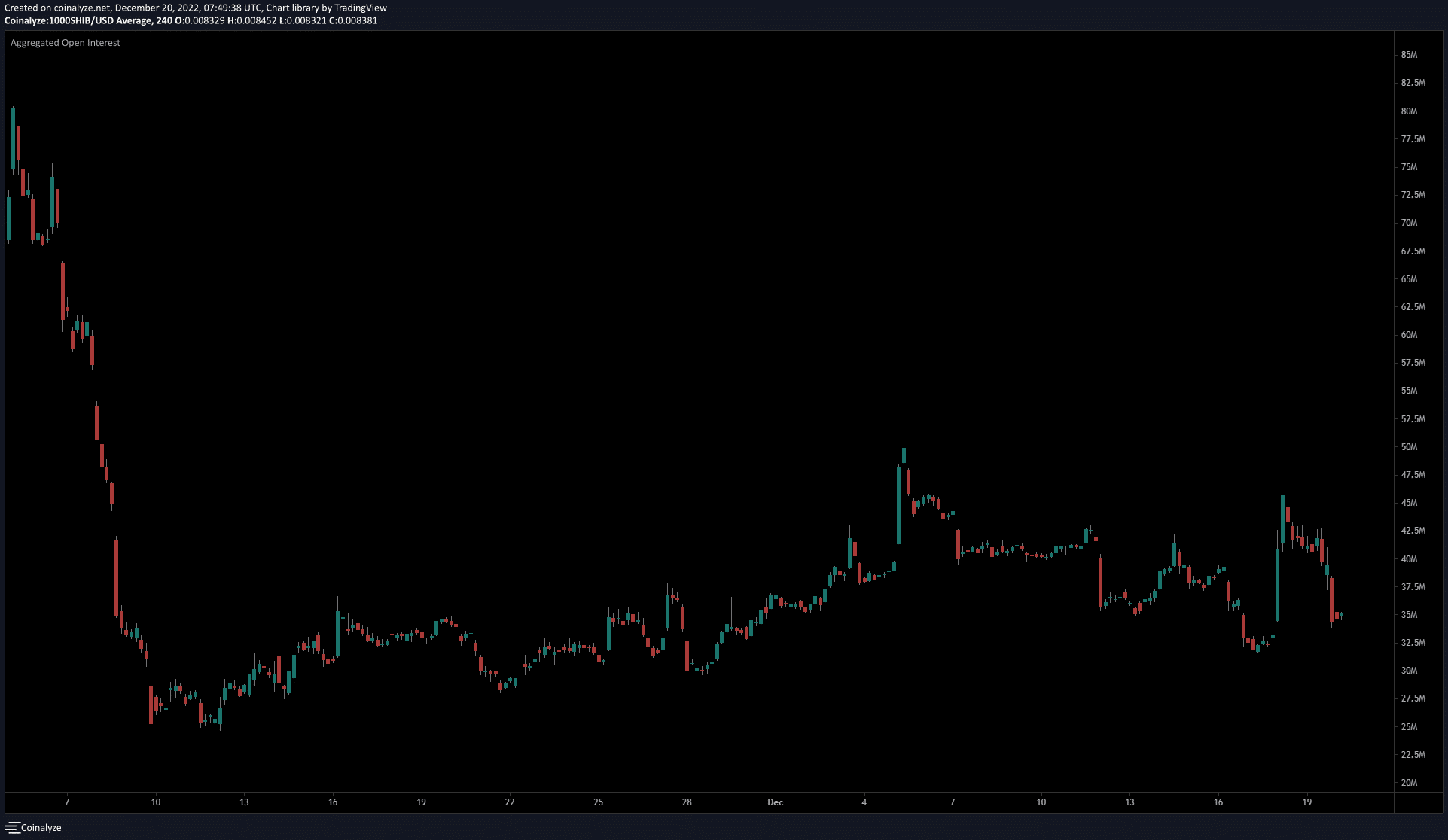

Supply: Coinalyze

The Open Curiosity chart confirmed aggregated OI has been on the rise since 10 November. Over the previous few days Open Curiosity has taken wild swings.

Worth surges on 5, 13, and 18 December had been adopted by an advance in OI. These rises had been rapidly worn out as merchants cashed in on their strikes, or over-enthusiastic bulls or bears noticed vital liquidations.

At press time, the market construction was bearish, and the futures market additionally confirmed bearish sentiment.