- Chainlink’s stochastic was in an oversold place

- Metrics had been additionally supportive of a pattern reversal however issues nonetheless stay

Chainlink’s [LINK] newest efficiency didn’t fairly align with the traders’ curiosity as its value declined significantly over the past week. In accordance with CoinMarketCap, LINK was down by greater than 13% and, at press time, was trading at $5.95 with a market capitalization of over $3 billion.

Nonetheless, traders may have a motive to loosen up as CryptoQuant’s data revealed a serious bullish sign for LINK. The info prompt the potential of a value surge within the close to future.

Learn Chainlink’s [LINK] Value Prediction 2023-24

Right here’s the excellent news

Chainlink’s stochastic was in an oversold place, which may give traders hope for a pattern reversal within the days to observe. Furthermore, LINK’s change reserve was additionally reducing, suggesting decrease promoting strain.

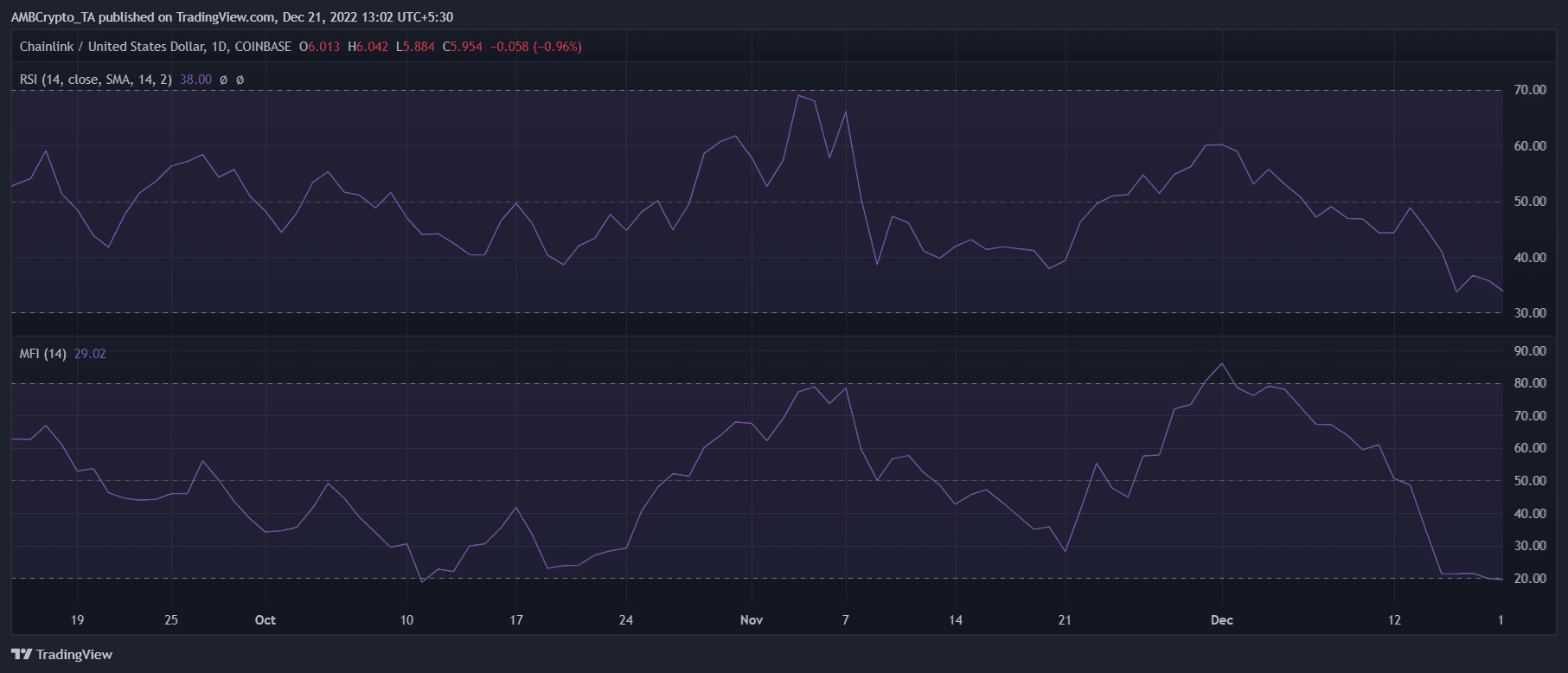

LINK’s energetic addresses and variety of transactions had been additionally rising, which was one more optimistic sign. Apparently, not solely the stochastic, however LINK’s Relative Power Index (RSI) and Cash Circulate Index (MFI) had been additionally fairly near the oversold zone.

This might additional improve the possibilities of a northbound breakout.

Supply: TradingView

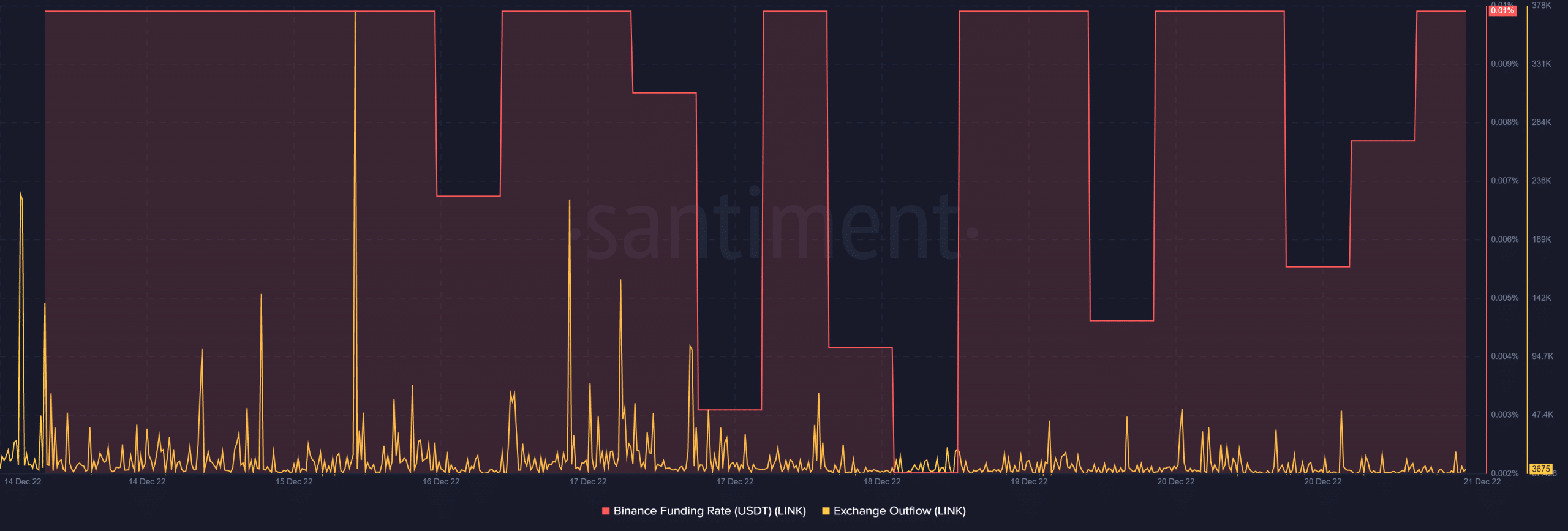

Santiment’s chart additionally identified just a few of the constructive metrics, corresponding to LINK’s funding charge. As per the chart, LINK’s Binance funding charge was persistently excessive, indicating extra curiosity from the derivatives market.

LINK’s change outflow additionally spiked fairly just a few occasions final week, which additionally could possibly be taken as a inexperienced sign.

Supply: Santiment

Whereas the metrics began to align with traders’ curiosity, a number of developments on the Chainlink ecosystem may function the inspiration for its subsequent bull run. As an example, FSN and Chainlink Labs established a channel partnership to speed up NFT adoption.

Are your LINK holdings flashing inexperienced? Verify the Revenue Calculator

Lee Sang Seok, CEO of FSN, mentioned,

“Each FSN and Chainlink Labs are on the forefront of the NFT ecosystem, and we firmly imagine Chainlink Oracle providers are important to unlocking new types of NFT utility, garnering consumer confidence in Web3 initiatives, and enabling NFTs to comprehend their immense potential.”

In a latest announcement, Chainlink additionally acknowledged that will probably be working with Arbitrum to assist the enlargement of layer 2 dApps within the DeFi house. By way of the partnership, Arbitrum will be capable to scale the dApps working on its community and make the most of Chainlink’s automation.

It’s a greater than meets the attention scenario

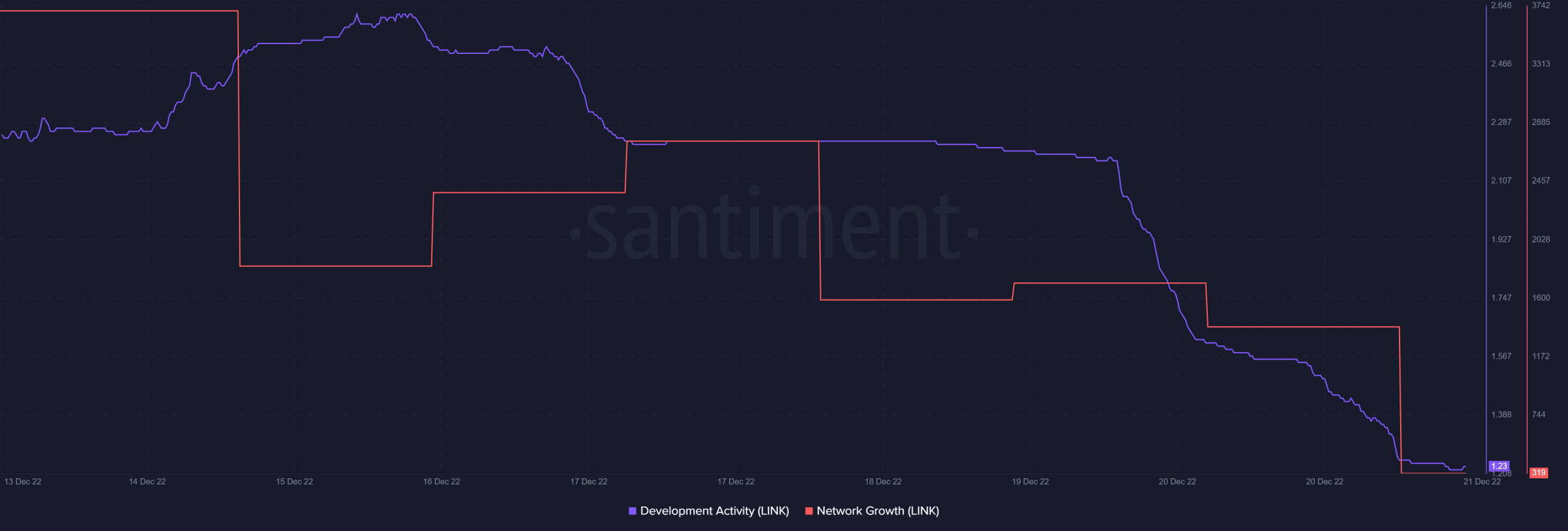

Chainlink, in its daily roundups on Twitter, has been mentioning all of the integrations on its community. Although this prompt elevated efforts by builders, Santiment’s chart revealed that LINK’s improvement exercise went down over the past week.

Moreover, LINK’s community progress additionally adopted an analogous route and declined over the previous seven days, which could postpone LINK’s subsequent bull run.

Supply: Santiment