- Ethereum-based NFTs on OpenSea simply noticed its highest gross sales quantity since Might.

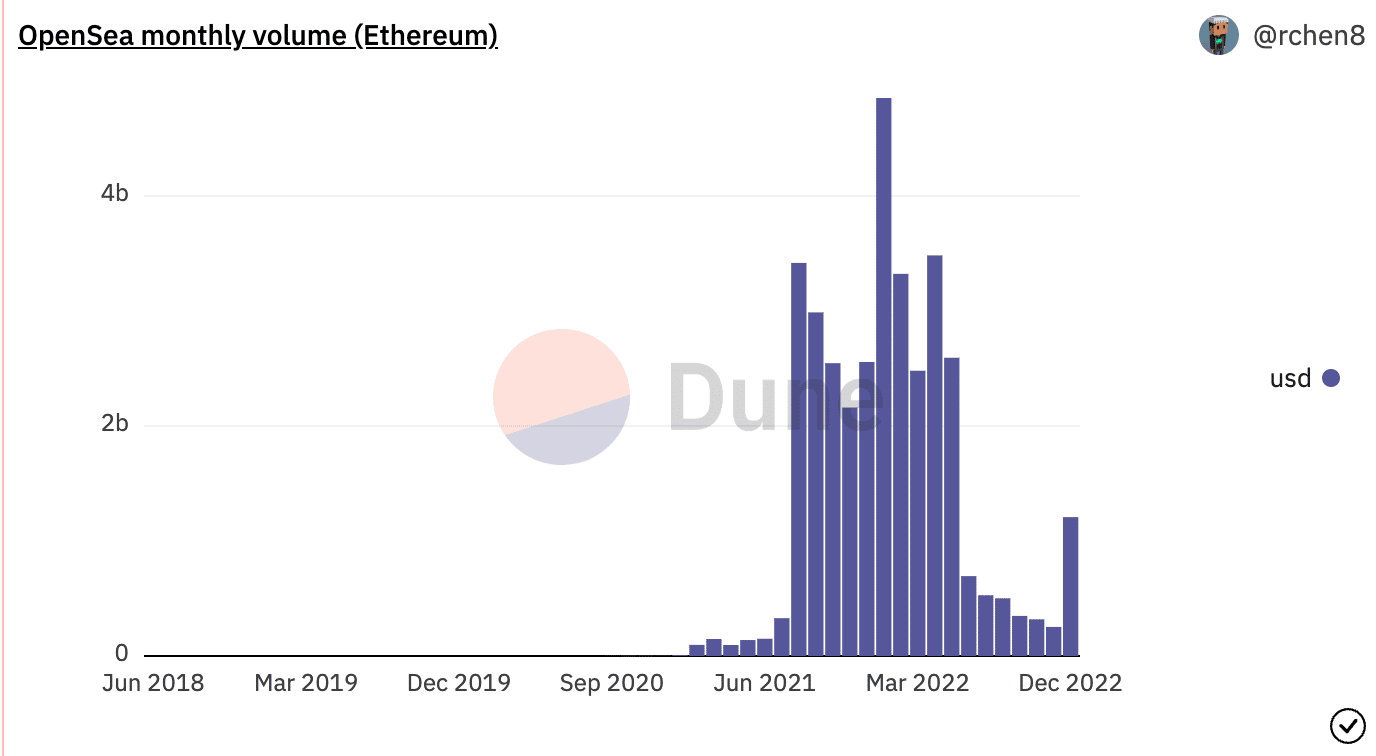

- Month-to-month gross sales quantity throughout OpenSea, nonetheless, is at its lowest stage this 12 months.

After struggling a extreme decline in curiosity, Ethereum-minted NFTs on OpenSea clinched the best month-to-month gross sales quantity since Might, information from Dune Analytics confirmed.

With 696,908 Ethereum-based NFTs bought on OpenSea for the reason that starting of December, the month-to-month gross sales quantity totaled $1.2 billion at press time. With seven days left until the tip of 2022, this index represented a 74% improve from the $253 million logged because the gross sales quantity in November.

Supply: Dune Analytics

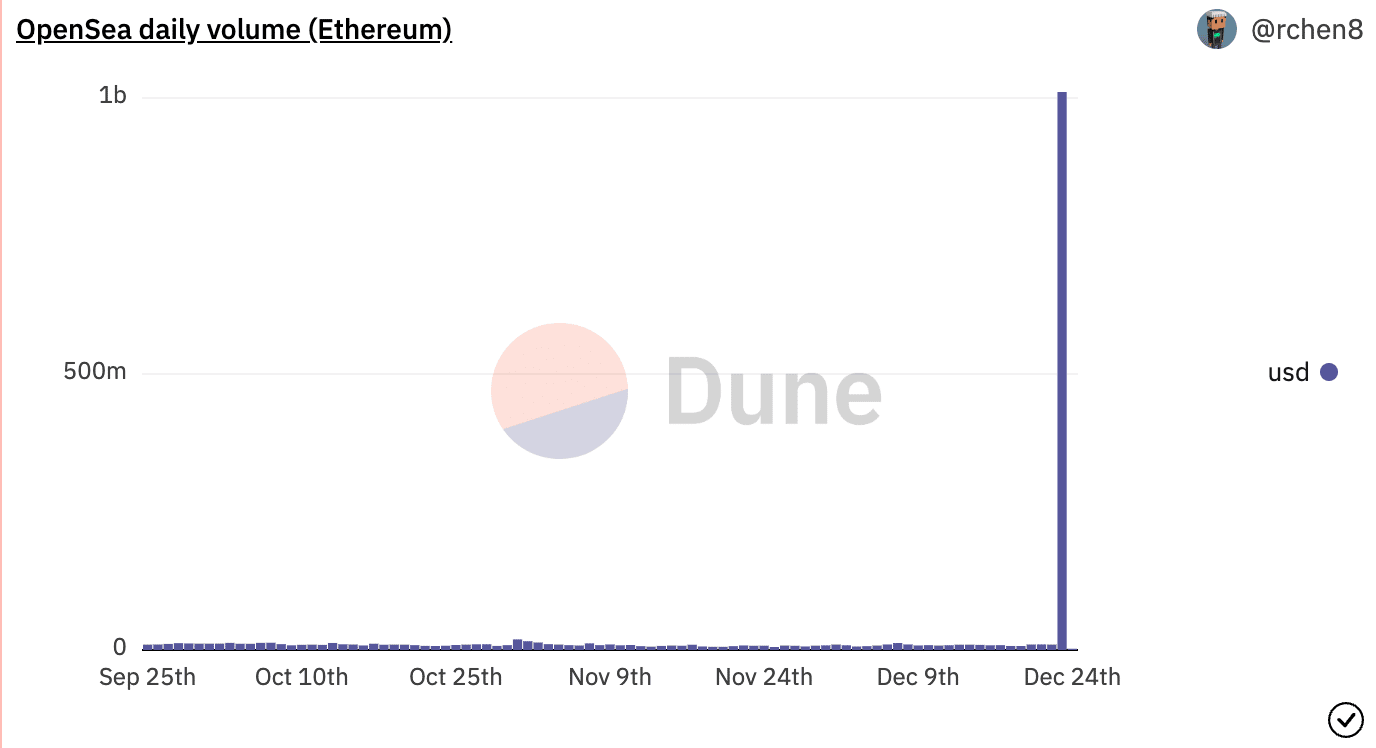

Curiously, of the $1.2 billion registered as month-to-month gross sales for Ethereum-minted NFTs on OpenSea thus far this month, the each day sale quantity of $1.01 billion recorded on 24 December amounted to 84% of whole gross sales made.

Actually, for a number of months, the gross sales quantity for Ethereum-minted NFTs bought on OpenSea had been lower than $20 million.

Supply: Dune Analytics

Whereas information from DappRadar revealed a 4% uptick in gross sales quantity throughout OpenSea within the final week, an evaluation of month-to-month gross sales quantity throughout the main market revealed a decline.

In keeping with information from Dune Analytics, since April, month-to-month gross sales quantity on the OpenSea market has fallen by 95% and may shut the 12 months at its lowest stage since June 2021.

Supply: Dune Analytics

2022 in a nutshell

As tightening circumstances within the broader monetary markets foisted a decline within the normal cryptocurrency market, profile footage (PFP) NFTs suffered a major decline in traders’ curiosity.

The drop in curiosity exhibited itself by way of a major decline in gross sales quantity, depend of NFTs bought, and so forth., throughout main NFTs marketplaces.

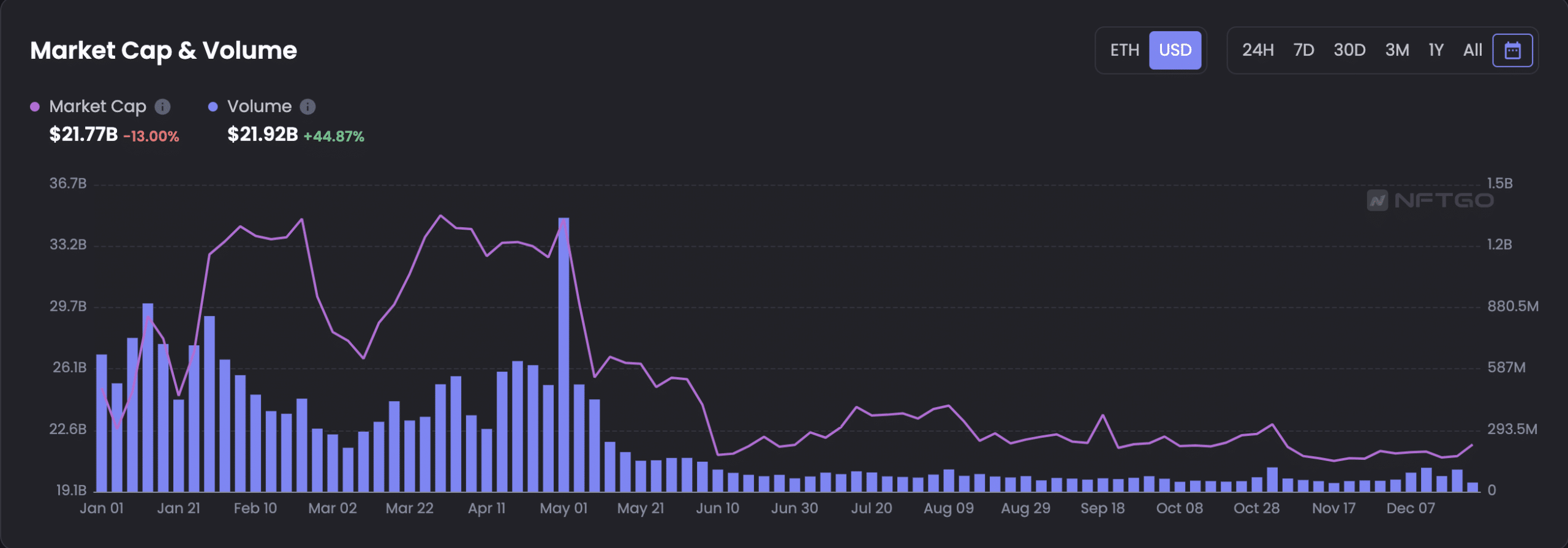

In keeping with information from the NFT analytics platform NFTGo, the market capitalization of the NFT ecosystem fell by 13%. As of 24 December, this stood at $21.77 billion.

Curiously, with a plethora of NFT initiatives launched through the 12 months, gross sales quantity grew by 44.87% this 12 months. As of this writing, NFTs gross sales quantity throughout all marketplaces stood at $21.92 billion.

Supply: NFTGo

Moreover, in a newly printed analysis, Blockworks Research discovered that within the web3 ecosystem, the NFT/Gaming vertical sectors attracted essentially the most funding. In keeping with the analysis platform, each sectors raised $8.3 billion, which represented a 51% development from the funds raised in 2021.

[4/17]

Funding Tendencies:

🏆 NFT/Gaming vertical attracted essentially the most funding this 12 months.

📈 The vertical raised $8.3bn in 2022, a 51% improve YoY.

➡️ Half of those investments have been in VR/metaverse, blockchain-based gaming, and sport studio. pic.twitter.com/QpgBCzzAQf— The Block Analysis (@TheBlockRes) December 21, 2022

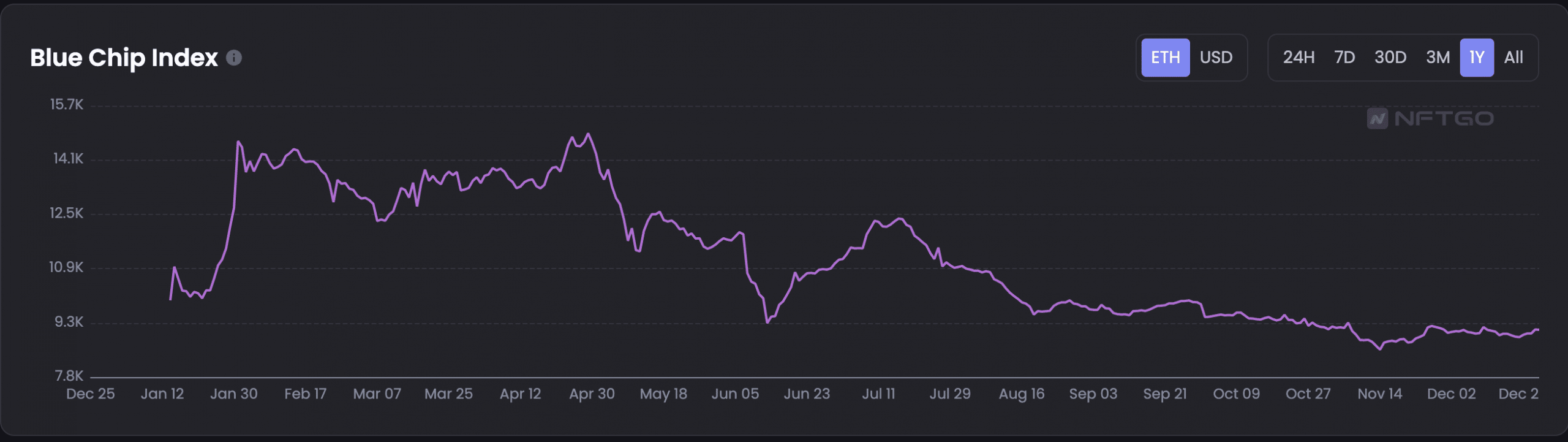

As for Blue Chip NFTs, they noticed a decline in worth in 2022. The NFT collections that make up the Blue Chip NFTs class embody however are usually not restricted to Bored Ape Yacht Membership, Cool Cats, CryptoPunks, Artwork Blocks, and CloneX.

In keeping with NFTGo, the Blue Chip Index is calculated by weighing the market capitalization of Blue Chip NFT collections to find out their efficiency. At 9138 ETH as of 24 December, this fell by over 30% within the final 12 months.

Supply: NFTGo