- LDO might face some bother as this two-year previous traders sells off part of his LDO holdings

- The LDO worth hike may retrace because it was overbought

A bit of the crypto market revived after Christmas led to sluggishness, with Lido Finance [LDO] registering a ten% enhance within the final 24 hours. Because of the uptick, long-term traders of the Ethereum [ETH] staking protocol determined to unload a few of his holdings.

Learn Lido Finance’s [LDO] Worth Prediction 2023-2024

In keeping with Lookonchain, this explicit investor owned LDO since December 2020. Round this era, the person amassed about 25 million LDO tokens.

Nevertheless, these tokens weren’t bought till some elements went off the wallets in January 2022. The most recent being let go was 790,000, valued at $850,040 as at when he bought.

The worth of $LDO is up 10% prior to now 24 hours.

An investor of $LDO is promoting $LDO and has bought 790,000 $LDO ($850,040) prior to now 1 hour, with a mean promoting worth of $$1.075.

This investor obtained 25M $LDO on Dec 17, 2020, and began promoting $LDO on Jan 02, 2022. pic.twitter.com/mTAALkJiWj

— Lookonchain (@lookonchain) December 27, 2022

Income dips however the system continues to be alive

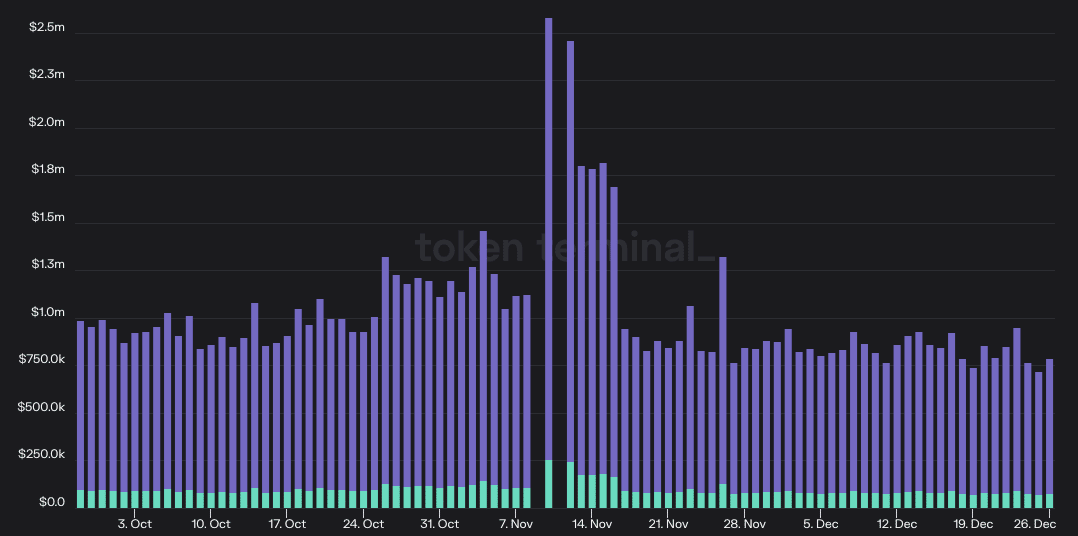

Moreover the radiant LDO present, there have been downsides to the protocol’s situation. In keeping with Token Terminal, the income registered by Lido within the final 30 days was removed from dazzling. On the time of writing, the 30-day revenue was 29.42% fall off.

On the brilliant aspect, the income decline couldn’t maintain the Lido community in ruination. This was because of the participation of the builders within the ecosystem. At press time, the blockchain and dAPP aggregator showed that lively builders participating the Lido protocol had elevated 9.43%.

Supply: Token Terminal

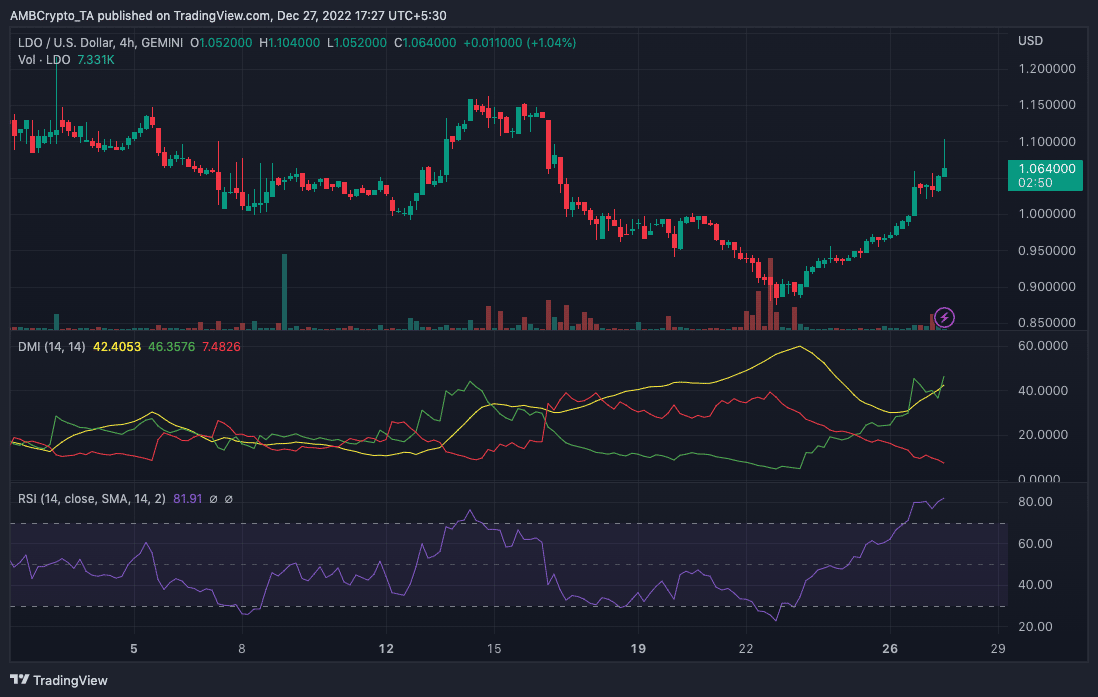

With LDO exchanging hands at $1.07, and a 67.50% quantity hike, it was potential to see extra upside. Indications per the Directional Motion Index (DMI) revealed excessive rising ranges on the optimistic (inexperienced) outlook. At 46.35, LDO appeared in pole place to not retract its uptrend, in comparison with the -DMI (crimson) at 7.48.

Within the case of the Common Directional Index (ADX), it was strongly in assist of the +DMI. This was as a result of trended above 25. For the reason that ADX (yellow) heeded the +DMI route, quick time period traders may wish to think about this a shopping for place.

What number of LDOs are you able to get for $1?

Nonetheless, the prospect of a market downturn was nonetheless rife. One indicator that might lead LDO right into a worth reversal was the Relative Energy Index (RSI). At press time, the RSI was 81.91. Beaming at such a excessive place, it was evident that LDO was oversold. And momentarily, might be off to retraction.

Supply: TradingView

TVL holds regular

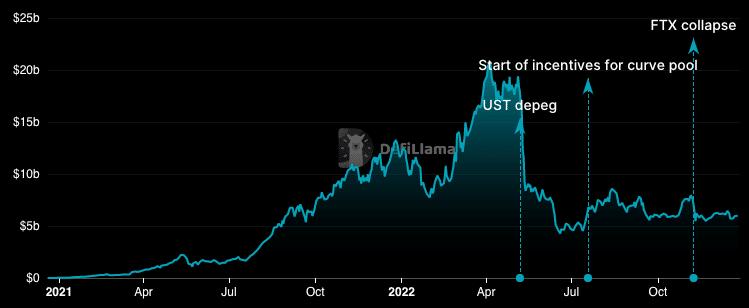

In the meantime, Lido had left its underwhelming efficiency per its Whole Worth Locked (TVL). In keeping with multi-chain TVL dashboard, DeFi Llama, Lido’s TVL was a 1.33% uptick at $5.98 billion.

After all, the one-day change was largely negligible. Therefore, the sum of all property deposited into the dApps beneath the Lido chain weren’t essentially imposing. Nevertheless, the protocol’s well being appeared in fine condition.

Supply: DeFi Llama