NFT

From the dizzying highs of the bull run, when NFT Google searches had been up what felt like hundreds of share factors, to the darkish corners of the bear market, it has been a tumultuous 12 months for NFTs.

As “What’s an NFT?” turned one of the searched phrases, marketplaces squabbled over royalty funds, quantity dwindled, and a few shocking gamers entered the area. The pervading theme for 2022 appeared to be mainstream adoption.

The Block right-clicked and saved among the 12 months’s most dramatic information factors. This is the 12 months in NFTs:

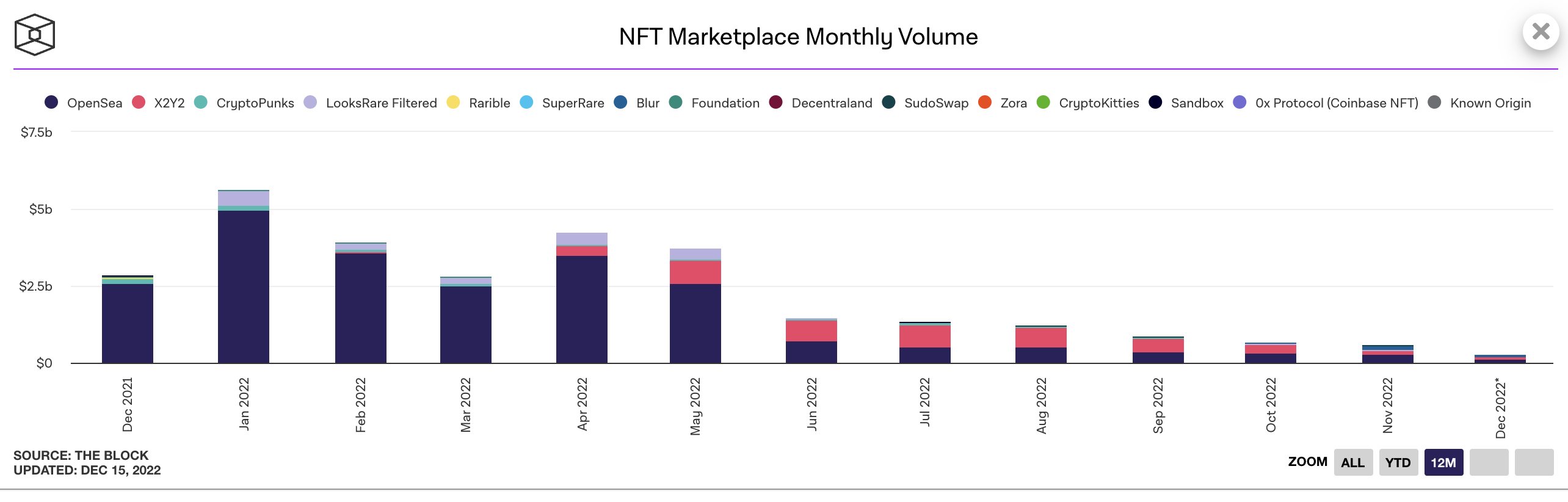

NFT market wars and a drop in quantity

Earlier this 12 months, a wave of recent, disruptive NFT market entrants seemed to shake up price constructions, together with all-important artist royalty funds.

These levies, generally known as creator charges, have been used to justify the existence of NFTs for artists — providing constant revenue on future gross sales of labor.

XY2Y was on the forefront of this, providing an optionally available cost mannequin – which implies that customers themselves can select to implement (or not implement) royalties. {The marketplace} launched in February, with a ‘vampire assault’ airdrop of thousands and thousands of tokens to customers of OpenSea. The fruits of this, nonetheless, did not come good till 5 months later.

This was across the time the group behind the decentralized NFT market Sudoswap launched a brand new platform known as SudoAMM on July 8, nixing all creator royalties to maintain charges right down to 0.5% per transaction. SudoAMM noticed $50 million in complete buying and selling quantity two months after the platform launched.

The surge in low-fee marketplaces sparked an ongoing, and generally labored, debate amongst folks working within the sector, inflicting some artists to get artistic concerning the phrases of their good contracts.

On Sept. 28 Fidenza artist Tyler Hobbs launched the QQL Mint Go; a mission which protests these dodging royalties by means of blocking X2Y2’s pockets within the good contract coding, successfully blacklisting it.

Solana’s largest NFT market Magic Eden additionally subsequently switched to an optionally available royalty cost mannequin in October, a transfer it later modified by issuing code permitting the enforcement of royalties and ‘gamification’ of collections.

In the meantime, heavyweight OpenSea additionally rolled out instruments to assist artists implement royalties on-chain; an motion that was later criticized for having tenants of centralization.

As squabbles have died down considerably, it is unclear who will emerge because the ethical winner on this debate. What’s clear, although, is that regardless of the erosion of OpenSea’s market share over the course of the 12 months — rivals are nonetheless not near touching it when it comes to quantity. It would take greater than reduce buying and selling charges to lure prospects away.

Learn extra: The TL;DR on NFT royalties

You’ve got been CryptoPunk’d

Blue-chip mission CryptoPunks noticed extra motion in 2023 than most NFT collections will see of their complete lifecycle — with a buyout, a brand new supervisor and a play for unique utility.

Yuga Labs acquired the rights to the gathering in March from Larva Labs for an undisclosed sum. In the identical fell swoop, the NFT large additionally purchased out gaming assortment Meebits. This meant a brand new set of phrases and circumstances, and query marks surrounding what the brand new heavyweight supervisor had in retailer.

By June, Christie’s NFT maven Noah Davis had been poached by Yuga to shepherd the gathering’s future. At Christie’s, Davis was accountable for bringing Beeple’s piece ‘The First 5,000 Days’ to public sale. The sale made headlines on the time in March 2021 for its $69 million price ticket, a determine which put Beeple — the American graphic artist Mike Winkelmann — “among the many high three Most worthy dwelling artists.”

CryptoPunks ground worth in ETH as much as Dec. 20. Chart: NFT Worth Flooring

August noticed the Punks group up with luxurious jewellery retailer Tiffany & Co. to create bespoke pendants and corresponding NFTs dubbed NFTiffs. The restricted run bought out in about 20 minutes for round $50,000 every.

Complete quantity for the gathering had surpassed $3.5 million by mid-December, based on information supplier NFT Go, with a mean worth of about 29 ETH, or about $35,000.

Learn extra: Tiffany CryptoPunk NFTs are already being ‘flipped’

OtherSide’s fuel wars

OtherSide not solely bought out all accessible 55,000 Otherdeed metaverse land NFTs inside three hours of its public sale in Could; it additionally momentarily triggered a fuel warfare on the Ethereum community.

Ethereum customers tried to purchase NFTs on the similar time and outbid one another through the use of the community’s transaction charges. Such bids could cause the charges on the blockchain to spike, as was the case throughout the mint.

On-chain information revealed the Otherdeed fuel warfare led to the sale operating up an extra $172 million in transaction charges that value particular person consumers between $4000 and $10,000. Such excessive mint charges triggered many to complain they had been unable to make purchases.

Learn extra: Yuga Labs champions openness, collaborative growth in Otherside litepaper

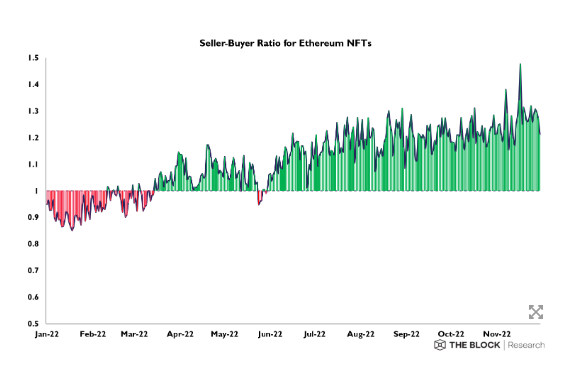

‘Extra consumers than sellers’ — the ETH buying and selling ratio

Fairly merely put, the information exhibits that there have been extra consumers than sellers by the tip of the 12 months for Ethereum NFTs.

Regardless of the rise of different chains, Ethereum nonetheless stays the dominant blockchain in NFT land.

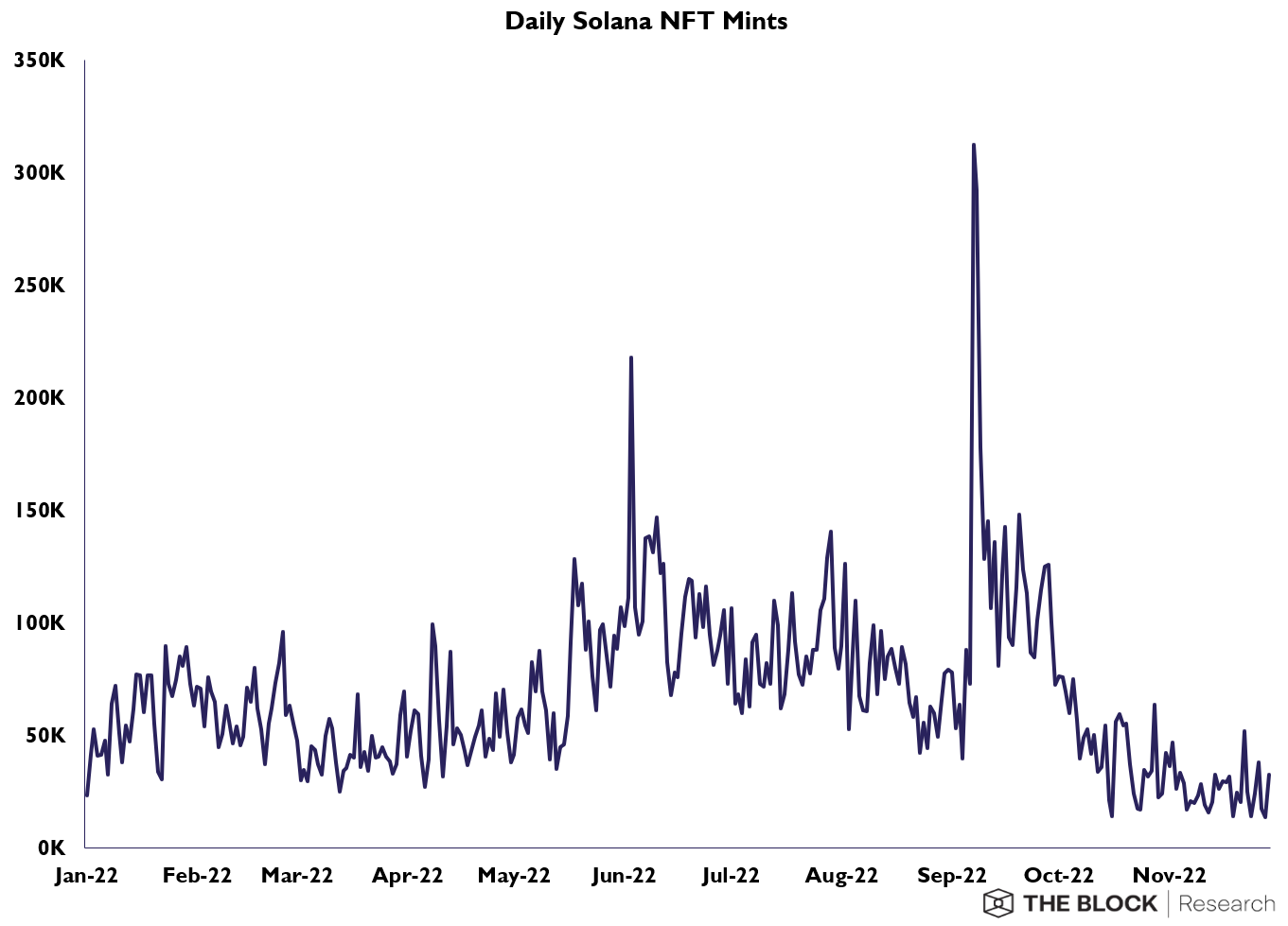

A Solana September

No blockchain had a warmer 12 months than Solana when it comes to piqued NFT curiosity.

The variety of NFTs minted on Solana hit a excessive of 312,000 on Sept. 7, up from 39,000 simply three days earlier. On Sept. 6, Solana-based NFT market quantity his $11.5 million, the best stage since Could.

The surge was possible influenced by the joy surrounding the y00ts mint. The 15,000-strong NFT assortment was a brand new launch from Mud Labs, the group behind the DeGods NFT assortment.

Reddit’s stealth recruitment drive

With an eye fixed on distancing itself from perplexed customers’ qualms about NFTs, Reddit launched a set of cute ‘digital avatars,’ available for purchase with common fiat forex quite than cryptocurrency.

The online end result was that because the inception of its NFT market in July, customers have created about 3 million crypto wallets, an organization govt stated in October. That’s a number of hundred thousand greater than the two.3 million energetic wallets held on OpenSea, the world’s largest NFT market, which has been in operation for practically 5 years.

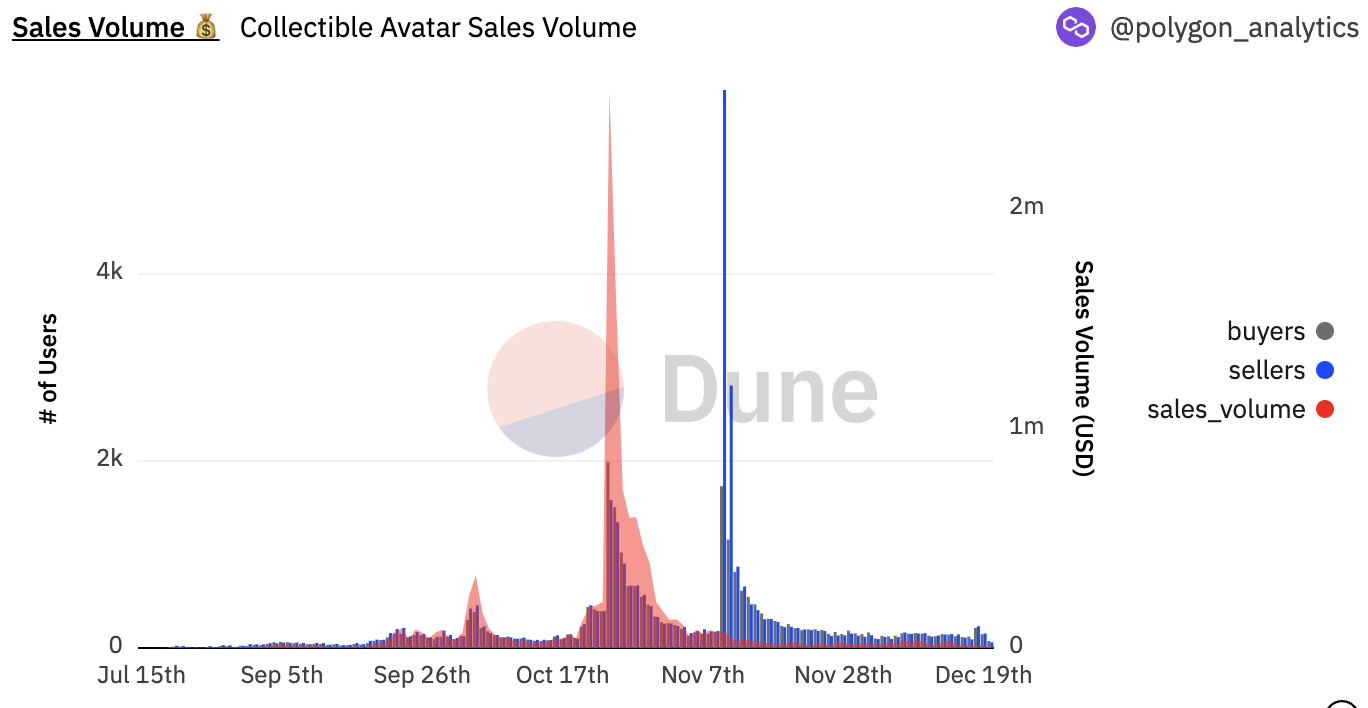

Reddit Avatar buying and selling quantity. Chart: Dune Analytics

Subtracting the variety of energetic OpenSea wallets —once more, the most well-liked NFT market— by the variety of Reddit wallets means that Reddit’s technique might have helped encourage as many as half one million or extra folks to purchase an NFT for the primary time.

It was lauded throughout the ecosystem for instance of profitable ‘onboarding’ of non-crypto normies.

Learn extra: Reddit avoids crypto lingo, exhibits how one can take NFTs mainstream

A final-minute Trump card

Former U.S. President Donald Trump swooped in at virtually the final second in 2022, conspiring to Make NFTS Nice Once more with a so-called buying and selling card assortment of 45,000 objects.

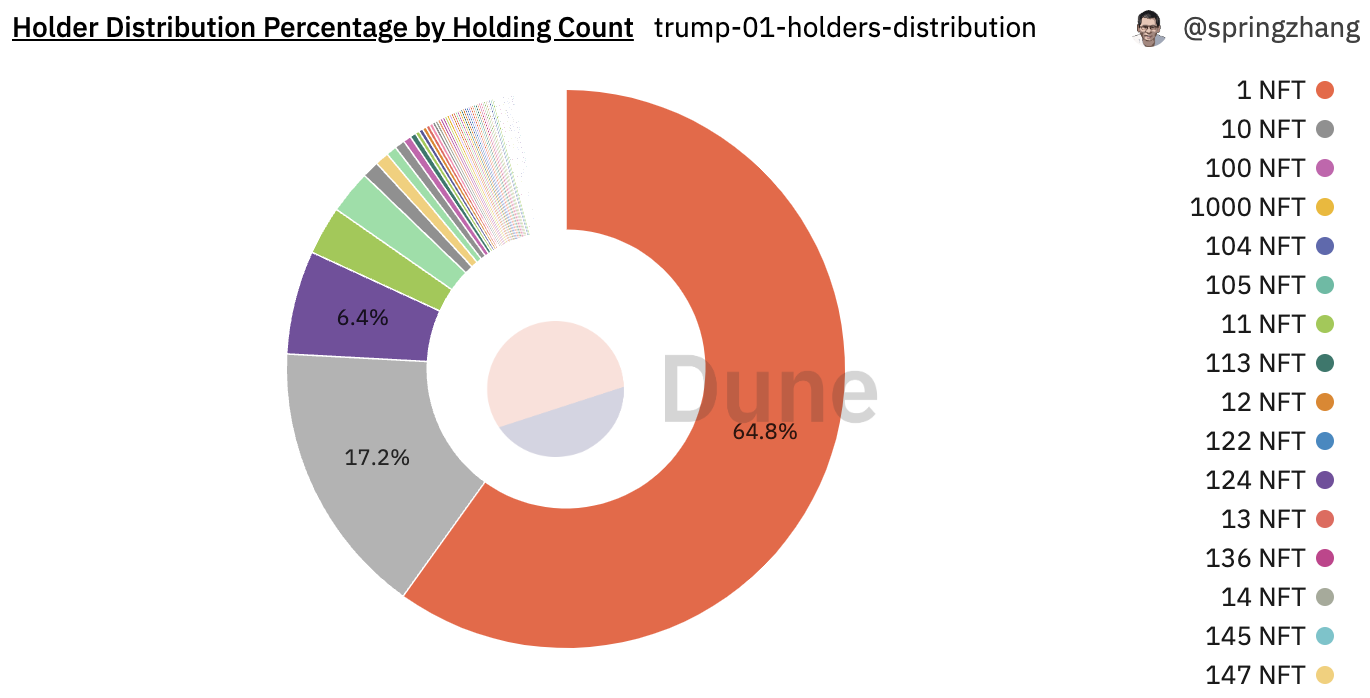

The gathering bought out inside hours, with nearly all of holders hanging onto one NFT every from the gathering, based on information from Dune Analytics.

Trump NFT holder distribution. Chart: Dune Analytics

Nonetheless, even hours after the sale there have been already some Trump NFT whales amongst holders. 34 wallets held 100 or extra objects from the gathering the day after launch. OpenSea figures additionally counsel that 1,000 of the NFTs had been airdropped to at least one pockets hours earlier than the general public sale.

Learn extra: Donald Trump NFT assortment sells out inside hours