The present Bitcoin cycle is perhaps its “most difficult” one but if the drawdown on this on-chain metric is something to go by.

Whole Quantity Held By 1k-10k BTC Worth Band Has Sharply Gone Down Just lately

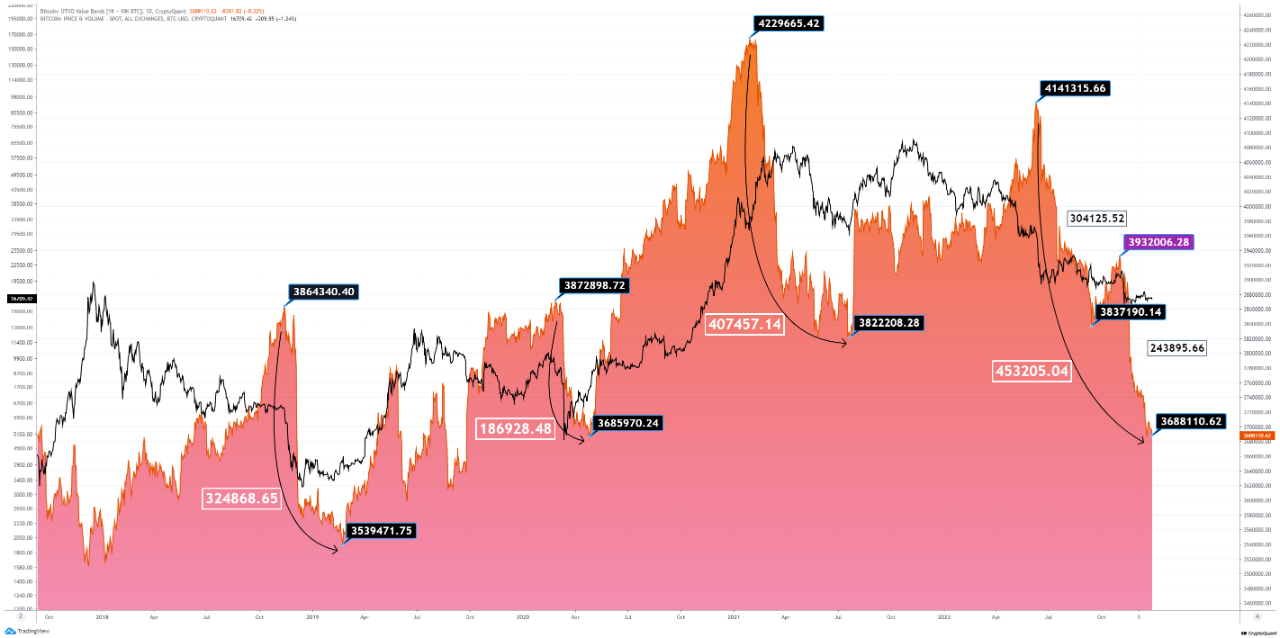

As identified by an analyst in a CryptoQuant post, the most recent drawdown within the holdings of the 1k-10k BTC worth band is probably the most drastic within the historical past of the crypto. The related indicator right here is the “UTXO Worth Bands,” which tells us the whole quantity of cash every worth band is holding out there.

UTXOs are divided into these “worth bands” or teams primarily based on their present worth. As an illustration, the 100-1k BTC worth band consists of all UTXOs carrying between 100 and 1,000 cash. Right here, the related UTXO worth band is the 1k-10k BTC vary, a traditionally necessary cohort as normally solely the whales have wallets with UTXO quantities so massive.

Now, the beneath chart shows the pattern within the complete holdings of this worth band during the last 5 years:

Appears like the worth of the metric has quickly declined in current months | Supply: CryptoQuant

The graph reveals that the whole variety of cash held by this Bitcoin UTXO worth band has seen a pointy drop this 12 months. In all, the drawdown has amounted to 453,205.04 BTC being dumped by this cohort for the reason that peak noticed in June 2022.

For comparability, within the 2018/19 bear market, the 1k-10k BTC worth band noticed a complete drawdown of 324,868.65 BTC from the excessive. In the course of the COVID black swan crash of 2020, the group additionally distributed a big quantity, shedding 186,928.48 from its holdings.

And within the bull run throughout the first half of final 12 months, these whales lowered their holdings by 407,457.14 BTC between the height in February and the July backside. The newest drawdown within the metric’s worth is the sharpest that Bitcoin has seen but. Due to this reality, the quant exclaims the present cycle to be the “most difficult” one within the historical past of the asset to this point.

An attention-grabbing sample may also be seen within the chart; at any time when the 1k-10k BTC has completed with the distribution and began accumulating once more, Bitcoin has felt a bullish affect. “Typically, the market can solely get better when this cohort has sufficient confidence to build up once more,” explains the analyst. “And in the mean time, we nonetheless not get any constructive indicators from this cohort.”

BTC Value

On the time of writing, Bitcoin’s value floats round $16,600, down 1% within the final week.

BTC appears to have gone down throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com