- Exercise on DEXes on Ethereum elevated over the previous couple of years.

- Furthermore, the variety of validators on the Ethereum community grew.

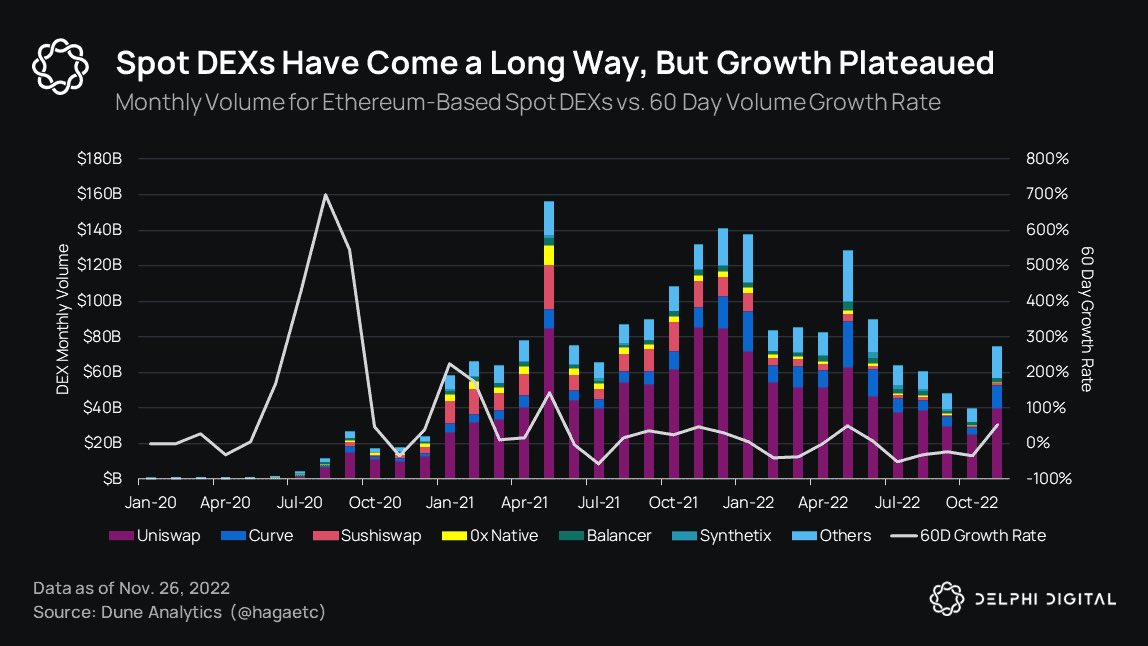

In line with a tweet by Delphi Digital on 29 December, the DEX exercise on Ethereum [ETH] surged considerably over the previous 12 months. One cause for a similar might be the distrust in CEXes attributable to the collapse of FTX.

Ethereum DEX quantity had a 402.4% compounded annual development fee from January 2020 to November 2022. pic.twitter.com/ZQbupsVfCX

— Delphi Digital (@Delphi_Digital) December 29, 2022

Are your ETH holdings flashing inexperienced? Verify the revenue calculator

A spike in exercise

From January 2020 to November 2022, the DEX quantity on Ethereum grew by 402.4%. Despite the fact that the expansion plateaued over the previous few months, Ethereum may capitalize on the growing DEX exercise on its community.

Supply: Delphi Digital

This growing exercise was coupled with curiosity from retail traders. In line with Glassnode, the variety of addresses with non-zero balances reached an all-time excessive of 91.97 million addresses.

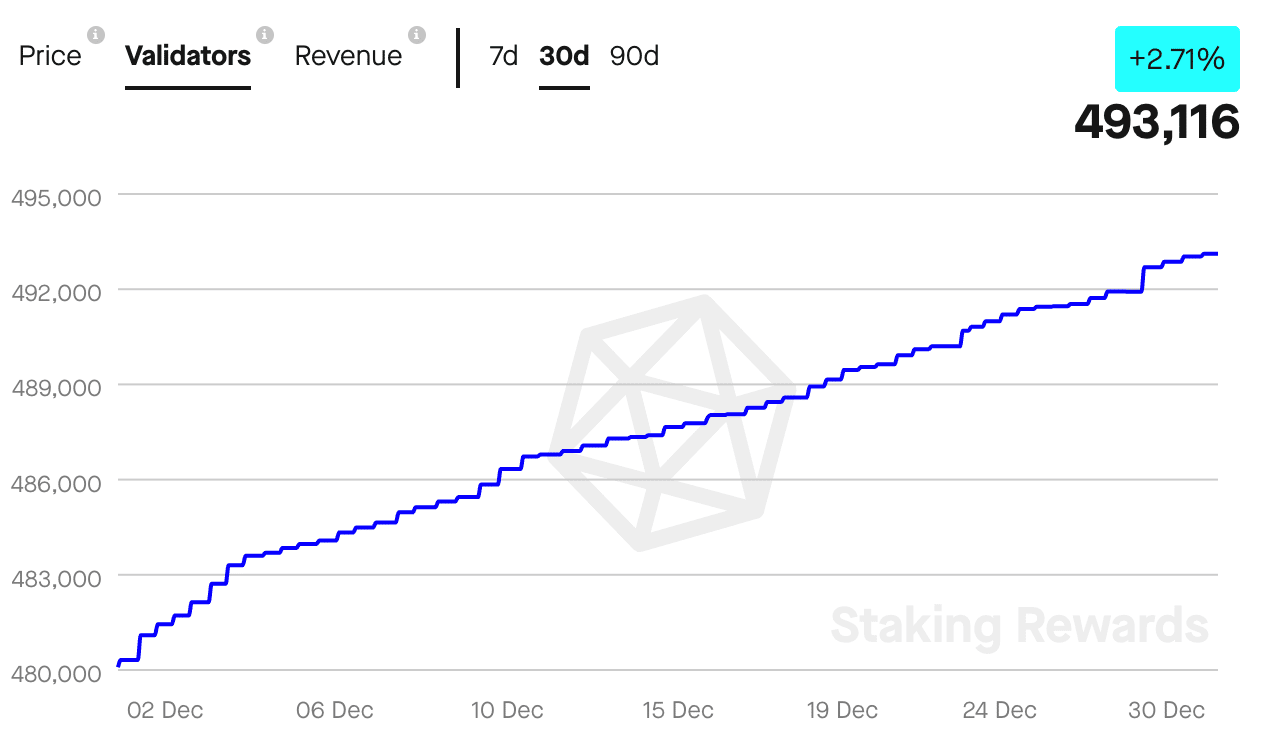

Together with retail traders, the variety of validators on the Ethereum community grew. Over the past 30 days, the variety of validators grew by 2.71%. Nonetheless, the income generated by the community declined throughout the identical interval, in keeping with information offered by Staking Rewards.

Supply: Staking Rewards

Wanting on the on-chain information

Coupled with the rising variety of validators, the variety of giant addresses on the Ethereum community additionally grew.

Nonetheless, Ethereum wasn’t in a position to generate curiosity from new addresses. This was indicated by the declining community development, which recommended that the variety of new addresses that transferred Ethereum for the primary time had lowered.

Moreover, Ethereum’s velocity fell throughout the identical interval, implying that the frequency with which Ethereum was being transferred amongst addresses declined.

Supply: Santiment

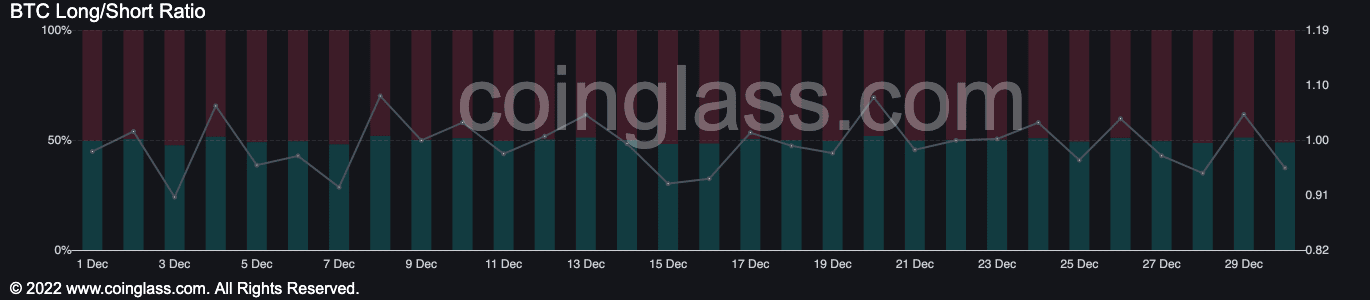

Despite the fact that whales remained optimistic regardless of the declining exercise on Ethereum, merchants within the crypto market held a distinct view.

What number of ETHs are you able to get for $1?

In line with information offered by Coinglass, the variety of brief positions being held towards Ethereum elevated. On the time of press, 51.07% of merchants had taken a brief place towards ETH.

Supply: Coinglass

It stays to be seen whether or not the merchants grow to be proper in betting towards Ethereum. On the time of writing, ETH was buying and selling at $1,192.5 and its worth fell by 0.67% within the final 24 hours, in keeping with CoinMarketCap.