Navigating the world of Bitcoin and cryptocurrencies, basically, has been a tough rollercoaster in 2022. That chapter is now closed and we’ve got now entered into new unchartered territory. Each crypto fanatic and their canine at the moment are questioning whether or not 2023 will deliver good tidings or whether or not it’ll end up worse than 2022.

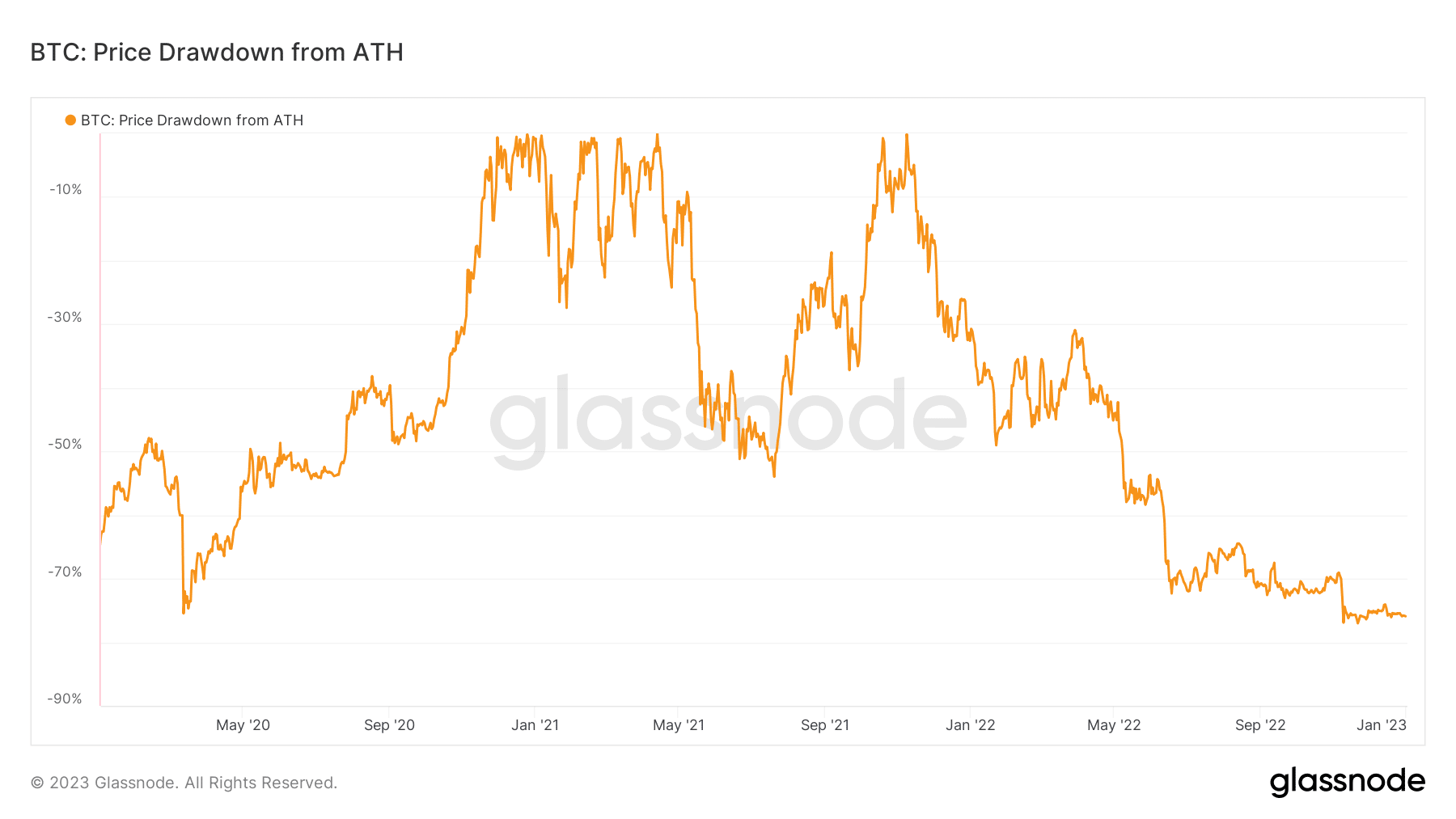

Whereas quick and long-term projections are frequent, Bitcoin’s efficiency in 2022 demonstrated an enormous scope of unpredictability. Maybe a recap of its efficiency might assist put issues into perspective. At its present value stage, Bitcoin is drawn down by roughly 75.92% from its all-time excessive.

Supply: Glassnode

You will need to pay attention to the place most of this drawdown has occurred. It’s from round November 2021 to the top of 2022. Why is that this vital? Nicely, principally due to the time interval through which it occurred.

The financial perspective and Bitcoin’s correlation with risk-on property

If we cross-reference the beginning of the Bitcoin bear market and the U.S. Federal Reserve commenced quantitative tightening, we see a sample. And that is the place the inflation hyperlink is available in.

Quite a few components and occasions within the final three years careworn the worldwide economic system and pushed main economies within the blink of a recession. The COVID pandemic affected world commerce and positioned loads of stress on the worldwide economic system.

The Russia-Ukraine warfare added salt to the proverbial wound as financial pressures mounted. The important thing denominator was inflation. Governments printed cash closely through the pandemic and this quickly raised the extent of inflation throughout the globe. The greenback significantly performed a pivotal function in exporting inflation internationally as the worldwide reserve foreign money.

Folks had invested closely in BTC utilizing low cost funds out there at low-interest charges. However the authorities’s plan to battle inflation concerned elevating rates of interest as a part of its technique to mop up the surplus liquidity.

Bitcoin discovered itself within the financial crosshairs and consequently, many individuals began panic promoting as quantitative tightening hammered down.

The tip of low cost cash

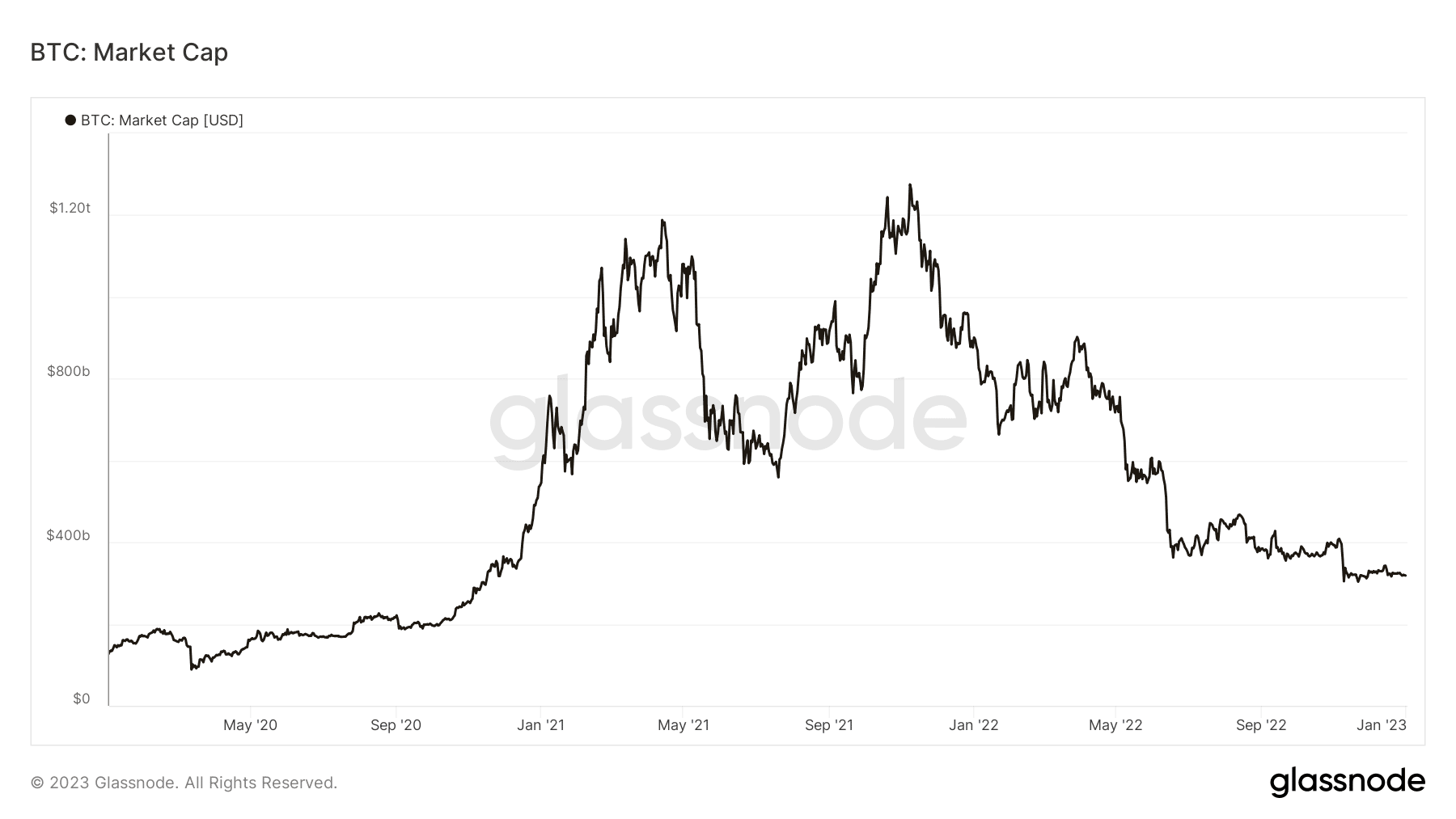

With low cost cash rapidly being sucked out of the markets, the financial stress had a detrimental cascading impact on risk-on property. Bitcoin occurs to fall into this class regardless of it being thought of an inflation hedge. The mixed financial components resulted in sturdy outflows mirrored in Bitcoin’s market cap.

Supply: Glassnode

The outflows had been sharp at the start however the tempo slowed down in the direction of the top of 2022. Now that we’ve got a deeper perspective into what ailed BTC bulls in 2022, we will begin wanting into key components to think about that will provide insights into 2023 expectations.

The connection between Bitcoin and the bonds market

Bitcoin’s 2022 efficiency proved that there’s, the truth is, a hyperlink between BTC’s efficiency and the standard finance market. Earlier than we get into bonds, we’ve got to take a look at what the FED is at present aiming at.

As famous earlier, the FED has put up an aggressive battle towards inflation by elevating rates of interest. Nonetheless, this technique won’t be efficient in the long term.

An evaluation by Sean Foo highlights the potential dangers that the markets would possibly expertise in 2023. FED Chair Jerome Powell’s 2% goal is sort of bold and it underscores the potential for extra quantitative tightening forward.

Such an consequence means we’d see extra uncertainty, in addition to larger stress on risk-on property, and this, is the place bonds are available.

Bonds are preferable when the general funding panorama is deemed too dangerous. Because of this, traders have shifted their consideration towards the bonds market, particularly in the USA. It’s because traders would relatively have their funds in risk-free investments comparable to bonds.

Beneath regular circumstances, the demand for Bitcoin is anticipated to be low if there’s a larger demand for bonds. Nonetheless, the bonds yield curve is inverted and this implies there’s a excessive likelihood that the FED would possibly trigger an financial recession.

Extra dangers forward however a possible hail Mary for Bitcoin

The aforementioned state of affairs (inflation) might make bonds interesting however then that entire image is beginning to appear like a home of playing cards. It’s because the financial warfare between the USA, China, and Russia has intensified.

In 2022 we noticed an additional push in the direction of de-dollarization, particularly from China. In the meantime, Russia walks an analogous path after being slapped with heavy sanctions.

The European Union (EU) is pushing towards confiscating billions of wealth owned by Russia as a part of the sanctions. This transfer might set off fears throughout different nations, encouraging them to de-dollarize. Such an consequence might encourage many nations to dump their greenback bonds.

If these occasions do come to fruition, the dollar would possibly change into weaker. Buyers have been speeding towards gold and it will seemingly be the end result for Russia if its property are confiscated.

It would seemingly use its greenback holdings to purchase gold, putting extra stress on the U.S. greenback. Bitcoin would possibly take pleasure in some demand too if this occurs.

Will Bitcoin see a resurgence of demand in 2023?

Now that a lot of the borrowed liquidity that contributed to the 2022 Bitcoin crash has been worn out, Bitcoin might lastly make extra sense as an inflation hedge. It’s because like gold, Bitcoin doesn’t have counterparty danger. This implies the crypto corporations liquidated in 2022 is perhaps a blessing in disguise.

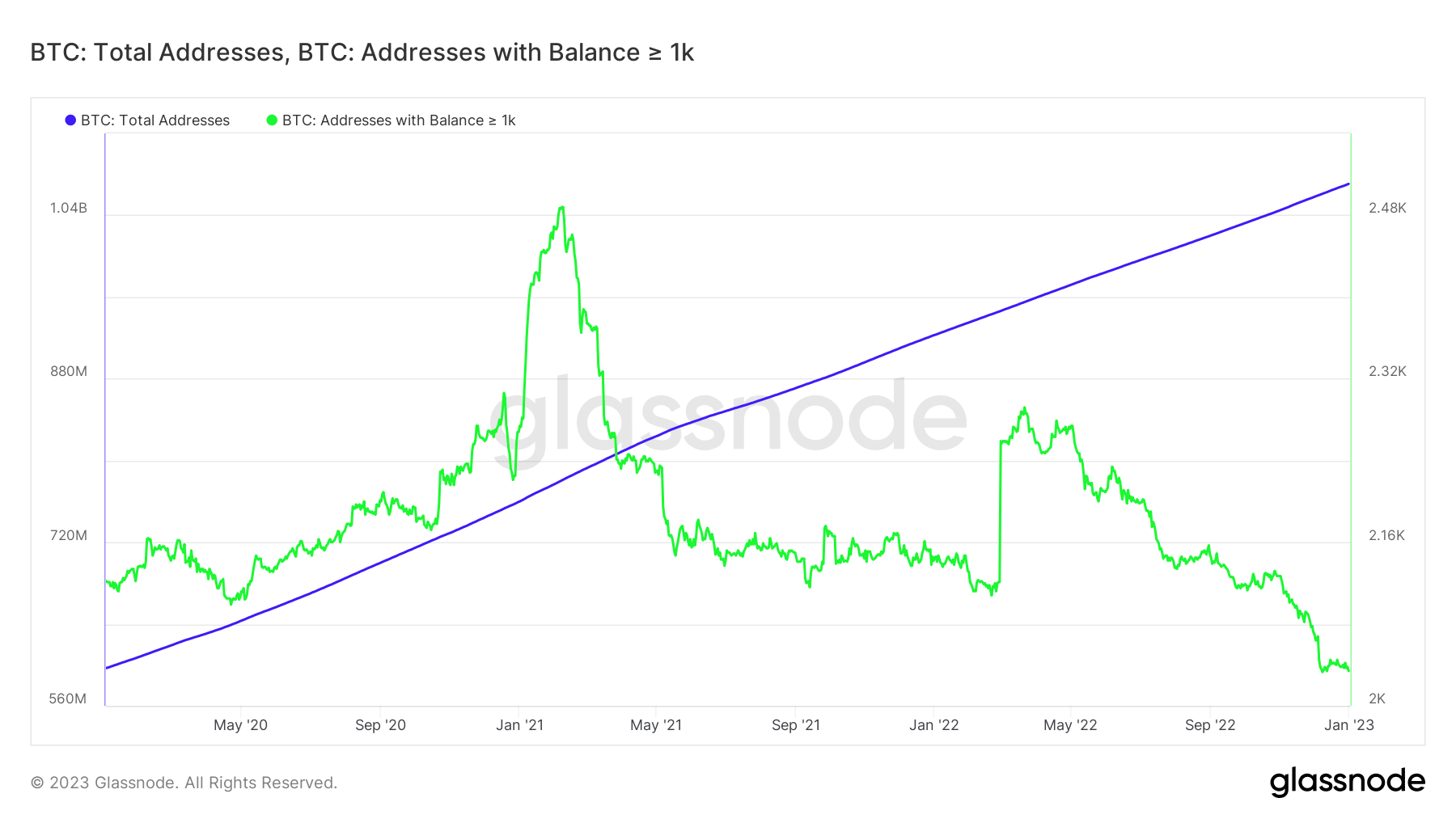

Bitcoin addresses have been steadily rising within the final three years, with over one billion addresses. Alternatively, the addresses holding over 1,000 BTC have dropped considerably within the final 12 months.

Supply: Glassnode

A resurgence of demand from addresses holding over 1,000 BTC would possibly assist the bulls to recuperate as a result of it will point out whale accumulation. These bullish expectations additionally align with a Bitcoin cycle evaluation. 2023 can also mark the beginning of the subsequent Bitcoin cycle.

#Bitcoin A bull run begins.

They begin each 4 years.

2011 / 2015 / 2019 / 2023 pic.twitter.com/jKIniBoLnU

— TAnalyst (@AurelienOhayon) December 28, 2022

Conclusion

We’d see a resurgence of Bitcoin demand in 2023 if the celebs align. Nonetheless, there’s nonetheless loads of uncertainty, particularly with the present financial circumstances and the aforementioned dangers.

![Key lessons from Bitcoin [BTC] in 2022 and what to expect in 2023](https://ambcrypto.com/wp-content/uploads/2023/01/aleksi-raisa-DCCt1CQT8Os-unsplash-1-1000x600.jpg)