Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- The market construction on the day by day timeframe was bearish

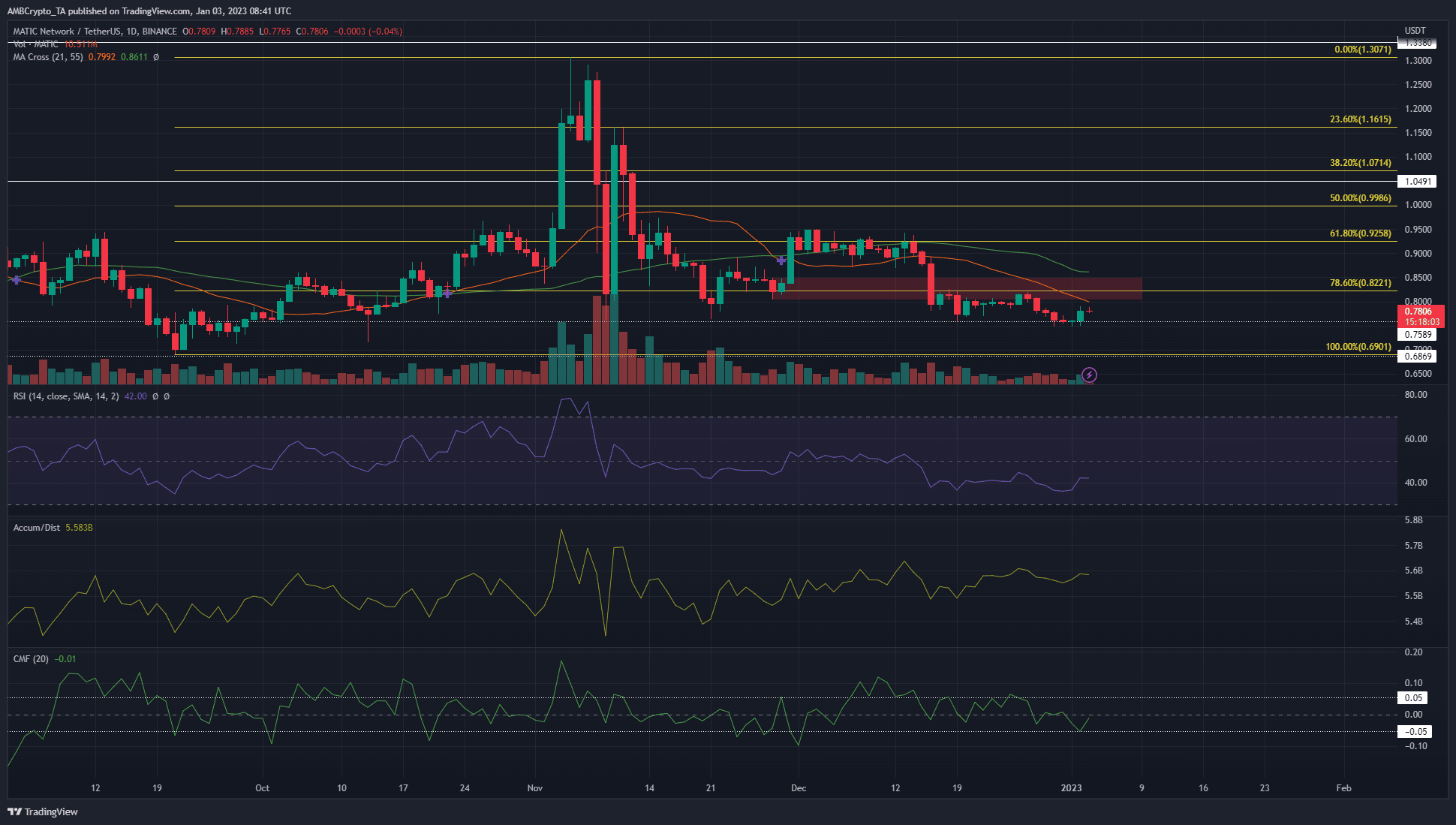

- The presence of the 78.6% retracement degree added confluence to the resistance at $0.82

Bitcoin [BTC] has not initiated a big transfer in latest weeks. Polygon [MATIC] additionally stayed comparatively quiet on the value charts. It bounced between the $0.759 and $0.822 ranges of help and resistance, however the increased timeframe bias was bearish.

What number of MATICs are you able to get for $1?

Accordingly, merchants can hunt down promoting alternatives and commerce with the development. One such alternative can current itself if the token climbed to the resistance space highlighted on the charts.

The bearish breaker and momentum continued to favor MATIC sellers

Supply: MATIC/USDT on TradingView

The worth motion remained bearish for MATIC on the upper timeframes. It has fallen beneath the 78.6% retracement degree of the transfer northward again in October. A bearish breaker on the day by day timeframe has additionally developed proper on the 78.6% retracement degree (highlighted in pink).

The transferring averages confirmed bearish momentum, and the Relative Energy Index (RSI) additionally moved beneath impartial 50 to spotlight the identical. The Accumulation/Distribution (A/D) indicator has shaped increased lows since late November, however didn’t but sign bullishness. The Chaikin Cash Move (CMF) was in impartial territory, and didn’t sign important capital circulate into or out of the market.

A bullish case may be made as soon as MATIC climbs above $0.822 and retests it as help. This might supply a shopping for alternative focusing on $0.925. Nevertheless, as issues stand, a extra compelling case may be made for the bears.

The bearish breaker prolonged from $0.8 to $0.85, and solely a day by day session shut above this space would invalidate the bearish thought. Due to this fact, brief sellers can look to load their positions on a transfer as much as $0.82-$0.84, and goal $0.76 and $0.69 as take-profit ranges.

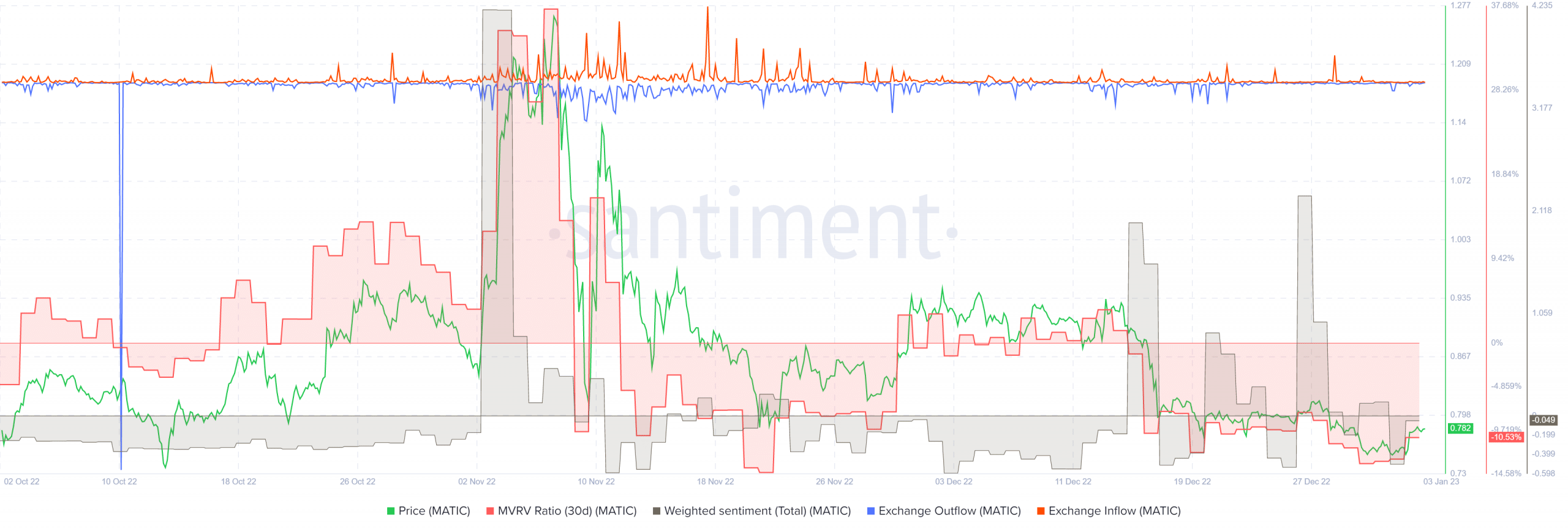

Sentiment flips detrimental as soon as once more and change outflow noticed a small improve close to the underside

Supply: Santiment

The weighted sentiment behind the token has been impartial up to now few days. Late December noticed sentiment shoot wildly into constructive territory. Nevertheless, the value solely managed to rise from $0.795 to $0.816- a 2.92% transfer increased.

The change influx and outflow didn’t see massive spikes in latest weeks, though the outflow metric did see a small bump when the costs reached $0.771 to point out some accumulation.

The 30-day Market Worth to Realized Worth (MVRV) ratio stood in detrimental territory, and has been right here since mid-December. This confirmed the token could possibly be undervalued on the decrease timescales.

Alternatively, the 365-day MVRV ratio (not proven right here) has climbed increased since June and shaped increased lows, though it nonetheless remained in detrimental territory.

Are your MATIC holdings flashing inexperienced? Examine the Revenue Calculator

The inference was that holders may want to attend for a lot of extra months earlier than a powerful increased timeframe uptrend may be established.