On-chain information exhibits the Bitcoin open curiosity RSI is presently forming a sample that may result in a short-term correction within the asset’s worth.

Bitcoin Open Curiosity 14-Day RSI Has Been Climbing Up Lately

As identified by an analyst in a CryptoQuant post, a short-term bearish correction may quickly happen for BTC. The “open curiosity” is an indicator that measures the full quantity of Bitcoin futures contracts presently open on by-product exchanges. The metric takes under consideration each lengthy and quick contracts.

When the worth of this metric goes up, it means traders are opening extra contracts on by-product exchanges proper now. Such a development might end in larger volatility for the crypto’s worth because it implies leverage is growing available in the market.

However, reducing values recommend holders are getting liquidated or are closing down their futures contracts presently. Naturally, this might result in a extra secure worth of BTC as a result of lesser leverage.

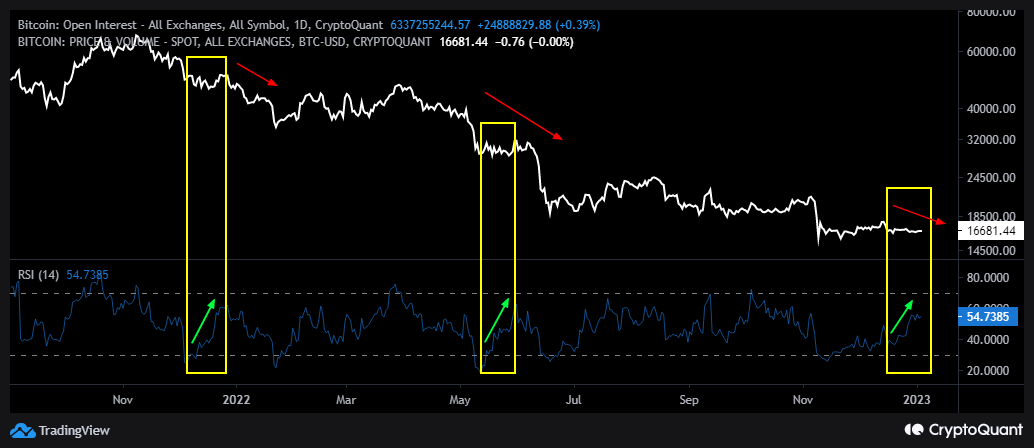

Now, the related metric within the context of the present dialogue isn’t the open curiosity itself, however its 14-day RSI. The Relative Energy Index (RSI) is a momentum oscillator that retains monitor of the pace and path of adjustments in any metric’s worth over a specified interval. The under chart exhibits the development within the 14-day RSI of the Bitcoin open curiosity over the previous yr:

The worth of the metric appears to have seen some rise in current days | Supply: CryptoQuant

As you possibly can see within the above graph, the quant has highlighted the related areas of the development for the Bitcoin open curiosity RSI (14). It might seem that every time the RSI has risen whereas the BTC worth has been transferring sideways or downwards, a bearish divergence has shaped for the crypto, and its worth has undergone a correction.

There have been different situations of a rising open curiosity RSI prior to now yr, however all these have been accompanied by an increase within the worth itself (and never consolidation or decline) so the identical sample by no means utilized to them. Lately, nonetheless, the metric has been as soon as once more surging, and this time the worth has been transferring sideways on the similar time, which implies the bearish divergence as these earlier situations is now forming.

If the development from the earlier occurrences certainly repeats this time as effectively, then Bitcoin might quickly see one other short-term correction in its worth.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16,800, up 1% within the final week.

Seems like the worth of the crypto has loved some uptrend in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Becca on Unsplash.com, charts from TradingView.com, CryptoQuant.com