- LDO demand could surge due to an upcoming Ethereum improve.

- LDO bulls for the win, however short-term momentum is shedding steam.

Anybody planning to stake Ethereum [ETH] and different cryptocurrencies might be considering going the route of Lido Finance [LDO]. The latter is at present one of many largest staking platforms, and this, by extension, makes LDO fairly an attention-grabbing funding possibility.

Learn Lido Finance’s [LDO] Worth Prediction 2023-24

The demand for LDO is anticipated to surge when the market begins its subsequent bull run. An evaluation by IntoTheBlock, launched on 5 January, provided some attention-grabbing insights on what to anticipate in the course of the bear market.

Easy methods to keep sane in a bear market, LIDO evaluation from @intotheblock, tons of stories, $BTC and $ETH charts.

All without cost.https://t.co/GRi0zt2YoH

— The Wolf Of All Streets (@scottmelker) January 5, 2023

The analysis famous that Lido accounted for roughly 29% of the overall quantity of staked ETH till press time. This makes it the most important liquid staking platform for ETH.

The demand for the staking platform went up after Ethereum switched to proof of stake in 2022. The evaluation additionally famous that Ethereum’s upcoming Shanghai fork will allow the withdrawal of staked ETH.

The fork is anticipated to encourage extra folks to stake by means of Lido. A possible impression is that extra liquidity would possibly circulation into the ecosystem and set off extra demand for LDO. This information might need had a big impression on LDO’s worth motion in the previous few days.

Is LDO shedding its bullish momentum?

LDO rallied by as a lot as 55% for the reason that begin of January 2023. This spectacular feat made it one of many prime performers among the many prime cryptocurrencies. However LDO is perhaps about to expertise a bearish retracement for the subsequent few days as a result of the upside pushed into overbought territory in line with the RSI indicator.

Supply: TradingView

Not solely was LDO oversold, however it additionally briefly crossed above the 200-day transferring common at press time, which can act as a psychological take-profit zone.

This expectation is backed by on-chain observations, which can point out that there’s a rise in promote stress.

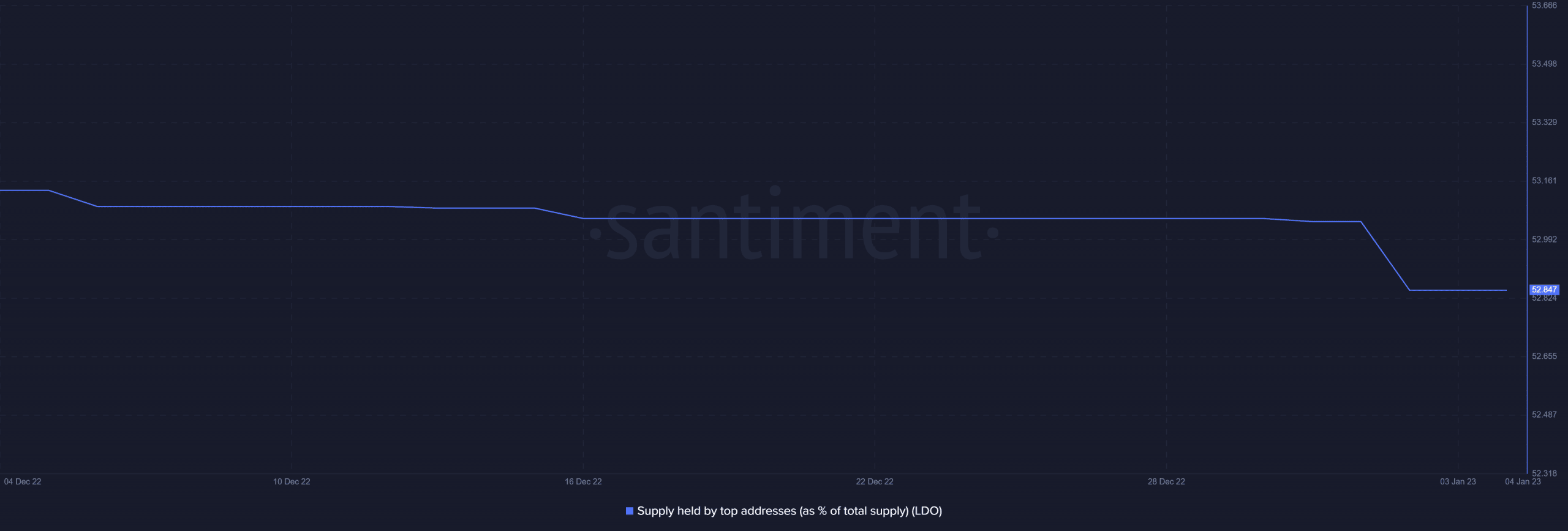

A very good instance of these observations is the drop within the provide held by prime addresses. It means that whales are promoting, an anticipated consequence, particularly after the sizable earnings achieved within the final 5 days.

Supply: Santiment

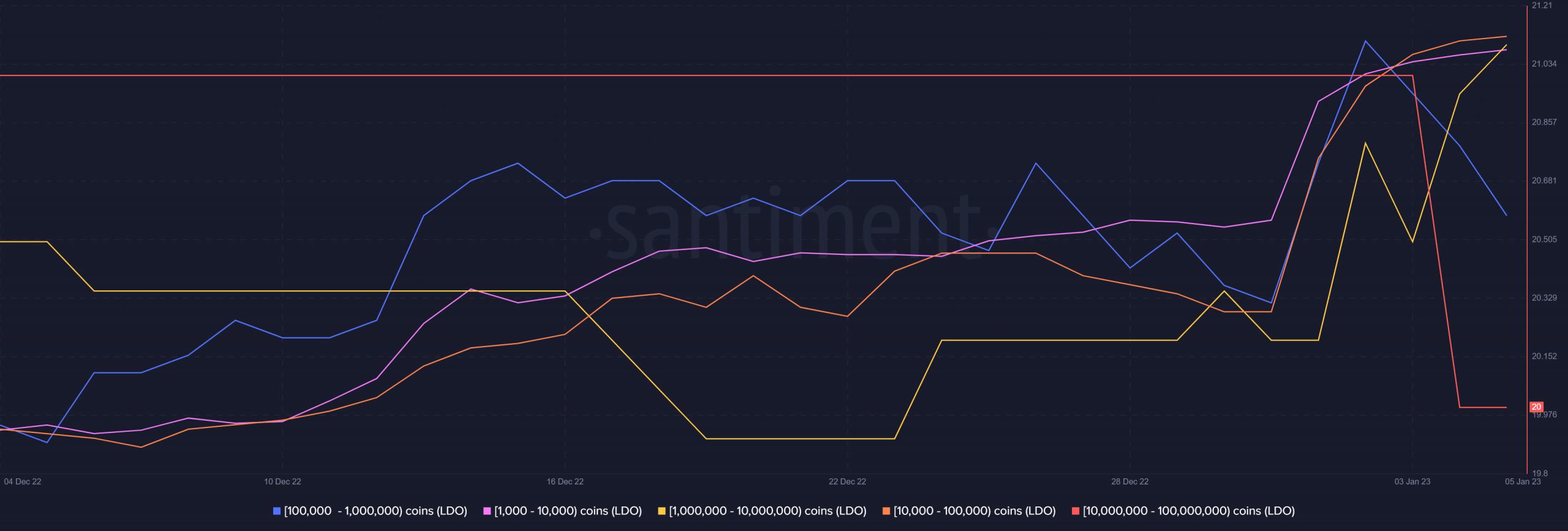

An analysis of LDO’s provide distribution revealed a greater image of the place precisely this promote stress was coming from.

Addresses holding over 10 million LDO tokens registered a pointy drop within the final three days. The identical commentary was made with addresses holding between 100,000 – a million tokens.

Supply: Santiment

A 286.65x hike on the playing cards if LDO hits Bitcoin’s market cap?

Some tackle classes participated in bullish quantity. This included these holding between 1,000 – 100,000 LDO, in addition to these within the a million – 10 million tokens bracket. Additionally, the most recent alternate circulation knowledge from Glassnode indicated a shift in favor of the bears.

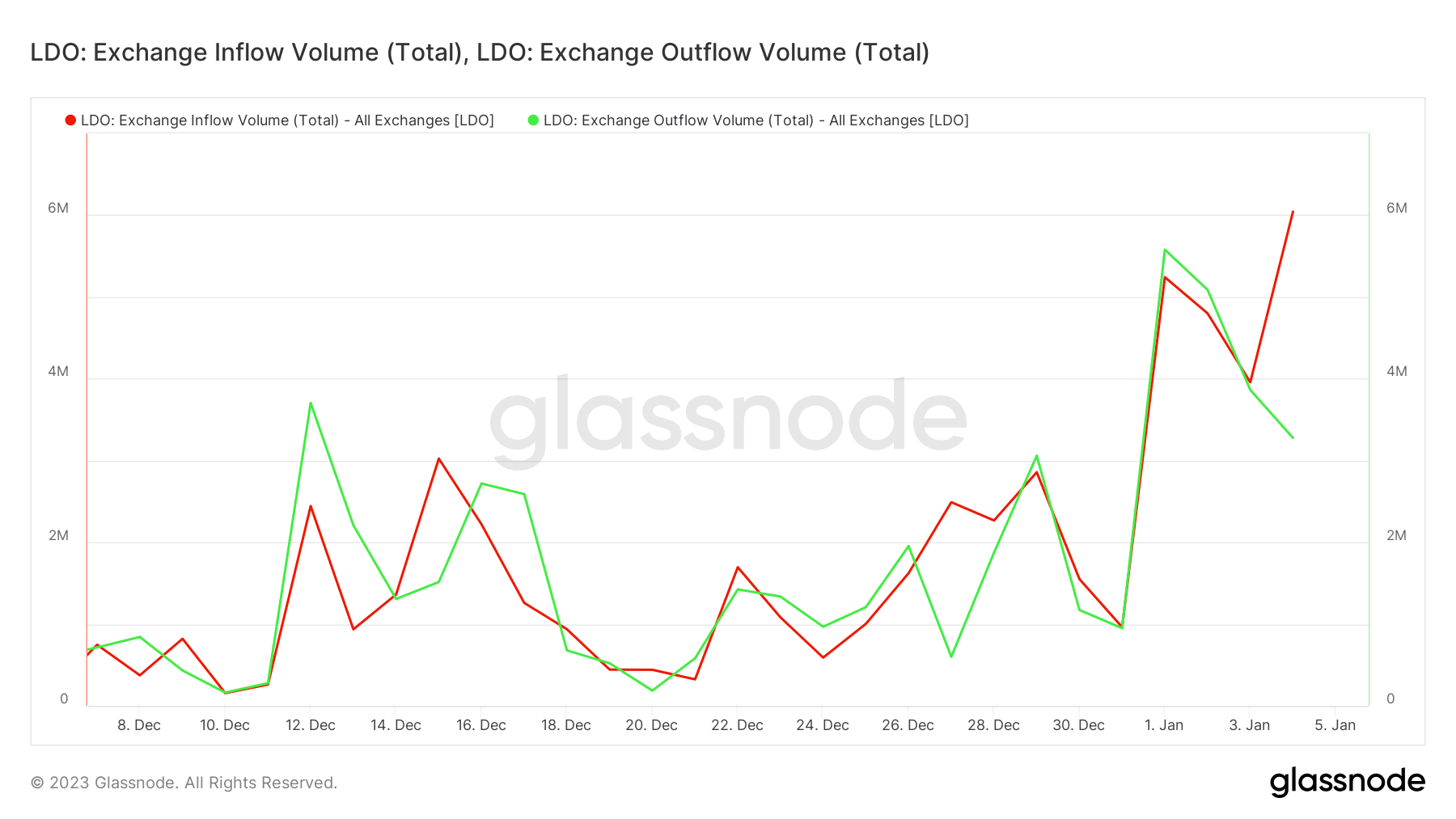

Supply: Glassnode

Exchanges are actually experiencing nearly double the variety of inflows than outflows. This was an indication that promoting stress was taking on after the most recent rally.