- Bitcoin’s low volatility managed to draw each retail and huge buyers which were capitalizing on the chance to purchase into the cryptocurrency

- Miner promoting stress reduces as revenues proceed to develop

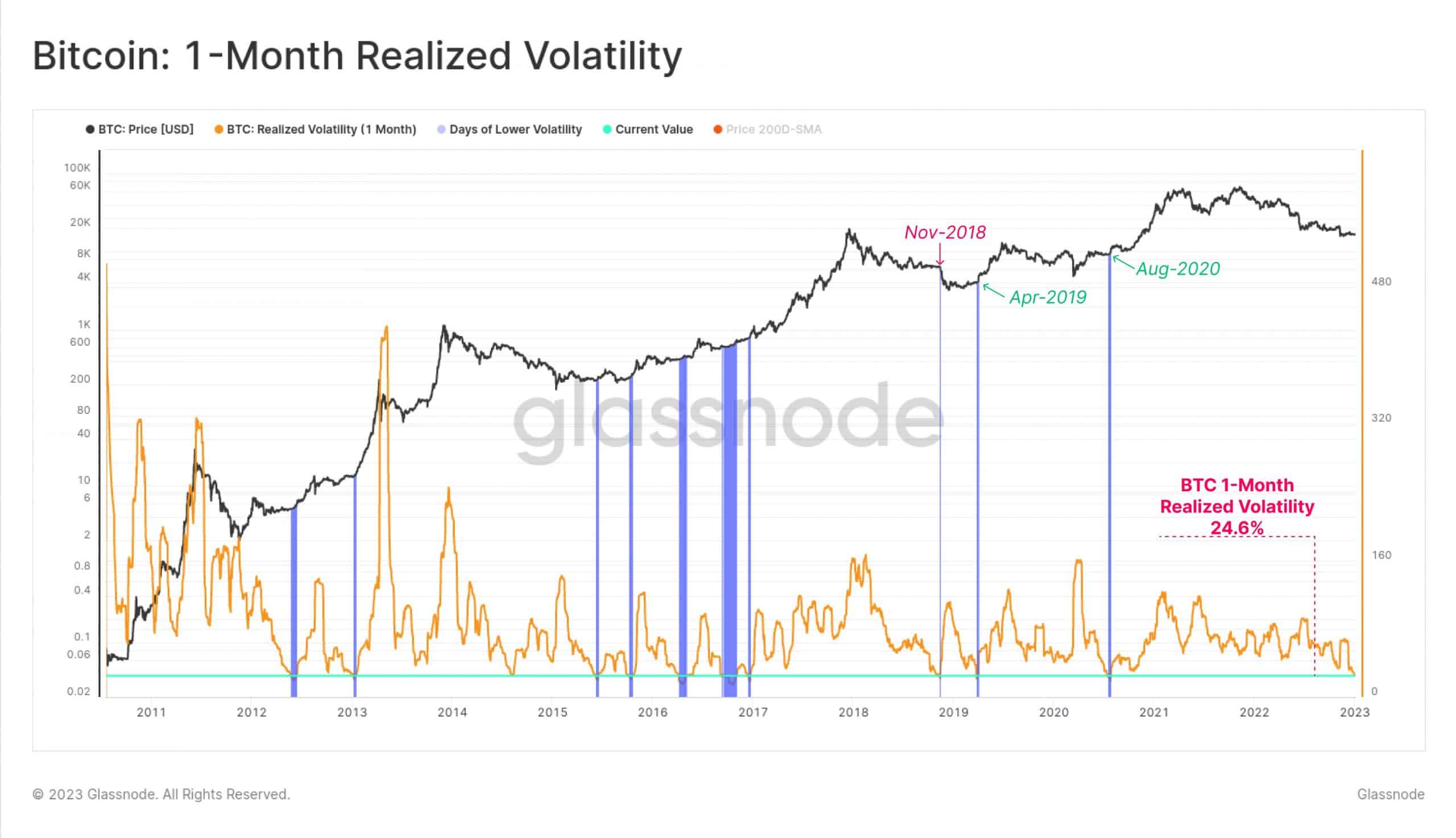

Current knowledge from Glassnode, urged that Bitcoin’s [BTC] volatility declined considerably during the last month. This low volatility attracted each retail and huge buyers which were capitalizing on the chance to purchase into the cryptocurrency.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

One of many causes for a similar may very well be that on earlier events when Bitcoin skilled low volatility, resembling in April 2019, and August 2020, BTC rallied within the brief time period and witnessed a surge in its worth.

Supply: Glassnode

Whales and retail buyers be part of fingers

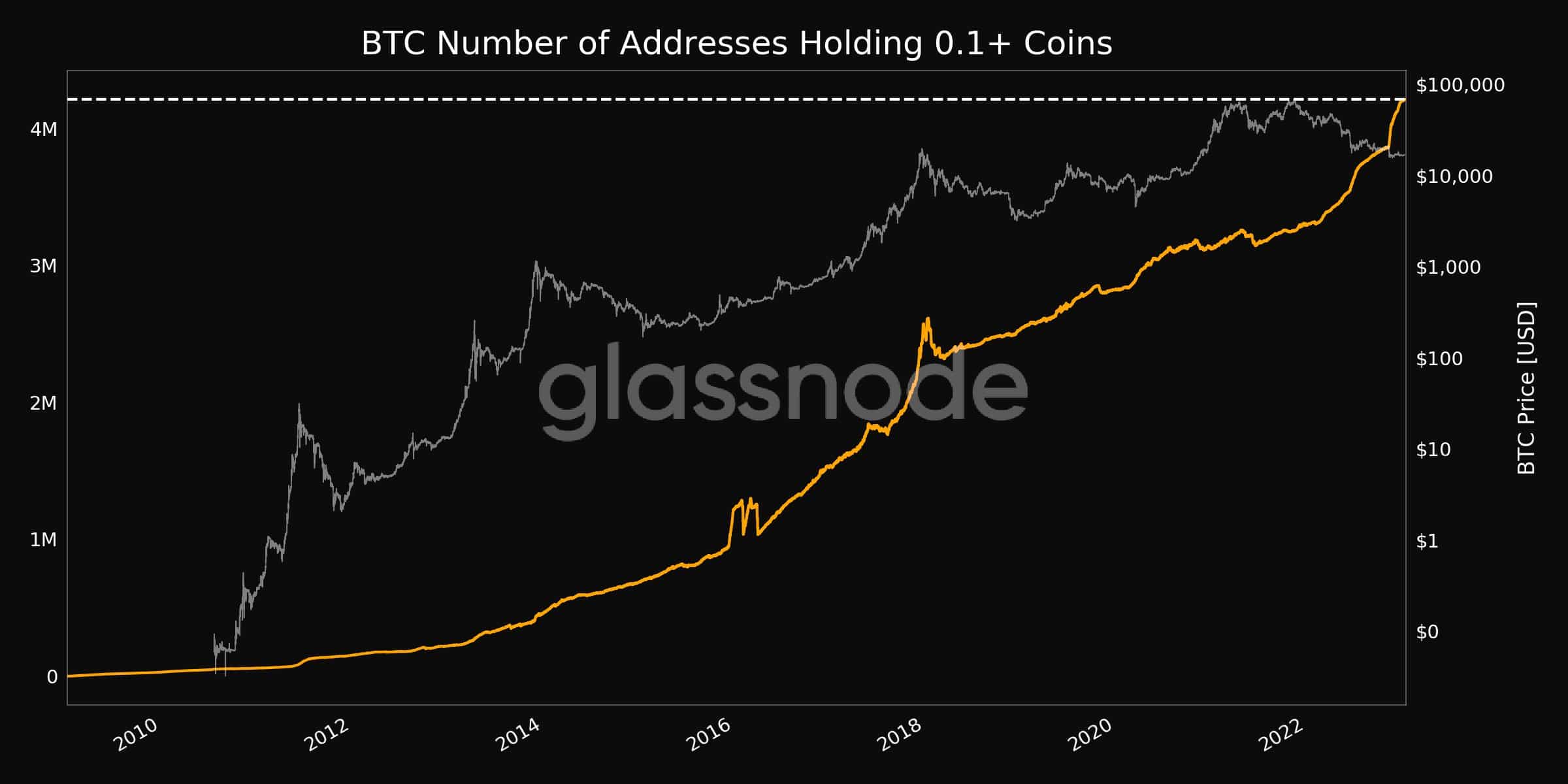

The curiosity from massive and retail buyers was indicated by the info supplied by Glassnode. As an illustration, the variety of addresses holding 0.1 or extra cash had been seen to achieve an all-time excessive of 4,212,110. Moreover, the variety of addresses holding 10 or extra cash reached a two-year excessive of 155,417.

Though curiosity from each massive addresses and retail buyers could also be helpful for BTC within the brief time period, a big focus of Bitcoin being held by BTC whales might make retail buyers susceptible to sudden worth actions. These actions may very well be a direct end result of whale conduct.

Supply: glassnode

The mining angle

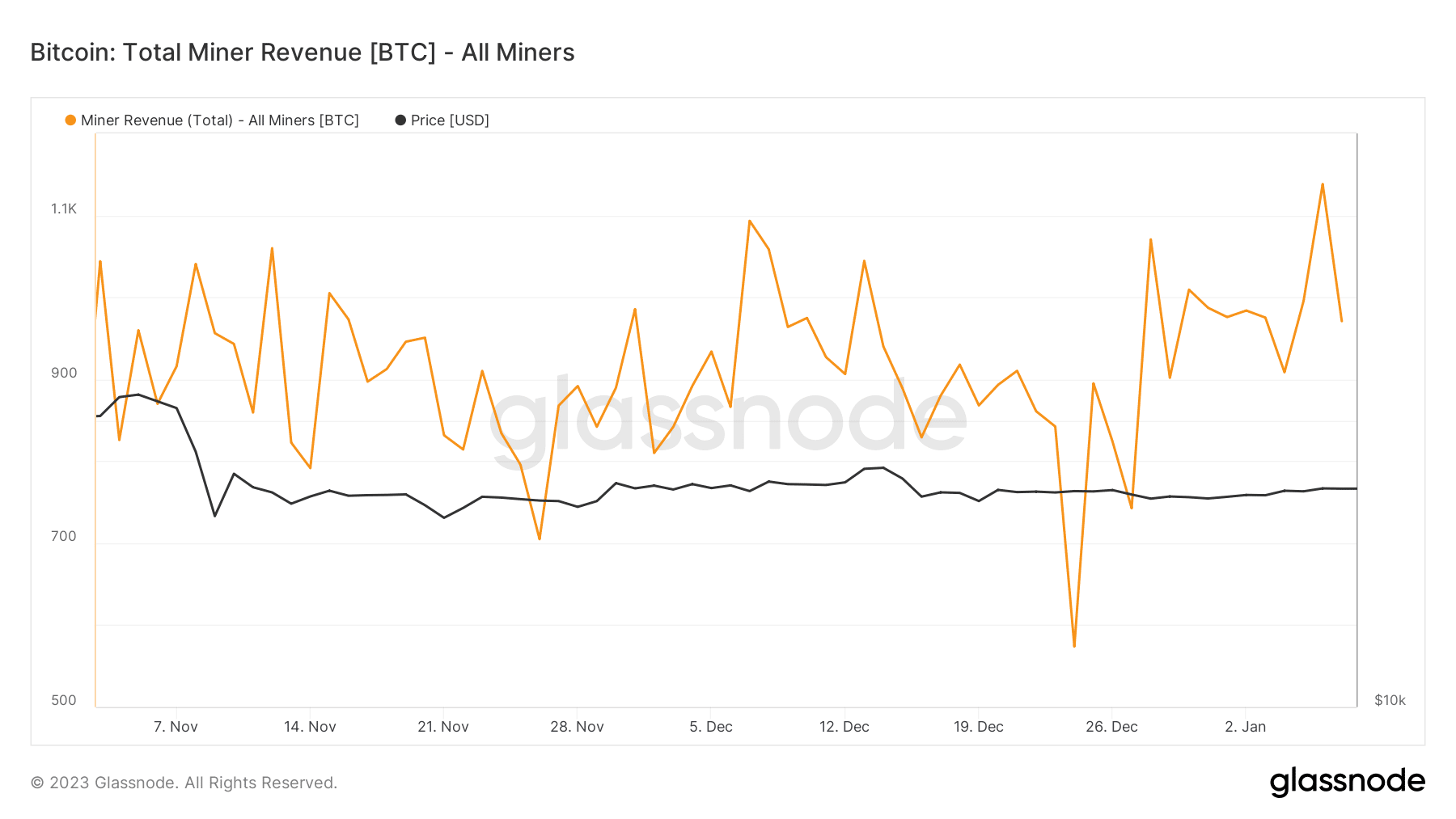

Miner curiosity might additionally improve together with retail curiosity. This was as a result of miner income was on the rise. Based on knowledge supplied by Glassnode, the whole miner income for Bitcoin elevated from 573 BTC to 978 BTC over the previous couple of weeks. A rising miner income might cut back the promoting stress on Bitcoin miners.

Supply: glassnode

Moreover, the mining hashrate, which measures the processing energy of the Bitcoin community, additionally elevated by 0.87% over the previous month. A excessive hahsrate means that the BTC community continues to be very safe.

One other optimistic for the mining business can be Hut8 Mining Corp’s latest announcement. Which acknowledged that it mined 3,568 Bitcoin in 2022, rising its reserves by 65% in 2022 to 9,086 BTC. Hut8 acknowledged that it plans to remain true to its HODL technique, and deposited 100% of the self-mined Bitcoin into custody in December.

Are your BTC holdings flashing inexperienced? Examine the revenue calculator

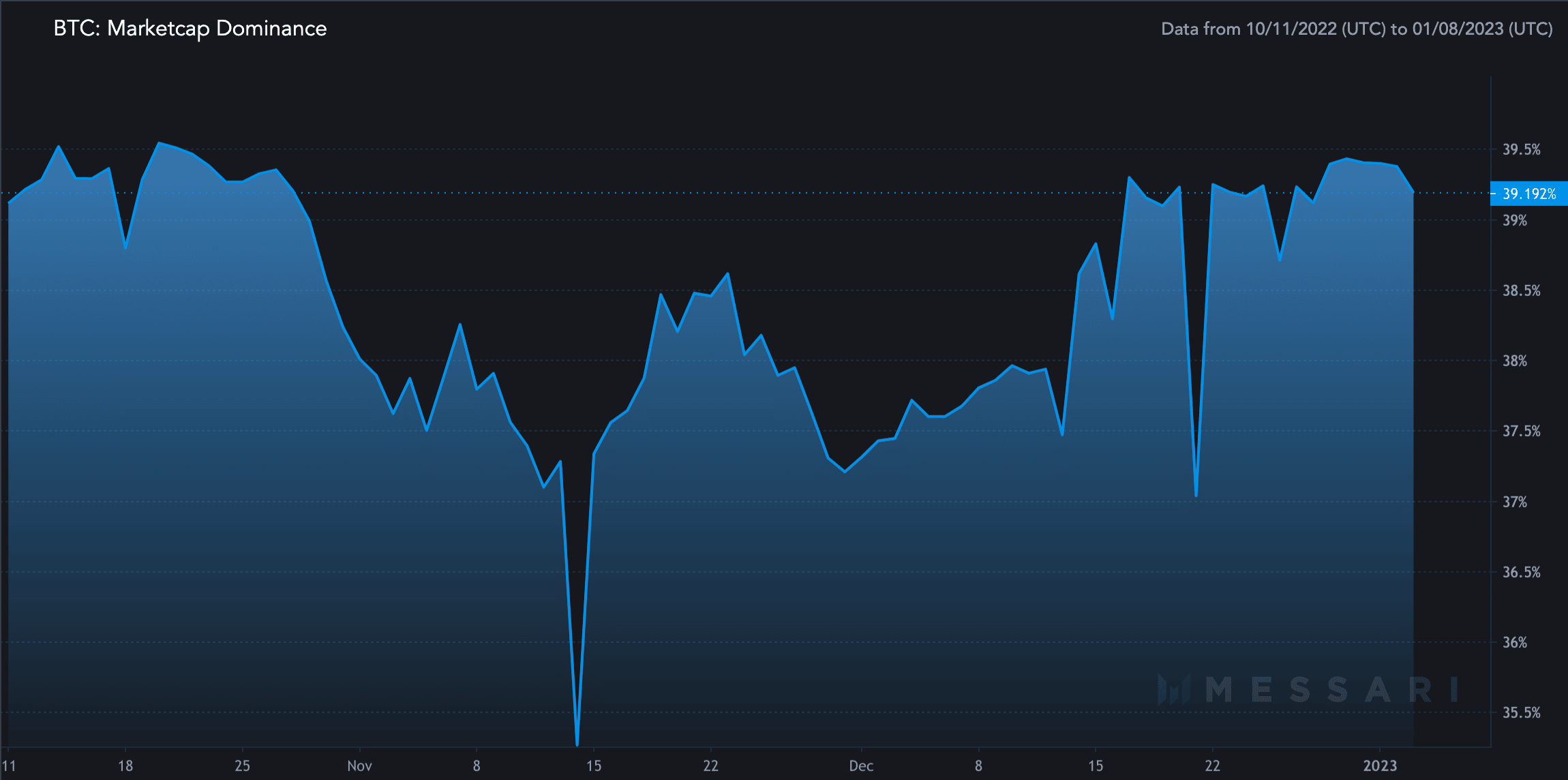

By way of market efficiency, Bitcoin’s market cap dominance grew during the last three months. At press time BTC’s market cap dominance was 39.192% in response to Messari.

Supply: Messari

Total, the decline in Bitcoin’s volatility may very well be a optimistic signal for the cryptocurrency going ahead. Moreover, a rising curiosity from each retail and huge buyers, in addition to the rising miner income, may very well be indicators of an optimistic future for BTC.