Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- The market construction flipped bullish for Ethereum final week

- The transfer above $1235 noticed the vary highs examined, however anticipating a breakout could possibly be harmful

Ethereum has famous positive factors of 15.5% prior to now three weeks. The protection of the $1160-$1180 area earlier than Christmas was adopted by a gradual however regular ascent for the altcoin big. On the time of writing, each Ethereum and Bitcoin traded near important resistance ranges.

Learn Ethereum’s Value Prediction 2023-24

Ethereum bulls face stern opposition at $1360, and Bitcoin additionally had a mountain to climb at $17.6k. A profitable conquest may imply the remainder of January could possibly be bullish as properly.

Ethereum reaches a month-long vary excessive and a breakout was not but in sight

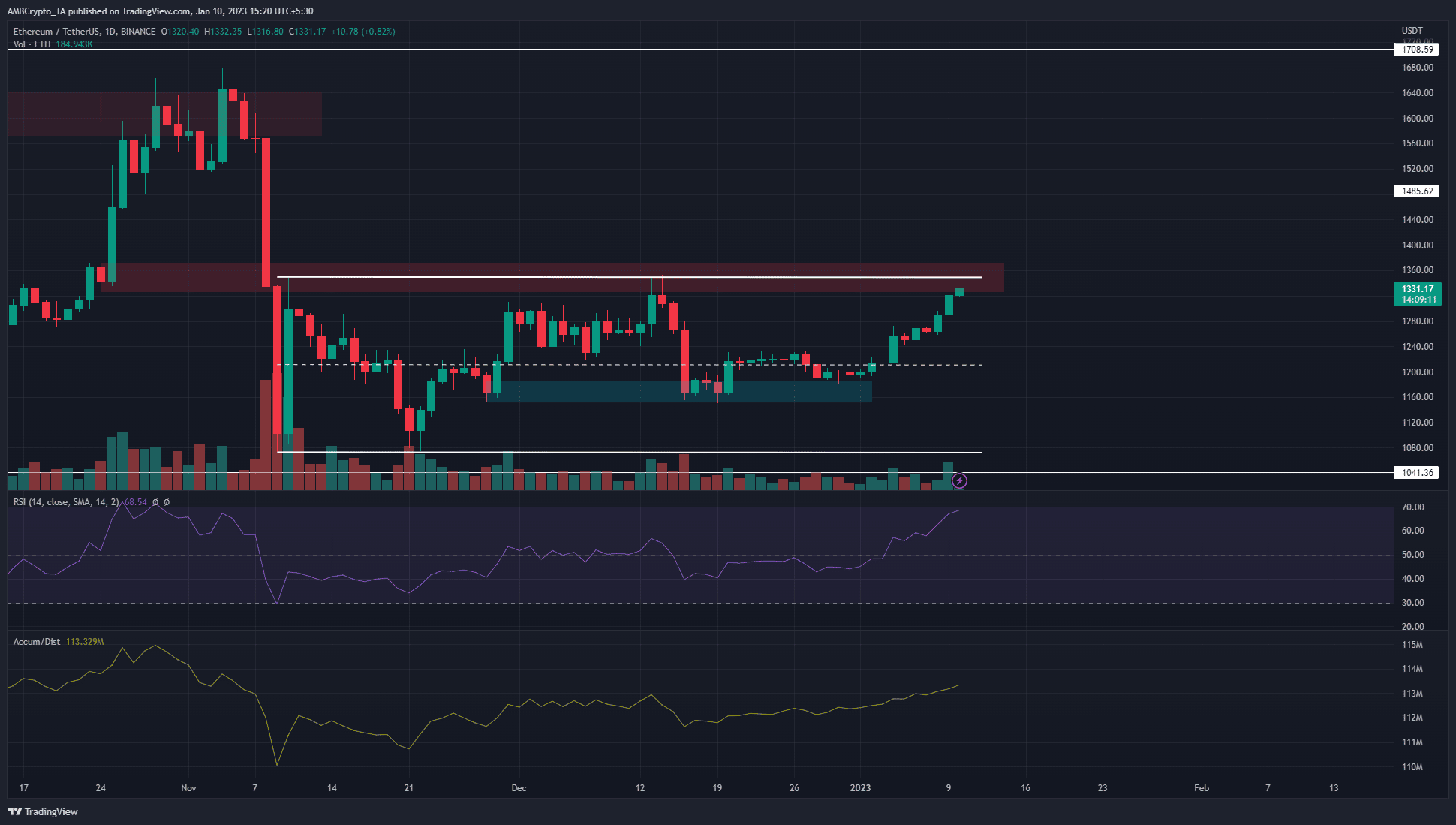

Supply: ETH/USDT on TradingView

Since November, Ethereum has traded inside a variety from $1350 and $1072. At press time, the value was making positive factors towards the vary excessive. Not solely has it served as resistance over the previous month however it was additionally the realm the place a bearish breaker from late October lies. This breaker, if breached and retested, can be a powerful signal of bullish intent from the consumers.

Are your holdings flashing inexperienced? Examine the ETH Revenue Calculator

But, till that state of affairs materializes, merchants can look to commerce throughout the vary itself. As a rule, a better timeframe vary is revered. Breakout merchants can look ahead to a real breakout. The RSI was at 68 to indicate heavy bullish momentum. The upward-sloping A/D line additionally concurred that real demand fueled the ETH rally.

A each day session shut above $1370 can be the primary signal that fairly than a reversal, merchants can count on a transfer increased to $1485.

MVRV ratio confirmed holders at a revenue whereas the funding charge remained constructive

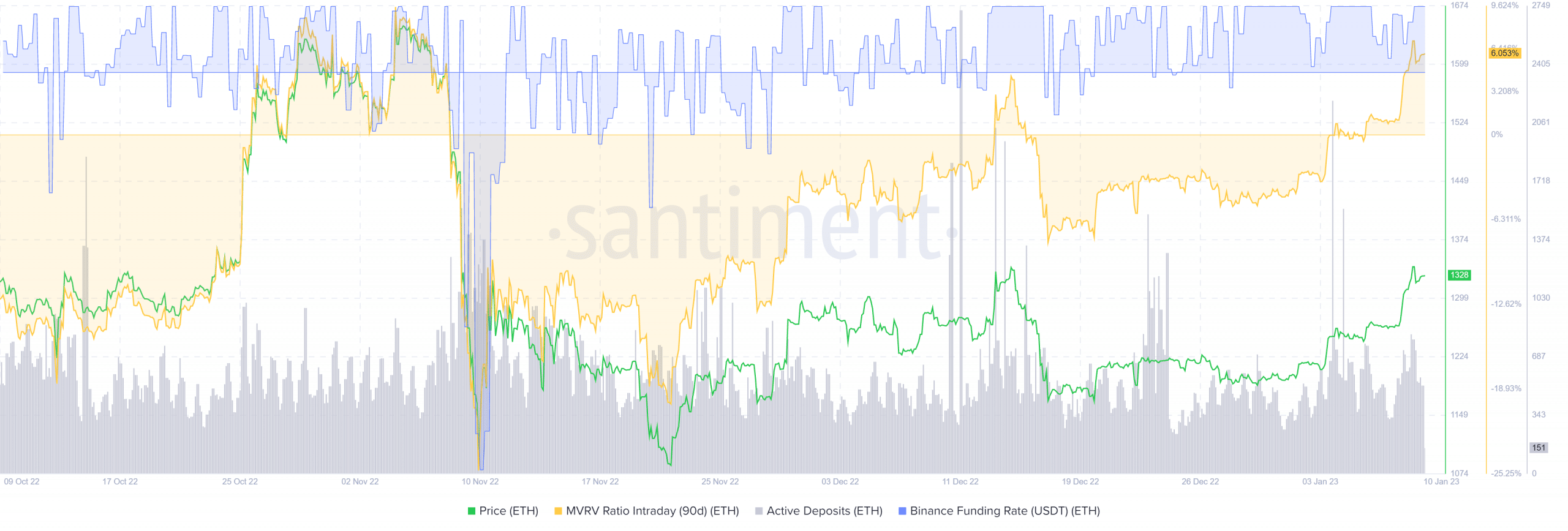

Supply: Santiment

The constructive funding charge meant lengthy positions paid the quick positions and total signaled bullish sentiment. The energetic deposits metric noticed some increased highs prior to now ten days, however the spikes it noticed final week weren’t adopted by a big wave of promoting.

Now that ETH was at a excessive timeframe space of curiosity, a spike on this metric may give bears some hope. The MVRV ratio (90-day) climbed to ranges it had beforehand reached in late October. Might this be adopted by a big wave of promoting?