- TRON’s TVL declined, however lively addresses and income elevated.

- The community witnessed optimistic dealer sentiment alongside USDD’s decline in pool stability and switch quantity.

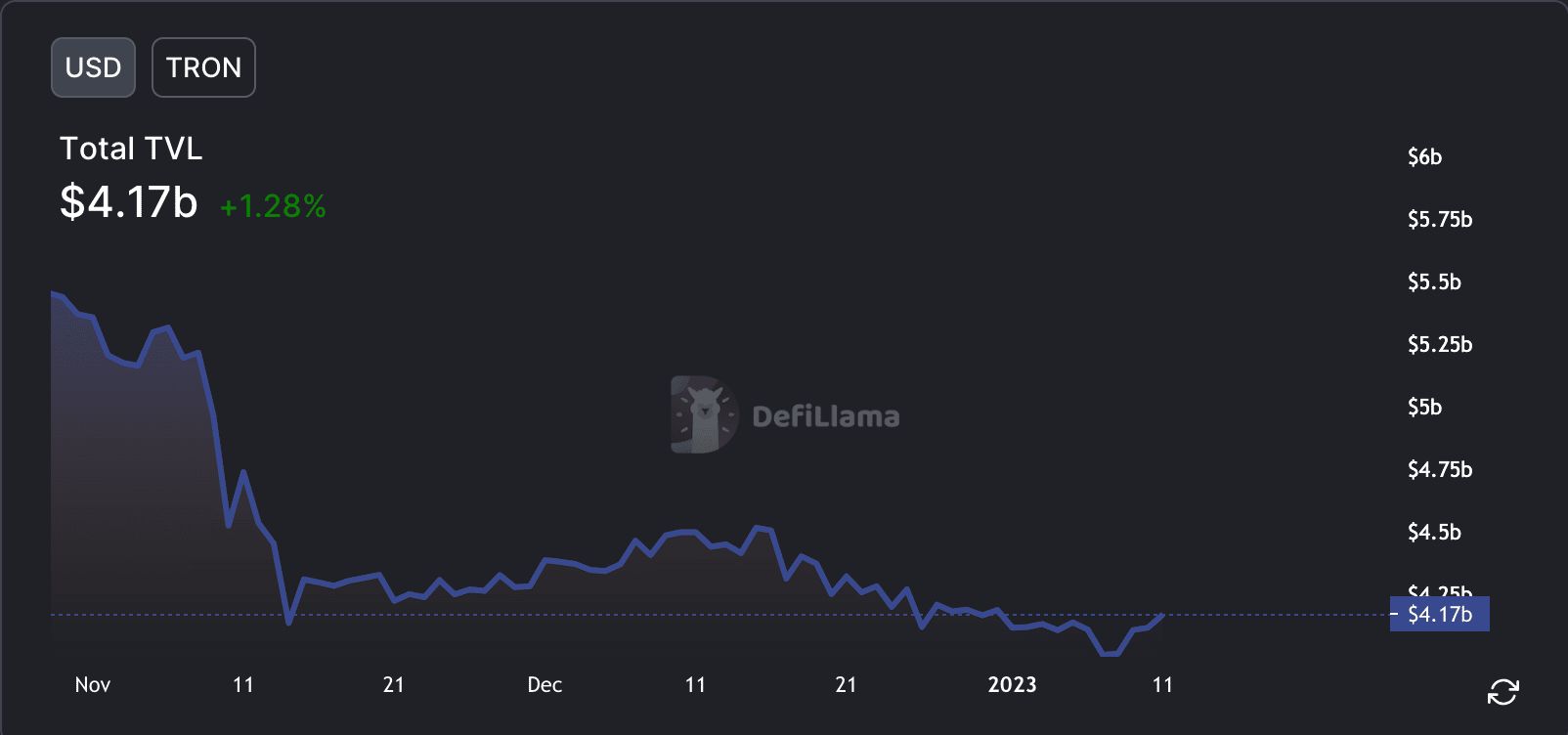

On 10 January, TRON [TRX] tweeted that it ranked quantity 2 when it comes to whole worth locked (TVL) within the cryptocurrency market. Nevertheless, regardless of this accomplishment, information confirmed that the TVL on TRON declined materially over the previous few months.

This raised a query on whether or not TRON would keep its rank within the cryptocurrency market and bounce again from the decline.

Supply: Defi Llama

Are your TRX holdings flashing inexperienced? Test the TRON revenue calculator

The TRON – dApp angle

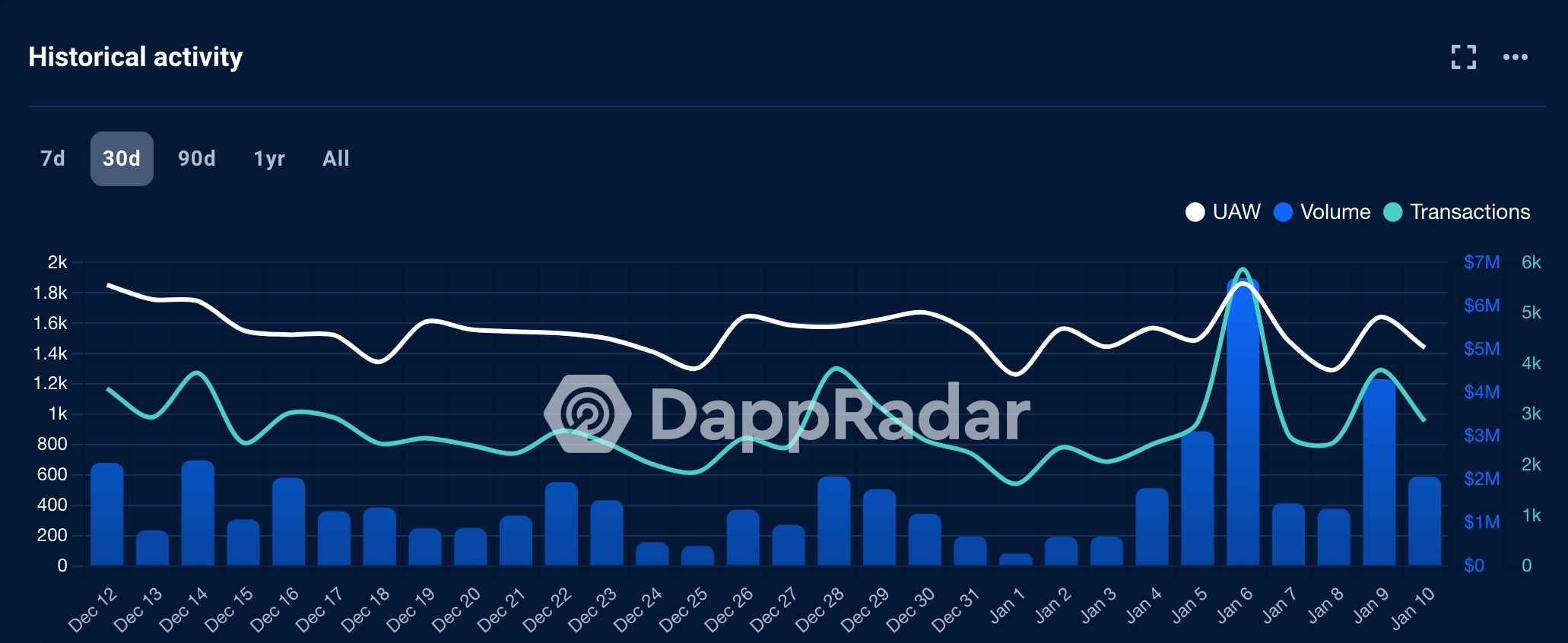

One potential motive for TRON‘s declining TVL might be a lower within the platform’s dApp exercise. In response to DappRadar, in style dApps equivalent to SunSwap, JustLend, and Transit Swap noticed a decline in distinctive lively wallets.

For instance, SunSwap’s distinctive lively wallets decreased by 13.61%, whereas JustLend and Transit Swap noticed declines of 14.93% and eight.93%, respectively.

SunSwap’s quantity fell by 37.9% throughout this era as effectively. Thus, the decline within the variety of lively customers might be an indication that patrons have been shedding curiosity in these dApps. Due to this fact, lessening the general worth locked on the platform.

Supply: Dapp Radar

Regardless of the declining TVL, information from TronScan confirmed that the income collected by TRON truly elevated from $509,937 to $637,520 during the last month. This might be due to the rise within the variety of lively addresses on the community, which was an indication of an rising variety of customers. In response to information supplied by Messari, the variety of lively addresses elevated by 4.47% during the last week.

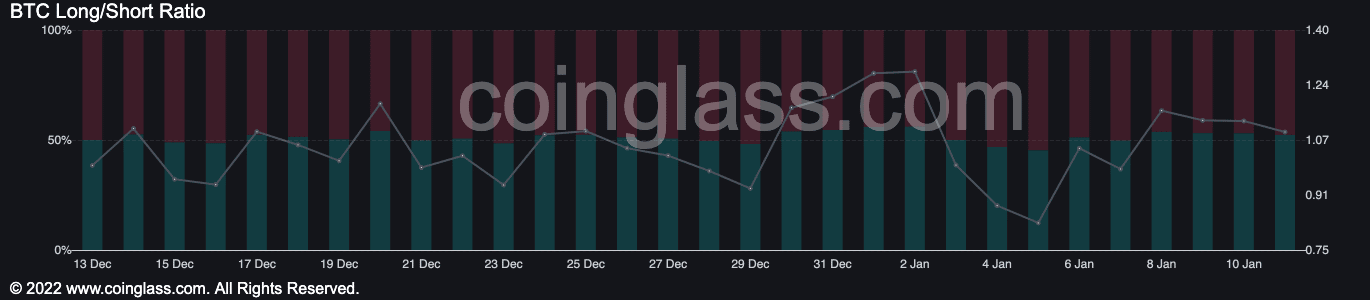

This might be one motive why the sentiment of merchants for TRON was optimistic. 52.3% of all positions on TRON have been lengthy, based mostly on info supplied by Coinglass. Thus, merchants believed that TRON’s value had the potential to rise sooner or later.

Supply: coinglass

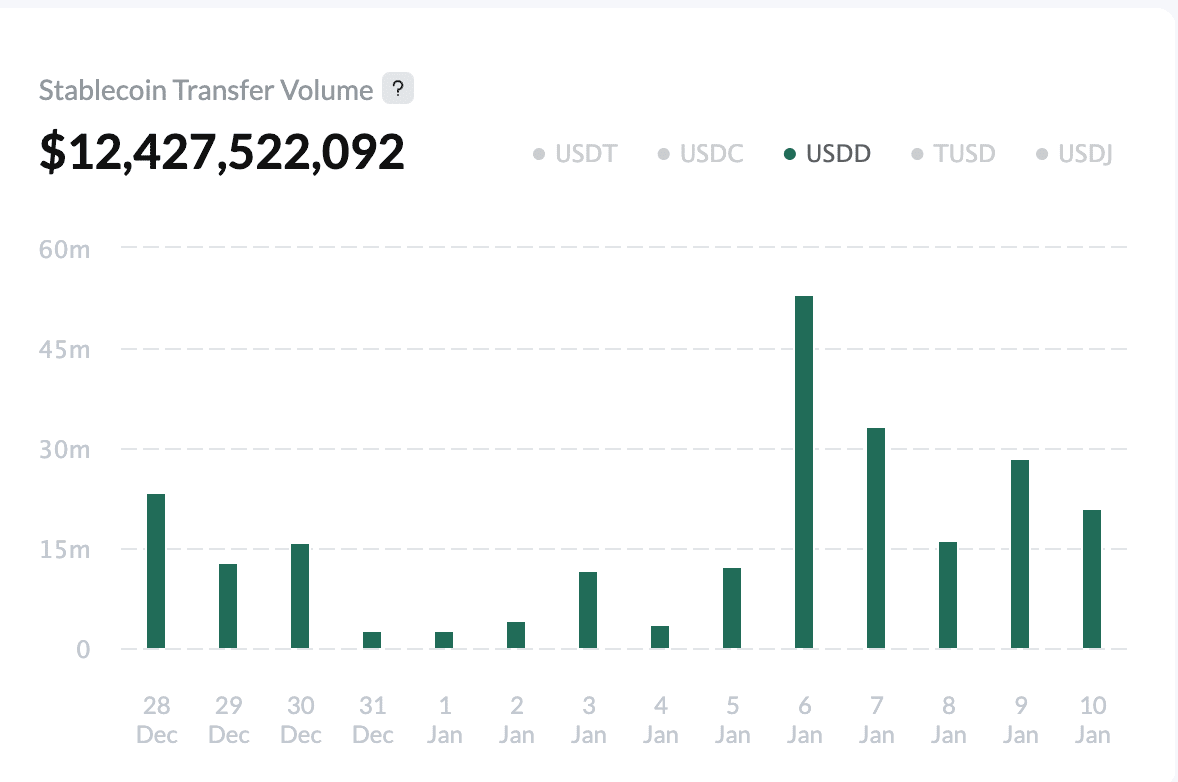

One other necessary side of TRON was USDD, the ecosystem’s stablecoin. In response to information supplied by TronScan, USDD’s switch quantity decreased. The decline in utilization of the USDD stablecoin may there be an indication that fewer merchants are utilizing USDD to commerce on decentralized exchanges.

Supply: TronScan

Whereas the declining TVL and dApp exercise might be a priority for TRON, the rising income and optimistic dealer sentiment could counsel that the platform was nonetheless experiencing total development at press time.