On-chain knowledge reveals Bitcoin miners may very well be dumping proper now, an indication that would present an impedance to the rally.

Bitcoin Miners’ Place Index Has Shot Up Not too long ago

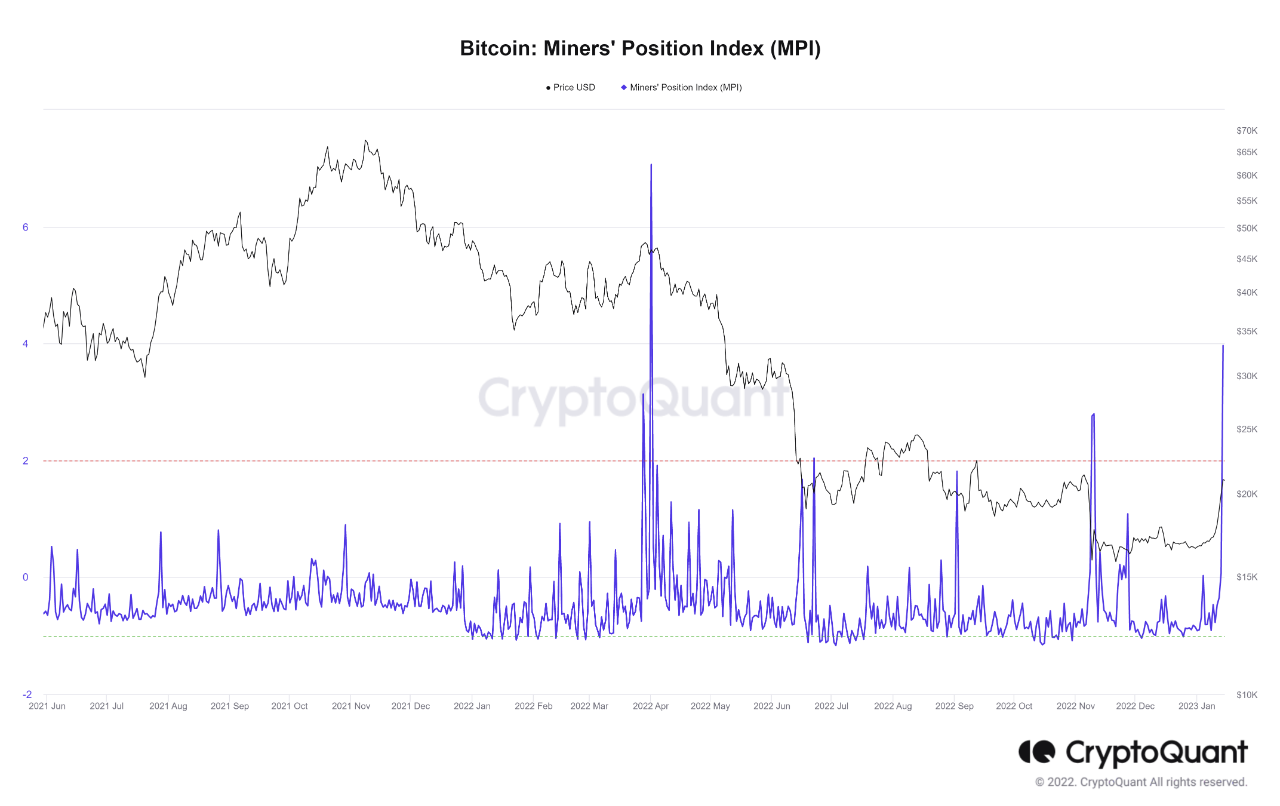

As identified by an analyst in a CryptoQuant post, miners could also be placing promoting strain available on the market at present. The related indicator right here is the “Miners’ Place Index” (MPI), which measures the ratio between the miner outflows and the 365-day transferring common of the identical.

The “miner outflows” seek advice from the full quantity of Bitcoin that every one these chain validators are transferring out of their wallets in the intervening time. Often, miners withdraw cash from their reserves with the principle objective of promoting them. Thus, a excessive worth of the outflows can recommend that this cohort is dumping giant quantities proper now.

Because the MPI compares these outflows with their yearly common, the metric’s worth can inform us how the present miner promoting is in contrast with the imply for the final twelve months.

When this indicator has a excessive worth, it means miners are promoting at a better diploma than regular at present, whereas the metric having a low worth may recommend there may be lesser promoting strain coming from these chain validators than the typical for the previous 12 months.

Now, here’s a chart that reveals the pattern within the Bitcoin MPI over the previous 12 months and a half:

The worth of the metric appears to have been fairly excessive in latest days | Supply: CryptoQuant

As proven within the above graph, the Bitcoin MPI has spiked up not too long ago and has hit a worth of about 4, the best stage that the indicator has noticed since April of final 12 months. The metric having such a big worth would recommend miners are taking out far more cash than regular, and are subsequently doubtlessly placing extraordinary promoting strain available on the market at present.

From the chart, it’s obvious that spikes within the metric have often been adopted by declines within the value of the crypto. Essentially the most excessive instance was again in April 2022, when the worth noticed a really sharp drawdown not too lengthy after the metric recorded even increased values than now.

The final time the indicator noticed excessive values had been again throughout the collapse of the crypto alternate FTX when the worth as soon as once more noticed a fast downward transfer.

Bitcoin has been busy rallying throughout the previous week or so, touching as excessive as $21,000 to this point, so these elevated withdrawals proper now would recommend miners need to make the most of this profit-taking alternative whereas they nonetheless can, and dump their cash.

If this cohort certainly intends to promote with these transfers, then the crypto’s rally may probably discover some impedance and briefly halt right here, if not outright reverse its path.

BTC Value

On the time of writing, Bitcoin is buying and selling round $20,800, up 20% within the final week.

The worth of the asset appears to be discovering it onerous to make a big break above $21,000 | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com