- FTX’s again door to Alameda gave the analysis arm entry to borrow billions of shoppers fund with out collateral

- The recovered funds are lower than the belongings that had been speculated to be on each FTX.com and FTX US

FTX Debtors launched a brand new replace on the latest developments within the chapter proceedings. The replace was relating to a gathering with the advisors and members of the Official Committee of Unsecured Collectors (OCC). In the course of the assembly, FTX Debtors revealed that the composition of the belongings recovered.

In a presentation to OCC, the Debtors said that it recovered $5.5 billion in liquid belongings consisting of $1.7 billion in money. As well as, $3.5 billion in cryptocurrencies and $0.3 billion in securities made up the remainder of the belongings. Nevertheless, regardless of the big restoration, FTX Debtors said that each FTX and FTX US nonetheless fall in need of cash. A press launch on the identical read,

“The FTX Debtors additionally confirmed that, based mostly on present estimates of the quantity of digital belongings related to the FTX.com and FTX US exchanges as of the Petition Date, there’s a substantial shortfall of digital belongings at each exchanges.”

Recognized belongings

Moreover, the presentation confirmed that the highest tokens held by FTX, FTX.US, and Alameda had been Solana (SOL), FTT, Bitcoin (BTC), Ethereum (ETH), Aptos (APT), Dogecoin (DOGE), Matic, XRP, and others. In the meantime, the tokens within the illiquid crypto belongings checklist included Serum (SRM), SOLETH, MAPS, SOLBTC, Oxygen (OXY), MEDIA, and BEAR.

Furthermore, the Debtors recognized 36 properties of the change within the Bahamas. The worth of those properties was estimated at $253 million on a price foundation.

Alameda’s billion-dollar again door

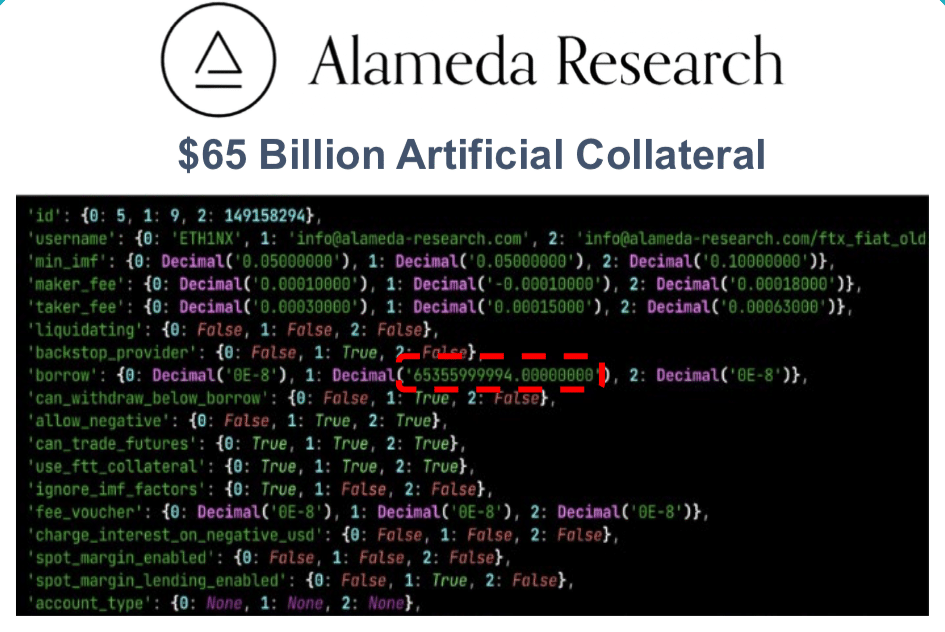

Notably, the presentation confirmed that the change had allowed Alameda to borrow as much as $65 billion of shoppers’ funds with out collateral. Along with this, “sure people may withdraw belongings with out file on the change ledger”

FTX backend code for Alameda | Supply: FTX Debtors

A receipt of FTX belongings

The Debtors said that FTX.com has almost $1.6 billion in cryptocurrencies. Out of this, the unauthorized third-party switch stood at $323 million, and the crypto within the fingers of The Securities Fee of The Bahamas was at $426 million. That is opposite to the billions of {dollars} of claims made by the fee just a few weeks again.

As well as, there’s $742 million of crypto within the fingers of the Debtors, which is at the moment in chilly storage, and the pending switch to the chilly storage is valued at almost $121 million. The press launch said,

“The belongings recognized as of the Petition Date are considerably lower than the mixture third-party buyer balances steered by the digital ledger for FTX.com.”

Belongings held by FTX US

Subsequently, the Debtors said that it has discovered almost $181 million of crypto that belongs to American customers. Out of this, the unauthorized third-party transfers stood at $90 million, crypto in chilly storage was valued at $88 million and crypto that was not in chilly storage was valued at $3 million. This stability too was lesser than the “combination third-party buyer balances”.