A number one analytics agency says that the one key metric signifies Bitcoin (BTC) has fashioned a backside, setting the stage for a rally.

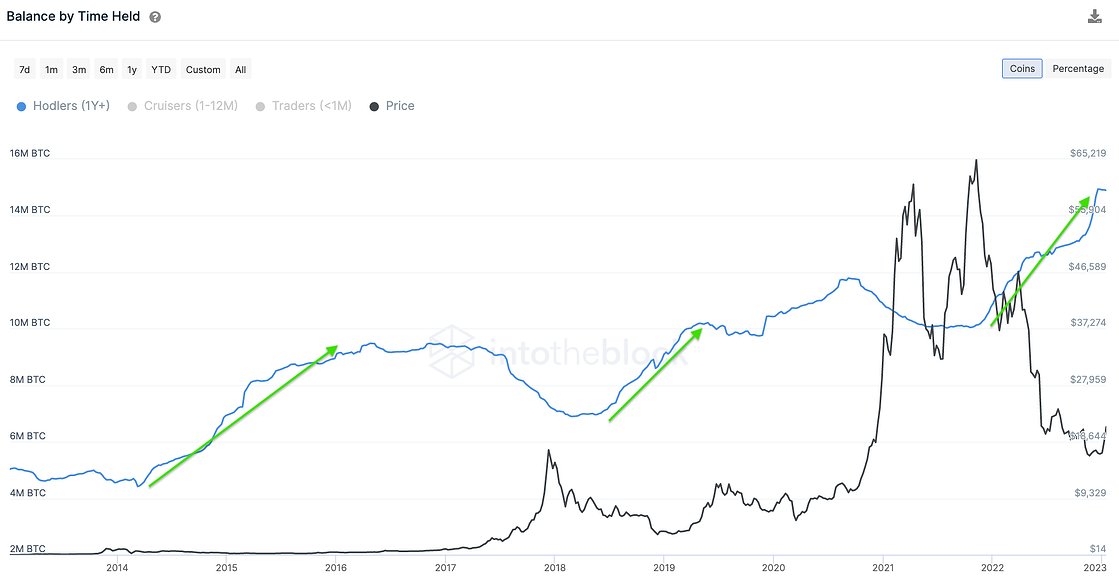

In accordance with blockchain analytics agency IntoTheBlock, a big increase within the variety of addresses holding the king crypto for greater than a 12 months has occurred throughout earlier backside formations previous to a giant surge.

IntotheBlock says the same enormous enhance in long-term Bitcoin holders occurred in 2022.

“Some metrics counsel the underside could also be in. In 2022 we noticed the quantity of Bitcoin owned by addresses holding for over one-year enhance by 50% from 10 million BTC to fifteen million BTC.

This similar sample has been noticed in earlier bear markets.”

One other crypto analytics agency, Glassnode, additionally suggests Bitcoin has fashioned a backside primarily based on a number of key indicators.

Per Glassnode, a rise in demand might point out Bitcoin’s latest 30% surge is sustainable.

“A sustainable market restoration is normally accompanied by a progress in community on-chain exercise.”

The agency says robust progress is signaled when the 30-day easy transferring common (SMA) of latest handle crosses above the 365-day SMA for not less than 60 days.

“An preliminary burst of constructive momentum occurred in early November 2022. Nevertheless, this has been sustained for just one month thus far.”

One other indicator is a big enhance in miner income from charges, which the agency says is happening.

“When the 90D-SMA of Miner Payment Income crosses above the 365D-SMA, it indicators a constructive uptick in blockspace congestion and payment strain is underway.”

Glassnode additionally says the formation of a “sturdy basis” is signaling a backside formation for Bitcoin.

“An early indication of a macro pattern reversal coming off such a basis tends to be a pointy surge within the P.c of Whole Provide in Revenue…

When the p.c of provide in revenue breaks above that of LTHs (long-term holders), it usually signifies a large-scale provide redistribution has occurred over latest months.”

Lastly, Glassnode says that Bitcoin seems to be “hitting all-time low,” outlined as the purpose when “vendor exhaustion could also be reached, and the place value declines are having a diminishing impact on motivating further sell-side exercise.”

“Durations the place the correlation between value, and the p.c of provide in revenue deviates beneath 0.75 signifies {that a} saturation of the holder base, by comparatively value insensitive holders, has taken place.”

At time of writing, Bitcoin is altering fingers for $21,361.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney

Featured Picture: Shutterstock/Natalia Siiatovskaia