- Genesis’ chapter submitting revived issues of a possible Bitcoin selloff.

- Nonetheless, bulls charged by the FUD and handed the $22,000 value degree.

Genesis reportedly filed for Chapter 11 chapter after failing to safe sufficient funds to cowl its debt. The corporate, which was one of many largest institutional lenders at one level, has the potential to unwind all of the beneficial properties achieved by Bitcoin [BTC] in January 2023.

How a lot are 1,10,100 BTCs price as we speak?

Genesis was indebted to a number of lenders till press time, together with bankrupt trade Gemini. Reportedly, Genesis entered into swap agreements by which it supplied GBTC shares to 3AC. The latter is similar crypto agency that collapsed in 2022, resulting in losses which have pushed Genesis to its present place.

Genesis Buying and selling filed for chapter 11 chapter this morning, in keeping with studies from @CoinDesk.

All Genesis Buying and selling wallets seem to have halted on-chain operations as of 11 hours in the past.

Genesis wallets nonetheless maintain $280M+ price of crypto, with $220M+ being pure $ETH. https://t.co/wFQsADLUxd pic.twitter.com/Jjdvm3oJy4

— Arkham (@ArkhamIntel) January 20, 2023

Genesis’ reference to Bitcoin

Sadly, the 3AC and FTX collapse pushed Genesis into insolvency, which means that it couldn’t repay its borrowed funds. Thus, Genesis could also be pressured to liquidate the crypto property in its wallets in an effort to repay its collectors. This plan of action could probably set off one other large sale of BTC.

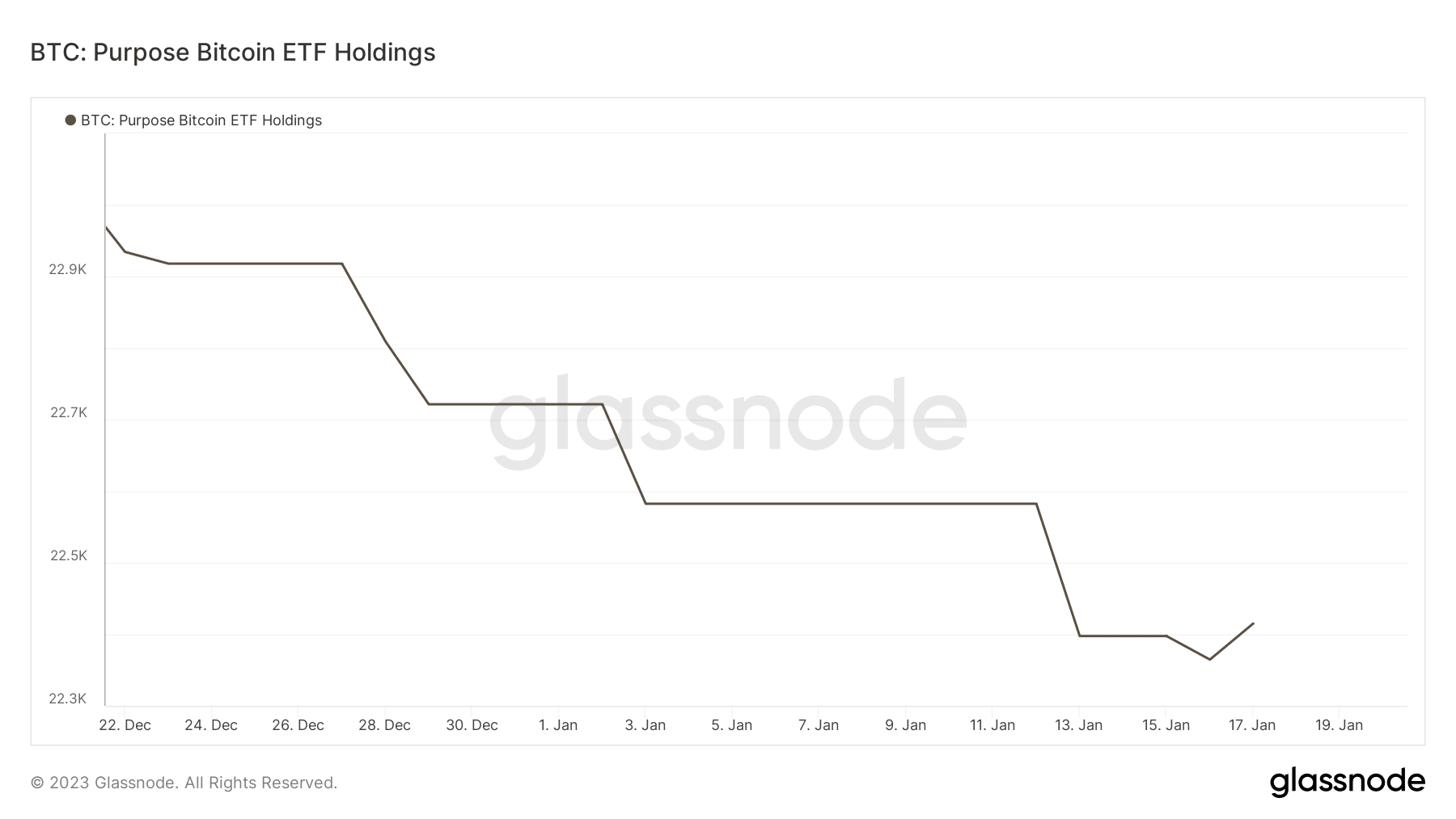

This threat highlighted above is perhaps the explanation why BTC had not seen sturdy institutional demand till press time. This was the case particularly with the Function Bitcoin ETF, which continued to drop regardless of the restoration it witnessed in January.

Supply: Glassnode

Nonetheless, it seemed like the identical metric had began to pivot on the time of writing, suggesting a optimistic shift in Bitcoin’s favor regardless of the aforementioned issues. The most recent trade circulate knowledge aligned with the potential for extra draw back.

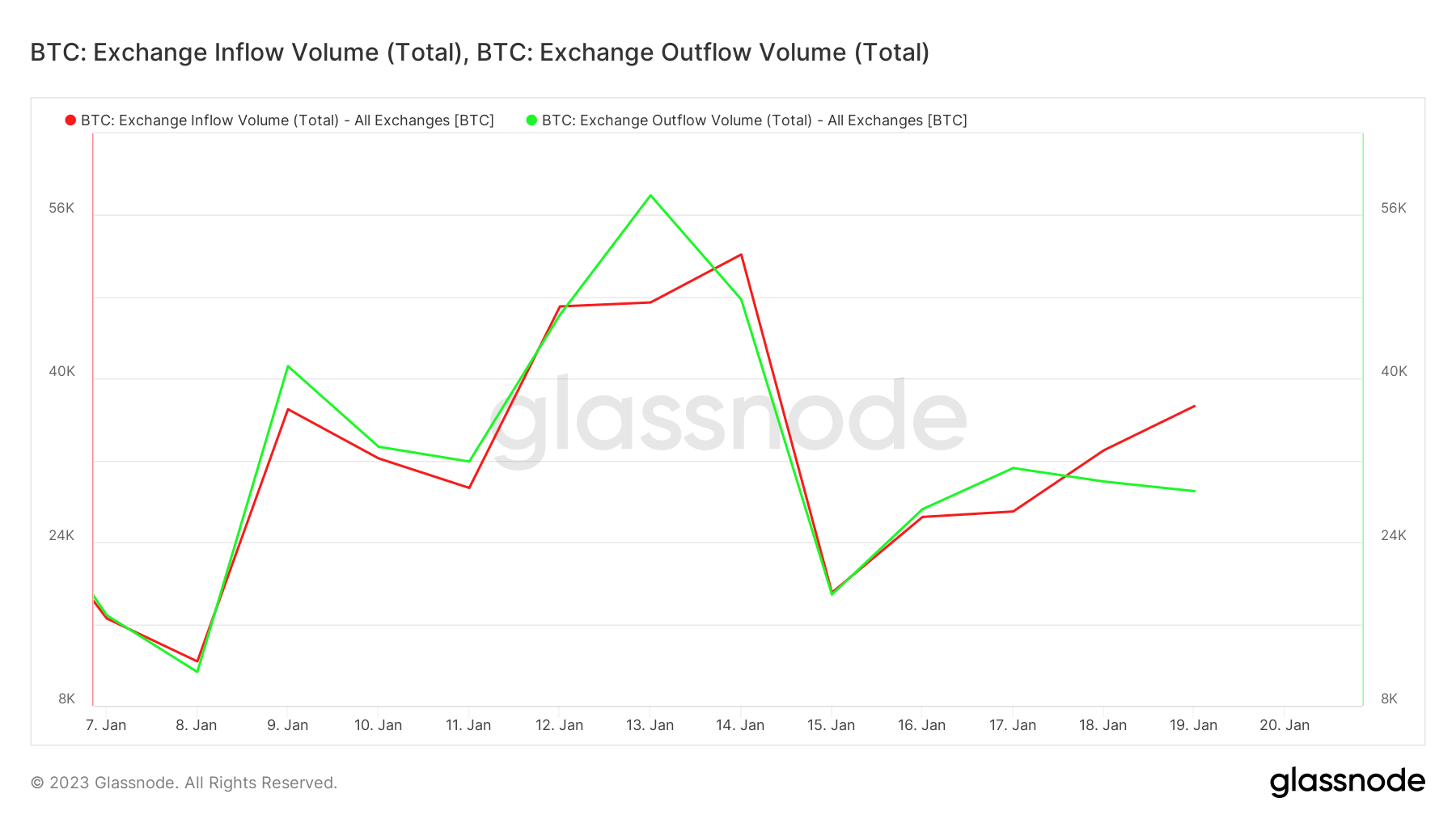

BTC’s trade inflows outweighed trade outflows since mid-week, suggesting that there is perhaps extra incoming promote stress than shopping for stress.

Supply: Glassnode

Whereas the conclusion is perhaps promote stress, it doesn’t essentially need to be the case. Many Bitcoin holders would possibly transfer their BTC to exchanges in preparation for a possible selloff.

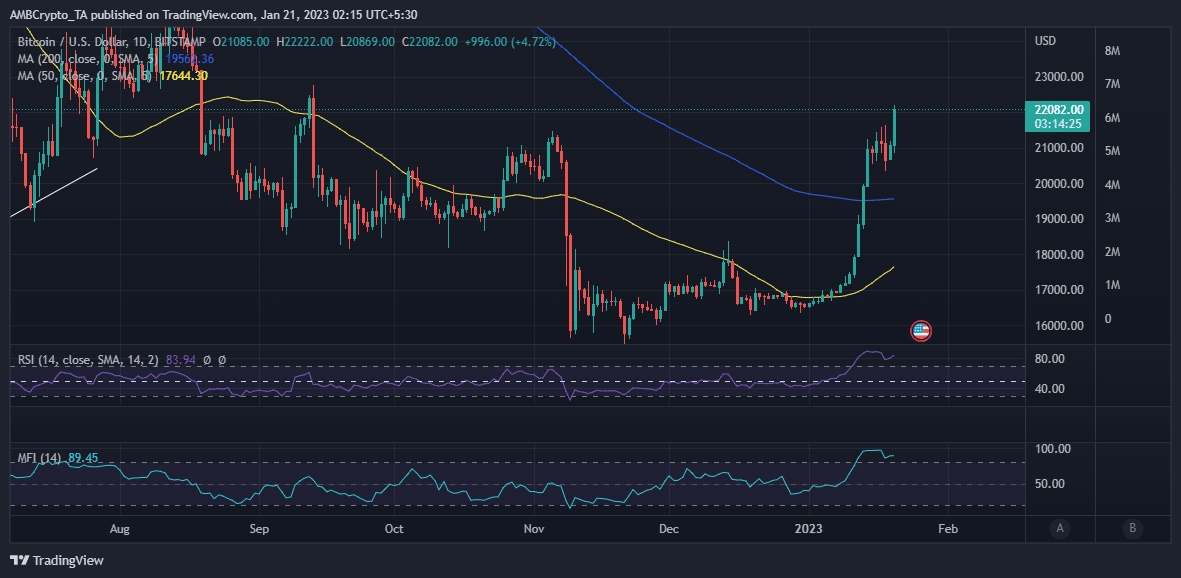

Nonetheless, in a spot of fine information, Bitcoin’s value continued to rally regardless of these issues. It had breached the $22,100 value vary at press time.

Supply: TradingView

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

The press time remark was that Bitcoin bulls had turned a deaf ear to the FUD and maintained their dominance. Probably, the cryptocurrency was experiencing sturdy purchase stress in the identical interval.

This lent credence to the concept Bitcoin is perhaps within the early phases of the subsequent bull run. Regardless of this, buyers mustn’t throw warning to the wind, as tables can rapidly flip.