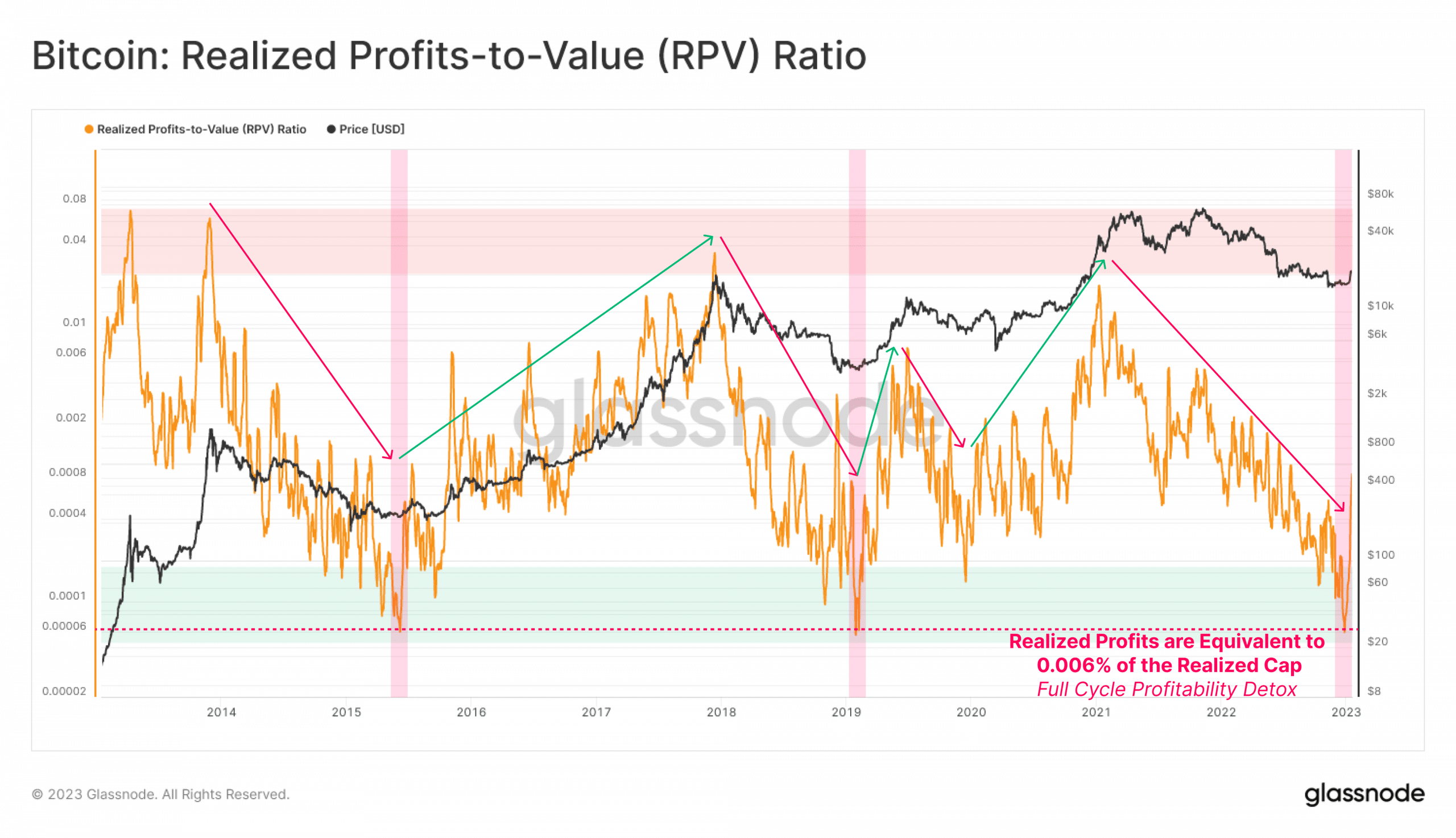

- RPV ratio suggests a lower in enthusiasm for the Bitcoin bull run.

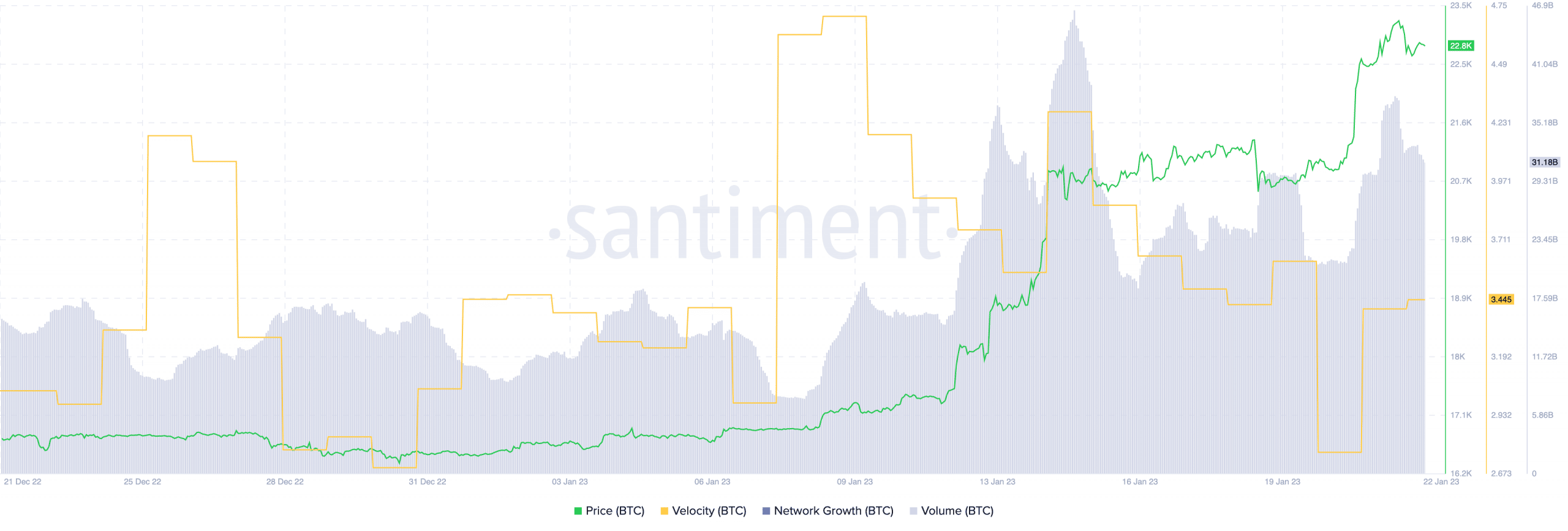

- Dealer sentiment stays optimistic and quantity, velocity, and trade reserves all present market power.

In keeping with information supplied by glassnode, Bitcoin‘s RPV, or Income-to-Worth Ratio, declined considerably over the previous couple of days. This ratio compares profit-taking out there towards the community valuation and its decline means that numerous enthusiasm for the bull market has dissipated.

This could have implications for each short-term and long-term holders of Bitcoin.

How a lot are 1,10,100 BTC value as we speak?

Supply: glassnode

HODLers get tempted

RPV decline was mirrored in an elevated MVRV ratio, indicating most holders would revenue from promoting. The lengthy/quick distinction remained destructive which additionally incentivized short-term holders to promote as they might gather a lot of the earnings.

One other indicator of this could be the decline within the variety of addresses in losses. In keeping with glassnode, the variety of addresses in losses reached an 8-month low. This may recommend that a number of addresses can be tempted to promote their holdings throughout this era.

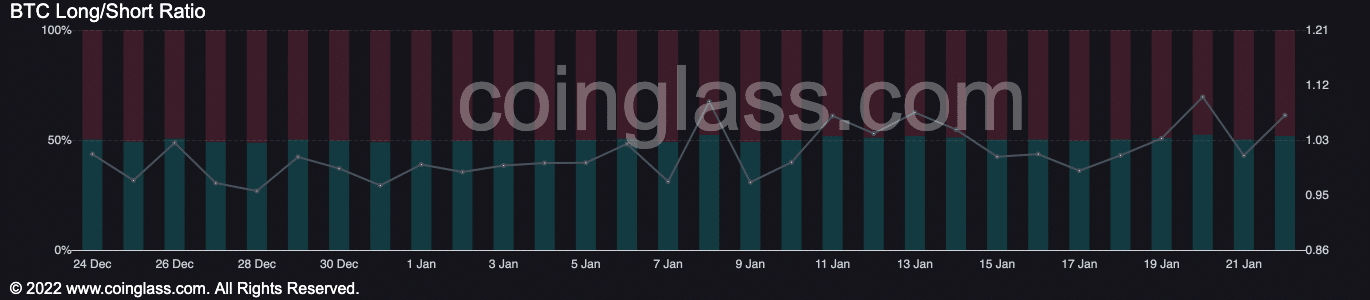

Merchants present religion

Regardless of the decline in RPV, dealer sentiment remained optimistic. In keeping with information supplied by coinglass, 51.2% of all positions have been lengthy on Bitcoin. This indicated that merchants have been nonetheless optimistic about the way forward for Bitcoin and believed that it’ll proceed to rise in worth.

Moreover, one other optimistic indicator for Bitcoin is the decline in trade reserves, because it signifies decrease promoting stress. Because of this there may be much less provide out there, which may contribute to a rise in value.

Supply: coinglass

Moreover, Bitcoin‘s quantity has additionally elevated, going from 14.56 billion to 31.1 billion over the past month. Its velocity additionally declined throughout this era, suggesting that BTC wasn’t being transferred amongst addresses and addresses have been holding on to their cash. This might point out that holders have gotten extra assured within the long-term potential of Bitcoin and are much less prone to promote their positions.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Supply: Santiment

In conclusion, the decline in RPV suggests decreased enthusiasm for the bull run. Nevertheless, alternatively, optimistic dealer sentiment, declining trade reserves, and rising quantity and velocity recommend market power.