On-chain knowledge exhibits the annual price of change within the Bitcoin Puell A number of has exited the bear market zone, an indication {that a} bull rally could also be right here.

Bitcoin Puell A number of 365-Day Fee Of Change Has Shot Up

As identified by an analyst in a CryptoQuant post, this could possibly be one of many first indications of the return of the bull market. The “Puell A number of” is an indicator that measures the ratio between the day by day Bitcoin mining income (in USD) and the 365-day shifting common (MA) of the identical.

When the worth of this metric is bigger than 1, miners are making extra revenue than the yearly common proper now. Alternatively, values under the brink indicate the revenues of those chain validators is lower than standard.

As miner revenues shift, these holders grow to be roughly more likely to promote BTC (relying on which manner of the break-even mark the ratio has swung in), which is an element that may have an effect on the value of the crypto. Thus, when the Puell A number of is bigger than 1, BTC could also be thought-about overvalued, whereas being lesser than this worth may recommend the coin is undervalued.

The related indicator right here shouldn’t be the Puell A number of itself however its price of change (RoC). The RoC shows the pace at which any metric adjustments its worth over an outlined interval.

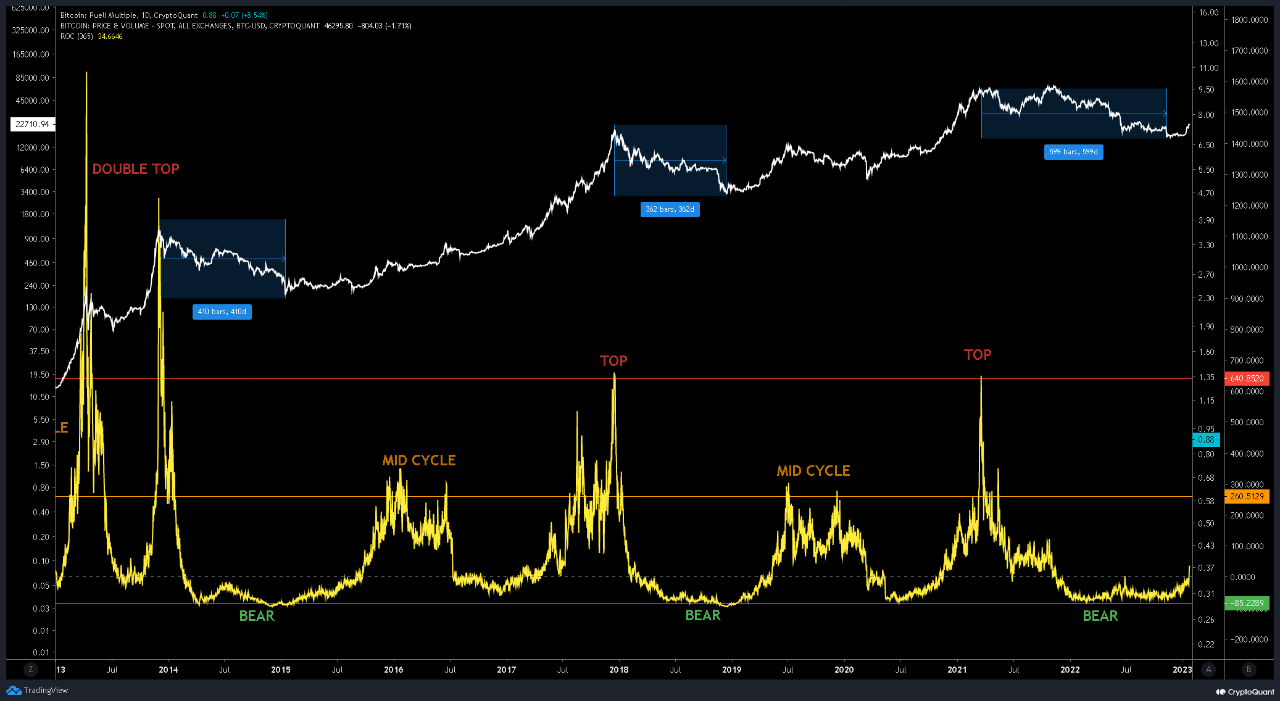

Specifically, the 365-day RoC of the Puell A number of is of curiosity within the present dialogue. Here’s a chart that exhibits the development on this indicator over the course of the totally different Bitcoin cycles:

Appears to be like like the worth of the metric has spiked in current days | Supply: CryptoQuant

Within the above graph, the quant has marked the related zones for the Bitcoin Puell A number of 365-day RoC. It looks as if tops have taken place within the crypto worth at any time when the metric has touched the pink line, whereas mid-cycle highs have been set across the orange line.

And it might seem that bear markets have lasted whereas the indicator has been across the inexperienced line. It additionally appears to be like like transitions to and from bear markets have usually adopted the dotted line traditionally.

Not too long ago, as Bitcoin has sharply rallied, miner revenues have additionally shot up, resulting in the Puell A number of additionally observing an increase. Because the chart shows, the 365-day RoC of the indicator has naturally seen some speedy rise in current days.

With this spike, the metric has lastly crossed above the dotted line, which may imply, if the previous sample is something to go by, that the bear market could also be coming to an finish, and the crypto may need began transitioning in the direction of a bullish development. The analyst notes, nonetheless, that it’ll nonetheless take some extra worth motion earlier than this breakout will be totally confirmed.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $22,800, up 9% within the final week.

The worth of the crypto appears to have been shifting sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Dylan Leagh on Unsplash.com, charts from TradingView.com, CryptoQuant.com