- MakerDAO voted in favor of a 2% further yield revenue from Yearn Finance.

- Whereas its growth exercise surges, MKR’s community progress fell.

After its proposal in November to deploy $100 USD Coin [USDC] into the Yearn Finance [YFI] DeFi protocol, MakerDAO [MKR] lastly permitted it. Particulars from the poll confirmed that 71.56% of the MKR neighborhood voted in favor of the proposition, whereas 28.44% most popular to say no to the “Yearn to earn Yield” proposal.

Maker Governance is voting to approve or reject the offboarding of the USDC-A, USDP-A, and GUSD-A vault varieties.

When you’re a USDC-A, USDP-A, or GUSD-A vault proprietor, we strongly encourage you to learn the implications of this offboarding course of.

— Maker (@MakerDAO) January 23, 2023

Is your portfolio inexperienced? Take a look at the MakerDAO Revenue Calculator

What’s with the TVL trigger?

The proposal centered round a DeFi technique to assist Maker earn an annual 2% yield, which might additionally assist with PSM USDC reserves and switch. MakerDAO additionally famous that the approval meant that it added one other means to generate revenue and add to its reserves.

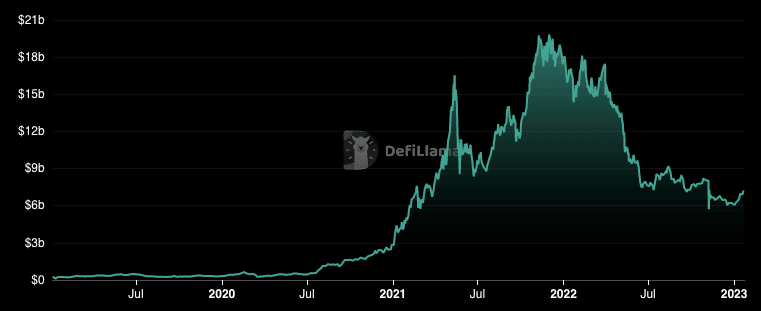

Regardless of the compliance, Maker remained second within the DeFi Complete Worth Locked (TVL) standings. Though it misplaced the pole place from Lido Finance [LDO], MKR’s TVL elevated a whopping 20.42%, DeFi Llama’s data confirmed.

The rise in TVL meant that extra buyers have proven curiosity within the dApps beneath the Maker community. At press time, the MakerDAO TVL was $7.5 billion. Nonetheless, it was massively down from its 2022 All-Time Excessive (ATH).

Supply: DeFi TVL

Apparently, Maker appeared to be in its proposal rollout interval. On 23 January, the governance arm of the DAI stablecoin builders put out one other provide for voting. However the situation for this factors to the off-boarding of USDC-A, USDP-A and GUSD-A vaults.

Maker Governance is voting to approve or reject the offboarding of the USDC-A, USDP-A, and GUSD-A vault varieties.

When you’re a USDC-A, USDP-A, or GUSD-A vault proprietor, we strongly encourage you to learn the implications of this offboarding course of.

— Maker (@MakerDAO) January 23, 2023

If permitted, Maker famous that it will set forth a 1500% liquidation ratio on the aforementioned vaults. Voting on that is billed to finish on 26 January. So, Maker cleared the air on the implications, saying:

“As soon as the talked about liquidation parameters are executed, all USDC-A, USDP-A, and GUSD-A positions with a collateralization ratio beneath 1500% might be liquidated.”

Real looking or not, right here’s MKR’s market cap in BTC’s phrases

On growth exercise and MKR’s community progress

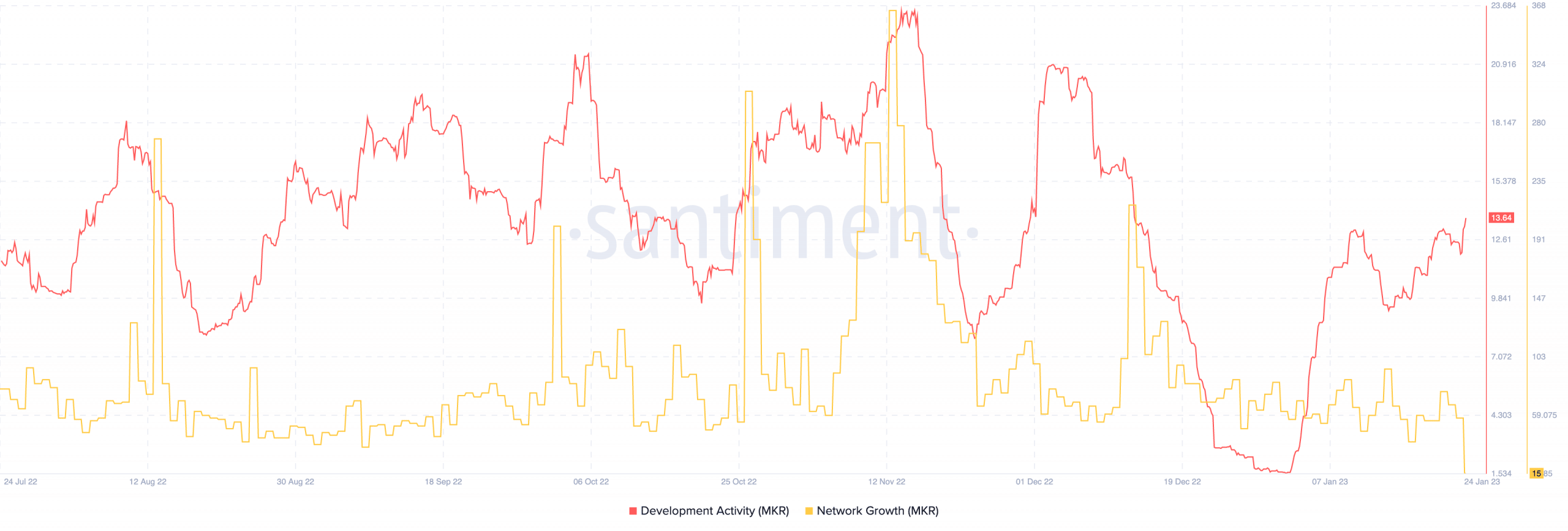

Per its growth exercise, Santiment confirmed that MakerDAO excelled in that half. On the time of writing, the MKR growth exercise was 13.64. This was an uptick from the downturn on 23 January. A proof of this improve factors to higher contribution by builders to the general public repositories of the Maker community.

On the flip aspect, the MKR community progress declined. Moreso, it reached one of many lowest factors in over six months, based on on-chain information from Santiment. This implied that Maker was dropping traction and fighting adoption since new addresses weren’t being created.

Supply: Santiment

By way of its token worth, CoinMarketCap confirmed that MKR was exchanging palms at $708.79. This accounted for a slight 0.56% within the final 24 hours.