- XTZ’s value has rallied by 61% because the yr started.

- Day by day chart readings, nevertheless, revealed {that a} value correction is likely to be imminent.

Based on information from the cryptocurrency value monitoring platform CoinMarketcap, Tezos native coin XTZ ranked as one of many best-performing crypto belongings within the final 24 hours.

Exchanging palms at $1.17, the altcoin’s value rallied by 4% throughout that interval. Within the final week, XTZ’s value additionally grew by 4%.

Whereas bullish sentiment lingers out there at press time, a better evaluation of XTZ’s efficiency on a each day chart revealed {that a} value drop would possibly happen within the coming week.

Sensible or not, right here’s XTZ’s market cap in BTC’s phrases

Brace for impression

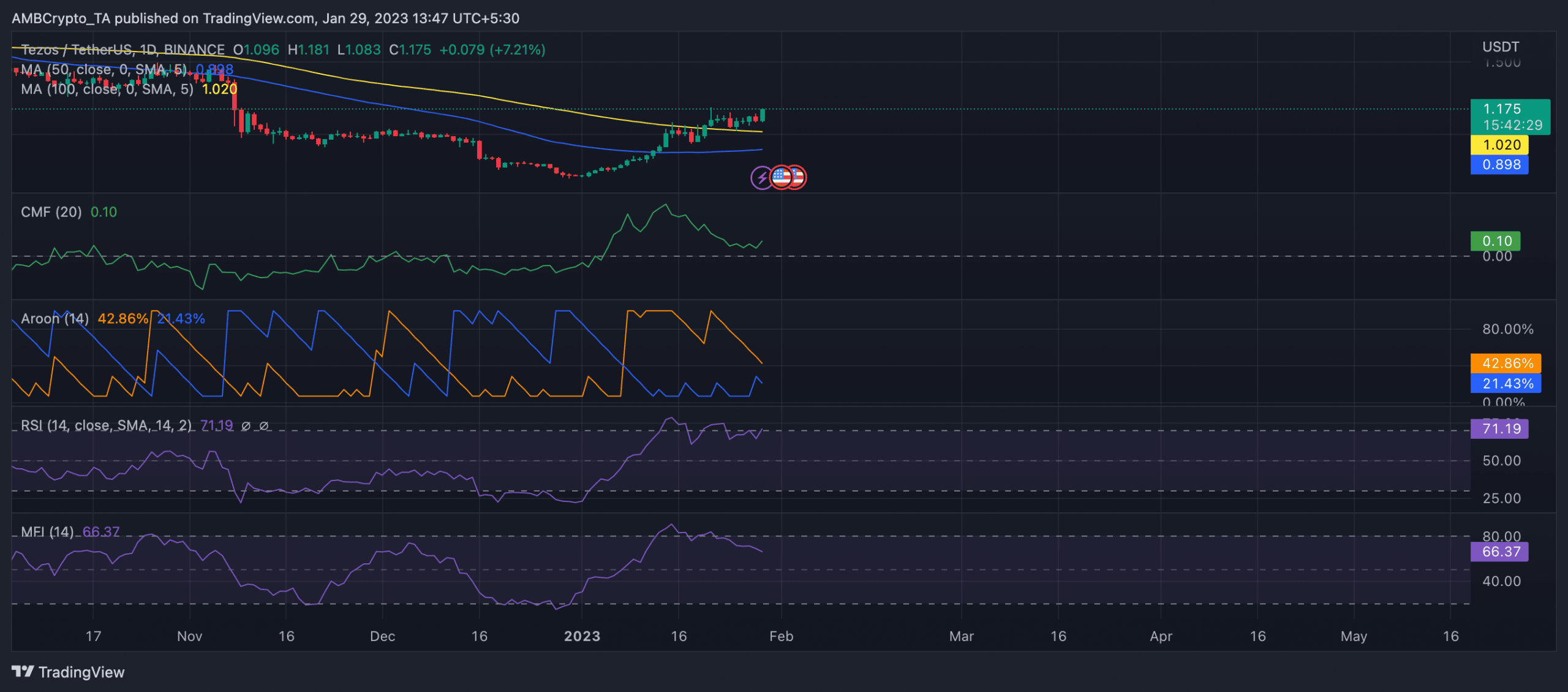

The widespread progress within the common cryptocurrency market brought on XTZ’s value to spike by 61% since 1 January. Traders who sought to shortly make income started buying cash, inflicting key indicators just like the Relative Power Index (RSI) and the Cash Movement Index (MFI) to achieve overbought highs.

Nonetheless, XTZ started to see a drop in bullish conviction on 14 January when its Chaikin Cash Movement (CMF) launched into a downtrend whereas its value rallied. This created a bearish divergence that always suggests an imminent value correction.

A rallying value coupled with a declining CMF signifies that the involved asset’s shopping for strain is just not as robust as the value improve would recommend.

This divergence might be an indication that the rally is just not sustainable and that the value could also be due for a correction. Nonetheless in a downtrend, XTZ’s CMF was 0.10 at press time.

Learn Tezos’ [XTZ] Worth Prediction 2023-24

Moreover, an examination of the Aroon indicator for XTZ confirmed that though the value of the altcoin could also be rising, the bullish momentum has weakened. At press time, the Aroon Up line (orange) was pegged at 42.86%.

The Aroon Up line is an indicator that measures the power and recentness of an asset’s uptrend. A worth near 100 signifies a robust uptrend and a current excessive, whereas a worth near zero signifies a weak uptrend and a excessive that was reached a very long time in the past. It is a signal of a possible reversal within the pattern.

Lastly, a demise cross was noticed with the 50-day shifting common (blue) mendacity beneath the 200-day shifting common (yellow). This crossover is taken into account a bearish sign and is commonly taken as a sign {that a} downtrend is about to start or that the present uptrend is shedding power.

Supply: XTZ/USDT on TradingView

![Tezos [XTZ] holders can expect price drawback this week, here’s why](https://ambcrypto.com/wp-content/uploads/2023/01/nick-fewings-zF_pTLx_Dkg-unsplash-1-1000x600.jpg)