- The SushiSwap 2023 income may surpass 2022 by $15 million.

- The token’s possible course may find yourself in a value lower, however HODLing may trigger features.

In 2022, SushiSwap [SUSHI] recorded a income of $16.75 million, in response to Token Terminal. Nevertheless, in comparison with protocols like MakerDAO [MKR] and Lido Finance [LDO], Sushiswap fell quick.

14/ SushiSwap:

– Whole income (FY2022): $16.75m

– Annual bills (2022-2023): $5.22m

– Annual salaries, incl. in bills (2022-2023): $4.74m

– Variety of FTEs: 18.5

– Annual bills per FTE: $282.0k

– Annual salaries per FTE: $256.3k pic.twitter.com/sGFWUmltEX— Token Terminal (@tokenterminal) January 30, 2023

Is your portfolio inexperienced? Take a look at the SushiSwap Revenue Calculator

Prepared so as to add sauce to the SUSHI

Nicely, all that might be behind the 2022 Uniswap [UNI] fork. It is because the challenge’s CEO, Jared Gray, proposed to modify SUSHI’s 100% income to its treasury. Earlier than it was accredited earlier in January 2023, it was normally distributed to the token holders.

For that reason, SushiSwap may make one other further $15 million. Moreover, full implementation of its roadmap may additionally contribute to reaching the target.

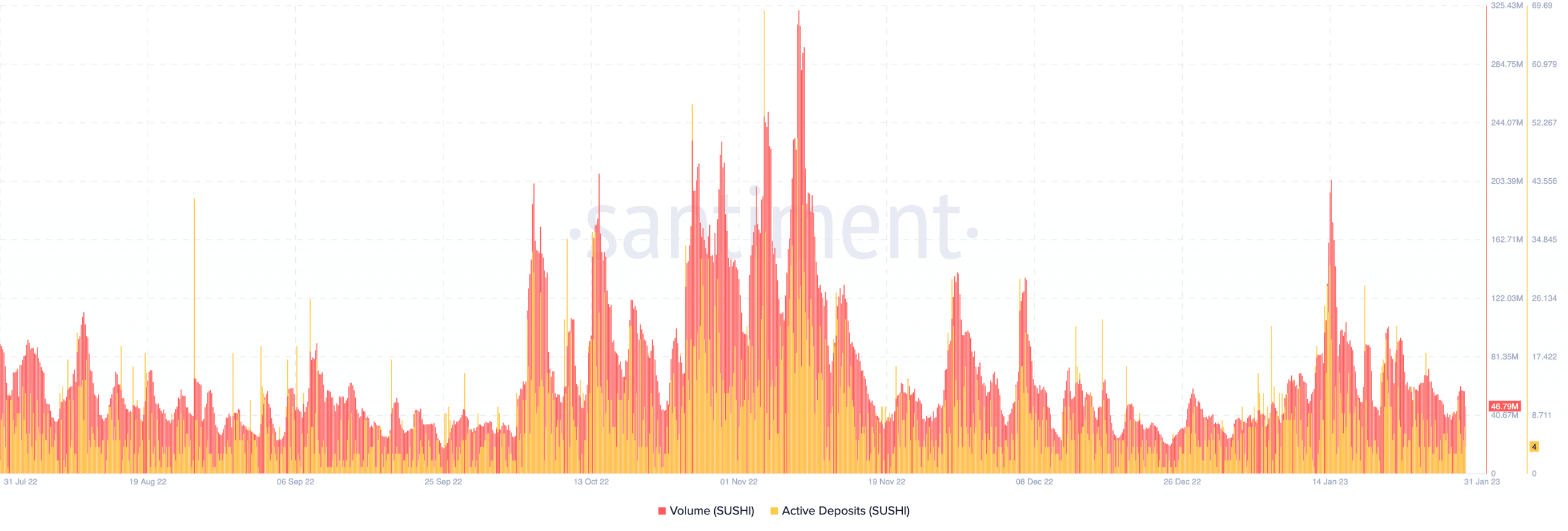

Within the final 30 days, SUSHI holders have made about 35.59% features and have been capable of maintain the buying and selling quantity to 57 million till 30 January. The rise displays improved merchants’ try to personal the tokens due to value modifications. Nevertheless, the momentum had dropped on the time of writing to 46.96 million.

Lively deposits on exchanges have slowed down, in response to Santiment. The metric measures the variety of distinctive addresses on the SushiSwap community. Consequently, selloffs may not be imminent.

Supply: Santiment

Preserve HODLing for lengthy?

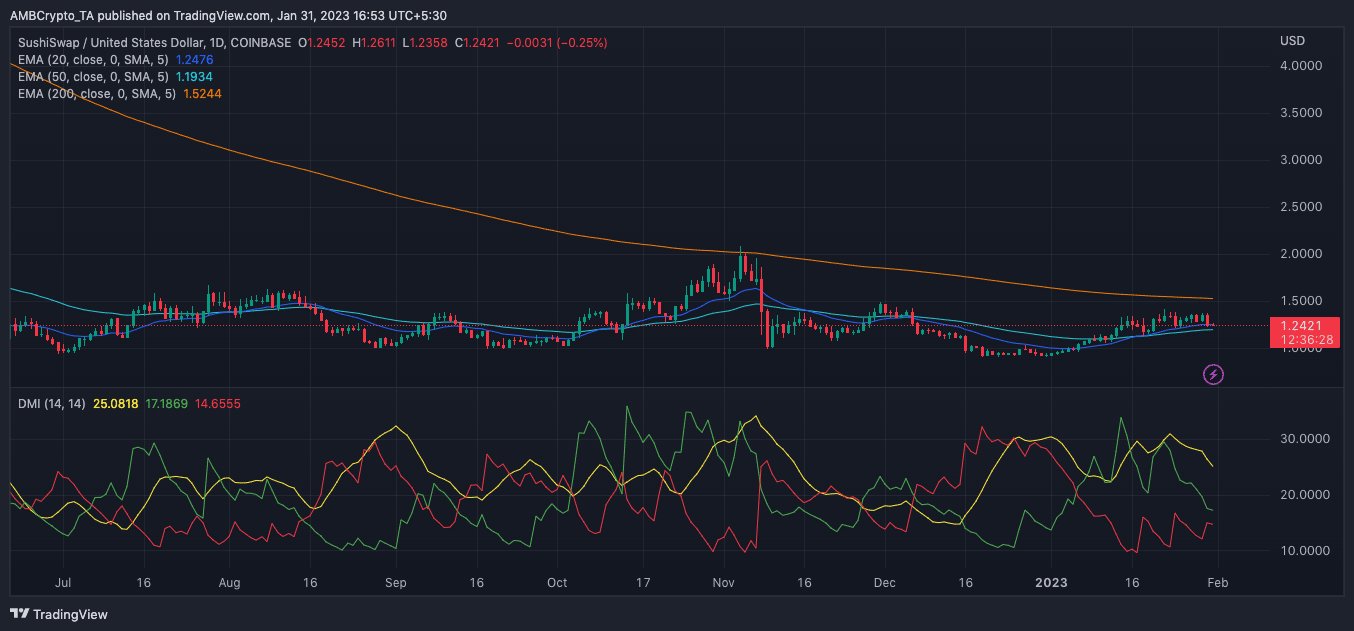

In response to the each day chart, holders of the token may gain advantage extra from sticking to the challenge. This was as a result of Exponential Transferring Common (EMA). At press time, the 200 EMA (orange) was above the 20 (blue) and 50 (cyan) EMAs. This indicated that the long-term view of SUSHI was doubtlessly bullish.

Within the quick time period, SUSHI’s projection was more than likely consolidation, for the reason that 20 and 50 EMAs have been inside attain of one another.

With respect to the Directional Motion Index (DMI), SUSHI may discover it tough to revert to greens. An evaluation of the DMI confirmed that the constructive DMI (inexperienced) was 17.18. The adverse DMI (purple), in distinction, was 14.65.

Conversely, the constructive and adverse exhibited downward strain on the SUSHI strain. However there was no massive unfold between each. So, the worth pattern was not strong.

Supply: TradingView

Learn Sushiswap’s [SUSHI] Value Prediction 2023-2024

The non-compulsory third dynamic line, referred to as the Common Directional Index (ADX), additionally types part of the DMI. It’s used to gauge directional energy.

At press time, the ADX (yellow) was 25.08. This worth signaled a robust directional motion. Nevertheless, the downward pattern displayed by the ADX meant that it may lose maintain of energy. Subsequently, it may lead to a bearish transfer.

![Why SushiSwap’s [SUSHI] 2023 revenue has potential to floor 2022](https://ambcrypto.com/wp-content/uploads/2023/01/po-2023-01-31T124000.002-1000x600.png)