- MUX protocol noticed promising development in buying and selling quantity and costs.

- The protocol’s native token MCB shot up by 6% at press time.

MUX Protocol, a decentralized perpetuals change, made gamers within the DeFi area sit up and take discover. Constructed on layer-2 scaling resolution Arbitrum, MUX has seen appreciable development in key efficiency indicators (KPIs) over the previous few weeks, as highlighted by a crypto analyst on 31 January.

Each the every day quantity because the cumulative quantity is quickly growing, displaying of the potential of the protocol:

15/N $MUC $MCB pic.twitter.com/elQqQhe07E

— Uncle (APE licensed) 🧢 (@UVtho) January 30, 2023

What number of are 1,10,100 MCBs value as we speak?

As per the Twitter thread, the every day buying and selling quantity and cumulative buying and selling quantity on the protocol rose sharply since its launch in August 2022, drawing consideration to its potential.

MUX sees MAX development

Small to mid-cap decentralized exchanges (DEXes) have registered regular development within the DeFi ecosystem of late. Beforehand, Positive aspects Community [GNS], which is constructed over Polygon [MATIC] and Arbitrum, displayed promising exercise.

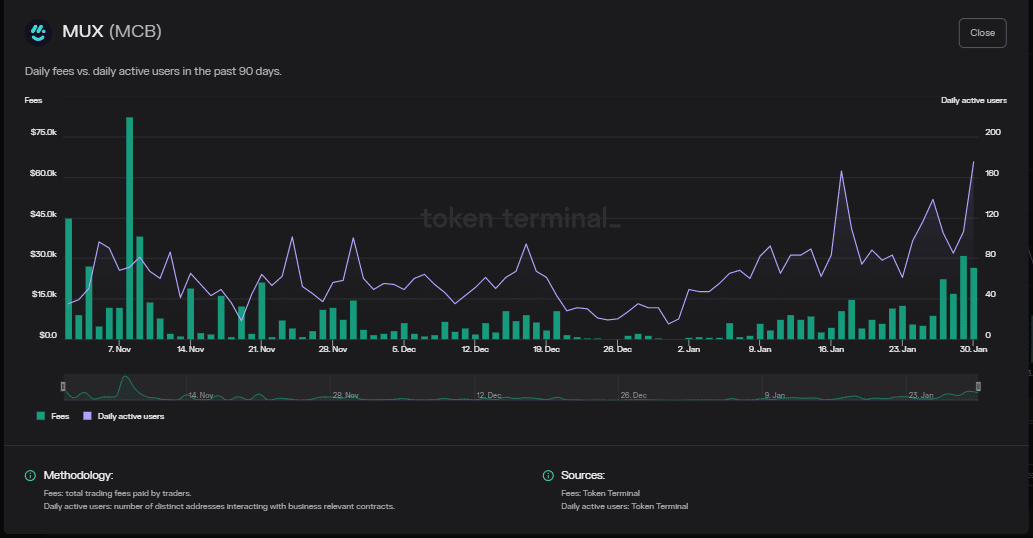

MUX protocol works on an analogous mechanism because the Positive aspects Community and has replicated a few of its success as nicely. In line with information from Token Terminal, the entire variety of lively customers on the protocol elevated considerably because the begin of 2023.

Supply: Token Terminal

The rise in charges paid by merchants has been exponential over the previous month, reaching over $30k from a bit of over $200 on 31 December. For DEXes, development in buying and selling charges is as an essential metric in estimating the protocol’s value, as this might entice liquidity suppliers and buyers to its fold.

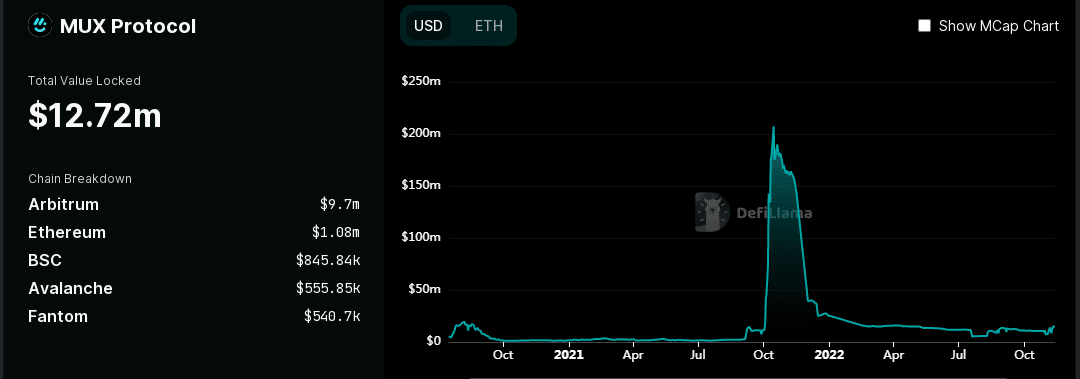

TVL provides unfavorable alerts

Then again, the entire funds locked into the protocol’s sensible contracts have stayed flat largely with out displaying noticeable development, as highlighted by DeFiLlama. This implied that the community is but to develop well-liked amongst a big part of buyers.

Supply: DeFiLlama

Is your portfolio inexperienced? Take a look at the MCB Revenue Calculator

In reality, in keeping with CoinMarketCap, the Market Cap/TVL ratio was 6.47 for MUX protocol, that means that the community was overvalued and will stem its development in the long term.

Regardless of this, the protocol’s native token MCB shot up by 6% at press time to $5.32. The token’s buying and selling quantity rose by greater than 36%.